The utilization of next-generation in vitro diagnostics (IVD) technologies holds promise for the early identification of diseases, facilitating timely interventions and preventive actions

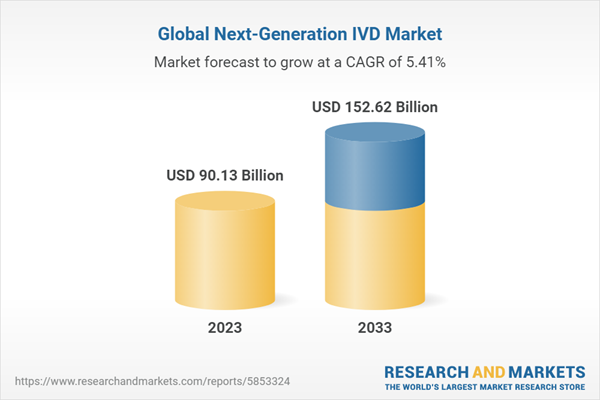

The next-generation IVD market was valued at $86.21 billion in 2022 and is expected to reach $152.62 billion by 2033, growing at a CAGR of 5.41% between 2023 and 2033. Next-generation in-vitro diagnostics (IVDs) refer to advanced and innovative technologies that are utilized for diagnostic testing outside the human body. These cutting-edge diagnostic tools represent a significant advancement in the field, offering enhanced accuracy, efficiency, and reliability in detecting and monitoring various diseases and conditions. Moreover, the next-generation IVD industry also faces challenges such as stringent regulations, industry consolidation, new healthcare reforms, and ever-changing demographics. However, despite these challenges, the advent of new technologies being used for diagnosis and innovations has the potential to invigorate the growth of the next-generation IVD market. Molecular diagnostics, genomics, and NGS are expected to be primary facilitators of this growth by providing new avenues for improved disease diagnosis, hence, redefining patient outcomes.

Market Introduction

The market for next-generation in-vitro diagnostics (IVD) holds considerable growth potential, driven by multiple factors. These include advancements in technology used for IVD, rising ageing population, a growing prevalence of chronic diseases, increasing demand for personalized medicine, and the need for more efficient diagnostic solutions. Further, global IVD market has exhibited consistent growth, and the introduction of next-generation IVD technologies is expected to further fuel market expansion. Market is projected to maintain a robust growth trajectory in the years ahead.

Industrial Impact

The industrial impact for growth in emerging countries, including developing nations, is substantial for next-generation in-vitro diagnostics (IVDs) market. These regions is experiencing a growing need for enhanced healthcare infrastructure, improved access to high-quality diagnostics, and the adoption of advanced technologies to address diseases effectively. This factor holds an opportunity for market to develop more in these countries. Further, the regulatory environment and reimbursement policies plays a crucial role in shaping the adoption and expansion of next-generation IVDs globally. Favourable regulations and reimbursement frameworks that facilitate the seamless integration of these technologies into routine healthcare practices can significantly boost market growth.

Market Segmentation

Segmentation 1: by Type

- Core Laboratory Diagnostics

- POC Testing

- Molecular Diagnostics

Core Laboratories Segment to Continue its Dominance as the Leading Type

The next-generation IVD market based on type is led by the core laboratories, with a 69.90% share in 2022. Core laboratory technologies in IVD encompass a range of analytical instruments and platforms used for centralized testing in laboratory settings. These technologies play a crucial role in clinical diagnostics and patient care. Core laboratory diagnostics include technologies such as immunoassay, hematology, and clinical chemistry, among others.

Segmentation 2: by Product

- Consumables

- Instruments

- Software

Consumables Expected to Continue to Dominate the Product Segment

The next-generation IVD market based on product is led by consumables panels based on product, with a 69.94% share in 2022. Next-generation in-vitro diagnostics (NG-IVD) uses a various range of consumables that are instrumental in conducting sample testing and analysis for any experiment undertaken in the laboratories. These consumables are essential for ensuring the precise and effective implementation of IVD technologies. Consumables such as assay kits used for in-vitro diagnostics comprise of essential consumables that include reagents, chemicals, and materials necessary for specific diagnostic tests. These assay kits are designed to provide standardized components and protocols, ensuring consistent and reliable results.

