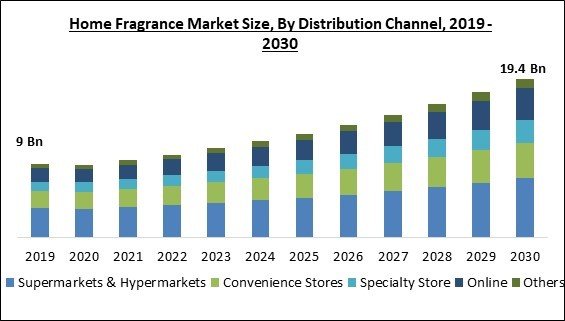

The Online sector is growing because of the rise in internet penetration over the past decade. Hence, the online segment acquired the $1,936.8 million revenue of the market in 2022. Even though the number of physical stores is higher, digital retail technologies such as automated chatbots, virtual stores, visual search, and augmented reality can help online retailers provide superior customer experiences. Due to rising disposable incomes and shifting lifestyles in several regions, the demand for household fragrances has increased significantly. E-commerce platforms for purchasing home fragrances like reed diffusers, luxury candles, room fresheners, etc., are acquiring immense popularity among consumers. E-commerce vendors sell artistically crafted household fragrances, particularly candles with intricate shapes and sculptural construction. This increased consumer interest in purchasing home fragrances, bolstering the market expansion.

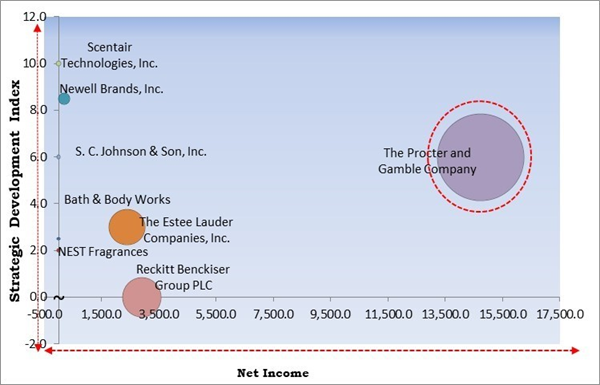

The major strategies followed by the market participants are Product Launches as the key developmental strategy to keep pace with the changing demands of end users. For instance, In June, 2023, ScentAir announced the launch of the Limited Edition Summer Fragrance Collection that consists of exciting latest fragrances involved in the excitement and thrill of travel and summer fun. Additionally, In January, 2022, The Yankee Candle Company, Inc., part of Newell Brands, Inc., unveiled Yankee CandleWell Living Collection, a lineup of wellness-inspired scents meant to change the mood of your house and encourage renewal and regeneration, the Well Living Collection helps the family create the most of every moment jointly.

The Cardinal Matrix - Market Competition Analysis

Based on the Analysis presented in the The Cardinal Matrix; The Procter and Gamble Company is the major forerunner in the Market. In January, 2023, Febreze introduced Mountain, a fragrance that reflects the need to Connect with the Earth. The launched product is a simple way to bring the calmness of the great outdoors into customers' homes through the pleasure of scent. Companies such as Newell Brands, Inc., The Estee Lauder Companies, Inc. and Scentair Technologies, Inc. are some of the key innovators in the Market.

Market Growth Factors

Increasing shift toward sustainability

Numerous trade laws already contain provisions for preserving endangered species and materials, and there are exclusive agreements concerning the traceability of wood. Various new regulations require businesses to identify, address, and remedy any violations or prospective violations of human rights, the environment, and good administration throughout their entire value chain. Also, modern consumers are extremely concerned with environmental preservation, which motivates them to make sustainable decisions. Therefore, eco-friendly packaging cases and production for home fragrances are preferred over the rest of the competition. Thus, such sustainable initiatives in the market will contribute to its expansion.Increasing prevalence and demand for aromatherapy

