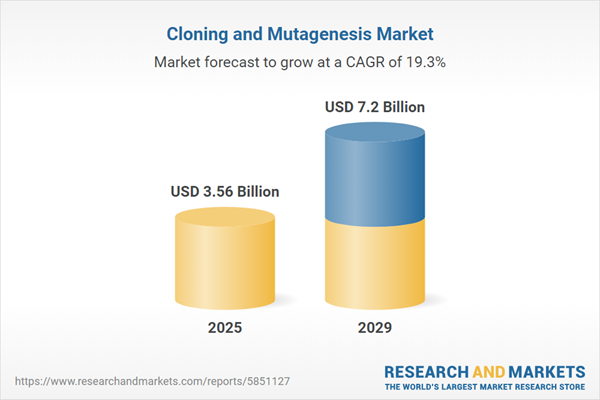

The cloning and mutagenesis market size is expected to see rapid growth in the next few years. It will grow to $7.2 billion in 2029 at a compound annual growth rate (CAGR) of 19.3%. The growth in the forecast period can be attributed to expanding applications in gene therapy, rising demand for personalized medicine, advancements in functional genomics, innovations in synthetic biology, application in agricultural biotechnology. Major trends in the forecast period include targeted gene editing in therapeutics, enhanced precision and specificity, customizable molecular tools, expanded applications in agriculture, ethical and regulatory considerations.

The cloning and mutagenesis market is expected to experience growth driven by the rising demand for genetically modified products. Genetically modified products involve organisms, materials, or substances that undergo deliberate genetic engineering to introduce new traits or characteristics. Cloning, a scientific process for producing exact genetic copies, is utilized in various applications, including creating insect and plant-resistant species and facilitating gene therapy in medical sciences. An annual report from Bayar AG, a Germany-based biotechnology and pharmaceutical company, revealed significant growth in the sales of genetically modified products, with the crop sciences segment reaching $27.79 billion in 2022, up from $22.31 billion in 2021. This increased demand for genetically modified products is a key driver of the cloning and mutagenesis market. The data is based on information provided in the annual report published by Bayar AG in February 2023.

The cloning and mutagenesis market is anticipated to grow due to the increasing demand for personalized medicine. Personalized medicine is an innovative healthcare approach that tailors medical treatment and interventions to the unique characteristics of each patient. Cloning and mutagenesis play crucial roles in various aspects of personalized medicine, such as disease modeling, drug development, target identification, gene therapy, biomarker discovery, patient-specific cell therapies, pharmacogenomics, and genome editing for personalized therapies. In April 2022, the Personalized Medicine Coalition reported that the Food and Drug Administration’s Center for Drug Evaluation and Research (CDER) approved 37 new molecular entities (NMEs) in 2022. Among the therapeutic NMEs, approximately 34% (12 of them) were classified as personalized medicines by the Personalized Medicine Coalition (PMC). This increasing demand for personalized medicine is a significant driver of the growth in the cloning and mutagenesis market.

Major players in the cloning and mutagenesis market are leveraging advanced technologies, such as bacteriophage genome modifying technologies, to enhance their competitive position. Bacteriophage genome modifying technologies involve intentional alterations to the genetic material of bacteriophages, viruses that infect bacteria, for applications in research, therapy, or industry. An example is iNtRON Biotechnology, a South Korea-based biotech company, which introduced its 2nd generation Robot Bacteriophage technology in October 2022. This technology utilizes random transposon mutagenesis to modify the bacteriophage genome, enabling the identification and removal of non-essential genes. iNtRON aims to design and produce bacteriophages with specific characteristics, facilitating the development of immunotherapeutic agents and antiviral solutions.

Leading companies in the cloning and mutagenesis markets are also actively exploring innovative techniques such as Polymerase Chain Reaction (PCR) to maintain a competitive edge. PCR is a molecular biology laboratory technique that amplifies specific DNA segments. Bio-Rad Laboratories, Inc., a US-based biotech company, launched the ID-Check Speciation Solution in April 2023. This real-time PCR method aids in meat speciation, allowing the identification of animal species in food, feed, and environmental samples. It provides a reliable and rapid means to verify raw material origins, enhancing production line cleaning processes. The solution targets mitochondrial DNA from various meat species with exceptional sensitivity, detecting DNA concentrations as low as 0.001%. It features a duplex detection system for accuracy and user convenience.

In May 2022, QIAGEN N.V., a Netherlands-based provider of sample and assay technologies, acquired BLIRT SA for an undisclosed amount. This acquisition is intended to bolster QIAGEN's capabilities in developing innovative molecular diagnostics and biopharmaceutical solutions. BLIRT SA, a manufacturer based in Poland, specializes in recombinant enzymes used for molecular cloning and site-directed mutagenesis.

