The global patient engagement solutions market is estimated to be worth over USD 11 billion in 2023 and expected to grow at compounded annual growth rate (CAGR) of 18.2% during the forecast period. Patient engagement solutions play a vital role in empowering patients to actively participate in their healthcare journey, fostering better patient outcomes and experiences. These patient engagement software and digital patient engagement platform enable patients to access their medical information, schedule appointments, and communicate with healthcare providers, thereby allowing remote patient monitoring and encouraging shared decision-making. Studies have shown that patients who participate in their treatment processes are three times less likely to have unmet medical needs and twice as likely to seek prompt care, as compared to those who are not actively engaged.

Recent advancements in patient engagement technology, including artificial intelligence (AI), machine learning, personalized care, telemedicine and remote monitoring devices, have revolutionized the healthcare landscape, digitizing various aspects of care delivery. In fact, leading patient engagement software companies are engaged in offering comprehensive patient engagement services and platforms to facilitate seamless interaction between patients and healthcare providers. The COVID-19 pandemic has further accelerated the adoption of such patient experience solutions, telehealth and virtual care, transforming patient centric care. Driven by the increasing patient awareness and ongoing pace of innovation in this field, the patient engagement solutions market size is likely to witness significant growth during the forecast period, offering a wide range of software platforms and services to enhance patient outcomes and overall healthcare experience.

Key Market Insights

The Patient Engagement Solutions Market: Distribution by Deployment Option (Cloud-based Solutions, On-Premise Solutions and Web-based Solutions), Type of Solution Offered (Appointment Management Solutions, Electronic Health Record Integration Solutions, Patient Education Solutions, Remote Patient Monitoring Solutions and Other Solutions), Application Area (Financial Health Management, Fitness and Wellbeing, Home Health Management, Research and Development and Social Health Management), End-user (Healthcare Providers, Individuals, Payers and Other End-users), and Key Geographical Regions (North America, Europe, Asia, Middle East and North Africa, and Rest of the World): Industry Trends and Global Forecasts, 2023-2035 report features an extensive study of the current market landscape, market size and future opportunities within the patient engagement solutions market during the forecast period. The report highlights efforts of several stakeholders engaged in this rapidly emerging segment of the pharmaceutical industry. Key takeaways of the patient engagement solutions market are briefly discussed below.

Key Advantages and Growing Demand for Patient Engagement Strategies

Patient engagement solutions have emerged as a promising alternative to the conventional in-person visits to healthcare providers owing to their multiple benefits, including ease of access, virtual consultations, patient education, scheduling and appointment management, real-time data management, prescription refills, chatbots / messaging options, and remote access to healthcare services. Considering the advantages offered by patient engagement solutions and growing demand for virtual healthcare across the world, specifically post the COVID-19 pandemic, companies have started implementing different patient engagement strategies that are anticipated to drive market growth during the forecast period.

Patient Engagement Solution Providers Market

The current patient engagement solution providers landscape features around 420 large, mid-sized and small companies. It is worth mentioning that 98% of the solution providers offer solutions for home health management and more than 75% of the solution providers offer cloud-based deployment options. Cloud-based solutions feature patient portals that offer convenient access to medical information. Notably, digital patient engagement encompasses the use of digital technologies and platforms, such as patient portals and mobile applications, to actively involve patients in their own treatment process. In fact, in January 2023, CipherHealth partnered with SADA to integrate socioeconomic data into its platform with Google Cloud to enhance patient engagement experience.

Key Drivers in the Patient Engagement Solutions Market

The pharmaceutical industry is developing novel drugs as well as improving the existing treatment modalities for various disease indications. Hence, there has been a significant increase in the number of clinical trials conducted worldwide, requiring enrollment of several participants. Conducting a multi-site, multi-state clinical trial is a time-consuming process, wherein majority of the effort goes into clinical trial patient recruitment / enrollment. Finding the right set of patients is challenging as the drugs are becoming more complex in nature and treatment approach is moving towards personalized therapy. In fact, over the years, the time taken for patient recruitment has increased to over 18 months. Several pharmaceutical companies are now using patient engagement software and platforms to improve the patient retention rates in clinical studies.

