Asia Pacific is the promising region for the growth of Augmented Analytics in BFSI due to the region's growing digitization and broad technology use, which offer financial institutions tremendous opportunities to deploy augmented analytics instruments by providing a vast source of data. Therefore, Asia Pacific is anticipated to generate approximately 2/5thshare of the market by 2030. Additionally, the capacity to handle this data through sophisticated analytics techniques offers a way for individualized consumer experiences, improved risk management, as well as simplified processes, which will enhance the regional market throughout the forecast period.

The major strategies followed by the market participants are Partnerships as the key developmental strategy in order to keep pace with the changing demands of end users. For instance, In July, 2021, IBM Corporation partnered with SAP SE to facilitate the IBM cloud adoption in the financial services industry by integrating IBM cloud with SAP's portfolio of finance and data management solutions. The partnership aids IBM to serve its customers in a better way by helping them in increasing operational efficiencies through the use of the cloud. Additionally, In September, 2020, QlikTech International AB partnered with Tangent Works to integrate Tangent Works' InstantML modelling solution with QlikTech's portfolio. The partnership aids QlikTech in serving customers in a better way by providing them with AI-powered decision-making solutions.

The Cardinal Matrix - Market Competition Analysis

Based on the Analysis presented in the The Cardinal Matrix; Microsoft Corporation is the forerunner in the Market. Companies such as SAP SE, IBM Corporation, Oracle Corporation are some of the key innovators in the Market. In May, 2023, SAP SE signed a partnership with Google Cloud, a cloud platform offered by Google, to integrate Google Cloud’s Data and Analytics Technology with SAP's portfolio. The partnership enables SAP to serve its customers in a better way by providing them with a portfolio that would simplify the data landscapes, perform advanced analysis and provide quick access to important business-related data.

Market Growth Factors

Increasing data volumes in the BFSI sector

Banking data can be quite helpful in making wise business decisions, but managing and analyzing it manually can be very time-consuming. To automate the data analysis process and give business users useful insights, augmented analytics in this scenario uses cutting-edge technology. As a result, augmented analytics solutions empower companies to make quicker and more accurate judgments based on insights derived from the massive volumes of data at their disposal. In order to give BFSI firms an advantage through data-driven decision-making, the use of augmented analytics is anticipated to pick up speed as data volumes in this sector continue to rise. Hence, the growing interest of banks in deriving insights from data is propelling the adoption of augmented analytic tools, which in turn is driving the market's growth.Rising use of augmented analytics for operational effectiveness and cost reduction

Augmented analytics can also increase operational effectiveness and lower costs in the BFSI industry. Financial organizations can therefore automate and streamline their operations for data analysis by utilizing augmented analytics capabilities. This automation does away with the necessity for labor-intensive and frequently mistake-prone manual data processing. Because complicated data sets can be correctly and swiftly examined with augmented analytics, financial institutions can get important insights and make decisions more quickly. As a result, the BFSI sector benefits greatly from augmented analytics regarding operational effectiveness and cost savings.Market Restraining Factors

Significant dearth of professional to implement and use technology

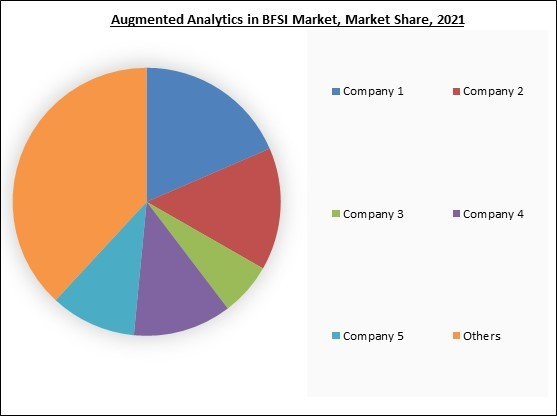

Organizations require qualified personnel who can comprehend and use these technologies successfully to fully use them. A professional's ability to use data and analytics technologies to gain insights and enhance business outcomes is also becoming increasingly in demand in the BFSI sector. Because of a shortage of qualified workers, the use of sophisticated analytics has lagged behind other industries in the insurance sector. The evolving nature of the BFSI sector requires professionals to possess a combination of technical expertise and industry-specific knowledge. Hence, the widespread use of augmented analytics may be hampered by a lack of qualified people in this field.The leading players in the market are competing with diverse innovative offerings to remain competitive in the market. The above illustration shows the percentage of revenue shared by some of the leading companies in the market. The leading players of the market are adopting various strategies in order to cater demand coming from the different industries. The key developmental strategies in the market are Partnerships & Collaborations.