Major companies operating in the cloning and mutagenesis market include Thermo Fisher Scientific, Takara Bio Inc., Agilent Technologies Inc., Jena Bioscience GmbH, Transgen Biotech Co, New England Biolabs, Merck KGaA, Promega Corporation, Bio-Rad Laboratories Inc., Danaher, Genomax Technologies Pte Ltd, GENEWIZ Inc., abm Inc., GenScript, EZBioscience, Codex DNA Inc., Aragen Life Sciences, Bio-Techne, Charles River Laboratories, Integrated DNA Technologies, MedGenome, Sino Biological Inc., BioChain Institute Inc., OriGene Technologies Inc., Creative Biogene, Bioneer Corporation, Synbio Technologies LLC, Lucigen Corporation, Biomatik Corporation, Quanta BioDesign Ltd., Inscripta Inc.

North America was the largest region in the cloning and mutagenesis market in 2024. Asia-pacific is expected to be the fastest-growing region in the global cloning and mutagenesis market report during the forecast period. The regions covered in the cloning and mutagenesis market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa. The countries covered in the cloning and mutagenesis market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Canada, Italy, Spain.

Cloning and mutagenesis are integral techniques within molecular biology that involve the replication of multiple identical copies of a DNA fragment, gene, or entire genome, along with the introduction of mutations into a DNA sequence. These techniques play a crucial role in studying gene function and regulation, facilitating the development of new drugs and therapeutics, and producing recombinant enzymes and proteins.

The primary products associated with cloning and mutagenesis include cloning kits, mutagenesis kits, and other related tools. Cloning kits are specialized laboratory instruments designed to streamline the process of cloning specific DNA fragments or genes into a cloning vector. These kits are essential for various cloning experiments, including gene cloning, subcloning, site-directed mutagenesis, and library construction. Techniques such as blunt end cloning, topo PCR cloning, seamless cloning, site-directed mutagenesis, among others, are employed by academic and research institutions, biotechnology companies, and other entities engaged in molecular biology research.

The cloning and mutagenesis software market research report is one of a series of new reports that provides cloning and mutagenesis software market statistics, including cloning and mutagenesis software industry global market size, regional shares, competitors with a cloning and mutagenesis software market share, detailed cloning and mutagenesis software market segments, market trends and opportunities, and any further data you may need to thrive in the cloning and mutagenesis software industry. This cloning and mutagenesis software market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenario of the industry.

The cloning and mutagenesis market includes revenues earned by entities by assay kits, biotin-peg linkers, Bira proteins, and cells. The market value includes the value of related goods sold by the service provider or included within the service offering. The cloning and mutagenesis market also includes of sales of techniques such as the isolation of DNA, cloning vectors, and DNA ligase. Values in this market are ‘factory gate’ values, that is the value of goods sold by the manufacturers or creators of the goods, whether to other entities (including downstream manufacturers, wholesalers, distributors, and retailers) or directly to end customers. The value of goods in this market includes related services sold by the creators of the goods.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

Cloning and Mutagenesis Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on cloning and mutagenesis market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for cloning and mutagenesis? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The cloning and mutagenesis market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include:

- The forecasts are made after considering the major factors currently impacting the market. These include the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) By Product: Cloning Kits; Mutagenesis Kits; Other Product2) By Technique: Blunt End Cloning; Topo PCR Cloning; Seamless Cloning; Site-Directed Mutagenesis; Other Techniques

3) By End User: Academic and Research Institutes; Biotechnology Companies; Other End User

Subsegments:

1) By Cloning Kits: Bacterial Cloning Kits; Yeast Cloning Kits; Viral Cloning Kits; Plasmid Cloning Kits2) By Mutagenesis Kits: Site-Directed Mutagenesis Kits; Random Mutagenesis Kits; Error-Prone PCR Kits; CRISPR or Cas9 Mutagenesis Kits

3) By Other Products: Enzymes; Vector Systems; Accessories

Key Companies Mentioned: Thermo Fisher Scientific; Takara Bio Inc.; Agilent Technologies Inc.; Jena Bioscience GmbH; Transgen Biotech Co

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

- Thermo Fisher Scientific

- Takara Bio Inc.

- Agilent Technologies Inc.

- Jena Bioscience GmbH

- Transgen Biotech Co

- New England Biolabs

- Merck KGaA

- Promega Corporation

- Bio-Rad Laboratories Inc.

- Danaher

- Genomax Technologies Pte Ltd

- GENEWIZ Inc.

- abm Inc.

- GenScript

- EZBioscience

- Codex DNA Inc.

- Aragen Life Sciences

- Bio-Techne

- Charles River Laboratories

- Integrated DNA Technologies

- MedGenome

- Sino Biological Inc.

- BioChain Institute Inc.

- OriGene Technologies Inc.

- Creative Biogene

- Bioneer Corporation

- Synbio Technologies LLC

- Lucigen Corporation

- Biomatik Corporation

- Quanta BioDesign Ltd.

- Inscripta Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 200 |

| Published | February 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 3.56 Billion |

| Forecasted Market Value ( USD | $ 7.2 Billion |

| Compound Annual Growth Rate | 19.3% |

| Regions Covered | Global |

| No. of Companies Mentioned | 31 |