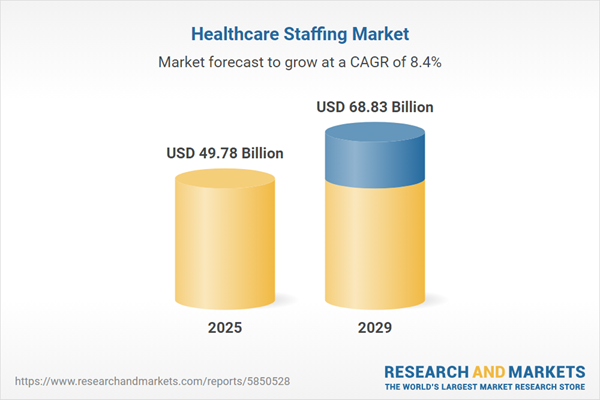

The healthcare staffing market size is expected to see strong growth in the next few years. It will grow to $68.83 billion in 2029 at a compound annual growth rate (CAGR) of 8.4%. The growth in the forecast period can be attributed to a focus on mental health services, a rise in home healthcare services, diversity and inclusion initiatives, government investment in healthcare, and public health preparedness. Major trends in the forecast period include innovative platforms, collaborations and partnerships, strategic investments, and technological solutions.

The increasing shortage of healthcare personnel is projected to drive the growth of the healthcare staffing market in the coming years. Healthcare staff includes everyone working in a healthcare or social care environment, such as medical students completing clinical rotations, frontline caregivers, and various healthcare professionals who may not interact directly with patients. These individuals play a vital role in preventing illness and impairment and are responsible for assessing conditions, diagnosing, and providing treatment. In recent years, many hospitals worldwide have experienced a decline in healthcare staff. For example, a study published in January 2023 by Oracle Corporation, a technology firm based in the U.S., forecasts that if current workforce trends continue, over 6.5 million healthcare professionals will permanently leave their positions by 2026, while only 1.9 million new workers are expected to enter the field. This situation could lead to a national shortfall of more than 4 million healthcare workers. Consequently, the growing shortage of healthcare personnel is fueling the expansion of the healthcare staffing market.

The healthcare staffing market is also expected to witness growth propelled by the increasing prevalence of chronic diseases. Chronic diseases, lasting three months or more and worsening over time, necessitate ongoing care and specialized expertise. Healthcare facilities grapple with rising patient loads and diverse care settings, creating a demand for a dynamic healthcare workforce. Healthcare staffing agencies play a crucial role in providing flexible staffing solutions for hospitals, clinics, and home healthcare, ensuring access to skilled professionals. The National Center for Biotechnology Information (NCBI) reported in January 2023 that the global number of people with chronic diseases is projected to reach 142.66 million by 2050, up from 71.522 million in 2020, further driving the growth of the healthcare staffing market.

Technological advancements are a prominent trend in the healthcare staffing market, with companies adopting new technologies to sustain their market position. For example, StaffHealth.com launched the 'NurseShifts' application technology in May 2022. This app facilitates quick connections and communication between nurses, recruiters, and healthcare facilities, streamlining onboarding and job invitation processes. The app also provides notifications for job opportunities based on nurses' backgrounds, regions, and availability.

Major players in the healthcare staffing market are developing tools for flexible staffing pools, ensuring adaptability in the workforce. Flexible staffing pools involve maintaining a pool of employees available to work on a flexible basis. In August 2023, CareRev launched a workforce management tool to address ongoing healthcare workforce challenges. This tool allows health systems to build flexible staffing pools by leveraging their existing in-house workforce, providing a solution to nurse shortages, retention issues, and clinician burnout. With features such as AI-based shift pricing and in-app communications, CareRev's platform offers health systems efficient and real-time management of their flexible staffing resources.

In January 2022, Acacium Group, a healthcare staffing and services company based in the UK, acquired Favorite Healthcare Staffing for an undisclosed sum. This acquisition allows Acacium Group to broaden its workforce solutions and improve its service offerings within the healthcare staffing industry. Favorite Healthcare Staffing is a U.S.-based company that specializes in providing staffing solutions to a variety of healthcare facilities, such as hospitals and nursing homes.

Major companies operating in the healthcare staffing market include Envision Healthcare Corporation, AMN Healthcare Holdings Inc., CHG Healthcare Services Inc., Maxim Healthcare Group Inc., Cross Country Healthcare Inc., Aya Healthcare Inc., Adecco Group AG, Trustaff Inc., TeamHealth Holdings Inc., LocumTenens.com LLC, Jackson Healthcare LLC, Favorite Healthcare Staffing Inc., Medical Solutions LLC, Syneos Health Inc., Aureus Medical Group LLC, CompHealth LLC, CoreMedical Group LLC, CrossMed Healthcare Staffing Solutions LLC, Emerald Health Services LLC, Health Carousel LLC, HealthTrust Workforce Solutions LLC, KPG Healthcare LLC, MAS Medical Staffing LLC, MedPro Healthcare Staffing LLC, MedStaff Healthcare Solutions LLC, Next Travel Nursing LLC, NurseFly LLC, Onward Healthcare LLC, ProLink Healthcare LLC, Provenir Healthcare LLC, Randstad Healthcare LLC, RNnetwork LLC, Soliant Health LLC, Supplemental Health Care LLC.

