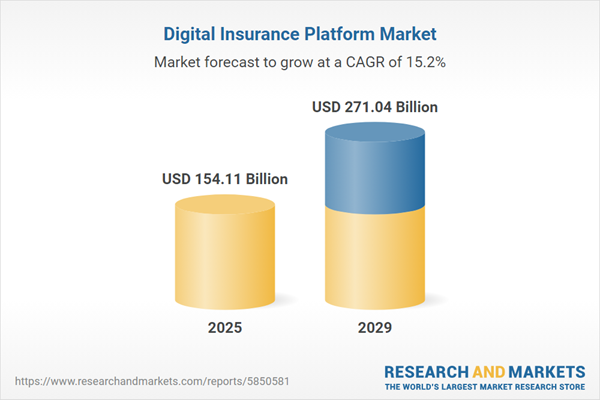

The digital insurance platform market size is expected to see rapid growth in the next few years. It will grow to $271.04 billion in 2029 at a compound annual growth rate (CAGR) of 15.2%. The growth in the forecast period can be attributed to increased emphasis on customer engagement, rise of usage-based insurance models, expansion of digital ecosystems, focus on climate and environmental risks, rising cybersecurity concerns. Major trends in the forecast period include collaboration with insurtech startups, integration with iot devices, advancements in blockchain technology, artificial intelligence for automation, on-demand insurance models.

The increasing adoption of cloud computing is anticipated to drive the growth of the digital insurance platform market in the future. Cloud computing refers to technology that enables users to access storage spaces, files, applications, and databases through internet-connected devices such as desktops, laptops, tablets, and sensors. Cloud computing services benefit the digital insurance platform market by providing a separate location for storing and analyzing information away from clients. For example, a report from the European Commission, a government body based in Belgium, indicated that in 2023, 77.6% of large enterprises reported utilizing cloud computing services, representing a 6 percentage point increase from 2021. For medium-sized enterprises, the percentage of those using cloud services rose to 59% in 2023, up from 53% in 2021. Among small businesses, this share increased by 3.8 percentage points, reaching 41.7% during the same timeframe. Thus, the growing adoption of cloud computing is driving the expansion of the digital insurance platform market.

The expansion of the insurtech sector is expected to play a pivotal role in propelling the digital insurance platform market. Insurtech involves leveraging digital technology and data analytics innovatively to enhance and streamline various aspects of the insurance industry. The integration of insurtech, incorporating technologies such as artificial intelligence, machine learning, and blockchain, contributes to the evolution of digital insurance platforms, resulting in more efficient processes and enhanced customer experiences. For example, according to the Insurtech Global Outlook Report published by NTT DATA, a Japan-based information technology company, the year 2022 saw the insurtech sector attract $8 billion in investments across 470 deals, representing a significant increase from the $5.83 billion secured in 2020 through 435 deals. Consequently, the upward trajectory of the insurtech sector is poised to drive the growth of the digital insurance platform market in the foreseeable future.

Technological advancements are a significant trend gaining traction in the digital insurance platform market. Leading companies in this sector are embracing new technologies to maintain their competitive edge. For example, in June 2024, Sapiens International Corporation, an intelligent software solutions company based in Israel, launched its next-generation intelligent insurance platform. This AI-powered, open, integrated, cloud-native solution is designed to enhance insurers' capabilities by streamlining operations and improving decision-making processes across various lines of insurance. As insurers face mounting pressure to boost efficiency and enhance customer experience, solutions like the Sapiens Insurance Platform are well-positioned to help them achieve these objectives.

Prominent companies in the digital insurance platform market are actively engaged in the development of innovative products, such as self-service digital insurance portals, to gain a competitive edge and broaden their customer base. A self-service digital insurance portal provides users with an online platform to independently manage their insurance needs. As an example, in October 2023, NCBA Bancassurance Intermediary Limited, a subsidiary of the Kenyan-based financial services provider NCBA Group, introduced a digital insurance portal. This platform empowers customers to autonomously handle their insurance requirements, offering advanced data security, the convenience of comparing motor insurance quotes from various underwriters, and the ability to make informed decisions. Features of the portal include quote comparison, immediate access to insurance portfolios, real-time claims submission and tracking, and diverse premium payment options such as Mpesa, bank accounts, and insurance premium financing.

In July 2023, Ryan Specialty, a specialty insurance company based in the United States, acquired Socius Insurance Services for an undisclosed amount. This acquisition is intended to strengthen Ryan Specialty’s market position through strategic partnerships, with the ultimate goal of enhancing efficiency and innovation in specialty insurance solutions. Socius Insurance Services is also a U.S.-based specialty insurance company that offers a variety of insurance solutions.

