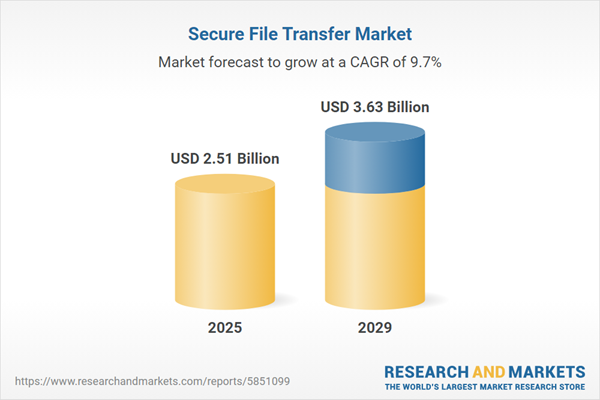

The secure file transfer market size is expected to see strong growth in the next few years. It will grow to $3.63 billion in 2029 at a compound annual growth rate (CAGR) of 9.7%. The growth in the forecast period can be attributed to increasing cybersecurity threats, increased use of iot devices, cloud integration and hybrid solutions, growing volume of data transfers, focus on user authentication and access control. Major trends in the forecast period include blockchain integration in security, ai-powered threat detection, end-to-end encryption solutions, mobile-friendly secure transfer, zero-trust security frameworks.

The increasing demand for cloud-based technologies is anticipated to drive growth in the secure file transfer market. Cloud-based file transfer solutions enhance secure information transfer by providing features such as encryption, access control, and other security measures. These systems often include secure file sharing and collaboration tools, enabling users to exchange files while managing access permissions. For example, in April 2024, the Statistical Office of the European Communities, a Luxembourg-based government agency, reported that in 2023, 42.5% of enterprises in the EU purchased cloud computing services, mainly for email, file storage, and office software. This marks a 4.2 percentage point increase compared to the share of enterprises using cloud computing services in 2021. Thus, the rising demand for cloud-based technologies is propelling the growth of the secure file transfer market.

The increasing prevalence of cybersecurity threats is also expected to contribute to the growth of the secure file transfer market. Cybersecurity threats encompass the rising quantity and sophistication of cyberattacks, dangers, and vulnerabilities that individuals, businesses, and governments face in the digital age. Secure file transfer methods play a crucial role in mitigating the risks associated with cyber threats, including interception, unauthorized access, data manipulation, and malware infiltration. For instance, a statement from AAG IT Services, a US-based cybersecurity company, in December 2023, highlighted an 81% increase in cyberattacks in Australia between July 2021 and June 2022. Additionally, attacks on financial websites surged by more than 200% in 2022, as per the latest cybercrime statistics. Consequently, the escalating cybersecurity threats act as a driving force behind the secure file transfer market.

Technological innovations stand out as key trends gaining prominence in the secure file transfer market, with companies in the sector actively embracing new technologies to maintain their competitive positions. For example, in January 2023, FileCloud, a US-based company specializing in file sharing, synchronization, and backup solutions, introduced zero-trust file-sharing technology. This innovative approach ensures data protection within the environment through the use of Zip file structures and password protection, achieving a Zero Trust model. Users can specify a Zero Trust password, creating a sharing link to a file or folder, and unauthorized access is prevented without this password, whether through a direct link or in the event of a breach.

Leading companies in the secure file transfer market are creating innovative file transfer platforms to improve security, streamline workflows, and ensure compliance with data protection regulations, all while enabling efficient file sharing. A file transfer platform is a software application or service designed to facilitate the secure transfer of files and data between users, devices, or systems over a network, typically the Internet. For example, in October 2023, Fileport, a U.S.-based technology company, launched an advanced file transfer platform aimed at seamless sharing, enabling users to securely transfer files and data over the internet with ease.

In February 2023, Redwood Software Inc., a software development company headquartered in the Netherlands, completed the acquisition of Cerberus FTP for an undisclosed sum. This strategic move significantly bolstered Redwood's leadership position, expanding its capabilities to deliver secure file transfer solutions that ensure the trustworthy and legally compliant transfer of vital business data across the entire technological ecosystem of an enterprise. The acquisition further underscored Redwood's unwavering commitment to customer satisfaction and a continuous focus on product innovation. Notably, Cerberus FTP, the US-based company acquired by Redwood, is specifically dedicated to meeting the demands of customers seeking secure file-sharing solutions.

