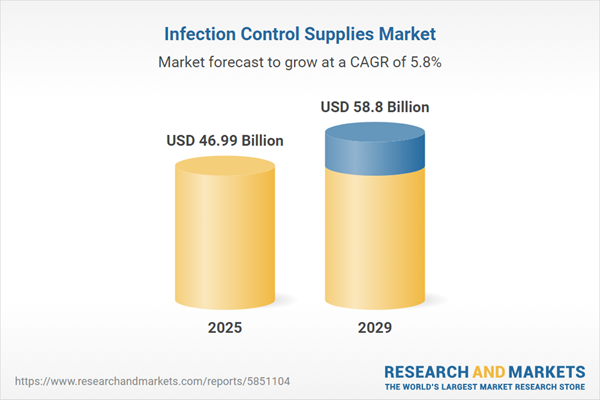

The infection control supplies market size is expected to see strong growth in the next few years. It will grow to $58.8 billion in 2029 at a compound annual growth rate (CAGR) of 5.8%. The growth in the forecast period can be attributed to the integration of digital health solutions, focus on environmental sustainability, shift in consumer behavior, continued demand for PPE, and evolving regulations and standards. Major trends in the forecast period include remote monitoring and contact tracing, supply chain resilience and redundancy, infection prevention education and training, antimicrobial surface solutions, and a demand surge for disinfectants and sanitizers.

The increasing prevalence of nosocomial infections is anticipated to drive the growth of the infection control supplies market in the coming years. Nosocomial infections are those acquired while receiving healthcare. Infection control supplies are essential in healthcare settings for preventing the spread of these infections. For example, in March 2024, the Centers for Disease Control and Prevention (CDC), a U.S.-based government agency, reported that tuberculosis cases rose from 8,320 in 2022 to 9,615 in 2023, marking an increase of 1,295 cases. Therefore, the rising incidence of nosocomial infections is expected to propel the infection control supplies market forward.

The rise in healthcare expenditure is expected to accelerate the growth of the infection control supplies market in the coming years. Healthcare expenditure refers to the total resources, including financial investments, allocated to healthcare goods and services within a specific timeframe in a given geographical area. As healthcare expenditure increases, healthcare facilities can invest more in infection control measures, thereby enhancing safety and hygiene for both patients and healthcare professionals, which drives demand for infection control supplies. For example, the 2021-2030 National Health Expenditure (NHE) report from the Centers for Medicare & Medicaid Services, a U.S. federal agency, projects that national health spending will grow at an average rate of 5.1% annually from 2021 to 2030, potentially reaching nearly $6.8 trillion. Additionally, Medicare spending is expected to increase at a rate of 7.2% per year, while Medicaid spending is projected to rise at a 5.6% annual rate. Similarly, the Canadian Institute for Health Information, a non-profit organization based in Canada, forecasted total health expenditure to reach $344 billion in 2023, reflecting a modest 2.8% growth compared to the previous year. Thus, the increase in healthcare expenditure is driving the expansion of the infection control supplies market.

Technological advancements in sterilization equipment represent a significant trend in the infection control supplies market. Leading companies in this field are creating innovative solutions, such as sterilizers, to improve the effectiveness and efficiency of sterilization processes. A sterilizer is a device that eradicates all microbial life on instruments using heat, steam, or chemicals, ensuring they are safe for reuse in medical and dental environments. For example, in January 2024, W&H Dentalwerk Burmoos GmbH, an Austria-based dental technology firm, introduced the Lexa Plus sterilizer as a new advancement in infection control. This sterilizer is engineered to optimize the sterilization process, featuring rapid cycle times, intuitive controls, and enhanced monitoring capabilities. This cutting-edge equipment not only guarantees effective sterilization of dental instruments but also includes user-friendly technology that simplifies operation for dental professionals. By enhancing efficiency and safety, the Lexa Plus is designed to address the evolving needs of dental practices while promoting higher standards of infection prevention and patient care.

Major companies in the infection control supplies market are focusing on developing intuitive user interfaces that enable healthcare professionals to easily access tools for monitoring cleanliness and tracking infection rates, thus enhancing patient safety and operational efficiency. Intuitive design entails creating products or interfaces that are user-friendly and straightforward, reducing the need for instructions or prior knowledge. For example, in January 2024, ICP Medical, a U.S.-based infection prevention company, launched a new website aimed at improving user experience while reflecting its mission of "Helping Those Who Help Others." This updated platform consolidates ICP Medical’s infection control products, such as Rapid Refresh quick-change privacy curtains and the BootieButler automatic shoe cover system, offering customers a convenient “one-stop shop.” The website, aligned with TEAM Technologies’ branding, is designed for healthcare, industrial, and government sectors, featuring an accessible layout. Key features include seamless e-commerce capabilities, comprehensive product displays, FAQs, downloadable resources, and engaging instructional videos to facilitate the purchasing process. Additionally, a dedicated page for privacy curtain samples showcases various patterns and styles, highlighting ICP Medical’s commitment to providing accessible and effective infection prevention solutions.

