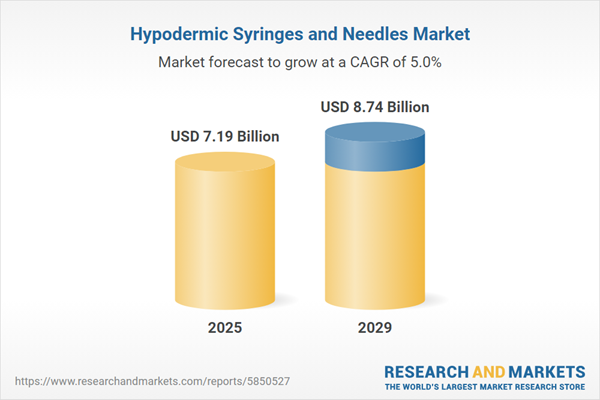

The hypodermic syringes and needles market size is expected to see steady growth in the next few years. It will grow to $8.74 billion in 2029 at a compound annual growth rate (CAGR) of 5%. The growth in the forecast period can be attributed to growth in biologics and biosimilars, home healthcare trends, rise in diabetes cases, focus on infection control, drug delivery devices for chronic conditions, e-commerce growth in medical supplies. Major trends in the forecast period include sustainable packaging, technological advances in needle safety, pre-filled syringes and autoinjectors, telehealth and remote medication administration, strategic partnerships in manufacturing.

The increasing prevalence of chronic diseases is projected to drive growth in the hypodermic syringes and needles market in the coming years. This rise in chronic diseases is largely due to factors such as aging populations, unhealthy lifestyles, environmental impacts, and a higher incidence of risk factors like obesity and sedentary behavior. Hypodermic syringes and needles are essential for administering medications, vaccines, and biological therapies to effectively manage chronic diseases, ensuring accurate dosage and delivery. For example, in June 2024, the Australian Institute of Health and Welfare, an independent agency of the Australian Government that provides health and welfare statistics, reported that in 2022, approximately 15.4 million individuals, or 61% of the population, were living with at least one selected long-term health condition. Consequently, the growing prevalence of chronic diseases is expected to boost the hypodermic syringes and needles market.

The surge in surgical procedures is anticipated to be a key driver for the growth of the hypodermic syringes and needles market. Surgical procedures, performed by qualified medical professionals, often involve the administration of medications or other substances through injections. Hypodermic syringes and needles are essential tools for delivering controlled and precise doses of these substances. For example, in October 2023, the Organization for Economic Co-operation and Development revealed an 8.4% increase in cataract surgical procedures in the Czech Republic, with 142,670 procedures in 2022 compared to 131,612 in 2021, illustrating the growing need for these medical devices.

Leading companies in the hypodermic syringes and needles market are focusing on the development of advanced passive safety needles to secure a competitive advantage. A passive safety needle is designed with an automatic safety mechanism that activates after use, effectively covering the needle tip to prevent needlestick injuries without necessitating any additional actions from healthcare professionals. For example, in January 2023, MTD Group, an Italy-based med-tech company, received FDA approval for the DropSafe Sicura passive safety needle. This innovative injection needle is intended for intramuscular and subcutaneous administration of vaccines and other medications, with the goal of reducing needlestick injuries among healthcare professionals (HCPs). Featuring an automatic locking transparent shield that engages post-injection, the DropSafe Sicura requires no further activation, thus ensuring a safer injection process.

Major companies in the hypodermic syringes and needles market are investing in the development of pre-fillable glass syringe systems. These systems are designed for the storage and administration of pharmaceuticals, vaccines, or other injectable substances. For instance, in September 2023, Nipro Corporation launched the D2F Pre-fillable Glass Syringe System - Silicone Oil-Free, addressing the pharmaceutical industry's need for products sensitive to silicone oil. This system aims to meet the increasing demand for injection systems that ensure optimal performance and reduce the risk of interaction-related issues in delivering biotech drugs and other sensitive pharmaceuticals.

In July 2022, Sharps Technology, a US-based technology company, acquired Safeguard Medical for $2.5 million, aiming to expand manufacturing capabilities and enhance product offerings in safety-engineered medical devices, including syringes. Hungary-based Smart Syringe, a medical device company, focuses on developing and manufacturing syringes to improve patient care and healthcare outcomes.

