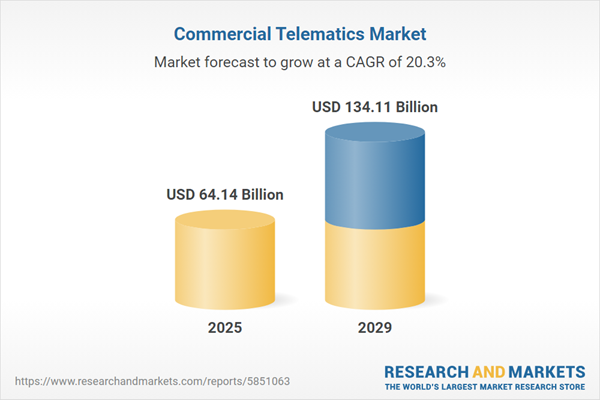

The commercial telematics market size is expected to see exponential growth in the next few years. It will grow to $134.11 billion in 2029 at a compound annual growth rate (CAGR) of 20.3%. The growth in the forecast period can be attributed to shift towards sustainability, industry-specific applications, increasing demand for real-time insights, cost efficiency demands, emergence of autonomous vehicles. Major trends in the forecast period include connectivity evolution, fleet management optimization, safety and compliance, data analytics and ai, integration with autonomous vehicles.

The rising sales of commercial and passenger vehicles are projected to drive the growth of the commercial telematics market in the future. Economic expansion and technological advancements have led to an increase in the demand for both commercial and passenger vehicles. As economies grow, consumers gain more purchasing power, resulting in higher demand for transportation services and automobile sales. Additionally, fleet managers are attracted to vehicles equipped with advanced safety systems and telematics solutions, which enhance vehicle appeal, efficiency, and operational effectiveness. For example, in January 2024, the International Organization of Motor Vehicle Manufacturers, a trade association based in France, reported that commercial vehicle sales reached 12,892,621 units in 2023, a significant rise from 11,371,749 units sold in 2022. Similarly, passenger vehicle sales increased from 2,858,575 in 2022 to 3,116,647 in 2023. Both segments experienced substantial growth, indicating a robust recovery and rising demand in the automotive sector. Therefore, the growing sales of commercial and passenger vehicles are fueling the expansion of the commercial telematics market.

The commercial telematics market is poised for growth, propelled by the expanding e-commerce industry. E-commerce, involving online buying and selling of goods and services, utilizes commercial telematics to enhance operational efficiency, enhance safety, and optimize delivery processes. The e-commerce sector witnesses increased transactions, and the adoption of telematics solutions contributes to improved business operations. For instance, in August 2023, the United States Census Bureau reported a 7.5% increase in e-commerce estimates for the second quarter of 2023 compared to the same period in 2022. Online sales accounted for 15.4% of total sales during the second quarter of 2023. This data underscores the growing significance of the e-commerce industry in driving the commercial telematics market.

Technological advancements are a prominent trend in the commercial telematics market, with companies actively innovating to maintain their market positions. For example, in December 2022, ATrack Technology Inc., a Taiwanese telematics hardware manufacturer, introduced the AK300 LTE vehicle tracker. This device enhances fleet management efficiency by offering real-time vehicle tracking with detailed information on positioning, mileage, speed, fuel consumption, and engine status. It also detects abnormal vehicle conditions and negative driving behaviors, allowing fleet managers to perform preventive maintenance and improve driver conduct.

Leading companies in the commercial telematics market are prioritizing innovative solutions such as Commercial Pulse, a comprehensive telematics AI system for commercial vehicles. Commercial Pulse, developed in-house, provides real-time vehicle location, driver safety information, battery state of charge, and more. In September 2023, Mullen Technologies launched Commercial Pulse as part of its fleet telematics software. This solution aims to maximize vehicle uptime, equip businesses with tools for efficient fleet management, and streamline operations. The system is accessible through two mobile applications, Mullen Commercial Pulse Fleet and Mullen Commercial Pulse Driver, currently available for the Mullen One (all-electric Class 1 cargo van) and the Mullen Three (all-electric Class 3 low-cab forward).

In March 2023, Cambridge Mobile Telematics, a US-based software company, completed the acquisition of Amodo for an undisclosed amount. This strategic move merges two telematics companies with significant footprints in Europe, providing Amodo's clients with access to Cambridge Mobile Telematics' extensive resources and expertise. Amodo, based in Croatia, is recognized for developing an insurance telematics platform focused on establishing direct digital channels and delivering customer behavior analytics.