In August 2024, Sowingo, a U.S.-based healthcare technology company, formed a partnership with Germiphene for an undisclosed amount. This collaboration aims to improve infection prevention and control measures in healthcare environments by combining Germiphene's advanced disinfection solutions with Sowingo's inventory management platform. Germiphene, a Canada-based company, specializes in manufacturing cleaning, disinfecting, and sterilization products for a variety of healthcare settings.

Major companies operating in the infection control supplies market include Steris Corporation, Getinge AB, 3M Company, Ecolab Inc., Johnson & Johnson Private Limited, Cardinal Health Inc., Medline Industries LP, Matachana Group, Kimberly-Clark Corporation, Halyard Health, Emergency Medical Products Inc., Certol International LLC, Schülke & Mayr GmbH, Henry Schein Inc., Belimed AG, Sterigenics International LLC, MMM Group, Cantel Medical Corporation, Fortive Corporation, Sotera Health Company, Metrex Research LLC, Reckitt Benckiser Group plc, Pal International, Melag Medizintechnik GmbH & Co. KG, The Miele Group, Systec GmbH, Contec Inc., Diversey Holdings Inc.

North America was the largest region in the infection control supplies market in 2024. The regions covered in the infection control supplies market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa. The countries covered in the infection control supplies market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Canada, Italy, Spain.

Infection control supplies are tools designed to provide a barrier for the skin, nose, and clothes against infectious agents, aiming to prevent the spread of infections, particularly in healthcare environments.

The primary products within the category of infection control supplies include disinfectants, medical face masks, surgical caps, surgical gowns, and medical gloves. Disinfectants are substances used on non-living objects to kill germs, eliminating microorganisms and preventing infections. These products are distributed through various channels, including wholesalers, retailers, pharmacies, e-commerce, and others. The end-users of infection control supplies encompass hospitals and clinics, medical device companies, pharmaceutical companies, research laboratories, and other relevant entities.

The infection control supplies market research report is one of a series of new reports that provides infection control supplies market statistics, including the infection control supplies industry global market size, regional shares, competitors with an infection control supplies market share, detailed infection control supplies market segments, market trends, and opportunities, and any further data you may need to thrive in the infection control supplies industry. This infection control supplies market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenarios of the industry.

The infection control supplies market consists of sales of respirators, infection control apparel, and surgical clippers. Values in this market are ‘factory gate’ values, that is the value of goods sold by the manufacturers or creators of the goods, whether to other entities (including downstream manufacturers, wholesalers, distributors, and retailers) or directly to end customers. The value of goods in this market includes related services sold by the creators of the goods.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

Infection Control Supplies Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on infection control supplies market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for infection control supplies? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The infection control supplies market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include:

- The forecasts are made after considering the major factors currently impacting the market. These include the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) By Product Type: Disinfectant; Medical Face Mask; Surgical Cap; Surgical Gown; Medical Gloves2) By Distribution Channel: Wholesalers; Retailers; Pharmacies; E-Commerce; Other Channels

3) By End-Use: Hospitals and Clinics; Medical Device Companies; Pharmaceutical Companies; Research Laboratories; Other End-Users

Subsegments:

1) By Disinfectant: Alcohol-Based Disinfectants; Quaternary Ammonium Compounds; Chlorine-Based Disinfectants; Hydrogen Peroxide-Based Disinfectants2) By Medical Face Mask: Surgical Masks; N95 Respirators; Disposable Masks; Reusable Masks

3) By Surgical Cap: Disposable Surgical Caps; Reusable Surgical Caps; Bouffant Caps

4) By Surgical Gown: Disposable Surgical Gowns; Reusable Surgical Gowns; Isolation Gowns

5) By Medical Gloves: Latex Gloves; Nitrile Gloves; Vinyl Gloves; Surgical Gloves

Key Companies Mentioned: Steris Corporation; Getinge AB; 3M Company; Ecolab Inc.; Johnson & Johnson Private Limited

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

- Steris Corporation

- Getinge AB

- 3M Company

- Ecolab Inc.

- Johnson & Johnson Private Limited

- Cardinal Health Inc.

- Medline Industries LP

- Matachana Group

- Kimberly-Clark Corporation

- Halyard Health

- Emergency Medical Products Inc.

- Certol International LLC

- Schülke & Mayr GmbH

- Henry Schein Inc.

- Belimed AG

- Sterigenics International LLC

- MMM Group

- Cantel Medical Corporation

- Fortive Corporation

- Sotera Health Company

- Metrex Research LLC

- Reckitt Benckiser Group plc

- Pal International

- Melag Medizintechnik GmbH & Co. KG

- The Miele Group

- Systec GmbH

- Contec Inc.

- Diversey Holdings Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 200 |

| Published | February 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 46.99 Billion |

| Forecasted Market Value ( USD | $ 58.8 Billion |

| Compound Annual Growth Rate | 5.8% |

| Regions Covered | Global |

| No. of Companies Mentioned | 28 |