Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

The market's trajectory is increasingly defined by functional specialization, material innovation, and digital integration across production lines. While cost-efficiency and material flexibility continue to anchor baseline demand, growth is now being accelerated by the adoption of low-emission, phthalate-free, and recyclable resin systems, as well as investments in automated calendaring technologies that improve product consistency and reduce operational waste.

Companies that align with application-specific performance standards, comply with regionally nuanced regulatory frameworks, and invest in value-added product differentiation are positioned to capitalize on both volume and margin expansion particularly in Asia-Pacific and other high-growth emerging markets.

Key Market Drivers

Urbanization and Infrastructure Development in Emerging Economies

The rapid pace of urbanization and infrastructure development in emerging economies is one of the most influential forces propelling the growth of the Global Plastic Calendaring Resins Market. As of today, 55% of the global population resides in urban centers, and this figure is projected to rise to 68% by 2050, reflecting a significant demographic shift toward urbanization. This trend signals expanding demand for urban infrastructure, housing, transportation, and utility services, with direct implications for industries tied to construction materials, engineered plastics, and urban development solutions.Emerging economies across Asia, Africa, Latin America, and the Middle East are undergoing extensive urban growth marked by the development of Affordable housing projects, Commercial and retail spaces, Transportation infrastructure, Public utilities and smart city frameworks. Plastic calendaring resins especially PVC and polypropylene (PP) play a central role in this transformation by enabling the production of low-cost, high-performance materials used in Vinyl flooring, Roofing membranes, Wall claddings and decorative films, Window profiles and waterproofing layers. The affordability and long life cycle of calendared plastics make them an attractive alternative to traditional building materials like wood, metal, or ceramic, especially in cost-sensitive developing regions.

The Gati Shakti initiative, formally known as the National Master Plan for Multi-modal Connectivity, has emerged as a transformative force within India’s infrastructure sector. With an estimated value of USD 1.2 trillion, the program is designed to synchronize infrastructure planning across multiple ministries and sectors, enabling more efficient allocation of resources and faster project execution. Many emerging economies are executing large-scale infrastructure development plans and public-private partnerships that prioritize speed, cost efficiency, and scalability.

India’s “Smart Cities Mission” and “Pradhan Mantri Awas Yojana” (Affordable Housing Scheme) are examples of government programs that generate substantial demand for plastic calendaring resins. African nations and Southeast Asian economies are investing in industrial parks, mass transit systems, and urban utility networks, all of which require calendared materials for insulation, piping, coatings, and more. These infrastructure initiatives create sustained, large-volume demand for calendered PVC sheets, films, and profiles, positioning the resins as integral to national development agendas.

By 2030, middle-income urban consumers in emerging markets are expected to account for nearly 60% of the world’s total consumption growth, signaling a profound shift in global demand dynamics. Urbanization is contributing to the rise of aspirational middle-class consumers who seek quality housing and modern amenities, thereby driving demand for value-added construction materials. There is an increasing preference for vinyl-based interior solutions like wall panels, decorative surfaces, faux wood finishes, and modular furniture components made from calendared resins. Consumers also favor durable, easy-to-maintain, and aesthetically pleasing materials, especially in multi-family housing and urban dwellings. Plastic calendaring resins enable manufacturers to offer such solutions at competitive price points, fueling widespread adoption in urban residential and commercial projects.

Key Market Challenges

Environmental and Regulatory Pressures on PVC and Other Plastics

One of the most significant barriers to market growth stems from mounting environmental concerns and increasingly stringent regulations, particularly related to polyvinyl chloride (PVC) the most widely used resin in calendaring applications.Toxic additives such as phthalates, lead-based stabilizers, and chlorine-based compounds used in conventional PVC formulations have come under global scrutiny. Regulatory bodies in Europe (e.g., REACH), North America (e.g., EPA), and parts of Asia are pushing for restrictions or outright bans on certain plasticizers and hazardous additives. Public and institutional pressure to reduce plastic waste, particularly in single-use and non-recyclable applications, is pushing end-users toward alternative materials.