Major companies operating in the hypodermic syringes and needles market include Becton Dickinson And Company, B. Braun Melsungen AG, Cardinal Health Inc., Smiths Medical Inc., Terumo Corporation, Nipro Corporation, Medline Industries LP, EXELINT International Co., Vitrex Medical A/S, Gerresheimer AG, Teleflex Incorporated, Catalent Pharma Solutions, DeRoyal Industries Inc., Hospira Inc., Owen Mumford Inc., Covidien plc, Schott AG, Codan Medizinische Geräte GmbH & Co. KG, Helapet Ltd., Vygon S.A., Medtronic plc, Argon Medical Devices Inc.

North America was the largest region in the hypodermic syringes and needles market in 2024. The regions covered in the hypodermic syringes and needles market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa. The countries covered in the hypodermic syringes and needles market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Canada, Italy, Spain.

Hypodermic syringes and needles are medical devices designed for the injection or withdrawal of bodily fluids or medications. The syringe comprises a barrel, a plunger, and a tip or hub where the needle is attached.

The main types of hypodermic syringes and needles include syringes and needles. Syringes are cylindrical devices equipped with a plunger for injecting or withdrawing bodily fluids. Hypodermic syringes serve various medical purposes, including blood collection through venipuncture. They are available in disposable and reusable models and are applied in diverse medical applications such as blood collection, drug delivery, vaccination, insulin administration, and more. These devices find usage in hospitals, ambulatory surgical centers, diagnostic centers, and various other healthcare end-users.

The hypodermic syringes and needles market research report is one of a series of new reports that provides hypodermic syringes and needles market statistics, including hypodermic syringes and needles industry global market size, regional shares, competitors with an hypodermic syringes and needles market share, detailed hypodermic syringes and needles market segments, market trends and opportunities, and any further data you may need to thrive in the hypodermic syringes and needles industry. This hypodermic syringes and needles market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenario of the industry.

The hypodermic syringes and needles market revenues includes earned by entities by vacutainer and other consumables, such as pistons, sharps, and sterile containers. The market value includes the value of related goods sold by the service provider or included within the service offering. Only goods and services traded between entities or sold to end consumers are included.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

Hypodermic Syringes and Needles Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on hypodermic syringes and needles market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for hypodermic syringes and needles? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The hypodermic syringes and needles market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include:

- The forecasts are made after considering the major factors currently impacting the market. These include the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) By Type: Syringes; Needles2) By Usability: Disposable; Re-Usable

3) By Application: Blood Collection; Drug Delivery; Vaccination; Insulin Administration; Other Applications

4) By End-Use: Hospitals; Ambulatory Surgical Centers; Diagnostic Centers; Other End-Uses

Subsegments:

1) By Syringes: Disposable Syringes; Reusable Syringes; Safety Syringes2) By Needles: Standard Needles; Safety Needles; Prefilled Needles; Specialty Needles

Key Companies Mentioned: Becton Dickinson and Company; B. Braun Melsungen AG; Cardinal Health Inc.; Smiths Medical Inc.; Terumo Corporation

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

- Becton Dickinson And Company

- B. Braun Melsungen AG

- Cardinal Health Inc.

- Smiths Medical Inc.

- Terumo Corporation

- Nipro Corporation

- Medline Industries LP

- EXELINT International Co.

- Vitrex Medical A/S

- Gerresheimer AG

- Teleflex Incorporated

- Catalent Pharma Solutions

- DeRoyal Industries Inc.

- Hospira Inc.

- Owen Mumford Inc.

- Covidien plc

- Schott AG

- Codan Medizinische Geräte GmbH & Co. KG

- Helapet Ltd.

- Vygon S.A.

- Medtronic plc

- Argon Medical Devices Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 200 |

| Published | February 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 7.19 Billion |

| Forecasted Market Value ( USD | $ 8.74 Billion |

| Compound Annual Growth Rate | 5.0% |

| Regions Covered | Global |

| No. of Companies Mentioned | 22 |