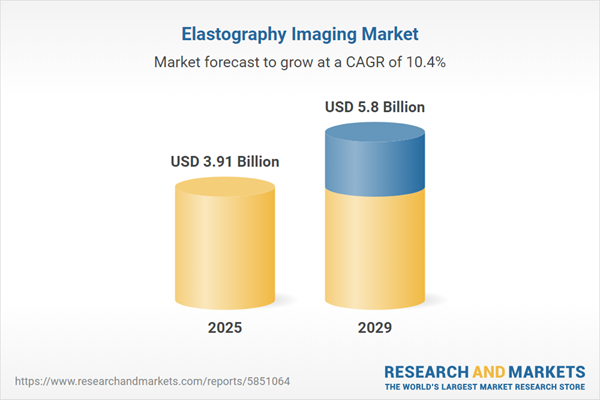

The elastography imaging market size is expected to see rapid growth in the next few years. It will grow to $5.8 billion in 2029 at a compound annual growth rate (CAGR) of 10.4%. The growth in the forecast period can be attributed to market growth and expansion, global healthcare trends, cost-efficiency and affordability, demand for non-invasive diagnostics, clinical adoption and acceptance. Major trends in the forecast period include clinical advancements, integration of shear wave elastography (swe), real-time imaging, multimodal imaging integration, expanding clinical applications.

The anticipated increase in the elastography imaging market is expected to be driven by the growing incidence of chronic liver and breast cancer. Chronic liver and breast cancer involve the uncontrolled growth and multiplication of liver cells, leading to life-threatening conditions. Elastography, a technique based on ultrasound (US), is commonly utilized in hepatology to assess liver stiffness in individuals with chronic liver disease. Consequently, the rising prevalence of chronic liver and breast cancer is poised to fuel the growth of the elastography imaging market. For example, data from the 'Cancer Facts And Figures 2023' report by the American Cancer Society, a nationwide voluntary health organization in the United States, revealed an increase in new cases of liver and intrahepatic bile duct cancer in females, rising from 12,640 in 2020 to 13,230 in 2023.

The rise in healthcare spending is projected to drive the growth of the elastography imaging market in the future. Healthcare expenditure refers to the overall financial resources allocated to healthcare-related goods and services during a specific timeframe, usually at a national or regional scale. In elastography imaging, healthcare spending enhances diagnostic precision, facilitates early disease detection, reduces invasiveness, improves monitoring of disease progression, and ultimately contributes to more cost-effective healthcare solutions. For example, reports from the Office for National Statistics (ONS), a national statistical institute in the UK, indicate that total healthcare spending increased by 5.6% in nominal terms from 2022 to 2023, contrasting with a growth rate of only 0.9% in 2022. Consequently, the rise in healthcare expenditure is driving the expansion of the elastography imaging market.

A prominent trend gaining traction in the elastography imaging market is the adoption of technologically advanced devices. Leading companies in the market are directing their efforts towards the development of sophisticated elastography imaging devices to maintain their competitive positions. For example, in May 2022, Mindray Medical International Limited, a China-based medical instrumentation manufacturing company, introduced the Resona I9 Ultrasound Machine. This Shear Wave Elastography (SWE)-based system features an intelligent iConsole control panel, customizable E-Ink keys, and a 2-hour battery. The Resona I9 incorporates Mindray's groundbreaking ZONE Sonography Technology+ (ZST+), providing advanced ultrasound capabilities with a harmonious blend of resolution, tissue homogeneity, and crisp imaging. Shear-wave elastography enables increased frame rates, greater refresh rates, and smoother transitions in the I9.

Major players in the elastography imaging market are also focusing on launching innovative technological products, such as performance endoscopic ultrasound systems, to enhance patient care and workflow efficiency. Performance endoscopic ultrasound systems represent cutting-edge medical technology utilized for diagnosing and treating various digestive and respiratory diseases. For instance, in November 2022, Pentax Corporation, a Japan-based camera and optical equipment manufacturer, introduced its Performance Endoscopic Ultrasound System (EUS) in Canada. This system combines the ARIETTA 65 PX ultrasound scanner with the J10 Series Ultrasound Gastroscopes, providing exceptional imaging, maneuverability, and efficiency for endoscopic ultrasound procedures. This powerful and versatile tool aims to improve the quality of care for patients undergoing endoscopic ultrasound procedures.

In January 2024, Mindray North America Inc., a medical device company based in the United States, joined forces with Aegle Medical Solutions Inc. to incorporate advanced medical imaging solutions aimed at improving patient monitoring. Through this collaboration, Mindray and Aegle Medical Solutions intend to advance the development and integration of elastography imaging technologies, ultimately enhancing patient diagnosis and monitoring in healthcare environments. Aegle Medical Solutions Inc. is also a medical technology company located in the United States.

