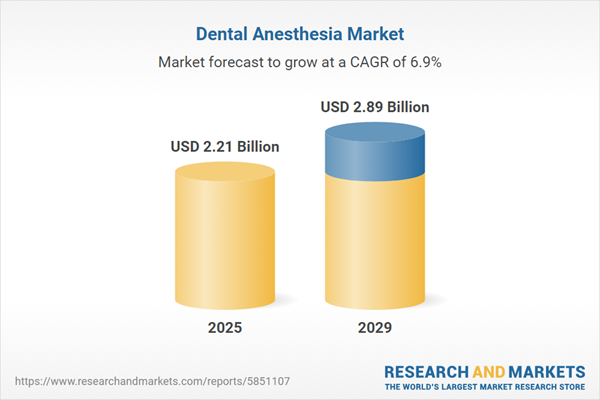

The dental anesthesia market size is expected to see strong growth in the next few years. It will grow to $2.89 billion in 2029 at a compound annual growth rate (CAGR) of 6.9%. The growth in the forecast period can be attributed to enhanced patient experience, rising demand for minimally invasive procedures, development of safer anesthetic agents, personalized anesthesia solutions, innovative needle-free anesthesia. Major trends in the forecast period include digital dentistry integration, non-injectable anesthesia techniques, technology-driven delivery systems, patient-centered care approach.

The dental anesthesia market is anticipated to experience growth, propelled by the high prevalence of dental diseases. The prevalence of dental diseases refers to the proportion of individuals within a population affected by specific dental conditions or diseases at a given time. Dental anesthesia plays a crucial role in alleviating pain and discomfort associated with dental diseases, enabling patients to undergo procedures such as fillings, root canals, or extractions more comfortably. As the incidence of dental diseases rises globally, there is an increased demand for dental procedures, consequently driving the need for dental anesthesia. In March 2023, the World Health Organization reported that oral diseases affected approximately 3.5 billion people worldwide, with around 2 billion individuals experiencing caries in permanent teeth and approximately 514 million children suffering from caries in primary teeth. The heightened prevalence of dental diseases is a significant factor fueling the growth of the dental anesthesia market.

The growth in the number of dental practitioners is expected to contribute to the expansion of the dental anesthesia market. Dental practitioners, also known as oral health professionals, are licensed individuals providing a range of oral health care services. The increase in the number of dental practitioners leads to a rise in dental clinics, creating more opportunities for dental procedures and the administration of anesthesia. According to a report from the American Dental Association (ADA) Health Policy Institute, there were 60.8 dentists per 100,000 people in 2021, and this number is projected to increase steadily from 2025 to 2040, reaching 67 dentists per 100,000 people. The growing number of dental practitioners is a key driver behind the growth of the dental anesthesia market.

Product innovation is a significant trend gaining traction in the dental anesthesia market. Leading companies in this field are focusing on developing new products to maintain their market position. For example, in November 2023, Convergent Dental Inc., a U.S.-based company specializing in dental equipment and technology, introduced Solea Protect. This innovative application of the Solea All-Tissue Dental Laser aims to prevent tooth decay by reducing mineral loss in dental enamel. Solea Protect utilizes advanced CO2 laser technology with a unique 9.3-micron wavelength to gently heat the surface of tooth enamel, effectively removing impurities that can weaken tooth strength. This process creates a strong, crystal-like structure that is more resistant to decay. When combined with fluoride, Solea Protect significantly enhances protective effects, reducing mineral loss much more effectively than fluoride alone. Clinical trials indicate that patients treated with Solea Protect and fluoride had no need for caries restorations within a year, highlighting its effectiveness in preventing caries and offering a convenient, anxiety-free solution for both dental professionals and their patients.

Major players in the dental anesthesia market are strategically opting for partnerships to address oral pain management challenges. An example of this approach is demonstrated by the collaboration between Young Innovations Inc., a US-based dental equipment and supplies manufacturing company, and Synapse Dental LLC, a US-based dental solution provider. This partnership, formed in August 2022, aims to revolutionize dental care with the introduction of the Dental Pain Eraser - an innovative electronic dental anesthesia device resembling a pen. This device offers swift relief and prevention of oral pain without the need for local anesthetic injections, gels, or medications. Through this collaboration, Young Innovations and Synapse Dental aim to provide dental professionals and patients with enhanced access to pain-free dental care, addressing common anxieties associated with dental visits.

In April 2022, Keystone Dental Group Inc., a medical technology company based in the United States, formed a partnership with Milestone Scientific for an undisclosed amount. This collaboration aims to improve the distribution and use of the STA Single Tooth Anesthesia System in implant dentistry, thereby enhancing patient comfort and streamlining dental procedures. Milestone Scientific is also a technology company located in the U.S.

