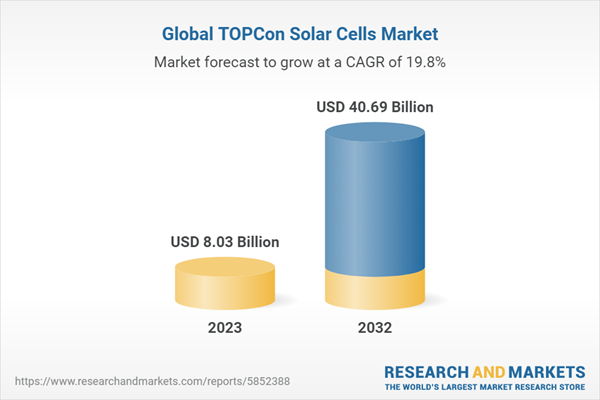

The global TOPCon solar cells market was valued at $7.54 billion in 2022 and is anticipated to reach $40.69 billion by 2032, witnessing a CAGR of 19.8% during the forecast period 2023-2032. The growth in the global TOPCon solar cells market is expected to be driven by growing demand for solar cells with the upper level of efficiency and flexible manufacturing process with TOPCon technology.

Introduction of TOPCon Solar Cells

The concept behind the tunnel oxide passivated contact (TOPCon) technique is that the metallic component does not come into proximity with the wafer. The TOPCon technology is associated with N-type cells. The N-type silicon substrate of TOPCon is covered with an extremely thin film of tunnelling oxide, which is subsequently followed by an additional layer of highly doped polysilicon that connects the metal at the edges. A silicon wafer is used in the production of P-type and N-type solar cells. The distinction between N-type and P-type originates from the substance utilized to dope the silicon wafer, which is done to enhance power output. Boron is added to P-type cells, while phosphorus is added to N-type cells. When compared to boron, phosphorus has the benefit that phosphorus cannot be degraded by oxygen, but boron can. Additionally, phosphorus doping boosts effectiveness by introducing electrons that are liberated to the wafer. The efficiency of the cell and module is higher with TOPCon cells than with P-type cells, as they assimilate a greater amount of sunlight.

Market Introduction

The global TOPCon solar cells market is in a growth phase, wherein the number of companies offering TOPCon cells is increasing rapidly. Latest technological advancements in photovoltaics technologies and the growing number of utility projects in residential and commercial sectors are boosting the adoption of TOPCon solar cells across the globe. Moreover, increased expenditures in the field of renewable energy are one of the primary factors fuelling the expansion of solar industry. As a result of its minimal carbon footprint and competitive manufacturing expenditures, energy from renewable sources has seen an upsurge in investments worldwide. Furthermore, TOPCon solar cells' capacity to outperform more traditional solar cell technologies in terms of effectiveness is one of its primary benefits. The greater limit of output is a result of the special design and production methods used in TOPCon solar cells. With significant demand for TOPCon solar cells during the forecast period, primarily from the utility, residential, and commercial sectors, the market competition is expected to grow considerably among established and emerging TOPCon solar cell providers in the TOPCon solar cell industry.

Industrial Impact

The global TOPCon solar cells market is driven by several factors, such as rising demand for TOPCon solar cells due to an increased upper level of efficiency and growing concerns for the environment and carbon neutrality targets.

TOPCon solar cells are increasingly growing in demand, owing to benefits such as higher potential for efficiency, enhanced stability, adaptable manufacturing process, and ability to perform effectively under extreme temperatures. Additionally, when compared to conventional energy sources, TOPCon solar cells offer environmental advantages such as less carbon emissions, air pollution, and water use. They offer long-term solutions that comply with environmental stewardship guidelines and aid in protecting the environment for upcoming generations. Additionally, the investigation on efficiency improvement for TOPCon solar cells is also ongoing and developing. Researchers seek to increase efficiency by tackling these important aspects and enable this promising solar cell technology to grow rapidly. Furthermore, by providing customers with cutting-edge and sustainable products, the companies are establishing a large international customer base while increasing R&D investments. The growth of the global TOPCon solar cells market largely depends on their higher efficiency levels and their adoption across various major markets. In the current market scenario, the market growth is held back either due to the increased need for precious metals such as silver to print the contacts on the cells, constrained market acceptance due to more established technologies in the market, and higher competition from other types of solar cells. Over the projected period (2023-2032), it is anticipated that this market environment will become more favourable and assist in promoting market expansion.