Segmentation 3: by Application

- Oncology/Cancer

- Infectious Diseases

- Diabetes

- Cardiology

- Other Applications

Oncology/Cancer Dominates the Next-Generation IVD Market in Application

As of 2022, the global next-generation IVD market (by application) was dominated by the oncology/cancer segment, holding a 34.95% market share, and is growing with a CAGR of 5.10%. Increasing prevalence of cancer cases across the globe and efforts by the diagnostics companies for carrying out treatment regimen for treating cancer is driving the market growth of this segment.

Segmentation 4: by End User

- Hospitals and Clinics

- Diagnostic Laboratories

- Academic and Research Institutions

- Other End Users

Hospital and Clinics Dominates the Next-Generation IVD Market by End User

The next-generation IVD market by end user is led by hospitals and clinics, with a 44.14% share in 2022. Hospitals and clinics are the major end users for the next-generation IVD market. Apart from the central laboratory testing at hospitals, IVD is being increasingly adopted for the rapid and bed side analysis for various parameters. These are usually performed by the non-laboratory trained individuals such as nurses, paramedics, and physicians, among others. Hospitals and clinics rely extensively on next-generation in-vitro diagnostics (IVD) as an integral part of their daily functioning. These diagnostic tests play a vital role in ensuring accurate disease diagnosis, monitoring patient well-being, and informing treatment strategies. IVD is essential in various healthcare settings.

Segmentation 5: by Region

- North America - U.S., Canada

- Europe - Germany, U.K., France, Italy, Spain, and Rest-of-Europe

- Asia-Pacific - Japan, India, China, South Korea, Australia, and Rest-of-Asia-Pacific

- Latin America - Brazil, Mexico, and Rest-of-Latin America

- Middle East and Africa

In 2022, the North America next-generation IVD market dominated the global market with a market value of $35.97 million in 2022, and it is expected to hold its dominance throughout the forecast period 2023-2033. However, the Asia-Pacific (APAC) region, constituting several emerging economies, is expected to register the highest CAGR of 7.05% during the forecast period 2023-2033.

Recent Developments in the Global Next-Generation IVD Market

- In June 2023, BD launched a new automated instrument i.e. BD-FACSLyric-Duet that prepares samples for clinical diagnostics using flow cytometry. The system leverages liquid-handling robotics to automate the entire sample preparation process, for both in-vitro diagnostics (IVD) and user-defined test.

- In April 2023, Thermo Fisher Scientific launched its 37 CE-IVD-marked broad PCR Test menu.

- In January 2023, Tempus company received the FDA approval for Premarket Approval (PMA) application for its xT CDx which is a companion diagnostic test. xT CDx is a 648-gene NGS test for solid tumor profiling, which includes companion diagnostic and microsatellite instability status claims for colorectal cancer patients.

- In January 2023, QIAGEN N.V. launched the EZ2 Connect MDx IVD platform for automated sampling in diagnostic laboratories. The company provides this platform. The platform holds a high degree of automation and enables laboratories to DNA and RNA purification from up to 24 samples in 30 minutes.

- In June 2023, BD commercially launched a new automated instrument that prepares samples for clinical diagnostics using flow cytometry. The company enables a workflow solution designed to improve reproducibility and standardization in cellular diagnostics.

- In May 2023, Beckman Coulter unveiled the DxI 9000 Access Immunoassay Analyzer, a next-generation analyzer for the most productive immunoassay analyzer per footprint. The DxI 9000 Analyzer can run up to 215 tests per hour per square meter (tests/hr/m2).

- In June 2023, Invivoscribe, Inc. partnered with Complete Genomics to commercialize and develop biomarker tests for oncology research. The partnership uses NGS platforms from Complete Genomics to develop new tests.

