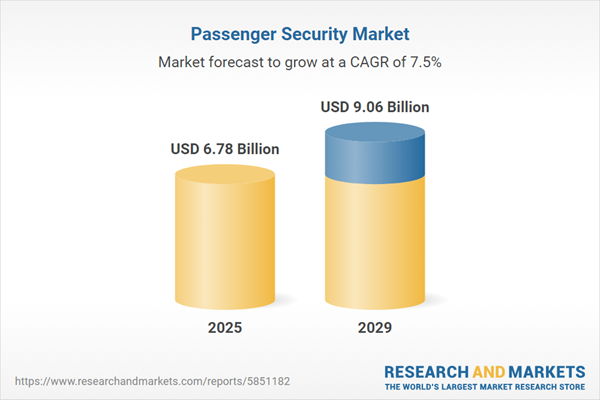

The passenger security market size is expected to see strong growth in the next few years. It will grow to $9.06 billion in 2029 at a compound annual growth rate (CAGR) of 7.5%. The growth in the forecast period can be attributed to increased air travel, focus on threat detection, adoption of biometric solutions, global events impacting security, and health screening integration. Major trends in the forecast period include threat intelligence and information sharing, biometric identification, enhanced screening technologies, behavioral analytics, and integration of AI and machine learning.

Anticipated growth in passenger traffic is set to drive the expansion of the passenger security market. Passenger traffic denotes the collective number of travelers across various transportation modes, necessitating heightened security measures. Airport security measures are crucial in ensuring passenger safety during air travel. For instance, between January and April 2022, global air travel witnessed a 65% increase in passengers compared to the same period in 2021, with a simultaneous 30% surge in aircraft departures. Additionally, Eurostat statistics from April 2023 highlighted a 16.5% increase in rail passenger travel within the European Union, partially recovering from 2020. This surge in passenger traffic is a significant catalyst propelling the growth of the passenger security market.

The rising incidences of terrorism are significantly driving the growth of the passenger security market. The increase in terrorist threats indicates a growing danger and heightened vulnerability to attacks worldwide. Passenger security tackles these threats by implementing stringent screening measures and protocols aimed at preventing potential attacks and ensuring the safety of air travel. For example, in February 2024, The Institute for Economics and Peace, an Australia-based international think tank, reported that terrorist attacks became more lethal in 2023, averaging 2.5 deaths per attack compared to 1.6 in 2022. Thus, the rising incidences of terrorism are expected to propel the passenger security market in the future.

Technological advancements emerge as a pivotal trend shaping the passenger security market. Leading companies in this sector are intensifying their focus on pioneering technologies to maintain their market positions. For example, Thales Group introduced HELIXVIEW in June 2022, an advanced Explosive Detection System for Cabin Baggage (EDS CB). HELIXVIEW integrates X-ray nanotechnology-based electronic scanning with 3D image reconstruction, leveraging artificial intelligence (AI) and cybersecurity expertise to offer innovative and cost-effective airport security solutions.

Major companies in the passenger security sector prioritize the development of innovative software solutions such as enterprise software platforms. These platforms serve to enhance threat detection capabilities, streamline operations, and fortify overall passenger security measures. For instance, Leidos launched ProSight in October 2023, an enterprise software platform designed for airports. ProSight unifies disparate systems such as security screening tools and threat detection algorithms, offering real-time actionable data through business intelligence dashboards. This integration facilitates enhanced operational efficiency and bolstered threat detection capabilities, contributing to heightened passenger security.

In October 2023, Security 101, a U.S.-based company specializing in comprehensive commercial security solutions, completed the acquisition of Advance Security Integration LLC. This strategic move is poised to bolster Security 101's regional footprint and consolidate the collective expertise of both entities. Beyond a mere business union, this acquisition symbolizes the amalgamation of shared values and aligned visions. Advance Security Integration LLC, a U.S.-based provider renowned for its security integration solutions, particularly in airport security and detection, now stands as an integral part of this collaboration.

Major companies operating in the passenger security market include Honeywell International Inc., Indra Sistemas S.A., Robert Bosch GmbH, Teledyne FLIR LLC, Autoclear LLC, Smiths Detection Group Limited, Adani Systems Inc., Advanced Perimeter Systems Limited, SITA - Société Internationale de Télécommunications Aéronautiques, Navtech Radar Ltd., NEC Corporation, OSI Systems Inc., Thales Group, Swissport International AG, Wabtec Corporation, Securitas Transport Aviation Security Ltd., G4S plc, ICTS Europe Systems BV, Allied Universal Security Services LLC, Prosegur Compañía de Seguridad S.A., Brink's Company, ADT Inc., Secom Co. Ltd., American Airlines Group Inc., Delta Air Lines Inc., United Airlines Holdings Inc., Southwest Airlines Co., Air France-KLM SA, Deutsche Lufthansa AG, The Emirates Group, Qatar Airways Group Q.C.S.C., Cathay Pacific Airways Limited, Singapore Airlines Limited, Japan Airlines Co. Ltd., Korean Air Lines Co. Ltd., China Southern Airlines Company Limited, Air China Limited, Turkish Airlines Inc.