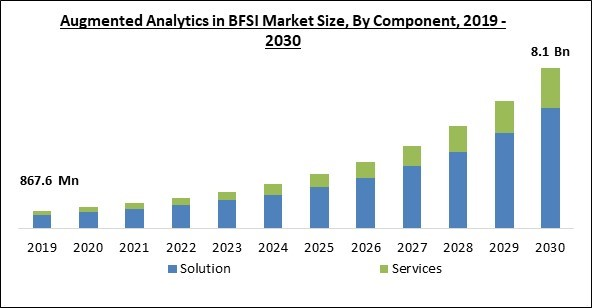

Component Outlook

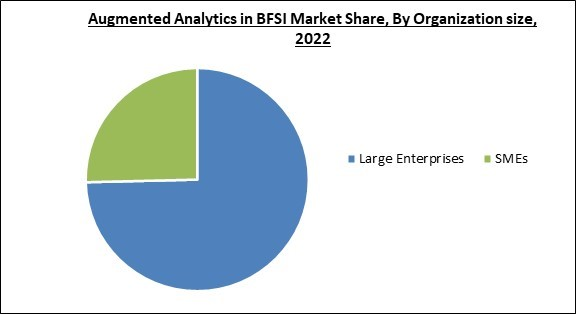

Based on component, the market is characterized into solution and services. The solution segment garnered the highest revenue share in the market in 2022. The growth of the segment is owed to the increasing demand for solutions by the BFSI firms since planning comes before everything else when developing financial solutions. Numerous banks are making significant investments to improve day-to-day activities and banking procedures. Additionally, in the midst of significant digital upheaval, banks are maximizing how the IoT could help produce goods that specifically match customer desires.Organization Size Outlook

By organization size, the market is divided into large enterprises and small & medium-sized enterprises (SMEs). The large enterprises segment witnessed the maximum revenue share in the market in 2022. Because of their considerable activities, highly effective augmented analytics are required. Additionally, the increased spending by major banks on the implementation of cutting-edge IoT technologies would accelerate the segment's growth. Large organizations are increasingly turning to augmented analytics to ensure that they can manage their financial operations quickly despite the complexity of those activities and the growing number of regulations.Application Outlook

Based on application, the market is segmented into risk & compliance management, customer analytics, fraud detection, portfolio management, and others. The customer analytics segment procured the highest revenue share in the market in 2022. Augmented analytics can analyze historical customer data and identify potential churn patterns. By leveraging ML algorithms, it can predict which customers will most likely switch to a competitor or discontinue their relationship with the BFSI organization. They can also aid in estimating the customer lifetime value (CLV) analysis for individual customers by considering their past behavior, transaction history, and engagement patterns.Deployment Mode Outlook

On the basis of deployment mode, the market is classified into on-premise and cloud. The cloud segment recorded a significant revenue share in the market in 2022. The expansion of the segment is because cloud-based analytics platforms have the advantages of being scalable, flexible, and cost-effective. This means that BFSI businesses can use the power of advanced analytics without making a lot of infrastructure investments. Additionally, the cloud solution offers real-time data access and collaboration, permitting smooth integration across numerous departments and branches and boosting market growth.Regional Outlook

Region wise, the market is analyzed across North America, Europe, Asia Pacific, and LAMEA. The North America segment recorded the largest revenue share in the market in 2022. Since the region has a highly developed financial industry and a supportive regulatory environment that fosters innovation, the North America region has been at the forefront of implementing augmented analytics in the BFSI market. A substantial amount of money has been invested in augmented analytics innovations in key financial centers like Silicon Valley and New York, which is fueling the expansion of the regional market.The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include SAS Institute, Inc., IBM Corporation, Salesforce, Inc., SAP SE, Microsoft Corporation, QlikTech International AB, Alteryx, Inc., Tibco Software, Inc. (Vista Equity Partners), ThoughtSpot, Inc. and Oracle Corporation.

Strategies Deployed in the Market

Partnerships, Collaborations and Agreements:

- May-2023: SAP SE signed a partnership with Google Cloud, a cloud platform offered by Google, to integrate Google Cloud’s Data and Analytics Technology with SAP's portfolio. The partnership enables SAP to serve its customers in a better way by providing them with a portfolio that would simplify the data landscapes, perform advanced analysis, and provide quick access to important business-related data.