Aromatherapy can be beneficial for those who have trouble falling or remaining asleep. This procedure involves inhaling plant extracts through the nostrils, which relaxes the person and assists them in falling asleep. Customers' increasing desire to live natural, healthy lives and their growing awareness of the health benefits offered by these aromatherapy wax melts have increased their popularity. As a result, they are becoming increasingly popular as a form of natural medication. In addition, due to their therapeutic benefits, aromatherapists require more scented wax melts today. Thus, the widespread use of natural preservatives in producing fragrances has led to a significant increase in their demand.Market Restraining Factors

Increasing popularity of DIYs for home fragrance

DIY home fragrance creation can cost far less in the long term than purchasing pricey commercial items. DIY home fragrances let the user design one-of-a-kind, individualized aromas that express their tastes and sense of style. Homemade scents can be manufactured with natural components such as essential oils, herbs, and flowers, which are frequently healthier and safer than the synthetic perfumes used in commercial items. In addition, some essential oils and herbs have medicinal qualities that can enhance mood, anxiety, stress, and relaxation. As a result, it is predicted that fewer consumers will adopt a variety of commercially available home fragrance items due to the growing popularity of DIYs, which will hamper the market's expansion.Product Outlook

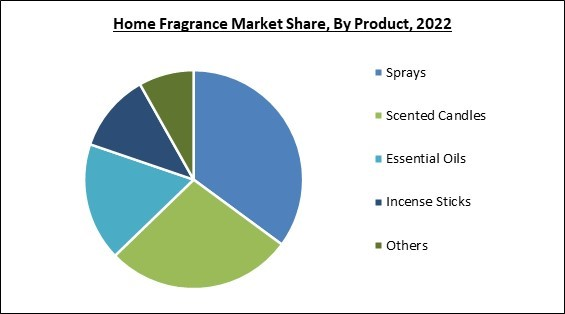

Based on product, the market is segmented into scented candles, sprays, essential oils, incense sticks and others. The sprays segment dominated the market with maximum revenue share in 2022. This is because home fragrance systems like sprays have been a consumer favorite for many years. They are simple to use and can rapidly add a burst of fragrance to a room. In addition, home fragrance sprays are easy to use & carry. They have their implementation in the hospitality sector, and with the sector's expansion, the segment's growth is expected to propel during the projected period.Distribution Channel Outlook

On the basis of distribution channel, the market is divided into supermarkets & hypermarkets, specialty stores, convenience stores, online and others. The online segment procured a promising growth rate in the market in 2022. This distribution channel provides consumers a simple and convenient way to shop for home fragrance products. With the rise of online purchasing and its convenience, it is anticipated that online distribution channels will continue to have a major role in the market. In addition, the company's e-commerce website features a vast selection of home fragrance products, including candles, room mists, and diffusers.Regional Outlook

Region-wise, the market is analyzed across North America, Europe, Asia Pacific, and LAMEA. The Europe region witnessed the largest revenue share in the market in 2022. The market is growing because European consumers are becoming increasingly health-conscious and seeking products that promote well-being due to rising demand for natural and environmentally sustainable home fragrances. Using natural constituents, such as essential oils, in home fragrance products is viewed as a healthier alternative to synthetic fragrances.The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include Seda France, Inc., Newell Brands, Inc., Bath & Body Works, NEST Fragrances, S. C. Johnson & Son, Inc., The Estee Lauder Companies, Inc., The Procter and Gamble Company, Reckitt Benckiser Group PLC, Bougie et Senteur and Scentair Technologies, Inc.

Strategies Deployed in the Market

Partnerships, Collaborations and Agreements:

- Apr-2023: The Yankee Candle Company, Inc., part of the Newell Brands, came into partnership with Vera Bradley, an American luggage and handbag design company. Under this partnership, both companies would launch a limited-edition collection of elegant latest designs before Mother's Day.

- Aug-2022: Bath & Body Works partnered with Instacart, an American delivery company that operates a grocery delivery and pick-up service. This partnership would aim to serve last-minute shoppers with many deliveries available fastly.