The COVID-19 pandemic has emphasized the significance of virtual patient participation, leading to a shift from conventional approaches to adoption of virtual modes for patient involvement in clinical trials and healthcare delivery. To enhance communication and foster effective relationship between patients and physicians, numerous healthcare facilities have adopted patient engagement software. Concurrently, there has been a notable increase in the prevalence of chronic diseases, such as diabetes and cardiovascular disorders, impacting a significant portion of the population. In fact, according to the WHO, over 420 million individuals, worldwide, are currently suffering from some form of diabetes. In addition, cardiovascular diseases have emerged to be the cause of nearly 18 million deaths, each year. This has created the need for innovative solutions in order to engage patients suffering from chronic diseases. As healthcare access continues to improve with the establishment of new healthcare facilities in remote areas, the demand for patient engagement solutions is becoming even more imperative. Further, the evolving regulatory standards has created lucrative opportunities for companies offering patient engagement services. All these factors are anticipated to drive growth of the patient engagement solutions market.

Recent Trends in the Patient Engagement Solutions Market

The growing applications of patient engagement solutions have garnered significant interest of investors, which has resulted in a strong spur in investment activity in this domain. In addition, various big players have undertaken several initiatives in order to strengthen their patient engagement solution portfolio, entering into strategic deals and making noteworthy financial investments. For instance, players, including Care Angel (offering web-based solutions), HealthPlix (offering cloud-based and web-based solutions) and Carium (offering web-based solutions) have raised funding during the recent years in order to enhance their patient engagement strategies.

OpenAI’s ChatGPT is Likely to Revolutionize the Chatbot Experience for Patients

Implementation of ChatGPT is emerging as one of the key patient engagement strategies being adopted by patient engagement service providers. According to a study conducted by researchers at the University of Maryland School of Medicine (UMSOM), ChatGPT's AI chatbot exhibits an impressive accuracy rate of approximately 88% when responding to patient queries. This is indicative of the potential of ChatGPT to transform the way patients seek medical information and engage with healthcare providers. This breakthrough technology has created lucrative opportunities for patient engagement solution providers. These patient engagement solutions can seamlessly integrate into ChatGPT's intelligent platform, enabling providers to enhance communication, empower patients, and deliver personalized care. This transformative synergy between ChatGPT and patient engagement solutions is likely to position providers as industry leaders, offering comprehensive and innovative solutions for improved patient outcomes and enhanced healthcare experience. Embracing this AI-driven patient engagement solution is anticipated to drive the market growth during the forecast period.

North America Holds the Largest Share of Patient Engagement Solutions Market

Presently, close to 40% of the market is captured by companies based in North America. Driven by the rising interest in digital and virtual health solutions, the market for patient engagement solutions is anticipated to grow at an annualized CAGR of 18.2%, during the forecast period, 2023-2035.

Key Players Engaged in Patient Engagement Solutions Market

Examples of key players (which have also been profiled in this report) engaged in patient engagement industry include (in alphabetical order) athenahealth, Coviu, GetWellNetwork, Health Catalyst, MediBuddy, Mocero Health, Orion Health, Physitrack, SolvEdge, Veradigm, Well-Beat and Wolters Kluwer. It is interesting to note that, in May 2023, athenahealth inked an agreement with LCH Health and Community Services to provide athenaOne® and athenaOne® Dental in order to improve patient access and drive patient satisfaction.

Scope of the Report

The study presents an in-depth analysis of the various firms / organizations that are engaged in this domain, across different segments.

The market report presents an in-depth analysis, highlighting the capabilities of various companies engaged in this industry, across different geographies. Amongst other elements, the report features:

- An executive summary of the key insights captured during our research, offering a high-level view on the current state of the patient engagement solutions market and its likely evolution in the short to mid and long term.

- A brief introduction to important concepts related to patient engagement solutions, featuring information on various types of patient engagement solutions and their applications. It also highlights the challenges associated with patient engagement solutions. Further, the chapter concludes with recent trends and future prospects within the patient engagement domain.

