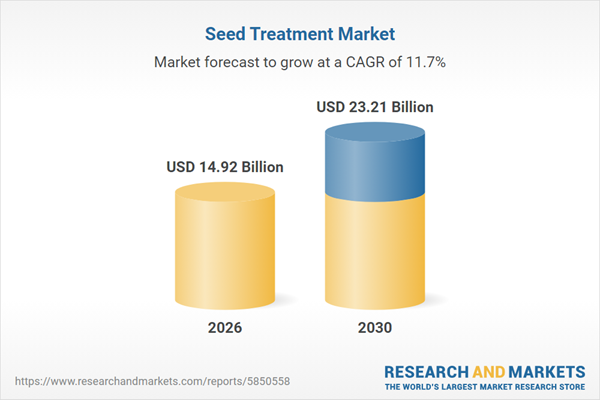

The seed treatment market size is expected to see rapid growth in the next few years. It will grow to $23.21 billion in 2030 at a compound annual growth rate (CAGR) of 11.7%. The growth in the forecast period can be attributed to rising demand for biological treatment products, increasing adoption of precision agriculture, growing focus on sustainable crop protection, development of advanced coating technologies, expansion of integrated pest management adoption. Major trends in the forecast period include growing adoption of biological seed treatments, rising preference for low-toxicity and eco-friendly formulations, increasing demand for multi-functional seed enhancement products, expansion of integrated disease and pest management solutions, development of advanced seed coating and pelleting technologies.

The rising incidence of seed- and soil-borne diseases is expected to drive the growth of the seed treatment market in the coming years. Seed- and soil-borne diseases refer to plant infections caused by pathogens that reside in the soil or on seeds. These diseases are primarily managed through seed treatment, which offers a cost-effective and efficient method for protecting crops, controlling pathogens, and improving overall crop production efficiency. For example, in February 2023, according to a report released by the Food and Agriculture Organization (FAO), a U.S.-based specialized agriculture agency, pests significantly affect global crop production each year, causing losses estimated between 20% and 40%. Plant diseases alone result in approximately $220 billion in global economic losses annually, while invasive insects add another $70 billion. Therefore, the rising number of seed- and soil-borne diseases is contributing to the expansion of the seed treatment market.

Major players in the seed treatment market are increasingly emphasizing the development of biological seed treatment solutions to gain a competitive advantage. Biological seed treatment involves the application of naturally occurring microorganisms to seeds, enhancing growth, disease protection, and overall plant health. An example is Helena Agri-Enterprises, a US-based seed treatment formulator, which launched two soybean seed treatments, Seed Shield Select and Enertia, in October 2023. These treatments integrate multi-fungicide and insecticide with Asset Formulation Technology to optimize plant vigor and root health. Enertia, a biological seed treatment, incorporates VersaShield Formulation Technology to improve nutrient availability and soil health, with stabilized enzymes for long-lasting activity.

In January 2023, Growmark Inc., a US-based agriculture company, made a strategic acquisition by acquiring Allied Seed LLC. This acquisition aligns with Growmark's supply and growth plans, positioning the company to meet the increasing demand for cover crops within a comprehensive on-farm sustainability strategy. Allied Seed, a US-based crop seed company, brings expertise in production, blending, packaging, and seed treatment, offering a range of forage, turf grass, and cover crop seed products. This acquisition enhances Growmark's capabilities and market presence in the seed treatment sector.

Major companies operating in the seed treatment market are BASF SE, Syngenta AG, Bayer AG, Croda International plc, DuPont de Nemours Inc., FMC Corporation, NuFarm Ltd., Solvay S.A, ADAMA Ltd., Corteva Inc., United Phosphorus Limited, Sumitomo Chemical Co. Ltd., Bioworks Inc., Novozymes A/S, Eastman Chemical Company, Agrauxine SA, Germains Seed Technology, Incotec Group BV, Valent Biosciences Corporation, Advanced Biological Marketing Inc., Wolf Trax Inc., BrettYoung Seeds Limited, Precision Laboratories LLC, Loveland Products Inc., Plant Health Care plc, Albaugh LLC, Gowan Company LLC.