- In June 2023, QIAGEN N.V. and Sysmex formed an alliance to foster collaborations with pharmaceutical companies for the drug treatments for cancer and also promote ultra-sensitive liquid biopsy companion diagnostics adoption.

- In April 2023, bioMérieux SA and Oxford Nanopore entered into a partnership to develop diagnostic solutions. The partnership was focused on providing access to nanopore-based clinical research and IVD solutions.

- In April 2023, ALPCO-GeneProof and Thermo Fisher Scientific, Inc. partnered to bring TaqPath Menu GeneProof PCR kits into the market. The partnership helped to bring ALPCO-GeneProof’s expertise in molecular diagnostics with Thermo Fisher’s supply chain and support systems.

Demand - Drivers and Limitations

Market Demand Drivers:

Technological Advancements in Next-Generation In-Vitro Diagnostics Transforming Healthcare System: The field of in vitro diagnostics (IVD) has been transformed by ongoing technological advancements, including genomics, proteomics, and molecular diagnostics. These advancements, such as Next Generation Sequencing (NGS), digital PCR, and other pioneering techniques, have significantly enhanced the precision, sensitivity, and efficiency of diagnostic testing. Consequently, these improvements have played a vital role in stimulating the expansion of the Next-Generation IVD market.

Furthermore, IVD and advancements in the technology being used are having a profound impact on the healthcare system, revolutionizing medical diagnoses and the delivery of healthcare. Technological progress in IVD, including molecular diagnostics, genomics, and proteomics, has significantly boosted the precision and accuracy of diagnostic tests. This empowers healthcare professionals to make more dependable diagnoses, leading to targeted and appropriate treatment plans. IVD technologies generate vast amounts of data, which, when effectively analyzed and interpreted, can provide valuable insights for healthcare providers. Advanced analytics and machine learning algorithms can extract meaningful information from this data, supporting clinical decision-making, treatment selection, and population health management.

Technological advancements in next-generation IVD have given rise to portable and handheld devices that enable testing to be conducted remotely and at the point of care. This is particularly advantageous in resource-limited settings and remote areas where access to centralized laboratories is limited. Point-of-care testing delivers rapid results, enabling immediate clinical decision-making and timely interventions.

IVD technologies, such as wearable devices and home testing kits, enable remote monitoring of patients' health conditions. This permits continuous monitoring of chronic diseases and facilitates remote disease management. Patients can track their health parameters and transmit data to healthcare providers for timely interventions and adjustments to treatment plans. In conclusion, the ongoing technological advancements in in-vitro diagnostics are transforming the healthcare system by improving precision and accuracy, enabling early disease detection, supporting personalized medicine, facilitating remote and point-of-care testing, driving data-driven healthcare, enhancing workflow efficiency, and enabling remote monitoring and disease management. These advancements have the potential to enhance patient outcomes, optimize resource utilization, and reshape the delivery of healthcare services.

Rising Demand of POC testing Boosting Next-Generation In-Vitro Diagnostics Market: The healthcare industry is witnessing an increasing need for quick and convenient diagnostic testing directly at the point of care. Next-Generation in vitro diagnostics (IVD) technologies, including portable and handheld devices, have emerged to fulfill this demand. These advanced devices enable real-time testing at the site of care, leading to reduced turnaround times for results and facilitating immediate clinical decision-making. The demand for point-of-care (POC) testing in in vitro diagnostics (IVD) is on the rise, with an increasing number of healthcare providers adopting this approach.

POC testing refers to diagnostic tests performed at or near the patient's location, providing immediate results that can guide clinical decision-making. Several factors contribute to the growing demand for POC testing in next-generation IVD. The rising demand and increasing utilization of POC testing in in-vitro diagnostics are driven by the need for rapid diagnoses, improved patient management, convenience, accessibility, effectiveness in remote settings, infectious disease control, and the availability of advanced POC testing devices. This trend is expected to continue as technology continues to advance, enabling more efficient and accurate testing at the point of care.