- An overview of the current market landscape of patient engagement solution providers based on relevant parameters, such as year of establishment, company size (in terms of number of employees) and location of headquarters, type of platform(s) (IoT , mobile apps and software), deployment options (cloud-based, on-premise and web-based), type of component(s) offered (chatbots / messaging options, patient portals, real-time data sharing, and remote patient monitoring tools), type of solution(s) offered (appointment management, data management and interoperability, electronic health record integration, email marketing, medication adherence, medical billing, patient activation, patient education, patient registration, prescription refills and remote patient monitoring), application area(s) (financial health management, fitness and wellbeing, health management / home health management, research and development and, social health), end-user(s) (healthcare providers, individuals, payers and others) and customization feature.

- An insightful analysis, highlighting the contemporary market trends in the patient engagement solutions domain through different representations, based on relevant parameters, such as company size and location of headquarters; location of headquarters and customization feature; company size, location of headquarters and type of solution(s) offered; type of platform(s) and deployment option(s); type of solution(s) offered and type of platform(s); application area(s) and end-user(s); type of solution(s) offered and end-user(s).

- A detailed competitiveness analysis of patient engagement solution providers, based on company strength (in terms of number of years of experience) and company competitiveness, taking into consideration product portfolio (type of platform offered, deployment option, type of component offered, type of solution offered, application area, end-user and customization feature) and funding strength (funding instances, amount invested and type of funding).

- Elaborate profiles of prominent players (shortlisted based on our proprietary company competitiveness analysis) offering patient engagement solutions. Each company profile features a brief overview of the company (including information on its year of establishment, number of employees, location of headquarters and key members of the executive team), details related to product portfolio, recent developments and an informed future outlook.

- An analysis of funding and investments received by companies engaged in this domain, during the period 2018-2023, including instances of seed financing, venture capital financing, debt financing, grants, initial public offering (IPOs) and subsequent offerings. The instances were analysed based on several parameters, such as year of funding, amount invested, type of funding, geography, and leading players and investors (in terms of number of funding instances and amount invested).

- A comprehensive fine-grained sentiment analysis of patients’ experience with patient engagement solutions, highlighting valuable insights on the key pain points, features, and suggestions for improvement. Through this analysis, we have provided insights on the challenges faced by patients while using patient engagement solutions, features they find most beneficial, and recommendations they have for enhancing their own engagement in healthcare.

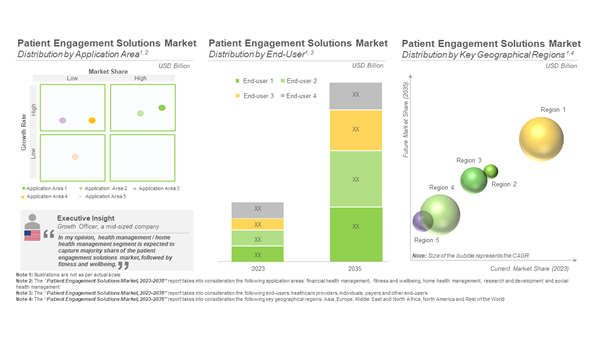

- A detailed market forecast analysis in order to estimate the existing market size and future opportunity for patient engagement solution providers over the next decade. Based on multiple parameters, likely adoption trends and through primary validations, we have provided an informed estimate on the evolution of the market for the period 2023-2035. The report also features the likely distribution of the current and forecasted opportunity within the patient engagement solutions market across various segments, such as deployment option (cloud-based solutions, on-premise solutions and web-based solutions), type of solution offered (appointment management solutions, electronic health record integration solutions, patient education solutions, remote patient monitoring solutions and other solutions), application area (financial health management, fitness and wellbeing, home health management, research and development and social health management), end-user (healthcare providers, individuals, payers, and other end-users), and key geographical regions (North America, Europe, Asia, Middle East and North Africa and Rest of the World). In order to account for future uncertainties and to add robustness to our model, we have provided three forecast scenarios, namely conservative, base and optimistic scenarios, representing different tracks of the industry’s growth.

The opinions and insights presented in the market report were influenced by discussions held with stakeholders in the industry.