Major companies operating in the dental anesthesia market include Dentsply Sirona, Halyard Health, Danaher Corporation, Carestream Dental, Midmark Corporation, B. Braun Melsungen AG, Acteon Group, Koninklijke Philips N.V., Sedana Medical AB, Masimo Corporation, DentalEZ Group, Cattani S.p.A., VITA Zahnfabrik H. Rauter GmbH & Co. KG, GC Corporation, 3M Company, Patterson Companies Inc., Coltene Holding AG, Integra LifeSciences, Neos Dental, Schuco Dental GmbH, Zyris Inc., RMO Inc., Vatech Co. Ltd., NMD Products Inc., Piezosurgery S.R.L., Stryker Corporation, Hu-Friedy Mfg. Co. LLC, DynaFlex, Dentsply Raintree Essix.

North America was the largest region in the dental anesthesia market in 2024. The regions covered in the dental anesthesia market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa. The countries covered in the dental anesthesia market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Canada, Italy, Spain.

Dental anesthesia is a form of anesthesia employed to desensitize the teeth, gums, and adjacent tissues within the oral and jaw regions during dental procedures. Its primary purpose is to induce numbness in specific areas of the mouth, preventing pain during treatment by impeding the nerves responsible for perceiving or transmitting pain.

The principal categories of dental anesthesia comprise local anesthesia, general anesthesia, and sedation. Local anesthesia targets a particular region of the body, and in the context of dental care, it is applied to numb specific areas such as the gums, teeth, or tongue during dental procedures. Various types of products, including lidocaine, mepivacaine, prilocaine, articaine, and others, are administered through oral, intravenous, and other routes of administration, each offering short, medium, or long-duration effects. The end-users of dental anesthesia encompass hospitals, dental clinics, and other healthcare settings.

The dental anesthesia market research report is one of a series of new reports that provides dental anesthesia market statistics, including dental anesthesia industry global market size, regional shares, competitors with a dental anesthesia market share, detailed dental anesthesia market segments, market trends and opportunities, and any further data you may need to thrive in the dental anesthesia industry. This dental anesthesia market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenario of the industry.

The dental anesthesia market consists of sales of bupivacaine and propofol. Values in this market are ‘factory gate’ values, that is the value of goods sold by the manufacturers or creators of the goods, whether to other entities (including downstream manufacturers, wholesalers, distributors and retailers) or directly to end customers. The value of goods in this market includes related services sold by the creators of the goods.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

Dental Anesthesia Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on dental anesthesia market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for dental anesthesia? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The dental anesthesia market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include:

- The forecasts are made after considering the major factors currently impacting the market. These include the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) By Type of Anesthesia: Local Anesthesia; General Anesthesia; Sedation2) By Product Type: Lidocaine; Mepivacaine; Prilocaine; Articaine; Other Product Types

3) By Route of Administration: Oral; Intravenous; Other Routes of Administration

4) By Duration of Action: Short; Long; Medium

5) By End-Use: Hospitals; Dental Clinics; Other End-Users

Subsegments:

1) By Local Anesthesia: Topical Anesthesia; Infiltration Anesthesia; Nerve Block Anesthesia2) By General Anesthesia: Inhalation Anesthetics; Intravenous Anesthetics; Balanced Anesthesia

3) By Sedation: Minimal Sedation; Moderate Sedation; Deep Sedation

Key Companies Mentioned: Dentsply Sirona; Halyard Health; Danaher Corporation; Carestream Dental; Midmark Corporation

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

- Dentsply Sirona

- Halyard Health

- Danaher Corporation

- Carestream Dental

- Midmark Corporation

- B. Braun Melsungen AG

- Acteon Group

- Koninklijke Philips N.V.

- Sedana Medical AB

- Masimo Corporation

- DentalEZ Group

- Cattani S.p.A.

- VITA Zahnfabrik H. Rauter GmbH & Co. KG

- GC Corporation

- 3M Company

- Patterson Companies Inc.

- Coltene Holding AG

- Integra LifeSciences

- Neos Dental

- Schuco Dental GmbH

- Zyris Inc.

- RMO Inc.

- Vatech Co. Ltd.

- NMD Products Inc.

- Piezosurgery S.R.L.

- Stryker Corporation

- Hu-Friedy Mfg. Co. LLC

- DynaFlex

- Dentsply Raintree Essix.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 200 |

| Published | February 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 2.21 Billion |

| Forecasted Market Value ( USD | $ 2.89 Billion |

| Compound Annual Growth Rate | 6.9% |

| Regions Covered | Global |

| No. of Companies Mentioned | 29 |