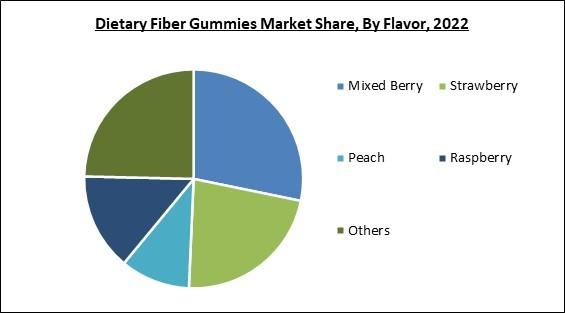

Raspberry flavor in dietary fiber gummies is getting more popular because of its taste and generated $621.6 million revenue in the market in 2022. Customers often identify the fruit taste of raspberry with natural and healthful items. Additionally, the raspberry taste is adaptable and may be found in a variety of goods. Gummies are also a fun and practical method to take nutritional supplements, such as fiber, vitamins, and minerals. Customers seeking to improve their digestive health may also be drawn to raspberry-flavored gummies with healthy fiber. Manufacturers in the sector are also aggressively employing more modern marketing strategies, such as introducing vegan supplements and particular tastes, to achieve popularity. The dietary fiber gummies don't include gluten or extra sugar. Some of the factors impacting the market are increase in disorders related to under-nutrition and vitamin-deficiency, the growing use of gummy supplements as a result of an increase in the elderly population, and the dangers of using too many gummy supplements.

Immune systems are weakened, baby growth and development are hampered, and human potential is constrained by micronutrient deficiencies, which raise morbidity and death rates. As a consequence, it is anticipated that the market will expand significantly during the following years. The WHO projects that by 2030, 1 in 6 individuals worldwide will be 60 or older. By this point, there will be 1.4 billion people over 60, up from 1 billion in 2020. The number of individuals in the world who are 60 or older will double (to 2.1 billion) by 2050. They are also packed with vitamins, minerals, and fiber. Thus, the market will expand as the world's population ages. However, Customers in the market use gummy supplements to meet their daily vitamin and mineral requirements and enhance their general health. Due to their taste and ease of use, gummy vitamins have been integrated into dietary patterns. Therefore, overconsumption of gummy supplements is a significant obstacle to expanding the market throughout the forecast period.

Flavor Outlook

Based on the flavor, the market is categorized into strawberry, mixed berry, peach, and raspberry. In 2022, the mixed berry segment held the highest revenue share in the market. The rising popularity of healthy snacking and the surge in customers searching for quick, pleasant, and nutritious solutions are the main factors driving the demand for mixed berry gummies. Gummies made of mixed berries are an easy and delicious way to get the dietary fiber needed for a healthy digestive system and to maintain a healthy weight.Application Outlook

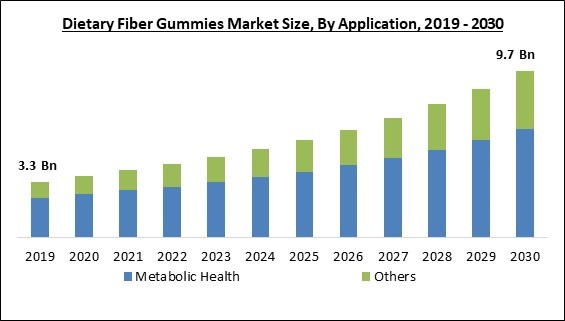

On the basis of application, the market is segmented into metabolic health and others. The others segment covered a considerable revenue share in the market in 2022. The other segment covers immune support, heart, anti-aging, and digestive health. Dietary gummies' fiber content helps support regular bowel movements, which can help avoid constipation and lower the risk of related digestive problems, including hemorrhoids, diverticulitis, and colon cancer. To increase customer demand, several firms are introducing probiotic-enriched dietary fibers that support gut health.Regional Outlook

Region wise, the market is analysed across North America, Europe, Asia Pacific, and LAMEA. In 2022, the North America region led the market by generating the maximum revenue share. This is because dietary fiber gummies have become more innovative, and functional foods are in great demand. Major corporations are looking for ways to grow their available gummies business in North America since gummies are in high demand there. Probiotic food Customers are increasingly embracing dietary fiber gummy supplements to boost their immune and digestive systems.The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include Nestle S.A, The Procter and Gamble Company, SmartyPants Vitamins (Unilever Plc), Pharmavite LLC (Otsuka Pharmaceutical Co., Ltd.) (Otsuka Holdings Co. Ltd), Church & Dwight Co., Inc., Swanson Health Products, Inc. (Swander Pace Capital), Better Nutritionals, LLC, Bellway, Inc. and Balance of Nature.

