The ever-expanding worldwide population and its rising purchasing power are primarily responsible for the growth of the food and beverage sector. Hence, the Food & Beverages sector would generate more than 15% share of the market by 2030. A frequent trend among today's consumers is the rising demand for meals with high natural flavor and taste standards. Due to this tendency, processed foods with flavor and taste had to be developed employing industrial enzyme applications. These enzymes function as catalysts by being critical in breaking vitamins and nutrients during metabolic reactions and the interconversion of complex molecules into simpler ones.

With sales of produced goods totaling $117.8 billion in 2019, the food and beverage processing business is the second-largest manufacturing sector in Canada, according to data from the Government of Canada. Similarly, India has one of the greatest food processing industries in the world, and by 2025-2026, Invest India estimates that it will produce $535 billion worth of food. The agri-food industry, according to the UK government, provided £116.2 billion, or 6%, of the country's Gross Value Added (GVA) in 2020.

The major strategies followed by the market participants are Product Launches as the key developmental strategy to keep pace with the changing demands of end users. For instance, In June, 2023, Kerry Group PLC launched Biobake EgR, an enzyme solution that reduces the number of eggs required in the baking process. The benefits of the product include a reduction of Co2 emissions by up to 14%. Additionally, In April, 2023, Creative Enzymes introduced detergent enzyme blend granules used for increasing the performance of laundry detergents. The product contains a mixture of lipase, amylase, protease, and mannanase. Additionally, the product is eco-friendly as it is made from natural sources.

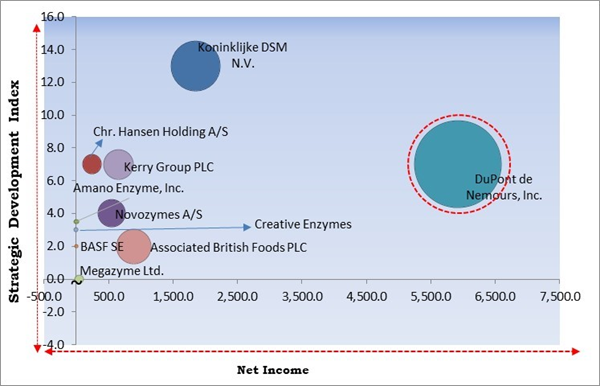

The Cardinal Matrix - Market Competition Analysis

Based on the Analysis presented in the The Cardinal Matrix; DuPont de Nemours, Inc. are the forerunners in the Market. In November, 2019, DuPont de Nemours, Inc. introduced DuPont Danisco Nurica and DuPont Danisco Bonlacta. The DuPont Danisco Nurica is an enzyme used for lactose conversion. The benefits of the product include sugar reduction and lactose optimization. Companies such as Koninklijke DSM N.V., Associated British Foods PLC, Kerry Group PLC are some of the key innovators in the Market.

Market Growth Factors

R&D efforts to support the growing demand for enzyme applications

By merging some impending technologies of gene editing and innovative bacterial platforms for therapeutic enzymes, the increasing interest in employing enzymes for numerous industrial processes has sparked the quest for biocatalysts with new or enhanced features. With advancements in technology, it is now possible to change odd residues in a natural enzyme to create an improved enzyme with enhanced functional characteristics. Hence, the increasing number of R&D initiatives in industrial enzyme use is boosting the expansion of the market.Growing interest in renewable energy sources and environmentally friendly products

The demand is rising in response to the demand for renewable and ecological alternatives. Since fermented sugars are produced during enzymatic hydrolysis and then further fermented, enzymatic hydrolysis plays a significant role in the production of bioethanol. The advantages of using biotechnology-based enzymes over conventional chemicals and a way to deal with the problems caused by synthetic chemicals have long been acknowledged. Therefore, the rising demand for sustainable and renewable products and methods will propel the growth of the market throughout the forecast period.Market Restraining Factors

Strict regulatory rules for the manufacturing industry

Manufacturers of enzymes are required to adhere to the regulations that are imposed by various governing agencies, including the Enzyme Technical Association (ETA), the EU Registration, Evaluation, and Authorization of Chemicals (REACH) Regulation, and the Association of Manufacturers & Formulators of Enzyme Products (AMFEP). The Food Chemicals Codex provides a set of criteria that must be followed when enzymes are used in the food manufacturing business. Therefore, such strict regulatory rules may hamper the expansion of the market to some extent.Source Outlook