North America was the largest region in the healthcare staffing market in 2024. Asia-Pacific is expected to be the fastest-growing region in the global healthcare staffing market during the forecast period. The regions covered in the healthcare staffing market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa. The countries covered in the healthcare staffing market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Canada, Italy, Spain.

Healthcare staffing involves the process of hiring healthcare workers or providers as needed for a specific organization. Beyond ensuring improved patient care, having adequate healthcare staffing numbers also helps mitigate nurse fatigue, prevents burnout, and enhances patient satisfaction.

The primary services within healthcare staffing include travel nurse staffing, per diem nurse staffing, locum tenens staffing, and allied healthcare staffing. A travel nurse is a registered nurse with clinical experience who works in a temporary or contract nursing position. Unsuch as being employed by a single facility, travel nurses are often hired through independent nursing staffing services. Healthcare staffing encompasses various roles, including patient care staff, administrative staff, support staff, technicians, and allied health professionals providing services to hospitals, pharmaceutical companies, clients, and government agencies.

The healthcare staffing market research report is one of a series of new reports that provides healthcare staffing market statistics, including healthcare staffing industry global market size, regional shares, competitors with an healthcare staffing market share, detailed healthcare staffing market segments, market trends and opportunities, and any further data you may need to thrive in the healthcare staffing industry. This healthcare staffing market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenario of the industry.

The healthcare staffing market includes revenues earned by entities by the selection of qualified candidates, the use of technology to check the credentials of candidates and employees, the validation of skills, and any other screening procedures. The market value includes the value of related goods sold by the service provider or included within the service offering. Only goods and services traded between entities or sold to end consumers are included.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

Healthcare Staffing Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on healthcare staffing market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for healthcare staffing? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The healthcare staffing market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include:

- The forecasts are made after considering the major factors currently impacting the market. These include the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) By Service: Travel Nurse Staffing; Per Diem Nurse Staffing; Locum Tenens Staffing; Allied Healthcare Staffing2) By Function: Patient Care Staff; Administrative Staff; Support Staff; Technicians; Allied Health Professionals

3) By End User: Hospitals; Pharma; Clients; Government Agencies

Subsegments:

1) By Travel Nurse Staffing: Registered Nurses (RNs); Licensed Practical Nurses (LPNs); Specialty Nurses2) By Per Diem Nurse Staffing: Temporary RNs; LPNs For Short-Term Needs; CNAs (Certified Nursing Assistants)

3) By Locum Tenens Staffing: Physicians; Nurse practitioners (NPs); Physician Assistants (PAs)

4) By Allied Healthcare Staffing: Physical Therapists (PTs); Radiologic Technologists; Medical Lab Technicians (MLTs)

Key Companies Mentioned: Envision Healthcare Corporation; AMN Healthcare Holdings Inc.; CHG Healthcare Services Inc.; Maxim Healthcare Group Inc.; Cross Country Healthcare Inc.

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

- Envision Healthcare Corporation

- AMN Healthcare Holdings Inc.

- CHG Healthcare Services Inc.

- Maxim Healthcare Group Inc.

- Cross Country Healthcare Inc.

- Aya Healthcare Inc.

- Adecco Group AG

- Trustaff Inc.

- TeamHealth Holdings Inc.

- LocumTenens.com LLC

- Jackson Healthcare LLC

- Favorite Healthcare Staffing Inc.

- Medical Solutions LLC

- Syneos Health Inc.

- Aureus Medical Group LLC

- CompHealth LLC

- CoreMedical Group LLC

- CrossMed Healthcare Staffing Solutions LLC

- Emerald Health Services LLC

- Health Carousel LLC

- HealthTrust Workforce Solutions LLC

- KPG Healthcare LLC

- MAS Medical Staffing LLC

- MedPro Healthcare Staffing LLC

- MedStaff Healthcare Solutions LLC

- Next Travel Nursing LLC

- NurseFly LLC

- Onward Healthcare LLC

- ProLink Healthcare LLC

- Provenir Healthcare LLC

- Randstad Healthcare LLC

- RNnetwork LLC

- Soliant Health LLC

- Supplemental Health Care LLC

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 200 |

| Published | February 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 49.78 Billion |

| Forecasted Market Value ( USD | $ 68.83 Billion |

| Compound Annual Growth Rate | 8.4% |

| Regions Covered | Global |

| No. of Companies Mentioned | 34 |