- Jul-2021: IBM Corporation partnered with SAP SE, a German software company, to facilitate the IBM cloud adoption in the financial services industry by integrating IBM cloud with SAP's portfolio of finance and data management solutions. The partnership aids IBM to serve its customers in a better way by helping them in increasing operational efficiencies through the use of the cloud.

- May-2021: SAP extended its partnership with Team Liquid, a leading worldwide professional esports organization. By using the power of SAP HANA, predictive & machine learning functionalities, and the SAP Business Technology Platform, Team Liquid would more rapidly and efficiently evaluate opponents’ approaches.

- Jan-2021: SAP SE extended its partnership with Microsoft, an American multinational technology company. This partnership aimed to combine Microsoft Teams with SAP’s intelligent portfolio of solutions and boost the adoption of SAP S/4HANA on Microsoft Azure. In addition, the companies also focus on simplifying and streamlining users' journeys to the cloud.

- Jan-2021: SAS extended its 40-year partnership with the US Food and Drug Administration (FDA). Under this expansion, SAS aimed to expand its capabilities in natural language processing, AI, and ML capabilities via the SAS Viya platform with the support of the FDA’s mission as an important public health agency. This partnership would help FDA to advance CDER’s initiative to modernize drug regulatory programs, better meet the centre’s mission, offer analytically driven drug manufacturing facility surveillance via other core initiatives.

Product Launches and Product Expansions:

- Mar-2023: Salesforce, Inc. unveiled Einstein GPT. The Einstein GPT is an AI-powered CRM technology used for delivering AI-created content at a hyper-scale across different interactions. The Einstein GPT features Salesforce's unique AI models and compatibility with Salesforce Data Cloud.

- Feb-2023: Alteryx, Inc. announced new features for the Alteryx Analytics Cloud Platform. The new features include the Alteryx Designer Cloud interface, Reporting functionality, and Alteryx Metrics Store.

- Nov-2022: IBM Corporation announced the launch of IBM Business Analytics Enterprise. The Business Analytics Enterprise is a collection of business intelligence services used for planning, forecasting, and reporting for a business. The Business Analytics Enterprise features IBM Analytics Content Hub that provides analytics and planning dashboards, it features algorithms used for advising role-based content for assistance in decision making.

Acquisition and Mergers:

- Feb-2022: Alteryx, Inc. took over Trifacta, a software company headquartered in the United States. The acquisition makes Alteryx a special provider of a comprehensive offering of end-to-end automated analytics solutions.

- Jan-2021: Tibco Software, Inc. announced the acquisition of Information Builders, Inc., a data analytics solutions provider. The acquisition enhances TIBCO's offerings by adding Information Builders' data analytics and management capabilities to TIBCO's Connected Intelligence platform.

- Jan-2021: SAS acquired Boemska, a privately held technology company. This acquisition aimed to improve SAS Viya, a cloud-native, advanced analytics platform, with enriching capabilities that accelerate SAS' objective of supporting the whole analytics life cycle and facilitating customer transformation to the cloud.

Scope of the Study

By Component

- Solution

- Services

By Application

- Customer Analytics

- Fraud Detection

- Risk & Compliance Management

- Portfolio Management

- Others

By Organization size

- Large Enterprises

- SMEs

By Deployment Mode

- On-premise

- Cloud

By Geography

- North America

- US

- Canada

- Mexico

- Rest of North America

- Europe

- Germany

- UK

- France

- Russia

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Singapore

- Malaysia

- Rest of Asia Pacific

- LAMEA

- Brazil

- Argentina

- UAE

- Saudi Arabia

- South Africa

- Nigeria

- Rest of LAMEA

Key Market Players

List of Companies Profiled in the Report:

- SAS Institute, Inc.

- IBM Corporation

- Salesforce, Inc.

- SAP SE

- Microsoft Corporation

- QlikTech International AB

- Alteryx, Inc.

- Tibco Software, Inc. (Vista Equity Partners)

- ThoughtSpot, Inc.

- Oracle Corporation

Unique Offerings

- Exhaustive coverage

- The highest number of Market tables and figures

- Subscription-based model available

- Guaranteed best price

- Assured post sales research support with 10% customization free

Table of Contents

Companies Mentioned

- SAS Institute, Inc.

- IBM Corporation

- Salesforce, Inc.

- SAP SE

- Microsoft Corporation

- QlikTech International AB

- Alteryx, Inc.

- Tibco Software, Inc. (Vista Equity Partners)

- ThoughtSpot, Inc.

- Oracle Corporation