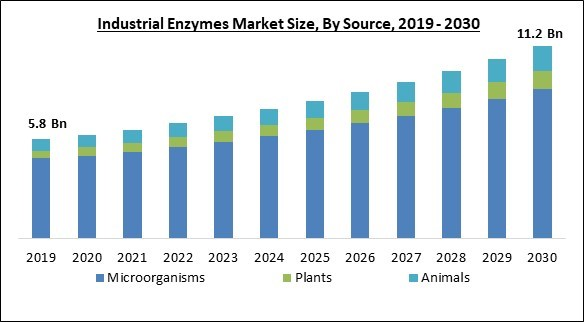

On the basis of source, the market is classified into microorganisms, plants, and animals. The plants segment recorded a significant revenue share in the market in 2022. The capacity of plant-based enzymes to meet particular allergies and dietary restrictions has led to an increase in demand for them. Plant-based enzymes are excellent substitutes for those who are lactose intolerant or who adhere to dietary restrictions that forbid substances originating from animals. Demand for plant-based enzymes has also increased due to consumer worries regarding product components. Due to their plant-based origins and lack of usage of GMOs or synthetic chemicals, they are regarded as clean-label ingredients.Product Outlook

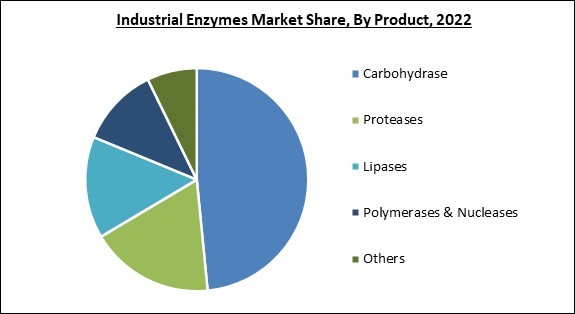

Based on product, the market is characterized into carbohydrase, proteases, lipases, polymerases & nucleases, and others. The carbohydrase segment garnered the highest revenue share in the market in 2022. The expansion of the segment is due to its expanding application across a range of sectors, including, among others, the pharmaceutical, food & beverage, and animal feed industries. It is primarily utilized as a catalyst to transform carbohydrates into sugar syrups like fructose and glucose, which are then employed in the food and beverage, and pharmaceutical sectors. It is used to make prebiotic goods like isomaltose for wines and juices, as well as artificial sweeteners.Application Outlook

By application, the market is divided into food & beverages, biofuels, textiles, detergents, paper & pulp, personal care & cosmetics, wastewater, animal feed, agriculture, and others. The food and beverages segment witnessed the maximum revenue share in the market in 2022. The increased use of enzymes in manufacturing food and drink products is responsible for this growth. Both tailored enzyme solutions and exclusive enzyme products are used in processing cheese, vegetables, fruits, oils and fats, grains, and several other food products in the dairy, baking, and brewing industries. Lipases, carbohydrase, and proteases are the three enzymes most commonly used in the food and beverage industry.Regional Outlook

Region wise, the market is analyzed across North America, Europe, Asia Pacific, and LAMEA. The North America segment garnered the largest revenue share in the market in 2022. Due to a number of elements that support both enzyme producers and consumers in their commercial endeavors, the demand for industrial enzymes in North America is rising noticeably. Governments in this region have put supportive measures in place, including rules, subsidies, and tax incentives to encourage the use of sustainable technologies. Due to the governmental encouragement to use environmentally friendly products, such as enzymes, businesses are growing.The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include Novozymes A/S (Novo Holdings A/S), DuPont de Nemours, Inc., Koninklijke DSM N.V., Chr. Hansen Holding A/S, Creative Enzymes, BASF SE, Kerry Group PLC, Associated British Foods PLC (Wittington Investments Limited), Amano Enzyme, Inc., and Megazyme Ltd. (Neogen Corporation)

Strategies Deployed in the Market

Partnerships, Collaborations and Agreements:

- Jan-2023: BASF SE came into partnership with Cargill, a global food company, to market their enzyme solutions within the US market. The partnership aids BASF in expanding its geographical footprint.

- Dec-2022: Koninklijke DSM N.V. signed a distribution partnership with Azelis, food ingredient service provider. The partnership allows the company to gain a strong foothold in the Indian market by providing its customers with a comprehensive vitamin range.