Major companies operating in the elastography imaging market include Canon Medical Systems Corporation, Esaote S.p.A., GE Healthcare Technologies Inc., Koninklijke Philips N.V., Mindray Bio-Medical Electronics Co. Ltd., Samsung Medison Co. Ltd., Siemens Healthineers AG, Clarius Mobile Health Corp., Toshiba America Medical Systems Inc., SuperSonic Imagine, Resoundant Inc., Shimadzu Corporation, BK Medical Holding Company Inc., SonoScape Medical Corp., Philips Healthcare, Hitachi Medical Systems, Fujifilm Holdings Corporation, Analogic Corporation, Exact Imaging Inc., Echosens, Konica Minolta Healthcare Americas Inc., Arterys Inc., Fovia Medical Inc, QT Ultrasound LLC, Healcerion Co. Ltd., EDAP TMS Inc.

Asia-pacific was the largest region in the elastography imaging market in 2024. The regions covered in the elastography imaging market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa. The countries covered in the elastography imaging market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Canada, Italy, Spain.

Elastography imaging is a non-invasive diagnostic technology designed to assess the rigidity of organs and various body components. This method involves utilizing painless, low-frequency vibrations to determine the stiffness of tissues and organs, aiding in the diagnosis of related disorders.

Two primary modes of elastography imaging are ultrasound and magnetic resonance. Ultrasound, also known as sonography, is an imaging technique that employs high-frequency sound waves to visualize the interior organs and connective tissues such as muscles. This method is valuable for identifying the root causes of discomfort, edema, and diseases affecting the body's internal organs. Elastography imaging finds applications in various medical fields, including radiology, cardiology, obstetrics, urology, vascular, orthopedic, musculoskeletal, and others. These applications are utilized by hospitals, ambulatory surgery centers, and other healthcare facilities.

The elastography imaging software market research report is one of a series of new reports that provides elastography imaging software market statistics, including elastography imaging software industry global market size, regional shares, competitors with a elastography imaging software market share, detailed elastography imaging software market segments, market trends and opportunities, and any further data you may need to thrive in the elastography imaging software industry. This elastography imaging software market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenario of the industry.

The elastography imaging market consists of sales of one-dimensional transient elastography, point shear wave elastography, and two-dimensional shear wave elastography. Values in this market are ‘factory gate’ values, that is the value of goods sold by the manufacturers or creators of the goods, whether to other entities (including downstream manufacturers, wholesalers, distributors, and retailers) or directly to end customers. The value of goods in this market includes related services sold by the creators of the goods.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

Elastography Imaging Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on elastography imaging market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for elastography imaging? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The elastography imaging market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include:

- The forecasts are made after considering the major factors currently impacting the market. These include the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) By Modality: Ultrasound; Magnetic Resonance2) By Application: Radiology; Cardiology; Obstetrics; Urology; Vascular; Orthopedic and Musculoskeletal; Other Applications

3) By End Use: Hospitals; Ambulatory Surgery Centers; Other End Uses

Subsegments:

1) By Ultrasound: Shear Wave Elastography (SWE); Strain Elastography; Acoustic Radiation Force Impulse (ARFI) Imaging2) By Magnetic Resonance: Magnetic Resonance Elastography (MRE); Diffusion-Weighted Imaging (DWI) With Elastography; Dynamic Contrast-Enhanced Imaging With Elastography

Key Companies Mentioned: Canon Medical Systems Corporation; Esaote S.p.A.; GE Healthcare Technologies Inc.; Koninklijke Philips N.V.; Mindray Bio-Medical Electronics Co. Ltd.

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

- Canon Medical Systems Corporation

- Esaote S.p.A.

- GE Healthcare Technologies Inc.

- Koninklijke Philips N.V.

- Mindray Bio-Medical Electronics Co. Ltd.

- Samsung Medison Co. Ltd.

- Siemens Healthineers AG

- Clarius Mobile Health Corp.

- Toshiba America Medical Systems Inc.

- SuperSonic Imagine

- Resoundant Inc.

- Shimadzu Corporation

- BK Medical Holding Company Inc.

- SonoScape Medical Corp.

- Philips Healthcare

- Hitachi Medical Systems

- Fujifilm Holdings Corporation

- Analogic Corporation

- Exact Imaging Inc.

- Echosens

- Konica Minolta Healthcare Americas Inc.

- Arterys Inc.

- Fovia Medical Inc

- QT Ultrasound LLC

- Healcerion Co. Ltd.

- EDAP TMS Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 200 |

| Published | February 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 3.91 Billion |

| Forecasted Market Value ( USD | $ 5.8 Billion |

| Compound Annual Growth Rate | 10.4% |

| Regions Covered | Global |

| No. of Companies Mentioned | 26 |