The report features detailed transcripts of interviews held with the following industry stakeholders:

- Debra Zalvan (Chief Executive Officer, UbiCare)

- Bob Abrahamson (Chief Marketing Officer, pCare)

- Sarah Larsen (Growth Officer, Mytonomy)

- Adam Bergquist (Executive Vice President, Client Experience, C3LX)

- Raven Cobb (Vice President, Marketing and Growth, Clearstep)

- Anthony Gonsalves (Vice President, SolvEdge)

- Opifia Dian (Business Development Manager, Physitrack)

- Alaina Victoria (Clinical Content Manager, OneStep)

All actual figures have been sourced and analyzed from publicly available information forums and primary research discussions. Financial figures mentioned in this report are in USD, unless otherwise specified.

Frequently Asked Questions

Question 1: What is patient engagement? What are the examples of patient engagement?

Answer: Patient engagement refers to the active involvement of patients in their own healthcare journey. It encompasses various strategies and technologies that empower patients to participate in decision-making, enabling them to access their medical information, schedule appointments, and communicate with healthcare providers. Effective patient engagement improves patient outcomes and enhances the overall healthcare experience.

Question 2: What are patient engagement solutions?

Answer: Patient engagement solutions are technological tools used to enhance communication between patients and healthcare providers.

Question 3: What is the importance of patient engagement solutions in the healthcare sector?

Answer: These solutions offer features, such as appointment management, medication adherence, patient education, electronic health record integration, remote patient monitoring, medical billing and prescription refills to improve health outcomes.

Question 4: What is the likely market size of the patient engagement solutions market?

Answer: The global patient engagement solutions market is expected to be worth around USD 82 billion by 2035.

Question 5: What is the estimated growth rate (CAGR) of the patient engagement solutions market?

Answer: The global patient engagement solutions market revenue is anticipated to grow at a compound annual growth rate (CAGR) of 18.2%, during the forecast period 2023-2035.

Question 6: Which region is likely to hold the largest share in the patient engagement solutions market?

Answer: Currently, North America and Europe collectively hold 65% of the market share. However, in the long run, market in Asia is expected to grow at a relatively faster pace.

Question 7: What is the trend of capital investments in the patient engagement solutions market?

Answer: Owing to the lucrative market opportunity associated with patient engagement solutions, several investors have collectively invested over USD 5.7 billion, during the period 2018-2023.

Question 8: Which application area currently accounts for the largest market share in the patient engagement solutions market?

Answer: At present, home health management segment captures the largest market share (45%) of the overall patient engagement solutions market. This trend is unlikely to change during the forecast period.

Question 9: Which patient engagement solutions are considered best based on features?

Answer: Patient engagement solutions that offer most features include Digiteum, GetWellNetwork. and Wolters Kluwer.

Question 10: How do you improve patient engagement? How do patient engagement solutions improve the overall outcomes?

Answer: Patient engagement solutions play a crucial role in delivering value-based care to patients, leading to improved health outcomes. By actively involving patients in their healthcare journey, especially those suffering from chronic conditions, these solutions have created a significant impact on reducing the need for costly emergency procedures and enhancing patient retention.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- 1984 Ventures

- 360Medlink

- 4490 Venture

- 4PatientCare

- AblePay Health

- Accel

- Accel-KKR

- Accelmed Growth Partners

- access.mobile

- AccuReg

- Accurx

- ACME Capital

- Acton Capital

- Acuma Health

- AcuMedSoft

- Ada Ventures

- admedicum

- Advanced Computer Software

- Advanced Data Systems

- AdvancedMD

- Advocate Aurora Health

- Aegis Healthcare Solutions

- AIA

- AiCure

- AIHCON

- AIoT Health

- AirTree Ventures

- AkosMD

- AlayaCare

- AlbionVC

- ALES Global Japan

- Alkemi Growth Capital

- AllegianceMD

- AlleyCorp

- Alliance Care Technologies

- AllianceChicago

- Allianz Life Ventures

- Allos Ventures

- Altos Venture

- Amazon Web Services (AWS)