Major companies operating in the secure file transfer market include Accellion Inc., Axway India Private Limited, Box Inc., Citrix Systems Inc., Egnyte Inc., Google LLC, GlobalSCAPE Inc., International Business Machines Corporation (IBM), Microsoft Corporation, Progress Software Corporation, Coviant Software LLC, Saison Information Systems Co Ltd., BlackBerry Limited, Biscom Inc., Ipswitch Inc., CTERA Networks Ltd., HelpSystems LLC, Hightail Inc., Huddle, Seeburger AG, SolarWinds Worldwide LLC, South River Technologies Inc., Cleo Communications Inc., Cornerstone Technology S.A., DataMotion Inc., FileCatalyst, FileZilla, Flux Corporation, JSCAPE, Leapfile Inc., Linoma Software.

North America was the largest region in the secure file transfer market in 2024. Asia-Pacific is expected to be the fastest-growing region in the global secure file transfer market report during the forecast period. The regions covered in the secure file transfer market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa. The countries covered in the secure file transfer market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Canada, Italy, Spain.

Secure file transfer data sharing technology involves employing encryption and security measures to protect data while it is in transit. This technology ensures the safety of data during its transfer by utilizing methods such as encoding, verification, access restrictions, and auditing. It is particularly crucial for sharing files within or between enterprises, providing a secure environment for the exchange of sensitive information.

The primary types of secure file transfer include business-to-business (B2B), accelerated transfer, ad hoc, and others. In a business-to-business (B2B) transaction, which can also be referred to as a B-to-B transaction, data is securely transferred between businesses. These secure file transfer solutions cater to both small and medium enterprises as well as large enterprises, and they are deployed in various models, such as on-premise, cloud-based, and hybrid setups. This technology finds applications across diverse industries, including banking, financial services, and insurance (BFSI), healthcare, manufacturing, logistics, retail, media and entertainment, IT and telecommunications, government, and others.

The secure file transfer market research report is one of a series of new reports that provides secure file transfer market statistics, including secure file transfer industry global market size, regional shares, competitors with a secure file transfer market share, detailed secure file transfer market segments, market trends and opportunities, and any further data you may need to thrive in the secure file transfer industry. This secure file transfer market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenarios of the industry.

The secure file transfer market includes revenues earned by entities through encryption, authentication, and data protection services. The market value includes the value of related goods sold by the service provider or included within the service offering. Only goods and services traded between entities or sold to end consumers are included.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

Secure File Transfer Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on secure file transfer market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for secure file transfer? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The secure file transfer market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include:

- The forecasts are made after considering the major factors currently impacting the market. These include the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) By Type: Business To Business; Accelerated Transfer; Ad hoc; Other Types2) By Deployment Model Type: On-Premises; Cloud-Based; Hybrid

3) By Enterprise: Small and Medium; Large

4) By Industry Vertical: Banking, Financial Services and Insurance (BFSI); Healthcare; Manufacturing; Logistics; Retail; Media and Entertainment; IT and Telecommunication; Government; Other Industry Verticals

Subsegments:

1) By Business To Business: Managed File Transfer; Enterprise File Sync and Share2) By Accelerated Transfer: High-Speed File Transfer; File Transfer Optimization Solutions

3) By Ad hoc: Temporary File Sharing Solutions; Instant Transfer Services

4) By Other Types: Secure Email Transfer; Secure Cloud Storage Solutions

Key Companies Mentioned: Accellion Inc.; Axway India Private Limited; Box Inc.; Citrix Systems Inc.; Egnyte Inc.

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

- Accellion Inc.

- Axway India Private Limited

- Box Inc.

- Citrix Systems Inc.

- Egnyte Inc.

- Google LLC

- GlobalSCAPE Inc.

- International Business Machines Corporation (IBM)

- Microsoft Corporation

- Progress Software Corporation

- Coviant Software LLC

- Saison Information Systems Co Ltd.

- BlackBerry Limited

- Biscom Inc.

- Ipswitch Inc.

- CTERA Networks Ltd.

- HelpSystems LLC

- Hightail Inc.

- Huddle

- Seeburger AG

- SolarWinds Worldwide LLC

- South River Technologies Inc.

- Cleo Communications Inc.

- Cornerstone Technology S.A.

- DataMotion Inc.

- FileCatalyst

- FileZilla

- Flux Corporation

- JSCAPE

- Leapfile Inc.

- Linoma Software

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 200 |

| Published | February 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 2.51 Billion |

| Forecasted Market Value ( USD | $ 3.63 Billion |

| Compound Annual Growth Rate | 9.7% |

| Regions Covered | Global |

| No. of Companies Mentioned | 31 |