Market Segmentation

Segmentation 1: by End User

- Residential

- Commercial

- Utility

- Agriculture

- Others

Residential Segment to Dominate the Global TOPCon Solar Cells Market (by End User)

Based on end user, the residential segment led the TOPCon solar cells market in 2022 and was the largest segment due to the rising consumer demand for solar cells. A number of countries, including the U.S., U.K., Germany, and India, have adopted high goals to boost the proportion of renewable energy in their power mix. The governments of these countries have also set a goal to implement residential solar PV systems in the upcoming years (2023-2032) to increase the proportion of renewable energy. The producers and suppliers of solar cells for the residential sector are anticipated to benefit from this during the projected period (2023-2032).

Segmentation 2: by Type

- N-Type

- P-Type

N-Type Segment to Lead the Global TOPCon Solar Cells Market in the Forecast Period (by Type)

Based on type, the N-type segment is expected to lead the TOPCon solar cells market in the forecast period, owing to growing demand from end-use industries such as commercial and residential and its higher efficiency and improved passivation. Recently, the electrical output, thermal coefficient, and absorption velocity for N-type items have been enhanced. According to ongoing research, N-type products are more reliable and can generate power at a 3% greater rate than P-type products. However, in 2022, the P-type segment has a bigger market share than the N-type since it is presently readily accessible to the market and maintains an excellent efficiency of conversion in large-scale production, but the N-type segment is expected to gain market share during the forecast period and eventually surpass P-type shares.

Segmentation 3: by Installation

- Ground-Mounted

- Rooftop

Rooftop Segment to Dominate the Global TOPCon Solar Cells Market (by Installation)

Based on installation, the rooftop segment dominated the TOPCon solar cells market and was the largest segment, owing to expected decreases in expenses on electrical power, the need for alternate power availability, and the aim to lessen the threat of warming temperatures. Furthermore, there is an increase in utility-scale solar power installations and goals, as well as a decrease in the cost of solar PV systems. Ground-mounted installations have been considered to be simpler to keep pristine and maintained. Due to their increased efficiency, they also create more energy, which is expected to continue market expansion globally in the upcoming years.

Segmentation 4: by Region

- North America: U.S., Canada, and Mexico

- Europe: Germany, Spain, France, Italy, and Rest-of-Europe

- U.K.

- China

- Asia-Pacific and Japan: Japan, South Korea, India, Vietnam, and Rest-of-Asia-Pacific and Japan

- Rest-of-the-World: Middle East and Africa, and South America

The global TOPCon solar cells market is expected to witness significant growth in the coming years, with major contributions from China, Asia-Pacific and Japan, Europe, and North America regional markets. In terms of revenue generation, the China market is one of the key regions in the global TOPCon solar cells market. Much of this can be attributed to the comparatively faster adoption of new technology and the growing number of TOPCon solar cell businesses in the region. However, China and the Asia-Pacific and Japan regions are likely to be among the regions with the highest growth during the forecast period (2023-2032). Furthermore, China’s fast-developing economy and the presence of leading industry players across the TOPCon solar cells component’s supply chain are having a prominent effect on the growth of the TOPCon solar cells market.

Recent Developments in the Global TOPCon Solar Cells Market

- In November 2022, Jinko Solar announced to develop TOPCon solar cell with an efficiency of 25.6%. The company further stated that the manufacturing started at its pilot line in Zhangjiagang, China.