Product Launches and Product Expansions:

- Jun-2023: ScentAir announced the launch of the Limited-Edition Summer Fragrance Collection. The limited collection consists of exciting latest fragrances involved in the excitement and thrill of travel and summer fun.

- May-2023: ScentAir Technologies, LLC introduced fragrance-infused reeds, the newly developed patent pending fragrance. The launch would enable home consumers to cover spaces too small for the greater coverage ScentAir Whisper Home fragrance diffuser.

- Apr-2023: Friday Collective™, a brand within the Newell Brands suite, announced the launch of 'Free To Be', 'Sunroof's Open', and 'Free Spirit', the three exclusive fragrances. This launch consists of Scented Candles that consist of Uplifting and Experience-Driven Fragrances.

- Apr-2022: Galde, the brand of SC Johnson announced the launch of Coastal Sunshine Citrus, the everyday fragrance. With this launch, Glade's line would help consumers transform their homes from summer to spring.

- Jan-2023: Febreze introduced Mountain, a fragrance that reflects the need to Connect with the Earth. The launched product is a simple way to bring the calmness of the great outdoors into customers' homes through the pleasure of scent.

- Jan-2022: The Yankee Candle Company, Inc., part of Newell Brands, Inc., unveiled Yankee CandleWell Living Collection, a lineup of wellness-inspired scents meant to change the mood of your house and encourage renewal and regeneration, the Well Living Collection helps the family create the most of every moment jointly.

- Oct-2021: Estée Lauder unveiled Dream Dusk, Radiant Mirage, Desert Eden, and The new Eau de paerfum sprays, an extensive fragrance series, ranging from eau de parfums, hand creams, and travel sprays. The Launched products feature floral, woody, and fresh notes.

- Feb-2021: Glade released Glade® PlugIns® Scented Oil PLUS, the energy-efficient warmer across the marketplace which provides enduring fragrance with the least waste. This product was designed for customers who want to build the best mood for their homes but are concerned about waste.

- Feb-2021: Febreze launched Fade Defy Plug, a Plug-In with Tech that controls Scent Release. The product features a dual-wick system that switches between two slightly different, complementary scents every 45 minutes, making sure consumers don’t become nose blind to the scent.

Geographical Expansions:

- May-2023: Bath & Body Works opened its high street store in Bangalore, India. The new facility would offer exclusive fragrances for the home and body. Additionally, Bath & Body further broadens its reach in the online space by introducing fashion and beauty e-retailers including Myntra, Amazon, and Nykaa.

Scope of the Study

By Product

- Sprays

- Scented Candles

- Essential Oils

- Incense Sticks

- Others

By Distribution Channel

- Supermarkets & Hypermarkets

- Convenience Stores

- Specialty Store

- Online

- Others

By Geography

- North America

- US

- Canada

- Mexico

- Rest of North America

- Europe

- Germany

- UK

- France

- Russia

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Singapore

- Malaysia

- Rest of Asia Pacific

- LAMEA

- Brazil

- Argentina

- UAE

- Saudi Arabia

- South Africa

- Nigeria

- Rest of LAMEA

Key Market Players

List of Companies Profiled in the Report:

- Seda France, Inc.

- Newell Brands, Inc.

- Bath & Body Works

- NEST Fragrances

- S.C. Johnson & Son, Inc.

- The Estee Lauder Companies, Inc.

- The Procter and Gamble Company

- Reckitt Benckiser Group PLC

- Bougie et Senteur

- Scentair Technologies, Inc.

Unique Offerings

- Exhaustive coverage

- The highest number of Market tables and figures

- Subscription-based model available

- Guaranteed best price

- Assured post sales research support with 10% customization free

Table of Contents

Companies Mentioned

- Seda France, Inc.

- Newell Brands, Inc.

- Bath & Body Works

- NEST Fragrances

- S. C. Johnson & Son, Inc.

- The Estee Lauder Companies, Inc.

- The Procter and Gamble Company

- Reckitt Benckiser Group PLC

- Bougie et Senteur

- Scentair Technologies, Inc.