Major companies operating in the commercial telematics market include Geotab Inc., Masternaut Limited, MiX Telematics Limited, Omnitracs LLC, TomTom International BV, Verizon Communications Inc., American Telephone and Telegraph Company, OnStar Corporation, Bayerische Motoren Werke AG, Zonar Systems Inc., Inseego Corporation, Vontier Corporation, Microlise limited, Solera Holdings Inc., Continental AG, Daimler AG, Karooooo Ltd., Michelin SCA, CalAmp Corp., Fleetmatics Group PLC, Garmin Ltd., Transics International NV, Trimble Navigation Limited, Webtech Wireless Inc., Wireless Matrix Corporation, XRS Corporation, Actsoft Inc., AirIQ Inc., AssetWorks LLC, Autotrac Comércio e Telecomunicações Ltd., Azuga Inc., Blue Tree Systems Ltd., CarrierWeb LLC.

North America was the largest region in the commercial telematics market in 2024. Asia-Pacific is expected to be the fastest-growing region in the global commercial telematics market report during the forecast period. The regions covered in the commercial telematics market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa. The countries covered in the commercial telematics market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Canada, Italy, Spain.

Commercial telematics involves the utilization of technology to gather data pertaining to the operation of commercial vehicles, encompassing trucks, buses, and delivery vans. This data encompasses details about the vehicle's location, speed, fuel consumption, engine performance, and driver behavior, among other relevant parameters.

Commercial telematics is categorized into two main types, solutions and services. A solution refers to a specific approach or method designed to address a particular problem or challenge. It entails providing a comprehensive and effective resolution to a specific issue or requirement. These solutions are offered in various system formats, including embedded, tethered, and smartphone-integrated solutions, which are delivered through original equipment manufacturers (OEM) and aftermarket channels. Commercial telematics solutions find application across diverse end-user sectors, such as transportation and logistics, insurance, healthcare, media and entertainment, vehicle manufacturers or dealers, government agencies, and other entities.

The commercial telematics market research report is one of a series of new reports that provides commercial telematics optical components market statistics, including commercial telematics optical components industry global market size, regional shares, competitors with a commercial telematics optical components market share, detailed commercial telematics optical components market segments, market trends and opportunities, and any further data you may need to thrive in the commercial telematics optical components industry. This commercial telematics optical components market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenario of the industry.

The commercial telematics market includes revenues earned by entities by providing services including vehicle tracking, remote diagnostics and maintenance monitoring, fuel management and optimization, and driver behavior monitoring and coaching. The primary goal of commercial telematics is to improve the efficiency and safety of commercial vehicle operations. The market value includes the value of related goods sold by the service provider or included within the service offering. Only goods and services traded between entities or sold to end consumers are included.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

Commercial Telematics Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on commercial telematics market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for commercial telematics? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The commercial telematics market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include:

- The forecasts are made after considering the major factors currently impacting the market. These include the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) By Type: Solutions; Services2) By System: Embedded; Tethered; Smartphone Integrated

3) By Provider: Original Equipment Manufacturer (OEM); Aftermarket

4) By End User: Transportation and Logistics; Insurance; Healthcare; Media and Entertainment; Vehicle Manufacturers or Dealers; Government Agencies; Other End-Users

Subsegments:

1) By Solutions: Fleet Management Solutions; Vehicle Tracking Solutions; Driver Behavior Monitoring Solutions; Route Optimization Solutions; Fuel Management Solutions2) By Services: Installation Services; Consulting Services; Maintenance and Support Services; Data Analytics Services

Key Companies Mentioned: Geotab Inc.; Masternaut Limited; MiX Telematics Limited; Omnitracs LLC; TomTom International BV

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

- Geotab Inc.

- Masternaut Limited

- MiX Telematics Limited

- Omnitracs LLC

- TomTom International BV

- Verizon Communications Inc.

- American Telephone and Telegraph Company

- OnStar Corporation

- Bayerische Motoren Werke AG

- Zonar Systems Inc.

- Inseego Corporation

- Vontier Corporation

- Microlise limited

- Solera Holdings Inc.

- Continental AG

- Daimler AG

- Karooooo Ltd.

- Michelin SCA

- CalAmp Corp.

- Fleetmatics Group PLC

- Garmin Ltd.

- Transics International NV

- Trimble Navigation Limited

- Webtech Wireless Inc.

- Wireless Matrix Corporation

- XRS Corporation

- Actsoft Inc.

- AirIQ Inc.

- AssetWorks LLC

- Autotrac Comércio e Telecomunicações Ltd.

- Azuga Inc.

- Blue Tree Systems Ltd.

- CarrierWeb LLC

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 200 |

| Published | February 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 64.14 Billion |

| Forecasted Market Value ( USD | $ 134.11 Billion |

| Compound Annual Growth Rate | 20.3% |

| Regions Covered | Global |

| No. of Companies Mentioned | 33 |