Strategies Deployed in the Market

- Mar-2023: SmartyPants Vitamins introduced SmartyPants Sugar-Free Multi & Omegas gummy multivitamins in Kids, Women’s, and Prenatal formats. The product consists of all-in-one supplements with 0g sugar and 0g net carbs and is sweetened with plant-derived allulose and monk fruit, which means the formulation is not to cause digestive upset which could be associated with sugar alcohols.

- Oct-2022: Better Nutritionals came into partnership with DouxMatok, a food tech company and the developer of Incredo® Sugar, a sugar reduction solution. This partnership would aim to provide Better Nutritionals' network of customers with sugar-reduced gummies with great taste as standard gummies. Moreover, this would allow companies to bring to market new products and also maintain a focus on nutraceutical-grade quality with good taste.

- Aug-2022: Swanson Health announced the launch of Strawberry Melatonin Gummies, the Immune Boosting Gummies, the Passion Fruit Orange Ashwagandha Gummies, and Blue Light Protection Gummies, the multivitamin Gummies to serve Adults and Kids. The launched products make it easier to incorporate supplements and vitamins into consumers' wellness routines.

- Jul-2022: Nestlé Health Science took over The Better Health Company (TBHC), the provider of end-to-end care solutions, home delivery, bundling peer support, and coaching. This acquisition would empower Nestlé Health Science’s available health and nutrition offerings across New Zealand.

- Jul-2022: Pharmavite expanded its geographical presence by building a facility in New Albany, Ohio. The facility of vitamin and supplement manufacturing would broaden the company's production capacity into the Columbus region of the United States.

- Apr-2021: Procter & Gamble acquired Voost Vitamins, an Australian effervescent supplements brand. This acquisition strengthens its healthcare footprint across Australia and also broadens its consumer healthcare portfolio to include a wider range of minerals, vitamins, and supplements.

- Jun-2020: Nestle announced the launch of Gerber Gummy multivitamins, a multivitamin for children aged two or more. The product is supported by the largest US dietary intake study which examines what and how toddlers and infants eat.

- Jan-2020: Bellway unveiled a “next-generation” soluble fiber that supports paleo, keto, and gluten-free diets. The launch addresses the dietary requirements of health-conscious US consumers, with the primary ingredient in the product, psyllium, with the ability to nourish healthy bacteria in the gut supporting enhanced immunity function, better mood, and clear skin.

Scope of the Study

By Flavor

- Mixed Berry

- Strawberry

- Peach

- Raspberry

- Others

By Application

- Metabolic Health

- Others

By Geography

- North America

- US

- Canada

- Mexico

- Rest of North America

- Europe

- Germany

- UK

- France

- Russia

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Singapore

- Malaysia

- Rest of Asia Pacific

- LAMEA

- Brazil

- Argentina

- UAE

- Saudi Arabia

- South Africa

- Nigeria

- Rest of LAMEA

Key Market Players

List of Companies Profiled in the Report:

- Nestle S.A

- The Procter and Gamble Company

- SmartyPants Vitamins (Unilever Plc)

- Pharmavite LLC (Otsuka Pharmaceutical Co., Ltd.) (Otsuka Holdings Co. Ltd)

- Church & Dwight Co., Inc.

- Swanson Health Products, Inc. (Swander Pace Capital)

- Better Nutritionals, LLC

- Bellway, Inc.

- Balance of Nature

Unique Offerings

- Exhaustive coverage

- The highest number of Market tables and figures

- Subscription-based model available

- Guaranteed best price

- Assured post sales research support with 10% customization free

Table of Contents

Companies Mentioned

- Nestle S.A

- The Procter and Gamble Company

- SmartyPants Vitamins (Unilever Plc)

- Pharmavite LLC (Otsuka Pharmaceutical Co., Ltd.) (Otsuka Holdings Co. Ltd)

- Church & Dwight Co., Inc.

- Swanson Health Products, Inc. (Swander Pace Capital)

- Better Nutritionals, LLC

- Bellway, Inc.

- Balance of Nature