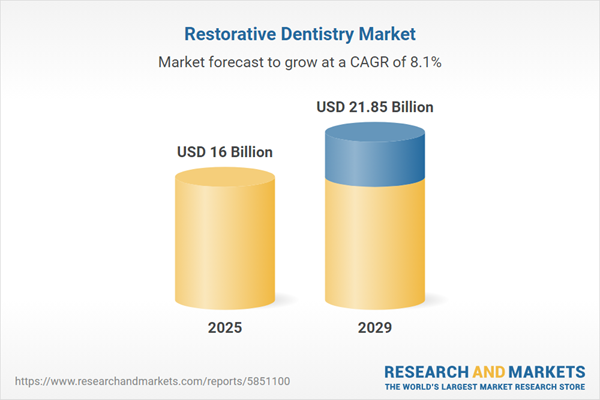

The restorative dentistry market size is expected to see strong growth in the next few years. It will grow to $21.85 billion in 2029 at a compound annual growth rate (CAGR) of 8.1%. The growth in the forecast period can be attributed to regenerative dentistry approaches, personalized treatment plans, tele-dentistry and remote consultations, growing dental health, focus on preventive dentistry. Major trends in the forecast period include advancements in dental materials, technological innovations in procedures, minimally invasive techniques, focus on aesthetic dentistry, demand for implant dentistry.

The increasing frequency of dental visits is projected to drive the growth of the restorative dentistry market in the future. A dental visit refers to a scheduled appointment at a dental office or clinic for services related to oral health. Restorative dentistry aims to restore or replace broken or missing teeth, improving the overall health and functionality of the mouth. For example, in October 2024, the Australian Institute of Health and Welfare, an Australian government agency, reported that in 2022-23, there were approximately 87,400 hospitalizations for dental conditions that could have been prevented with timely treatment. Among these, children aged 5 to 9 years experienced the highest rate of preventable hospitalizations, at 12.3 per 1,000 population. Therefore, the rising number of dental practices is contributing to the growing demand for the restorative dentistry market.

The escalating prevalence of dental disorders is poised to drive the growth of the restorative dentistry market. Dental disorders encompass a spectrum of conditions affecting the oral cavity, teeth, gums, and surrounding tissues. Restorative dentistry interventions, such as scaling and root planing for gum disease, are instrumental in treating these conditions, preventing tooth loss, and promoting gum health. A March 2023 report from the World Health Organization reveals that nearly 3.5 billion individuals globally suffer from oral disorders, with three out of every four cases attributed to the middle-class population. Additionally, 514 million children worldwide grapple with primary tooth caries, and an estimated 2 billion adults contend with caries of the permanent teeth. This prevalence of dental disorders underscores the heightened demand for restorative dentistry solutions in the market.

Leading companies in the restorative dentistry market are concentrating on technological innovations such as antimicrobial technology to improve patient outcomes, lower infection rates, and enhance the longevity of dental restorations. Antimicrobial technology is advantageous in restorative dentistry as it helps prevent infections and supports the healing of dental tissues, leading to improved patient results and extended durability of dental repairs. For example, in February 2022, Nobio, an Israel-based antimicrobial technology firm, introduced infinix, a new line of advanced antimicrobial restorative materials that includes a bonding agent and the first FDA-cleared antimicrobial composites designed to prevent recurrent decay. Using Nobio’s patented qasi technology, infinix offers long-lasting bacterial inhibition at the margins of restorations, effectively addressing secondary caries and decreasing restoration failures in the restorative dentistry market.

Leading companies in the restorative dentistry market are actively incorporating automation through digital dentistry integration to enhance market revenues. A case in point is Formlabs Dental, a Germany-based dental company that introduced the Formlabs Automation Ecosystem in January 2023. Comprising products such as Form Auto, Fleet Control, and High Volume Resin System, this ecosystem is designed to facilitate high-productivity 3D printing at scale for dental labs. By significantly reducing the labor required for each dental model and enabling autonomous printing, part removal, and initiation of subsequent prints, the Formlabs Automation Ecosystem ensures continuous production even outside regular working hours.

In April 2024, Behrman Capital L.P., a US-based equity investment firm, acquired Inter-Med Inc. for an undisclosed sum. This acquisition is intended to strengthen Behrman Capital’s investment in the healthcare sector by utilizing Vista Apex’s proven success and innovative capabilities in dental products. The firm plans to collaborate closely with Vista Apex’s management to implement growth strategies, which include expanding the product portfolio and pursuing strategic mergers and acquisitions. Inter-Med Inc. is a US-based manufacturing company that supplies essential dental products that facilitate effective tooth repair and replacement in restorative dentistry.