Companies must invest in R&D to develop safer, non-toxic, and environmentally compliant resin formulations, increasing operational costs. Some end-users in construction, packaging, and medical sectors are shifting to alternative materials such as bio-based polymers, which could reduce demand for traditional calendaring resins. Brand owners and retailers are increasingly demanding eco-friendly materials to meet sustainability targets, potentially limiting the use of standard calendared resins.

Key Market Trends

Shift Toward Functional and Aesthetic Customization in End-Use Products

A significant trend influencing the future of plastic calendaring resins is the growing demand for highly functional, visually appealing, and customized end products, especially in sectors such as automotive interiors, decorative films, luxury packaging, and consumer electronics.Brand differentiation strategies are pushing manufacturers to offer materials with enhanced surface finishes such as matte, gloss, leather-like textures, and metallic effects made possible through calendared films. In industries like interior design and fashion accessories, calendared resins enable manufacturers to produce durable yet flexible products that mimic leather or specialty textiles. Performance additives (anti-scratch, UV-resistance, antimicrobial properties) are being incorporated into calendared resin formulations, expanding their application in high-end consumer goods and medical products.

The ability of calendaring technology to offer dimensional consistency, tight tolerances, and superior surface quality positions it favorably for applications where aesthetics and functionality converge. Players investing in bespoke resin formulations and value-added finishes are likely to capture premium segments of the market.

Key Market Players

- Formosa Plastics Corporation

- Westlake Corporation

- Eastman Chemical Company

- Occidental Petroleum Corporation

- Shin-Etsu Chemical Co., Ltd

- Avery Dennison Corporation

- Covestro AG

- Reliance Industries Limited

- LG Chem

- China Petrochemical Corporation

Report Scope:

In this report, the Global Plastic Calendaring Resins Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Plastic Calendaring Resins Market, By Type:

- Polyvinyl Chloride (PVC)

- Polyethylene Terephthalate (PET)

- Polypropylene (PP)

- Polyethylene Terephthalate Glycol (PETG)

- Others

Plastic Calendaring Resins Market, By End User:

- Food & Beverages

- Automotive

- Healthcare & Medical

- Electrical & Electronics

- Construction & Buildings

- Furniture & Furniture Trim

- Others

Plastic Calendaring Resins Market, By Region:

- North America

- United States

- Canada

- Mexico

- Europe

- France

- United Kingdom

- Italy

- Germany

- Spain

- Asia-Pacific

- China

- India

- Japan

- Australia

- South Korea

- South America

- Brazil

- Argentina

- Colombia

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Plastic Calendaring Resins Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

1.1. Market Definition

1.2. Scope of the Market

1.2.1. Markets Covered

1.2.2. Years Considered for Study

1.2.3. Key Market Segmentations

Companies Mentioned

The leading companies profiled in this Plastic Calendaring Resins market report include:- Formosa Plastics Corporation

- Westlake Corporation

- Eastman Chemical Company

- Occidental Petroleum Corporation

- Shin-Etsu Chemical Co., Ltd

- Avery Dennison Corporation

- Covestro AG

- Reliance Industries Limited

- LG Chem

- China Petrochemical Corporation

Table Information

| Report Attribute | Details |

|---|---|

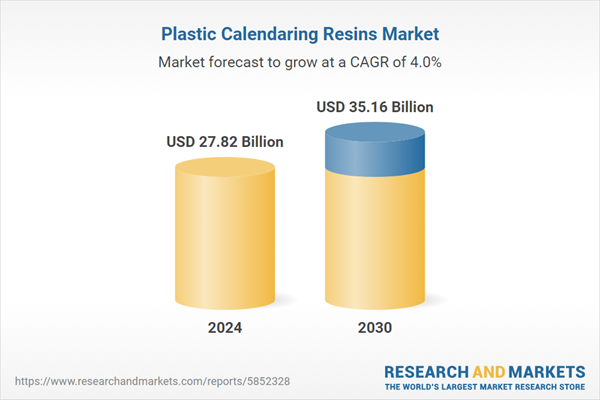

| No. of Pages | 182 |

| Published | September 2025 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 27.82 Billion |

| Forecasted Market Value ( USD | $ 35.16 Billion |

| Compound Annual Growth Rate | 3.9% |

| Regions Covered | Global |

| No. of Companies Mentioned | 11 |