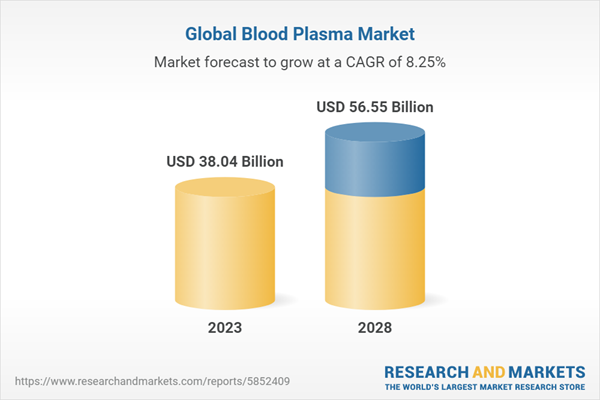

Blood plasma, the liquid component of blood, plays a vital role in the field of medicine. Comprising proteins, hormones, electrolytes, and antibodies, it serves as a crucial resource for various therapeutic applications. Blood plasma holds significant medical importance due to its use in treating a wide range of conditions. Plasma-derived therapies, derived from blood plasma, have proven essential in the management of immune disorders, bleeding disorders, and rare diseases. Products such as immunoglobulins, coagulation factors, and albumin derived from plasma have saved countless lives and improved patients' quality of life. The global blood plasma market in 2022 was valued at US$35.14 billion and is expected to reach US$56.55 billion by 2028. In 2022, the global blood plasma market witnessed a supply of 54.75 million liters, while the global demand reached 72 million liters.

The blood plasma market is projected to grow at a CAGR of 8.25%, during the forecast period of 2023-2028. The rise in prevalence of life-threatening disorders such as immunodeficiency, the rise in geriatric population, and growth in adoption of blood plasma derivatives products are expected to drive the blood plasma market. Moreover, advances in plasma fractionation technologies, increasing awareness of the benefits of plasma-derived therapies, and the potential for personalized medicine contribute to the sector's positive outlook.

Market Segmentation Analysis:

- By Type: The report splits the global blood plasma market into four different types: Immunoglobulin, Albumin, Coagulation Factors and Others. Immunoglobulin sector held the highest share in the market in 2022. Immunoglobulin products are derived from blood plasma and are used to treat various medical conditions, including immune deficiencies, autoimmune diseases, and certain infections. Immunoglobulin therapy is often required by older adults, as their immune systems tend to weaken with age. The expanding elderly population globally is driving the demand for immunoglobulin products. Moreover, advances in plasma fractionation techniques and the identification of new therapeutic uses for immunoglobulins have expanded the demand for these products. For example, immunoglobulins are increasingly being used in the treatment of neurological disorders like multiple sclerosis. However, there are still many patients undiagnosed, and consumption of immunoglobulins varies widely between regions, which suggests there is still room for further appealing growth.

- By Application: The global blood plasma market can be divided into four segments on the basis of application: Immunodeficiency Diseases, Hypogammaglobulinemia, Hemophilia and Other. Hemophilia segment is anticipated to grow at the fastest CAGR during the forecasted period. Hemophilia is a genetic bleeding disorder characterized by a deficiency in clotting factors, primarily factor VIII (hemophilia A) or factor IX (hemophilia B). Plasma-derived clotting factor concentrates are a crucial treatment for hemophilia patients. Technological advancements in the production of clotting factor concentrates, along with improved clinical management of hemophilia, have increased the demand for plasma-based therapies. Furthermore, efforts to improve access to treatment in developing countries and initiatives to raise awareness about hemophilia have resulted in a higher number of patients seeking treatment, thereby driving the demand for plasma-derived product.

- By End User: The report divides the global blood plasma market into three end users: Hospitals, Clinics and Others. Hospitals are one of the major end users of blood plasma. They require blood plasma for various medical procedures, such as transfusions, surgeries, and treatments for patients with severe injuries or medical conditions. Patients with chronic diseases like hemophilia, immune deficiencies, and certain types of cancers may require regular blood plasma transfusions as a part of their treatment. The increasing prevalence of these diseases contributes to the demand for blood plasma in hospitals. With a globally aging population, the demand for blood plasma in hospitals is increasing.

- By Region: According to this report, the global blood plasma market can be divided into four major regions: North America (The US, Canada and Mexico), Europe (Germany, UK, France, Italy and Rest of Europe), Asia Pacific (China, Japan, India, and Rest of Asia Pacific), and Rest of the World. The North American region has emerged as a dominant player in the blood plasma market. The North American blood plasma market is a well-established and thriving industry. With advanced healthcare infrastructure and high healthcare expenditure, the region has witnessed significant growth in plasma-derived products. The prevalence of chronic diseases such as immune disorders, bleeding disorders, and liver diseases has fueled the demand for plasma therapies. Technological advancements in plasma collection and fractionation techniques have further boosted the market.