Note that the outlook for this market is being affected by rapid changes in trade relations and tariffs globally. The report will be updated prior to delivery to reflect the latest status, including revised forecasts and quantified impact analysis. The report’s Recommendations and Conclusions sections will be updated to give strategies for entities dealing with the fast-moving international environment.

Tariffs on chemical agents, formulation ingredients, and imported seed treatment machinery have elevated production costs and limited access to specialized inputs, particularly affecting regions dependent on global suppliers such as Asia-Pacific and Latin America. Segments involving insecticides, fungicides, and coating technologies face the strongest impact due to higher material import intensity. Despite these challenges, tariffs have encouraged local manufacturing of biological treatments and domestic innovation in eco-friendly formulations, supporting long-term market resilience.

The seed treatment market research report is one of a series of new reports that provides seed treatment market statistics, including seed treatment industry global market size, regional shares, competitors with a seed treatment market share, detailed seed treatment market segments, market trends and opportunities, and any further data you may need to thrive in the seed treatment industry. This seed treatment market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenario of the industry.

Seed treatment involves the application of diverse agents to seeds before planting, aiming to safeguard them from diseases and pests while enhancing germination and overall growth. This practice is widely employed to optimize seed performance.

The key categories of chemicals utilized in seed treatment encompass insecticides, fungicides, chemicals, and non-chemicals. These substances are available in various formulations, including liquid solutions, powders, emulsions, flowable concentrates, water dispersible powders for slurry, and others. Insecticides play a crucial role in seed treatment, acting as chemical or biological agents designed to control or eliminate insects that pose a threat to crops. Their applications span seed protection and enhancement across a diverse range of crops, including oilseeds, cereals and grains, fruits and vegetables, among others. Insecticides are employed in various seed treatment applications, such as seed coating, seed dressing, and seed pelleting, contributing to the overall health and productivity of crops.North America was the largest region in the seed treatment market in 2025. The regions covered in the seed treatment market report are Asia-Pacific, South East Asia, Western Europe, Eastern Europe, North America, South America, Middle East, Africa. The countries covered in the seed treatment market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Taiwan, Russia, South Korea, UK, USA, Canada, Italy, Spain.

The seed treatment market includes revenues earned by entities by providing services such as seed disinfection, seed disinfestation, and seed protection. The market value includes the value of related goods sold by the service provider or included within the service offering. Only goods and services traded between entities or sold to end consumers are included.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 1-3 business days.

Table of Contents

Executive Summary

Seed Treatment Market Global Report 2026 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses seed treatment market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 16 geographies.

- Assess the impact of key macro factors such as geopolitical conflicts, trade policies and tariffs, inflation and interest rate fluctuations, and evolving regulatory landscapes.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on end user analysis.

- Benchmark performance against key competitors based on market share, innovation, and brand strength.

- Evaluate the total addressable market (TAM) and market attractiveness scoring to measure market potential.

- Suitable for supporting your internal and external presentations with reliable high-quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for seed treatment? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward, including technological disruption, regulatory shifts, and changing consumer preferences? The seed treatment market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, total addressable market (TAM), market attractiveness score (MAS), competitive landscape, market shares, company scoring matrix, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market. This section also examines key products and services offered in the market, evaluates brand-level differentiation, compares product features, and highlights major innovation and product development trends.

- The supply chain analysis section provides an overview of the entire value chain, including key raw materials, resources, and supplier analysis. It also provides a list competitor at each level of the supply chain.

- The updated trends and strategies section analyses the shape of the market as it evolves and highlights emerging technology trends such as digital transformation, automation, sustainability initiatives, and AI-driven innovation. It suggests how companies can leverage these advancements to strengthen their market position and achieve competitive differentiation.