- AmerisourceBergen

- AMN Healthcare

- Ampersand Health

- Amplify Capital

- Andreessen Horowitz

- Anges Quebec

- Appscrip

- Aquiline Capital Partners

- Arali Ventures

- Arkam Ventures

- Artera

- Asahi Kasei

- Ascension Investment Management

- Asset Management Ventures (AMV)

- AssureCare

- athenahealth

- Atlanta Technology Angels

- Atomico

- Atos

- Autism Impact Fund

- Avadyne Health

- Avataar Ventures

- Avidon Health

- Axxess

- AZZLY

- B Capital Group

- Baird Capital

- Base10

- Battery Ventures

- BeeHealthy

- Bessemer Venture Partners

- BestDoc

- BestNotes

- BetterHealthcare

- Beyond Next Ventures

- billrMD

- Biofourmis

- Biomatics Capital

- Biomedical Catalyst Fund

- Bizmatics

- Blackbird Ventures

- Blackstone Growth

- Blackstone Life Sciences

- Blue Cloud Ventures

- BlueJay Health

- BlueRun Ventures

- Bravelily

- Bridge Patient Portal

- Broad Street Angels

- Bryan Health

- Buckley Ventures

- Buddy Healthcare

- C3LX

- Caisse de Depot et Placement du Quebec

- Calian

- Canaccord Genuity

- Capier Investments

- CapitalG

- Caple BV

- Care Angel

- CareClinic

- CareCloud

- Carefeed

- CareMessage

- CareMetx

- CarePassport

- CarePaths

- Carepatron

- CareSignal

- CareStack

- Carilion Clinic

- Carium

- Carle Health

- Catalia Health

- Catalyst Investors

- Catalyze Systems

- CBI Health

- Cecelia Health

- Cedar Cares

- Change Healthcare

- Charm Health

- Chart Talk

- ChartLogic

- CheckinAsyst

- Checkit

- Chiratae Ventures

- Christiana Care

- Chrysalis Ventures

- CIBC Innovation Banking

- CipherHealth

- CitusHealth (Subsidiary of Resmed)

- CivicHealth

- Clearstep

- Clearwave

- cliexa

- CLIN1

- Clinicia

- Cliniconex

- Clinion

- Clinix

- ClinVigilant

- CNO Financial

- Commerce Ventures

- Commonfund

- Comport Technology Solutions

- CompuGroup Medical

- Connecticut Innovations

- Connecting Now

- ConnectiveRx

- Connectivity Ventures Fund

- Consentz

- Contexture

- ContinuumCloud

- Contrary

- Cortico Health

- Coviu

- CPSI

- Creathor Ventures

- CrelioHealth

- Crosslink Capital

- Crystal Practice Management

- CSIRO

- Curable.care

- Curago Health

- Curogram

- Current Health

- Curve Dental

- Daffodil Software

- Datos Health

- Deaconess Health System

- DearDoc

- Deloitte

- Delta Dental

- Demandforce

- DFJ

- Digital Pharmacist

- Digiteum

- DMZ Partners

- DocASAP

- Docent Health (Acquired by GetwellNetwork)

- Docon Technologies

- DocsInk

- Doctible

- Doctor Genius

- Doctor On Demand

- Doctor.com

- doctoranytime

- Doxper

- DrChrono

- DrFirst

- Drucare

- Dudley Fund

- Echo Health Ventures

- eClinicalWorks

- Edison Partners

- Edward Elmhurst Health

- EHNOTE

- Eight Roads Ventures

- EIT Health

- Elements Health Ventures

- Elsevier

- eMedicalPractice

- Emitrr

- Empathiq

- Enable Healthcare

- EnableDoc

- Endeavour Vision

- Endo Investors

- EnlivenHealth

- Entrepreneur First

- Epic Systems

- Epion Health

- EQT Life Sciences

- Equicare Health

- Equipo Health

- Equity Venture Partners

- eRemede

- Espresso Capital

- European Bank for Reconstruction and Development

- European Investment Bank

- eVideon

- eVisit

- Experian Health

- Experity

- ExpertBox

- Exponential Ventures

- EyeCare Prime

- Eyefinity

- Ezovion

- Fast Pathway

- FCA Venture Partners

- Fifth Third Bank

- FinSight Ventures

- Firefly Health

- FirstMark

- First Trust Capital Partners

- Fitango Health

- FitPeo

- Five Faces

- Flatworld Solutions

- Florence Health

- Florida Funders

- Fonds Innovexport

- Force Therapeutics

- Forestay Capital

- F-Prime Capital

- Francisco Partners

- Frist Cressey Ventures

- Frontier Growth

- FTV Capital

- FutureShape (Acquired by Build Collective)