Growing Incidence of Chronic and Acute Diseases Demanding for Early Treatment: Next-Generation IVD technologies enable the early identification of diseases, even before symptoms become apparent. This early detection allows for timely interventions, resulting in improved patient outcomes and potentially reduced treatment costs. Screening tests for conditions like cancer, infectious diseases, and genetic disorders are increasingly sensitive and specific, facilitating early intervention and preventive measures. Next-Generation In-vitro Diagnostics (IVDs) are highly beneficial in monitoring the efficacy of treatments and making necessary adjustments to therapies. They enable the evaluation of treatment response, drug levels, and the development of drug resistance, enabling personalized and precise therapeutic interventions. According to the published article in PubMed in American College of Rheumatology in 2020, approximately half of the population in the United States is affected by chronic diseases, which has led to an epidemic. Moreover, a significant 86% of healthcare expenses can be attributed to these chronic conditions. Unfortunately, the medical profession and its leaders have not adequately acknowledged or addressed the increasing prevalence of chronic diseases.

Boost in the Next-Generation IVD Market during COVID-19 Pandemic: The COVID-19 pandemic had a substantial impact on the field of in vitro diagnostics (IVD), leading to the accelerated development and adoption of next-generation IVD technologies. Heightened demand for diagnostic testing during the pandemic created an urgent requirement for precise and rapid diagnostic tests for COVID-19. This demand has driven the innovation of advanced next-generation IVD technologies, such as nucleic acid-based tests such as PCR and RT-PCR, which have played a crucial role in detecting the SARS-CoV-2 virus.

Furthermore, the need for quick testing in diverse settings, including hospitals, clinics, and non-medical facilities, has spurred the development of next-generation point-of-care testing devices. These devices enable swift and accurate testing at the location where patients are receiving care, reducing the time taken to obtain test results and facilitating prompt decision-making. Pandemic has underscored the significance of molecular diagnostics in the detection and monitoring of infectious diseases. Next-generation molecular diagnostic technologies, such as high-throughput sequencing, digital PCR, and CRISPR-based diagnostics, have witnessed substantial advancements and found applications in COVID-19 testing. These technologies offer enhanced sensitivity, specificity, and the ability to detect multiple targets simultaneously.

Market Challenges:

Regulatory Hurdles Related to Next-Generation IVD Technologies: The development, adoption, and implementation of next-generation in vitro diagnostics (IVD) encounter various challenges. Securing regulatory approvals and adhering to rigorous regulations present significant hurdles for these advanced IVD technologies. The intricate nature of these technologies, particularly those incorporating novel platforms or innovative biomarkers, often necessitates additional validation studies and regulatory procedures to ensure their efficacy and safety are thoroughly established.

Under the In Vitro Diagnostic Regulation (IVDR), manufacturers will face increased requirements and stricter oversight from notified bodies, resulting in additional costs to successfully market IVD products in compliance with the new regulations. Manufacturers have to carefully assess and streamline their IVD portfolios, which may lead to limitations on the availability of certain assays or product types for a temporary period.

Poor Reimbursement Scenario: The manufacturers of in-vitro diagnostics tests face specific challenges to boost payers to cover in-vitro diagnostics tests and to set payment rates that comply with the cost required to perform such tests. In-vitro diagnostics tests and kits have been recognized as an integral part of medical care and are currently reimbursed by a number of federal and private sector health care insurers. However, the reimbursement rates are non-specific for any particular IVD test. They vary significantly with different reimbursing agencies. While the policies for coding, billing, and payment for IVD tests/kits remain similar to pharmaceutical drugs and medical devices, these policies are indistinct in nature and vary from payer to payer.

