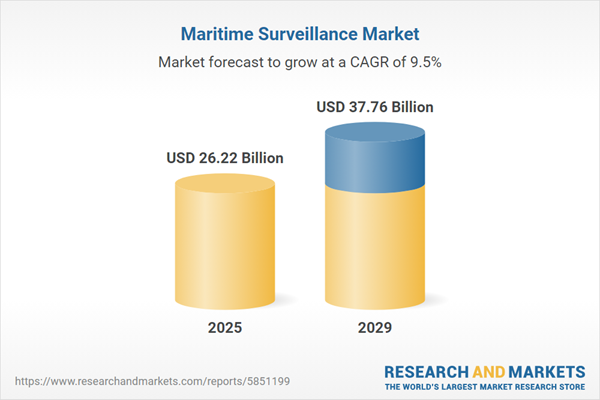

The maritime surveillance market size is expected to see strong growth in the next few years. It will grow to $37.76 billion in 2029 at a compound annual growth rate (CAGR) of 9.5%. The growth in the forecast period can be attributed to data integration and information sharing, commercial sector integration, geopolitical developments, environmental concerns, security challenges. Major trends in the forecast period include collaboration and information sharing, commercial industry adoption, geopolitical tensions, environmental protection, security concerns, increased global trade.

The anticipated increase in maritime commerce activity is expected to significantly drive the growth of the maritime surveillance market in the near future. Maritime commerce encompasses the buying and selling of goods through the marine transport system, which includes all processes essential for identifying, tracking, and understanding activities in the marine domain. This expansion in maritime trade necessitates enhanced surveillance capabilities to ensure the security and efficiency of maritime operations. For instance, in July 2024, Eurostat reported that the gross weight of seaborne goods in the European Union reached 893.97 million tonnes in Q2 2022, an increase from 851.28 million tonnes in Q2 2021. Therefore, the rise in maritime commerce and freight transport activity is driving the growth of the maritime surveillance market.

The increasing adoption of autonomous vessels and robots is expected to be a driving force behind the growth of the maritime surveillance market. Autonomous vessels are watercraft that operate without direct human control. Integrating maritime surveillance into autonomous vessels and robots provides benefits such as enhanced situational awareness, collision avoidance, improved navigation accuracy, remote monitoring and control, reduced human error, decreased risk in hazardous environments, and swift response to emergencies. According to a report by NATO in April 2022, the projection is for 21 autonomous ships by 2025, with an anticipated increase to 143 autonomous ships by 2045. This uptrend in the adoption of autonomous vessels and robots propels the growth of the maritime surveillance market.

A prominent trend in the maritime surveillance market is the emphasis on product innovation. Major companies in this market are concentrating on developing innovative products to fortify their market positions. For instance, in May 2023, Image Soft, a maritime technology company based in Finland, launched the third generation of its UNWAS system. This system, equipped with entirely novel digital circuitry and software, can detect and warn of both underwater and surface hazards using a distributed modular sensor network with passive hydrophones and other sensors. It excels in handling rigorous acoustic underwater circumstances in various adverse settings.

Major companies engaged in the maritime surveillance market are directing their efforts towards introducing advanced solutions, including underwater surveillance systems (UNWAS), to drive market revenues. An underwater surveillance system (UNWAS) is a highly automated marine surveillance system designed to detect, locate, and categorize all underwater dangers. In May 2023, Image Soft, a Finland-based underwater and maritime technology company, launched the third generation of its UNWAS system. This system provides a comprehensive underwater surveillance solution, enhancing global security and protecting critical infrastructure. The third-generation UNWAS system ensures around-the-clock protection for underwater pipelines and subsea cables, capable of detecting and classifying various underwater dangers, even in busy and noisy shipping lanes.

In October 2024, NewSpring Holdings, a US-based venture capital and private equity firm, acquired C Speed for an undisclosed amount. This acquisition enhances NewSpring's capabilities in providing critical defense and security solutions, aligning with the growing trend of private equity investments in technology-driven services that support government operations. As national security demands evolve, these partnerships are crucial for driving innovation and improving operational efficiencies within the defense sector. C Speed is a US-based company specializing in the design, prototyping, and manufacturing of radar systems.

Major companies operating in the maritime surveillance market include Northrop Grumman Corporation, Raytheon Technologies Corporation, Thales Group, Lockheed Martin Corporation, Saab AB, Elbit Systems Ltd., Kongsberg Gruppen ASA, Indra Sistemas S.A., Furuno Electric Co. Ltd., Bharat Electronics Limited, SRT Marine Systems plc, Terma A/S, Smiths Group plc, Westminster Group plc, OSI Maritime Systems Ltd., Safran SA, Sonardyne International Ltd., Hensoldt AG, Honeywell International Inc., L3Harris Technologies Inc., Mind Technology Inc., General Dynamics Corporation, BAE Systems plc, Leonardo SpA, FLIR Systems Inc., Israel Aerospace Industries Ltd., Teledyne Technologies Incorporated, CONTROP Precision Technologies Ltd., Kelvin Hughes Limited, Navico Holding AS, Harris Corporation, Pole Star Space Applications Ltd., Inmarsat plc, Orbcomm Inc., Iridium Communications Inc., Speedcast International Limited, Marlink AS, Intelsat SA, SES SA, Viasat Inc.