- Future Ventures

- Fysiotest (Acquired by Physitrack PLC)

- G100 Capital

- GEMMS

- General Atlantic

- General Catalyst

- Generation Investment Management

- Get Real Health

- GetWellNetwork

- GI Partners

- Giant Leap Fund

- Glenwood Systems

- Globevestor

- GoMo Health

- Gozio

- Gradient Ventures

- Great Hill Partners

- Greenway Health

- GrowPractice

- growX ventures

- GS Growth

- GSR Ventures

- Guardian Life Insurance Company of America

- Hale Health

- Halo Health Systems

- HarbourVest Partners

- Hard facts AB

- Harmony Medical

- Harris Healthcare

- HasHealth

- HBox

- Heal Capital

- Healee

- Healic

- Healios

- Health Catalyst

- Health Enterprise Partners (HEP)

- Health iPASS

- Health Journeys

- Health Recovery Solutions

- HealthAsyst

- Healthcare Anytime

- HealthCloud (Subsidary of Alula Technologies Group)

- HealthEC

- Healthie

- HealthKOS

- HealthPlix

- HealthPrize

- HealthQuest Capital

- HealthSnap

- Healthspace

- HealthTalk A.I.

- HealthTap

- Healthvana

- HealthVerity

- HealthViewX

- HealthVoyager

- Healthy Interactions

- Healthy Ventures

- Henry Schein MicroMD

- Hifinite

- Highland Capital Partners

- Hikma Ventures

- HLM Venture Partners

- Holmusk

- HotDoc

- HotHealth

- Human API

- Hypercare

- I2BF Global Ventures

- IBM

- ID8 Investments

- IJS Publishing Group (IJSPG)

- IM Your Doc

- IMEDI Systems

- Impact X Capital Partners

- Inbox Health

- Infermedica

- Inflection Point Ventures

- InHealth Ventures

- Innovate UK

- InnoVen Capital

- Inovia Capital

- Insight Partners

- intakeQ

- INTEGRIS Health

- Intel Capital

- InteliChart

- Intelligent Contacts

- Intiveo

- InvAscent

- Investissement Québec

- iPlato Healthcare

- IQVIA

- iSalus Healthcare

- isosconnect

- JabFab

- JAFCO Asia

- JMI Equity

- Joined Up Care Derbyshire

- JPMorgan Chase

- JSW Ventures

- Jump Capital

- K1 Investment Management

- Kalaari Capital

- Kareo

- Karma Ventures

- Kayentis

- Keet Health

- Keona Health

- KeyReply

- Keystone Healthcare Partners

- KHP Ventures

- Kinnevik

- Klara

- Klass Capital

- Kratin

- Kyruus

- Lakestar

- LaunchCapital

- LBO France

- Lead Edge Capital

- LeewayHertz

- Legal & General

- Leonard Green & Partners

- Lerer Hippeau

- Level Equity

- LexisNexis Risk Solutions

- Life365

- Lifecycle Health

- Lifepoint Health

- Lifewire

- Lightbeam Health Solutions

- Lighthouse 360

- Lightrock

- Lightspeed Venture Partners

- Lightyear Capital

- Lincor Solutions

- Lipman Family Prize

- LNR Partners

- Loblaw Companies

- LocalGlobe

- Locus

- Louisiana Funds

- LRVHealth

- Luma Health

- Lumeon

- M25

- MacDonald Ventures

- Main Sequence Ventures

- Manage My Health

- Managed Health Care Associates

- Maple

- Marlin Equity Partners

- MaRS Investment Accelerator Fund

- Martin Ventures

- Mass Medical Angels

- MassMutual Ventures

- Matrix Partners

- Mazik Global

- McKesson

- mConsent

- Me+U CARE

- Medable

- Medallia

- MedBridge

- Med-Con

- Medecision

- Medesk

- MEDHOST

- MediBuddy

- MediBuddy vHealth

- Medicasimple

- medicaSMART

- Medicity (acquired by Health Catalyst)