- In April 2023, for an N-type M10 solar cell based on TOPCon technological devices, Jolywood announced that it would achieve an energy conversion effectiveness of 26.7%. The outcome has been confirmed by the China Academy of Metrology and Science, and Jolywood claims it is an international mark for an N-type TOPCon cell. It exceeds the company's prior mark of 26.1%, which occurred in November 2022.

- In September 2022, JA Solar revealed proposals for 30 GW of expansion, including 20 GW of TOPCon solar cells capacity and 10 GW of TOPCon module capacity. The company estimates that its N-type solar cell capacity to exceed 27 GW by the end of 2023.

- In January 2023, Solarspace Technology announced the formal beginning of its second-phase commencement of manufacturing of N-type TOPCon PV cells in the Chuzhou, China, facility, with a 16 GW production capacity. With a preliminary manufacturing capacity of 8 GW across 16 manufacturing facilities, the cell and module maker launched the initial phase of the $1.47 billion project in November 2022.

- In October 2022, Royal Green Energy announced that it had concluded a partnership strategy arrangement with Yingli Energy for the availability of 6 GW TOPCon solar cells after the signing of a similar arrangement with Jetion Solar Co., Ltd. for the supply of 6 GW TOPCon cells. To achieve a yearly manufacturing capacity of 20 GW of TOPCon N-type solar cells with an average efficiency rating of more than 25%, Royal Green Energy established a TOPCon solar cells manufacturing facility in the Chinese territory of Anhui. To succeed in the solar cells market and reach its goal of $2.79 billion in yearly sales, Royal Green Energies requires a long-term relationship with Yingli and Jetion Solar.

Demand - Drivers and Limitations

Market Demand Drivers: Growing Demand for TOPCon Solar Cells Due to Increased Upper Level of Efficiency

TOPCon solar cells are an appealing prospect as organizations seek alternate technologies for solar cells with lower manufacturing costs, simpler operations, and greater effectiveness prospects. TOPCon solar cells utilize N-type silicon, which provides superior performance and equilibrium, in contrast to other solar power techniques that suffer from difficulties such as excessive LID and light and elevated temperature-induced degradation (LeTID) deterioration. Additionally, multiple analyses have indicated that the potential maximum limit of TOPCon solar cells ranges from 28.2 to 28.7%. This effectiveness is significantly higher than that of PERC cells, which is 24.5%. Furthermore, improved effectiveness results in greater energy harvesting per unit area. TOPCon cells are bifacial by nature and can develop exceptionally high bifaciality. They have a voltage of roughly 730 mV and can attain up to 25% efficiency. Thus, it can be said that the growing demand for higher-efficiency solar cells is driving the growth of the global TOPCon solar cells market.

Market Challenges: Increased Need for Silver to Print the Contacts on the Cell

The increased silver requirement presents some difficulties and factors to take into account in terms of cost and resource use. Due to its increased use in the manufacturing of TOPCon solar cells, silver, a precious metal with a relatively high price, may increase the cost of the cells overall. The rising demand for silver in the solar sector may also raise questions about sustainability and availability because silver is a finite natural resource. Researchers and manufacturers are looking at new materials and methods to lessen the use of silver in TOPCon solar cells in order to address these issues. This entails the creation of novel contacts with enhanced conductivity and reduced material needs, as well as the improvement of printing processes to reduce silver waste. Moreover, reduced silver requirements for TOPCon solar cells would aid cost-cutting while also promoting sustainability and resource preservation. The goal is to strike a balance between preserving the high-performance features of TOPCon solar cells and optimizing the use of silver or finding substitute materials that offer comparable conductivity at a lower cost and with less negative environmental impact.

