Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

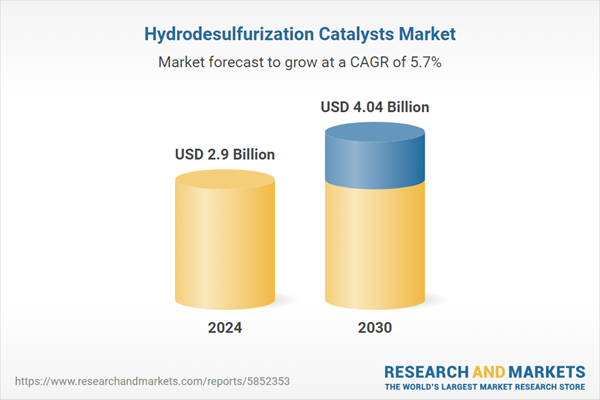

The market is poised for sustained growth driven not by cyclical demand but by structural factors such as increasingly stringent emissions legislation, the processing of heavier, sour crude slates, and expanding downstream capacity in energy-intensive economies across Asia and the Middle East. Moreover, advancements in catalyst formulation targeting improved hydrogen efficiency, longer cycle life, and superior activity under severe hydrotreating conditions are positioning HDS catalysts as performance-critical assets in refinery optimization strategies. As fuel specifications evolve and environmental compliance becomes a bottom-line imperative, the role of HDS catalysts will shift from being a regulatory necessity to a strategic lever for operational resilience and competitive advantage.

Key Market Drivers

Rising Demand for Ultra-Low Sulfur Diesel (ULSD)

The global shift toward cleaner fuels has positioned ultra-low sulfur diesel (ULSD) as a strategic product in the global energy and transportation sectors. This surge in ULSD demand is one of the most influential forces propelling the growth of the hydrodesulfurization (HDS) catalysts market, as these catalysts are essential for achieving the ultra-low sulfur levels mandated by modern environmental standards.Governments and environmental agencies worldwide have implemented stringent emissions regulations to reduce sulfur dioxide (SO₂) emissions, a major contributor to acid rain and air pollution. Key regulations such as The U.S. EPA’s Tier 2 and Tier 3 standards, The European Union’s EN 590 fuel standard, India's Bharat Stage VI norms, China's China VI standards, require diesel fuel to contain sulfur levels below 10-15 parts per million (ppm). These ultra-low sulfur thresholds can only be achieved through advanced hydrodesulfurization processes utilizing high-performance catalysts, thereby fueling consistent demand for HDS catalyst solutions.

Diesel remains a critical fuel for heavy-duty transportation, logistics, construction, agriculture, and industrial equipment. The demand for clean-burning diesel fuel that meets regulatory limits is rising across both developed and emerging economies. Refineries must rely on HDS catalysts to ensure that the diesel they produce complies with ULSD specifications, making these catalysts indispensable to modern fuel production. The United States remains the world’s largest consumer of diesel, accounting for a significant share of global demand across transportation, industrial, and commercial sectors. In addition to leading in diesel usage, the U.S.

also tops global consumption charts for both petrol and diesel combined, representing approximately 20.27% of total global oil consumption. In 2023, the country’s petroleum usage reached an estimated 816 million metric tons, underscoring the scale and intensity of its hydrocarbon-driven economy. Despite the push for electrification, diesel consumption continues to grow in many parts of the world due to its high energy density and fuel efficiency, especially in commercial and freight transport. With rising urbanization and economic development, regions such as Asia-Pacific, the Middle East, and Latin America are witnessing a spike in diesel-powered vehicle fleets. This directly correlates with increased production volumes of ULSD, thereby intensifying the need for hydrodesulfurization catalysts.

Refineries across the globe are either revamping existing hydrotreating units or commissioning new ones specifically designed for ULSD production. These upgrades often involve the installation of next-generation HDS catalysts capable of removing complex sulfur compounds while maintaining catalyst longevity and unit efficiency. The capital investment in these projects reflects the strategic importance of ULSD production, with catalysts playing a central role in achieving operational and regulatory targets.

Key Market Challenges

High Operational and Capital Costs Associated with Catalyst Deployment

One of the most prominent barriers to market growth is the high cost of catalyst procurement, handling, and reactor operation. Hydrodesulfurization catalysts are expensive to manufacture due to the use of rare or specialized active metals such as molybdenum, cobalt, or nickel often supported on high-surface-area alumina.Additionally, the installation and operation of HDS units require significant capital investment and ongoing operational expenditure, including High hydrogen consumption, Elevated temperatures and pressures, Frequent catalyst regeneration or replacement.

For small and mid-sized refiners, especially in developing regions, these costs can be prohibitive. The financial burden may deter catalyst upgrades or limit their use to only the most essential units, thereby capping the market’s overall growth potential.

Key Market Trends

Integration of Artificial Intelligence and Process Simulation in Catalyst Optimization

The future of hydrodesulfurization is being transformed by the digitalization of refining operations, particularly through the integration of artificial intelligence (AI), machine learning (ML), and advanced process simulation tools. Catalyst manufacturers and refiners are increasingly adopting these technologies to Model reactor behavior under varying operating conditions, Predict catalyst performance and degradation rates, Customize loading configurations for specific feedstocks, Optimize cycle lengths and hydrogen usage.This data-driven approach enables real-time decision-making and more accurate performance forecasting, leading to tailor-made catalyst solutions that are both efficient and cost-effective. The fusion of digital tools with chemical engineering not only enhances the technical capabilities of HDS systems but also creates a value-added service model, strengthening supplier-client relationships.

Key Market Players

- Albemarle Corporation

- W. R. Grace & Co.

- Sinopec Corp

- Topsoe A/S

- Shell PLC

- PetroChina Company Limited

- Axens

- JGC C&C.

- Honeywell International Inc

- Johnson Matthey

Report Scope:

In this report, the Global Hydrodesulfurization Catalysts Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Hydrodesulfurization Catalysts Market, By Type:

- Load Type

- Non Load Type

Hydrodesulfurization Catalysts Market, By Application:

- Diesel

- Naphtha

- Others

Hydrodesulfurization Catalysts Market, By Region:

- North America

- United States

- Canada

- Mexico

- Europe

- France

- United Kingdom

- Italy

- Germany

- Spain

- Asia-Pacific

- China

- India

- Japan

- Australia

- South Korea

- South America

- Brazil

- Argentina

- Colombia

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Hydrodesulfurization Catalysts Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

The leading companies profiled in this Hydrodesulfurization Catalysts market report include:- Albemarle Corporation

- W. R. Grace & Co.

- Sinopec Corp

- Topsoe A/S

- Shell PLC

- PetroChina Company Limited

- Axens

- JGC C&C.

- Honeywell International Inc

- Johnson Matthey

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 182 |

| Published | September 2025 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 2.9 Billion |

| Forecasted Market Value ( USD | $ 4.04 Billion |

| Compound Annual Growth Rate | 5.6% |

| Regions Covered | Global |

| No. of Companies Mentioned | 11 |