- MediOffice

- MediRecords

- Meditab

- MEDITECH

- MedleyMed

- Medsolis

- MEDTEQ+

- MedTrak Systems

- Medtronic

- Memora Health

- Memorial Hermann Foundation

- MemorialCare

- MemorialCare Innovation Fund (MCIF)

- Mend VIP

- Merck Global Health Innovation Fund

- Microsoft

- Milliways Ventures

- Mjog

- MMC Ventures

- Mocero Health

- Modento

- ModMed

- MonetaVenture Capital

- Moxie Labs

- mphrX

- MTBC

- MTIP

- Müller Medien

- Mutual Capital Partners

- My Rehab Pro

- MyKlinic

- MyRx

- Mytonomy

- Napier Healthcare

- Nashville Capital Network

- National Cancer Institute

- National Council for Prescription Drug Programs (NCPDP)

- Navigating Cancer

- Net Health

- Netsmart

- New Leaf Venture Partners

- New World Angels

- New York Ophthalmology

- NexHealth

- Nexogic

- Nextech

- NextGen Healthcare

- NextPatient

- Nexus Clinical

- Nexus Venture Partners

- Nidoco

- Nimblr.ai

- Nina Capital

- Northpond Ventures

- Norwest Venture Partners

- Nuance Communications

- Nueterra Capital

- NurseTim

- Oak HC/FT

- Obvious Ventures

- Octagos Health

- Octopus.Health

- Officite

- OhioHealth

- OhMD

- Oklahoma Heart Hospital

- Omnicell

- OnCall Health (Acquired by Qualifacts)

- One Mnet Health

- One Peak

- OneStep

- Oneview Healthcare

- OpenEMR

- Openspace Ventures

- Operator Partners

- OPKO Health

- OptimizeRx

- Optum Ventures

- Oracle Cerner

- Orb Health

- Orion Health

- ORIX Growth Capital

- OSF Ventures

- Osmind

- OSP Labs

- Pabau

- Palisades Growth Capital

- Panache Ventures

- PappyJoe

- Par Equity

- Pathway

- Patient Communicator

- Patient Connect 360

- PatientBond

- PatientClick

- PatientIQ

- PatientNow

- PatientPoint

- PatientPop

- PatientSync

- PatientTrak

- PatientWorks

- pCare

- PCIS GOLD

- PCL Health

- PeakSpan Capital

- PEC360

- Pelion Venture Partners

- PerfectServe

- Persivia

- Petrichor Healthcare Capital Management

- Philips

- Phreesia

- Physitrack PLC

- Planet DDS

- Playfair Capital

- Plug and Play

- Plus91 Technologies

- PlusPromo

- Plutus Health

- Point Nine

- PortalConnect

- Practice Fusion

- PracticeBeat

- PracticeDilly

- PracticeSuite

- Practo

- PrescribeWellness

- Princeville Global

- Pritzker Group

- Privis Health

- Profi

- Prompt Therapy Solutions

- Propell Health

- Providence Ventures

- Providertech

- PS3G

- ptSource

- PurpleDocs

- Push Health

- QED Investors

- Qmatic

- Quadria Capital

- Qualcomm Ventures

- Quenza

- Qure4u

- R.grid

- RAI Digital

- Rainforest Venture Network

- Raintree Systems

- Raleigh Neurology Associates

- RavePoint

- Ray Solution

- Razorpay

- Rebright Partners

- RecallMax

- Red Spot Interactive (RSI)