Major companies operating in the restorative dentistry market include Dentsply Sirona Inc., 3M Company, Zimmer Biomet Holdings Inc., GC Corporation, Ivoclar Vivadent AG, Straumann Holding AG, Danaher Corporation, COLTENE Holding AG, Nobel Biocare Holding AG, Bisco Inc., Septodont Holding, Keystone Dental Inc., Osstem Implant Co Ltd., DMG Chemisch-Pharmazeutische Fabrik GmbH, Voco GmbH, Envista Holdings Corporation, Mitsui Chemicals Inc., BEGO GmbH & Co KG, Henry Schein Inc., DiaDent Group International, Ultradent Products Inc., Kuraray Noritake Dental Inc., Brasseler USA, Shofu Inc., SDI BUSINESS SERVICES INDIA PRIVATE LIMITED, Zhermack S.p.A., DENTAURUM GmbH & Co KG, Dental Technologies Inc., Paradise Dental Technologies Inc., Kerr Corporation, Premier Dental Products Co, Pentron Clinical Technologies LLC.

Europe was the largest region in the restorative dentistry market in 2024. Asia-Pacific is expected to be the fastest-growing region in the global restorative dentistry market report during the forecast period. The regions covered in the restorative dentistry market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa. The countries covered in the restorative dentistry market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Canada, Italy, Spain.

Restorative dentistry focuses on the repair or replacement of damaged or missing teeth, aiming to enhance oral health and functionality through various procedures.

Key products within the field of restorative dentistry include restorative materials, implants, prosthetic materials, and restorative equipment. Dental restorative materials play a crucial role in addressing tooth cavities and treating dental caries. Traditional materials in this category encompass gold, amalgam, alumina, acrylic resins, zirconia, silicate cement, among others. These materials find applications in various dental disciplines, including conservative and endodontics, implantology, prosthodontics, and other specialized areas. The end-users of restorative dentistry products include hospitals, dental clinics, dental institutes, research centers, and other relevant entities. The utilization of restorative dentistry products contributes to the effective management and treatment of dental issues, promoting overall oral health and well-being.

The restorative dentistry market research report is one of a series of new reports that provides restorative dentistry optical components market statistics, including restorative dentistry optical components industry global market size, regional shares, competitors with a restorative dentistry optical components market share, detailed restorative dentistry optical components market segments, market trends, and opportunities, and any further data you may need to thrive in the restorative dentistry optical components industry. This restorative dentistry optical components market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenario of the industry.

The restorative dentistry market includes revenues earned by entities by providing services such as dental fillings, dental crowns, and dental bridges. The market value includes the value of related goods sold by the service provider or included within the service offering. Only goods and services traded between entities or sold to end consumers are included.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

Restorative Dentistry Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on restorative dentistry market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for restorative dentistry? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The restorative dentistry market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include:

- The forecasts are made after considering the major factors currently impacting the market. These include the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) By Product: Restorative Materials; Implants; Prosthetic Materials; Restorative Equipment2) By Application: Conservative and Endodontics; Implantology; Prosthodontics; Other Applications

3) By End-User: Hospitals; Dental Clinics; Dental Institutes and Research Centers; Other End-Users

Subsegments:

1) By Restorative Materials: Dental Composites; Dental Cements; Dental Amalgams; Glass Ionomer Cements; Resin Ionomer Cements2) By Implants: Endosteal Implants; Subperiosteal Implants; Zygomatic Implants

3) By Prosthetic Materials: Crowns; Bridges; Dentures; Veneers

4) By Restorative Equipment: Dental Chairs; Light Curing Units; Impression Materials; CAD or CAM Systems

Key Companies Mentioned: Dentsply Sirona Inc.; 3M Company; Zimmer Biomet Holdings Inc.; GC Corporation; Ivoclar Vivadent AG

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

- Dentsply Sirona Inc.

- 3M Company

- Zimmer Biomet Holdings Inc.

- GC Corporation

- Ivoclar Vivadent AG

- Straumann Holding AG

- Danaher Corporation

- COLTENE Holding AG

- Nobel Biocare Holding AG

- Bisco Inc.

- Septodont Holding

- Keystone Dental Inc.

- Osstem Implant Co Ltd.

- DMG Chemisch-Pharmazeutische Fabrik GmbH

- Voco GmbH

- Envista Holdings Corporation

- Mitsui Chemicals Inc.

- BEGO GmbH & Co KG

- Henry Schein Inc.

- DiaDent Group International

- Ultradent Products Inc.

- Kuraray Noritake Dental Inc.

- Brasseler USA

- Shofu Inc.

- SDI BUSINESS SERVICES INDIA PRIVATE LIMITED

- Zhermack S.p.A.

- DENTAURUM GmbH & Co KG

- Dental Technologies Inc.

- Paradise Dental Technologies Inc.

- Kerr Corporation

- Premier Dental Products Co

- Pentron Clinical Technologies LLC

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 200 |

| Published | February 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 16 Billion |

| Forecasted Market Value ( USD | $ 21.85 Billion |

| Compound Annual Growth Rate | 8.1% |

| Regions Covered | Global |

| No. of Companies Mentioned | 32 |