- Nov-2021: Novozymes A/S came into partnership with Novo Nordisk Pharmatech, a Danish pharmaceutical company and a sister company of Novozymes A/S, to develop enzymatic processing aids for gene and cell therapy applications. The combined expertise would enable the development of specialty enzymes that would aid the companies in strengthening their position in the market.

Product Launches and Product Expansions:

- Jun-2023: Kerry Group PLC launched Biobake EgR, an enzyme solution that reduces the number of eggs required in the baking process. The benefits of the product include a reduction of Co2 emissions by up to 14%.

- Apr-2023: Creative Enzymes introduced detergent enzyme blend granules used for increasing the performance of laundry detergents. The product contains a mixture of lipase, amylase, protease, and mannanase. Additionally, the product is eco-friendly as it is made from natural sources.

- Sep-2022: Koninklijke DSM N.V. released of Delvo Plant Go, a part of Delvo Plant enzyme portfolio used as an oat-based dairy alternative. The benefits of the product include reduced hydrolysis time and cost savings. Furthermore, the Delvo Plant Go features compatibility with non-GMO and organic formulations.

- Apr-2021: Chr. Hansen Holding A/S announced the launch of FreshQ cultures for protection applications. The benefits of the product include reduced post-acidification effect at increased temperatures and better sensory suitability.

- Mar-2021: Amano Enzyme, Inc. announced the launch of Umamizyme Pulse, a non-GMO enzyme formulation used for producing high cysteine and glutamic acid. The solution can be used in a variety of applications including broths, meat substitutes, soups, and snacks.

Acquisition and Mergers:

- May-2023: Koninklijke DSM N.V. announced a merger with Firmenich International SA, a chemical company based in Switzerland, to create DSM-Firmenich AG. The new company, DSM-Firmenich AG would combine the expertise of both companies and would be able to serve its customers in a better way.

- Feb-2022: Kerry Group PLC completed the acquisition of Enmex, a Mexican enzyme manufacturer. The acquisition would enhance Kerry's position in cereal and grain modification by enhancing its enzyme portfolio.

- Oct-2021: Koninklijke DSM N.V. took over First Choice Ingredients, an American food products supplier. The acquisition enhances the company's portfolio and would allow the company to serve its customers in a better way.

- Feb-2021: DuPont de Nemours, Inc. merged with International Flavors & Fragrances, a scent and flavour specialist. The combined company would operate by the name 'IFF' and would serve the customers with solutions for soy proteins, texture, taste, enzymes, and cultures.

Geographical Expansions:

- Nov-2022: Amano Enzyme, Inc., announced the opening of the EMEA hub in Oxfordshire, UK. The new hub would be used to oversee the operations across the company's EMEA sites and would aid the company in its collaboration efforts in the US and UK.

Scope of the Study

By Application

- Food & Beverages

- Detergents

- Animal Feed

- Biofuels

- Textiles

- Pulp & Paper

- Personal Care & Cosmetics

- Wastewater

- Agriculture

- Others

By Source

- Microorganisms

- Plants

- Animals

By Product

- Carbohydrase

- Proteases

- Lipases

- Polymerases & Nucleases

- Others

By Geography

- North America

- US

- Canada

- Mexico

- Rest of North America

- Europe

- Germany

- UK

- France

- Russia

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Singapore

- Malaysia

- Rest of Asia Pacific

- LAMEA

- Brazil

- Argentina

- UAE

- Saudi Arabia

- South Africa

- Nigeria

- Rest of LAMEA

Key Market Players

List of Companies Profiled in the Report:

- Novozymes A/S (Novo Holdings A/S)

- DuPont de Nemours, Inc.

- Koninklijke DSM N.V.

- Chr. Hansen Holding A/S

- Creative Enzymes

- BASF SE

- Kerry Group PLC

- Associated British Foods PLC (Wittington Investments Limited)

- Amano Enzyme, Inc.

- Megazyme Ltd. (Neogen Corporation)

Unique Offerings

- Exhaustive coverage

- The highest number of Market tables and figures

- Subscription-based model available

- Guaranteed best price

- Assured post sales research support with 10% customization free

Table of Contents

Companies Mentioned

- Novozymes A/S (Novo Holdings A/S)

- DuPont de Nemours, Inc.

- Koninklijke DSM N.V.

- Chr. Hansen Holding A/S

- Creative Enzymes

- BASF SE

- Kerry Group PLC

- Associated British Foods PLC (Wittington Investments Limited)

- Amano Enzyme, Inc.

- Megazyme Ltd. (Neogen Corporation)