Global Blood Plasma Market Dynamics:

- Growth Drivers: The increasing demand for immunoglobulins in therapeutic treatments has emerged as a significant driving factor for the blood plasma market. Immunoglobulins, also known as antibodies, are proteins produced by the immune system to identify and neutralize harmful substances such as bacteria and viruses. They play a crucial role in fighting off infections and providing immunity. In recent years, there has been a growing recognition of the therapeutic potential of immunoglobulins in treating various medical conditions. Further, the market is expected to increase due to increasing plasma centers and plasma collection, aging population, rising prevalence of alpha-1 antitrypsin deficiency (AATD) and rising incidence of hemophilia.

- Challenges: However, some challenges are impeding the growth of the market such as availability of alternatives and regulatory and safety considerations. Blood plasma is a crucial component in various medical therapies, including immunoglobulin therapy and coagulation factor replacement. However, ensuring the safety and regulatory compliance of blood plasma products has presented challenges. One major concern is the risk of transmitting infectious diseases through blood plasma. To mitigate this risk, strict regulations and testing protocols are imposed on blood plasma collection, processing, and distribution. The screening and testing processes are time-consuming and expensive, leading to higher production costs for plasma-derived products. These costs are eventually passed on to patients and healthcare systems, making these therapies less accessible and affordable.

- Trends: A major trend gaining pace in blood plasma market is expansion of plasma fractionation facilities. Plasma fractionation is the process of separating plasma into its various components, including proteins, enzymes, and antibodies, for the development of therapeutic products. The expansion of plasma fractionation facilities has played a crucial role in meeting the growing demand for plasma-derived therapies. With the increasing prevalence of diseases requiring these therapies, such as immunodeficiency disorders, hemophilia, and autoimmune diseases, there is a need for larger and more efficient facilities to process plasma and produce the necessary products. The expansion of these facilities enables higher production volumes, ensuring a sufficient supply of plasma-derived therapies to meet the needs of patients worldwide. More trends in the market are believed to augment the growth of blood plasma market during the forecasted period include explosive growth of cell & gene therapies in development, increasing adoption of therapeutic plasma exchange (TPE), etc.

Impact Analysis of COVID-19 and Way Forward:

The pandemic had a positive impact on the blood plasma market. The urgency of the pandemic stimulated research and development activities related to plasma-based therapies. Pharmaceutical companies and research institutions focused on developing monoclonal antibodies, hyperimmune globulins, and other plasma-derived treatments to combat COVID-19. This accelerated R&D has the potential to impact the future of the blood plasma market beyond the pandemic. Regulatory agencies, such as the US Food and Drug Administration (FDA), implemented emergency use authorization (EUA) to facilitate the use of convalescent plasma for COVID-19 treatment. These temporary measures streamlined the approval process and allowed for more widespread use of plasma therapies.

The post-COVID era would likely see significant investment in research and development efforts related to blood plasma therapies. Companies and organizations will focus on improving manufacturing processes, optimizing the collection of convalescent plasma, and developing new treatments based on plasma-derived products.

Competitive Landscape and Recent Developments:

The blood plasma market is consolidated with the presence of few number of players dominating worldwide. Compliance with regulatory requirements can be challenging for smaller players, leading to consolidation in the market as larger companies with greater resources and infrastructure dominate.

Key players of the blood plasma market are:

- CSL Limited

- Takeda Pharmaceutical Company Limited

- Grifols, S.A.

- Baxter International Inc.

- Kedrion Biopharma

- ADMA Biologics, Inc.

- Octapharma

- LFB S.A.

- Taibang Biotech Group Inc. (China Biologic Products)

Key players are establishing and expanding their plasma collection centers to ensure a consistent supply of source blood plasma, allowing them to meet the growing demand for plasma-derived therapies. Companies are engaging in strategic partnerships, collaborations, and acquisitions to enhance their product portfolios, expand their market reach, and strengthen their position in the blood plasma market. Given the regulatory scrutiny surrounding plasma-derived therapies, companies are emphasizing stringent quality control measures and safety standards to gain a competitive edge. For instance, on April 25 2022, Grifols announced the completion of the acquisition of 100% of the share capital of Tiancheng (Germany) Pharmaceutical Holdings AG, a German company that holds 89.88% of the ordinary shares and 1.08% of the preferred shares of Biotest AG, a European healthcare company specialized in innovative hematology and clinical immunology. The Biotest AG acquisition is a strategic transaction that would contribute to expanding and diversifying Grifols’ plasma supply; strengthening the company’s operations and revenues in Europe, Middle East and Africa; and supporting the company’s economic performance.

Table of Contents

1. Executive Summary

Companies Mentioned

- CSL Limited

- Takeda Pharmaceutical Company Limited

- Grifols, S.A.

- Baxter International Inc.

- Kedrion Biopharma

- ADMA Biologics, Inc.

- Octapharma

- LFB S.A.

- Taibang Biotech Group Inc. (China Biologic Products)

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 147 |

| Published | July 2023 |

| Forecast Period | 2023 - 2028 |

| Estimated Market Value ( USD | $ 38.04 Billion |

| Forecasted Market Value ( USD | $ 56.55 Billion |

| Compound Annual Growth Rate | 8.3% |

| Regions Covered | Global |

| No. of Companies Mentioned | 9 |