North America was the largest region in the passenger security market in 2024. The regions covered in the passenger security market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa. The countries covered in the passenger security market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Canada, Italy, Spain.

Passenger security encompasses a range of measures and protocols put in place to safeguard individuals traveling through diverse transportation modes such as air, rail, sea, or road. These security protocols aim to mitigate risks including terrorist threats, criminal activities, and other potential hazards that might jeopardize passenger safety or the integrity of transportation systems.

Various solutions constitute the landscape of passenger security. These include baggage inspection systems, video management systems, access control or biometric systems, cybersecurity solutions, hand-held scanners, full-body scanners, explosive trace detectors, walk-through metal detectors, perimeter intrusion detection systems, and bar-coded boarding systems. Baggage inspection systems employ imaging technologies to detect hazardous or prohibited items or substances within luggage. Equipped with high-resolution optical cameras and scanners sensitive to metallic objects and dangerous substances such as weapons, these systems play a pivotal role in enhancing security. Both new and replacement demands drive investments in these systems, catering to end users such as commercial airports, seaports, and railway stations.

The passenger security market research report is one of a series of new reports that provides passenger security market statistics, including passenger security industry global market size, regional shares, competitors with a passenger security market share, detailed passenger security market segments, market trends and opportunities, and any further data you may need to thrive in the passenger security industry. This passenger security market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenario of the industry.

The passenger security market consists of revenues earned by entities by providing passenger screening, aircraft security services, and cargo and baggage screening. The market value includes the value of related goods sold by the service provider or included within the service offering. The passenger security market also includes sales of X-ray scanners, metal detectors, and security screening equipment, which are used in providing passenger security services. Values in this market are ‘factory gate’ values, that is the value of goods sold by the manufacturers or creators of the goods, whether to other entities (including downstream manufacturers, wholesalers, distributors and retailers) or directly to end customers. The value of goods in this market includes related services sold by the creators of the goods.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

Passenger Security Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on passenger security market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for passenger security? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The passenger security market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include:

- The forecasts are made after considering the major factors currently impacting the market. These include the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) By Solution: Baggage Inspection Systems; Video Management Systems; Access Control or Biometric Systems; Cybersecurity Solutions; Hand-Held Scanners; Full-Body Scanners; Explosive Trace Detectors; Walk-Through Metal Detectors; Perimeter Intrusion Detection Systems; Bar-Coded Boarding Systems2) By Investment: New Demand; Replacement Demand

3) By End User: Commercial Airports; Seaports; Railway Stations

Subsegments:

1) By Baggage Inspection Systems: X-Ray Baggage Scanners; Computed Tomography (CT) Systems2) By Video Management Systems: Surveillance Cameras; Video Analytics Software

3) By Access Control or Biometric Systems: Card-Based Access Control; Fingerprint Recognition Systems; Facial Recognition Systems

4) By Cybersecurity Solutions: Firewall Solutions; Intrusion Detection Systems

5) By Hand-Held Scanners: Metal Detectors; Explosive Detection Scanners

6) By Full-Body Scanners: Millimeter Wave Scanners; Backscatter X-Ray Scanners

Key Companies Mentioned: Honeywell International Inc.; Indra Sistemas S.A.; Robert Bosch GmbH; Teledyne FLIR LLC; Autoclear LLC

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

- Honeywell International Inc.

- Indra Sistemas S.A.

- Robert Bosch GmbH

- Teledyne FLIR LLC

- Autoclear LLC

- Smiths Detection Group Limited

- Adani Systems Inc.

- Advanced Perimeter Systems Limited

- SITA - Société Internationale de Télécommunications Aéronautiques

- Navtech Radar Ltd.

- NEC Corporation

- OSI Systems Inc.

- Thales Group

- Swissport International AG

- Wabtec Corporation

- Securitas Transport Aviation Security Ltd.

- G4S plc

- ICTS Europe Systems BV

- Allied Universal Security Services LLC

- Prosegur Compañía de Seguridad S.A.

- Brink's Company

- ADT Inc.

- Secom Co. Ltd.

- American Airlines Group Inc.

- Delta Air Lines Inc.

- United Airlines Holdings Inc.

- Southwest Airlines Co.

- Air France-KLM SA

- Deutsche Lufthansa AG

- The Emirates Group

- Qatar Airways Group Q.C.S.C.

- Cathay Pacific Airways Limited

- Singapore Airlines Limited

- Japan Airlines Co. Ltd.

- Korean Air Lines Co. Ltd.

- China Southern Airlines Company Limited

- Air China Limited

- Turkish Airlines Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 200 |

| Published | February 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 6.78 Billion |

| Forecasted Market Value ( USD | $ 9.06 Billion |

| Compound Annual Growth Rate | 7.5% |

| Regions Covered | Global |

| No. of Companies Mentioned | 38 |