Market Opportunities:

Rising Number of Next-Generation IVD Companies involved in Business Expansion: The expanding business of next-generation vitro diagnostics (IVD) market can be attributed to the escalating prevalence of chronic diseases and infectious conditions. In the present economic situation, there has been a noticeable increase in chronic ailments like diabetes, cancer, heart disease, and tuberculosis. The utilization of next-generation in vitro diagnostics (IVD) technologies holds promise for the early identification of diseases, facilitating timely interventions and preventive actions. Next-generation IVD technologies are instrumental in the early detection, monitoring, and management of these ailments which is helping companies to expand their IVD business.

Inclination of Emerging Companies Towards Next-Generation In-vitro Diagnostics: Emerging companies within the in vitro diagnostics (IVD) sector are placing their focus on several key areas to drive innovation and advancements in the field. emerging companies in the IVD sector are dedicated to technological innovation, personalized medicine, digital health integration, point-of-care testing, novel biomarker development, and harnessing the potential of data analytics and artificial intelligence (AI). Their collective efforts are directed towards advancing next-generation IVD technologies to transform disease diagnosis, monitoring, and management.

How Can This Report Add Value to an Organization?

Product/Innovation Strategy: The global next-generation IVD market has been extensively segmented on the basis of various categories, such as product, type, application, end user, and region. This can help readers get a clear overview of which segments account for the largest share and which ones are well-positioned to grow in the coming years.

Growth/Marketing Strategy: Synergistic activities, product launches, and approvals accounted for the maximum number of key developments, i.e., nearly 80% of the total developments in the global next-generation IVD market were between January 2021 to June 2023.

Competitive Strategy: The global next-generation IVD market has numerous startups paving their way into manufacturing kits, panels, assays, and instruments and entering the market. Key players in the global next-generation IVD market analyzed and profiled in the study involve established players that offer various kinds of disease-specific panels and multiplex instruments.

Key Market Players and Competition Synopsis

The companies that are profiled have been selected based on inputs gathered from primary experts and analyzing company coverage, product portfolio, and market penetration.

The top next-generation IVD market type segment players who are leading capture around 69.90% of the presence in the market. Players in other industries, such as POC testing, and molecular diagnostics, account for approximately 12.24% and 17.86% of the presence in the market.

Key Companies Profiled:

- Abbott Laboratories

- Agilent Technologies, Inc.

- Becton, Dickinson and Company

- bioMérieux SA (BioFire Diagnostics)

- Bio-Rad Laboratories, Inc.

- Danaher Corporation

- F. Hoffmann-La Roche Ltd. (Roche Molecular Systems, Inc.)

- Guardant Health

- Illumina, Inc.

- Invivoscribe, Inc.

- PerkinElmer Inc.

- QIAGEN N.V.

- Quest Diagnostics Incorporated

- Sysmex Corporation

- Laboratory Corporation of America Holdings.

- Myriad Genetics, Inc.

- Siemens Healthineers AG

- Tempus

- Thermo Fisher Scientific Inc.

Table of Contents

Companies Mentioned

- Abbott Laboratories

- Agilent Technologies, Inc.

- Becton, Dickinson and Company

- bioMérieux SA (BioFire Diagnostics)

- Bio-Rad Laboratories, Inc.

- Danaher Corporation

- F. Hoffmann-La Roche Ltd. (Roche Molecular Systems, Inc.)

- Guardant Health

- Illumina, Inc.

- Invivoscribe, Inc.

- PerkinElmer Inc.

- QIAGEN N.V.

- Quest Diagnostics Incorporated

- Sysmex Corporation

- Laboratory Corporation of America Holdings.

- Myriad Genetics, Inc.

- Siemens Healthineers AG

- Tempus

- Thermo Fisher Scientific Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 325 |

| Published | July 2023 |

| Forecast Period | 2023 - 2033 |

| Estimated Market Value ( USD | $ 90.13 Billion |

| Forecasted Market Value ( USD | $ 152.62 Billion |

| Compound Annual Growth Rate | 5.4% |

| Regions Covered | Global |

| No. of Companies Mentioned | 19 |