Major companies operating in the digital insurance platform market include International Business Machines Corporation, Microsoft Corp., Infosys Ltd., Pegasystems Inc., Oracle Corp., Accenture Inc., Tata Consultancy Services Limited, Cognizant Technology Solutions Corp., Majesco Inc., DXC Technology Co., Appian Corp., Mindtree Ltd., Prima Solutions SA, SAP SE, EIS Software Limited, Fineos Corporation Ltd., Inzura Limited, Cogitate Technology Solutions Inc., OutSystems Inc., PolicyBazaar.com, PolicyGenius Inc., PolicyPal Network Technology Co. Ltd., PolicyX.com, Quantemplate Technologies Inc., Root Insurance Company, Slice Labs Inc., Trov Inc., Wefox Group GmbH, Zego Insurance Services Limited, Acko General Insurance Limited, Cover Genius Pty. Ltd., Shift Technology Inc.

North America was the largest region in the digital insurance platform market in 2024. Asia-Pacific is expected to be the fastest-growing region in the global digital insurance platform market during the forecast period. The regions covered in the digital insurance platform market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa. The countries covered in the digital insurance platform market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Canada, Italy, Spain.

A digital insurance platform is a type of insurance business that leverages technology to provide consumers with efficient and tailored insurance solutions by optimizing internal processes. This approach aims to enhance customer experience, increase productivity, reduce costs, and ultimately elevate customer satisfaction, enabling insurers to establish a competitive advantage in the market.

Digital insurance platforms are deployed through different models, including cloud and on-premise solutions. Cloud computing, a technology that allows users to access and store data remotely, is a key component of these platforms. Professional services associated with digital insurance platforms encompass consulting, implementation, support, and maintenance, catering to both large and small-medium enterprise organizations. These platforms find application across various sectors such as automotive and transportation, home and commercial buildings, life and health insurance, business and enterprise insurance, consumer electronics, industrial machines, and travel. The end-users benefiting from digital insurance platforms include insurance companies, third-party administrators, brokers, and aggregators.

The digital insurance platform market research report is one of a series of new reports that provides digital insurance platform optical components market statistics, including digital insurance platform optical components industry global market size, regional shares, competitors with a digital insurance platform optical components market share, detailed digital insurance platform optical components market segments, market trends and opportunities, and any further data you may need to thrive in the digital insurance platform optical components industry. This digital insurance platform optical components market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenario of the industry.

The digital insurance platform market includes revenues earned by entities by providing life insurance, haven life insurance, business insurance, next insurance and homeowners insurance. The market value includes the value of related goods sold by the service provider or included within the service offering. Only goods and services traded between entities or sold to end consumers are included.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

Digital Insurance Platform Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on digital insurance platform market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for digital insurance platform? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The digital insurance platform market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include:

- The forecasts are made after considering the major factors currently impacting the market. These include the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) By Deployment: Cloud; on-Premise2) By Professional Service: Consulting; Implementation; Support and Maintenance

3) By Organization Size: Large Enterprises; Small and Medium Enterprises

4) By Application: Automotive and Transportation; Home and Commercial Buildings; Life and Health; Business and Enterprise; Consumer Electronics; Industrial Machines; Travel

5) By End-User: Insurance Companies; Third-Party Administrators and Brokers; Aggregators

Subsegments

1) By Cloud: Public Cloud; Private Cloud; Hybrid Cloud; on-Premise2) By on-Premise Software Solutions: On-Premise Software Solutions; Custom on-Premise Deployments

Key Companies Mentioned: International Business Machines Corporation; Microsoft Corp.; Infosys Ltd.; Pegasystems Inc.; Oracle Corp.

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

- International Business Machines Corporation

- Microsoft Corp.

- Infosys Ltd.

- Pegasystems Inc.

- Oracle Corp.

- Accenture Inc.

- Tata Consultancy Services Limited

- Cognizant Technology Solutions Corp.

- Majesco Inc.

- DXC Technology Co.

- Appian Corp.

- Mindtree Ltd.

- Prima Solutions SA

- SAP SE

- EIS Software Limited

- Fineos Corporation Ltd.

- Inzura Limited

- Cogitate Technology Solutions Inc.

- OutSystems Inc.

- PolicyBazaar.com

- PolicyGenius Inc.

- PolicyPal Network Technology Co. Ltd.

- PolicyX.com

- Quantemplate Technologies Inc.

- Root Insurance Company

- Slice Labs Inc.

- Trov Inc.

- Wefox Group GmbH

- Zego Insurance Services Limited

- Acko General Insurance Limited

- Cover Genius Pty. Ltd.

- Shift Technology Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 200 |

| Published | February 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 154.11 Billion |

| Forecasted Market Value ( USD | $ 271.04 Billion |

| Compound Annual Growth Rate | 15.2% |

| Regions Covered | Global |

| No. of Companies Mentioned | 32 |