Market Opportunities: Growing Concern for the Environment and Carbon Neutrality Targets

Governments throughout the world are setting ambitious renewable energy objectives in order to cut carbon emissions and battle climate change. These initiatives frequently contain explicit objectives for the implementation of solar energy. With their increased efficiency and enhanced performance, TOPCon solar cells are ideally suited to assist governments in meeting their renewable energy targets. The demand for solar energy has been fueled by rising environmental consciousness and the requirement to switch to sustainable energy sources. Furthermore, the Sustainable Development Goals (SDGs) of the United Nations offer a blueprint for global development, including universal access to cheap and clean energy. The SDG 7 goal ensures that everyone has access to affordable, dependable, sustainable, and contemporary energy, which will be achieved through TOPCon solar cells.

How can this report add value to an organization?

Product/Innovation Strategy: The product segment helps the reader to understand the different types involved in TOPCon solar cells. Moreover, the study provides the reader with a detailed understanding of the global TOPCon solar cells market based on the end user (residential, commercial, utility, agriculture, and others). TOPCon solar cells are gaining traction in end-user industries on the back of sustainability concerns and their higher efficiency properties. They are also being used for controlling GHG emissions. Moreover, partnerships and collaborations are expected to play a crucial role in strengthening market position over the coming years, with the companies focusing on bolstering their technological capabilities and gaining a dominant market share in the TOPCon solar cells industry.

Growth/Marketing Strategy: The global TOPCon solar cells market has been growing at a rapid pace. The market offers enormous opportunities for existing and emerging market players. Some of the strategies covered in this segment are mergers and acquisitions, product launches, partnerships and collaborations, business expansions, and investments. The strategies preferred by companies to maintain and strengthen their market position primarily include partnerships, agreements, and collaborations.

Competitive Strategy: The key players in the global TOPCon solar cells market analyzed and profiled in the study include TOPCon solar cells providers that develop, maintain, and market TOPCon solar cells. Moreover, a detailed competitive benchmarking of the players operating in the global TOPCon solar cells market has been done to help the reader understand the ways in which players stack against each other, presenting a clear market landscape. Additionally, comprehensive competitive strategies such as partnerships, agreements, and collaborations will aid the reader in understanding the untapped revenue pockets in the market.

Key Market Players and Competition Synopsis

The companies that are profiled have been selected based on inputs gathered from primary experts and analyzing company coverage, product portfolio, and market penetration.

Among the top players profiled in the report, the private companies operating in the global TOPCon solar cells market accounted for around 45% of the market share in 2022, while the public companies operating in the market captured around 55% of the market share.

Key Companies Profiled:

Private Companies

- AE SOLAR

- CARBON

- RENA Technologies GmbH

- HELIENE Inc.

- Exiom Solution SA

- LUXOR SOLAR

- Jolywood

- FuturaSun srl

- SoliTek

Public Companies

- Wuxi Suntech Power Co., Ltd.

- Trina Solar Co., Ltd.

- JA SOLAR Technology Co., Ltd.

- LONGi

- Solar4America

- REC Solar Holdings AS

- Boviet Solar

- Hanwha QCells

- Websol Energy System Limited

- Sharp Energy Solutions Corporation

- Canadian Solar

Companies that are not a part of the aforementioned pool have been well represented across different sections of the report (wherever applicable).

Table of Contents

Companies Mentioned

- AE SOLAR

- CARBON

- RENA Technologies GmbH

- HELIENE Inc.

- Exiom Solution SA

- LUXOR SOLAR

- Jolywood

- FuturaSun srl

- SoliTek

- Wuxi Suntech Power Co., Ltd.

- Trina Solar Co., Ltd.

- JA SOLAR Technology Co., Ltd.

- LONGi

- Solar4America

- REC Solar Holdings AS

- Boviet Solar

- Hanwha QCells

- Websol Energy System Limited

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 249 |

| Published | July 2023 |

| Forecast Period | 2023 - 2032 |

| Estimated Market Value ( USD | $ 8.03 Billion |

| Forecasted Market Value ( USD | $ 40.69 Billion |

| Compound Annual Growth Rate | 19.8% |

| Regions Covered | Global |

| No. of Companies Mentioned | 18 |