- The regulatory and investment landscape section provides an overview of the key regulatory frameworks, regularity bodies, associations, and government policies influencing the market. It also examines major investment flows, incentives, and funding trends shaping industry growth and innovation.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include the technological advancements such as AI and automation, Russia-Ukraine war, trade tariffs (government-imposed import/export duties), elevated inflation and interest rates.

- The total addressable market (TAM) analysis section defines and estimates the market potential compares it with the current market size, and provides strategic insights and growth opportunities based on this evaluation.

- The market attractiveness scoring section evaluates the market based on a quantitative scoring framework that considers growth potential, competitive dynamics, strategic fit, and risk profile. It also provides interpretive insights and strategic implications for decision-makers.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth.

- Expanded geographical coverage includes Taiwan and Southeast Asia, reflecting recent supply chain realignments and manufacturing shifts in the region. This section analyzes how these markets are becoming increasingly important hubs in the global value chain.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The company scoring matrix section evaluates and ranks leading companies based on a multi-parameter framework that includes market share or revenues, product innovation, and brand recognition.

Scope

Markets Covered:

1) By Type: Insecticides; Fungicides; Chemicals; Non-Chemicals2) By Formulation: Liquid Solution; Powder; Emulsion; Flowable Concentrate; Water Dispersible Powder For Slurry; Other Formulations

3) By Crop Type: Oilseeds; Cereals And Grains; Fruits And Vegetables; Other Crop Types

4) By Function: Seed Protection; Seed Enhancement

5) By Application Technique: Seed Coating; Seed Dressing; Seed Pelleting

Subsegments:

1) By Insecticides: Systemic Insecticides; Contact Insecticides; Soil-Applied Insecticides2) By Fungicides: Seed Fungicides; Soil Fungicides; Foliar Fungicides

3) By Chemicals: Synthetic Chemicals; Biochemicals

4) By Non-Chemicals: Biological Treatments; Physical Treatments

Companies Mentioned: BASF SE; Syngenta AG; Bayer AG; Croda International plc; DuPont de Nemours Inc.; FMC Corporation; NuFarm Ltd.; Solvay S.A; ADAMA Ltd.; Corteva Inc.; United Phosphorus Limited; Sumitomo Chemical Co. Ltd.; Bioworks Inc.; Novozymes A/S; Eastman Chemical Company; Agrauxine SA; Germains Seed Technology; Incotec Group BV; Valent Biosciences Corporation; Advanced Biological Marketing Inc.; Wolf Trax Inc.; BrettYoung Seeds Limited; Precision Laboratories LLC; Loveland Products Inc.; Plant Health Care plc; Albaugh LLC; Gowan Company LLC

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Taiwan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; South East Asia; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: Word, PDF or Interactive Report + Excel Dashboard

Added Benefits:

- Bi-Annual Data Update

- Customisation

- Expert Consultant Support

Companies Mentioned

The companies featured in this Seed Treatment market report include:- BASF SE

- Syngenta AG

- Bayer AG

- Croda International plc

- DuPont de Nemours Inc.

- FMC Corporation

- NuFarm Ltd.

- Solvay S.A

- ADAMA Ltd.

- Corteva Inc.

- United Phosphorus Limited

- Sumitomo Chemical Co. Ltd.

- Bioworks Inc.

- Novozymes A/S

- Eastman Chemical Company

- Agrauxine SA

- Germains Seed Technology

- Incotec Group BV

- Valent Biosciences Corporation

- Advanced Biological Marketing Inc.

- Wolf Trax Inc.

- BrettYoung Seeds Limited

- Precision Laboratories LLC

- Loveland Products Inc.

- Plant Health Care plc

- Albaugh LLC

- Gowan Company LLC

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 250 |

| Published | January 2026 |

| Forecast Period | 2026 - 2030 |

| Estimated Market Value ( USD | $ 14.92 Billion |

| Forecasted Market Value ( USD | $ 23.21 Billion |

| Compound Annual Growth Rate | 11.7% |

| Regions Covered | Global |

| No. of Companies Mentioned | 28 |