Asia-Pacific was the largest region in the maritime surveillance market in 2024. Asia-Pacific is expected to be the fastest-growing region in the global maritime surveillance market report during the forecast period. The regions covered in the maritime surveillance market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa. The countries covered in the maritime surveillance market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Canada, Italy, Spain.

Maritime surveillance is a comprehensive process that involves maintaining knowledge and awareness of all marine operations. It encompasses the systematic application of various tools, such as visual, auditory, digital, photographic, and others, to observe regions, people, or objects in aerospace, cyberspace, the physical world, or other locations.

The main components of maritime surveillance include sensors, radar, Automatic Identification System (AIS) receivers, software, and other technologies. Sensors, in this context, refer to instruments that detect inputs from the physical world and respond accordingly. They are used to detect individuals at distances of at least 2.8 miles and other boats up to 10 miles away. Supplementary indicators, including lasers and laser rangefinders, are capable of marking and measuring the distance between objects. Maritime surveillance finds applications in naval, coast guard, and various other sectors, serving defense, customs, fisheries, intelligence, and other end-users.

The maritime surveillance market research report is one of a series of new reports that provides maritime surveillance market statistics, including the maritime surveillance industry global market size, regional shares, competitors with a maritime surveillance market share, detailed maritime surveillance market segments, market trends, and opportunities, and any further data you may need to thrive in the maritime surveillance industry. This maritime surveillance market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenarios of the industry.

The maritime surveillance market includes revenues earned by entities by gathering, analyzing, consolidating, and sharing data, with the information captured using a wide range of sensors and sensor combinations working across multiple areas of the spectrum (electronic signals, pictures, interactions, acoustics and installed on multiple systems (satellites, ships, and airplanes,). The market value includes the value of related goods sold by the service provider or included within the service offering. The maritime surveillance market also includes sales of active sensors and platforms, communication links, and passive sensors and platforms. Values in this market are ‘factory gate’ values, that is the value of goods sold by the manufacturers or creators of the goods, whether to other entities (including downstream manufacturers, wholesalers, distributors, and retailers) or directly to end customers. The value of goods in this market includes related services sold by the creators of the goods.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

Maritime Surveillance Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on maritime surveillance market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for maritime surveillance? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The maritime surveillance market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include:

- The forecasts are made after considering the major factors currently impacting the market. These include the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) By Component: Sensors; Radar; Automatic Identification System (AIS) Receiver; Software; Other Components2) By Application: Naval; Coast Guard; Other Applications

3) By End-User: Defense; Customs; Fisheries; Intelligence; Other End-Users

Subsegments:

1) By Sensors: Optical Sensors; Infrared Sensors; Acoustic Sensors; Other Sensors2) By Radar: Ground-Based Radar; Airborne Radar; Shipborne Radar

3) By Automatic Identification System (AIS) Receiver: Class a AIS Receiver; Class B AIS Receiver

4) By Software: Surveillance Software; Analytics Software; Integration Software

5) By Other Components: Communication Systems; Data Processing Units; Power Supply Systems

Key Companies Mentioned: Northrop Grumman Corporation; Raytheon Technologies Corporation; Thales Group; Lockheed Martin Corporation; Saab AB

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

- Northrop Grumman Corporation

- Raytheon Technologies Corporation

- Thales Group

- Lockheed Martin Corporation

- Saab AB

- Elbit Systems Ltd.

- Kongsberg Gruppen ASA

- Indra Sistemas S.A.

- Furuno Electric Co. Ltd.

- Bharat Electronics Limited

- SRT Marine Systems plc

- Terma A/S

- Smiths Group plc

- Westminster Group plc

- OSI Maritime Systems Ltd.

- Safran SA

- Sonardyne International Ltd.

- Hensoldt AG

- Honeywell International Inc.

- L3Harris Technologies Inc.

- Mind Technology Inc.

- General Dynamics Corporation

- BAE Systems plc

- Leonardo SpA

- FLIR Systems Inc.

- Israel Aerospace Industries Ltd.

- Teledyne Technologies Incorporated

- CONTROP Precision Technologies Ltd.

- Kelvin Hughes Limited

- Navico Holding AS

- Harris Corporation

- Pole Star Space Applications Ltd.

- Inmarsat plc

- Orbcomm Inc.

- Iridium Communications Inc.

- Speedcast International Limited

- Marlink AS

- Intelsat SA

- SES SA

- Viasat Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 200 |

| Published | February 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 26.22 Billion |

| Forecasted Market Value ( USD | $ 37.76 Billion |

| Compound Annual Growth Rate | 9.5% |

| Regions Covered | Global |

| No. of Companies Mentioned | 40 |