- Red Swan Ventures

- Redi.Health

- ReferralMD

- Refinery Ventures

- Reformation Partners

- Relatient

- RelevantMD

- Remassis

- Replikr

- Rev1 Ventures

- RevenueWell

- Review Wave

- Rhinogram

- Ridgeview Asset Management

- Right Click Capital

- Ripple Ventures

- Rittenhouse Ventures

- Riverside Acceleration Capital

- Rootines

- Royal Solutions

- RRE Ventures

- Rubicon Venture Capital

- Rustic Canyon Partners

- RXNT

- SaaS Capital

- Salesforce

- Salesforce Ventures

- Salucenter

- Samsung

- Samsung Ventures

- Sapphire Ventures

- Scale AI

- Scalex Technology Solutions

- ScienceSoft

- SCOR Ventures

- Scottish Investment Bank

- SE Health

- SEA Fund

- SeamlessMD

- Section 32

- Sequence Health

- Sequoia Capital

- Service Provider Capital

- Sesame Communications

- SGInnovate

- Sherpa Ventures

- SIG Venture Capital

- Signant Health

- Signature Venture

- Silicon Valley Bank

- Simple Interact

- SimplePractice

- Simplyhealth

- Singtel Innov8

- Sixth Street

- SmartClinix

- Smarter Health

- smartpatient

- SMARTWORKS

- snapIoT

- Sofina

- SoftBank Vision Fund

- SoftClinic GenX

- Solutionreach

- SolvEdge

- Somml Health

- SONIFI Health

- Spice Capital Partners

- Spinsci

- SpringRock Ventures

- Spruce Health

- SQN Venture Partners

- Stage 2 Capital

- Star OUTiCO

- Starboard Value

- StartUp Health

- Steadview Capital Management

- Steer Health

- Stereo Capital

- Stericycle Communication Solutions

- Stout Street Capital

- StrataPT

- Straumann

- Streamlined Ventures

- Stride Ventures

- Surgical Information Systems

- SustainVC

- Synaptek

- System C

- TA Associates

- TACTO Infomedia

- Talis Capital

- Tallahassee Memorial HealthCare

- TDF Ventures

- TEAMFund

- Teladoc Health

- TelASK

- TeleVox

- Tellen Systems

- TELUS Health

- Temerity Capital Partners

- Tenaya Capital

- Tencent

- TenderHealth Tech

- Texas Health Resources

- Texas Medical Center

- The American College of Gastroenterology (ACG)

- The American Society for Gastrointestinal Endoscopy (ASGE)

- The Clinic Place

- The Clinician

- The Digital Group (T/DG)

- The Good Clinic

- Therapy Brands

- Thirty Five Ventures (35V)

- Thrive Capital

- Tiger Global Management

- TigerConnect

- Tiny VC

- Toba Capital

- TouchPoint Care

- TP&P Technology

- Transformation Capital

- TRIARQ Health

- Tribeca Venture Partners

- Trifecta Capital

- TriWest Capital Partners

- TriZetto Provider Solutions

- Trusted Insight

- TT Capital Partners

- TVC Capital

- Twistle

- U.S. Venture Partners

- UbiCare

- UnityPoint Health Ventures

- University Growth Fund

- Updox

- Upfront Healthcare

- UPshow

- US Orthopedic Alliance

- UST

- VA Sierra Pacific Network (VISN 21)

- Vault Dragon

- VCDoctor

- vcita

- Veeva Systems

- Velvet Sea Ventures

- Venrock

- Venture Highway

- VEPRO

- Veradigm

- Verstra Venture

- Vertex Ventures Israel

- Vertical Venture Partners

- Verto Health

- Vida Health

- Vinehealth

- Vista Equity Partners

- Vital Interaction

- Vivo Capital

- Volition Capital

- Vytalize Health

- W Health Ventures

- W5 Group

- Wasatch Advisors

- Watershed Capital

- Weave Communications

- WebMD Health Services

- Webmedy

- Welkin Health

- Well-Beat

- Welldoc

- WellReceived

- WellSky

- WellWink

- Western Technology Investment

- West Technology

- What If Ventures

- Wolters Kluwer

- World Innovation Lab (WiL)

- WRS Health

- XCare

- x-tention

- Yosi Health

- Zappix

- ZealCare

- Zingit Solutions

- Zyla health

Methodology

LOADING...