Piping and pipe fabrication are significant for the continuous water supply for residential and commercial buildings. The commercial sector includes restaurants, cafes, hotels, educational institutes, fitness centers and gyms, recreational activities centers, and swimming pools. The growth of the residential and commercial sectors is expected to positively impact the demand for pipe fabrication in India over the forecast period.

Non-residential sector is also booming in the country with a more positive approach and investments in commercial projects. The growing construction of office buildings, shopping malls, recreational places, and community spaces is likely to drive the growth of the pipe fabrication market. The growth has been driven by the expansion of the IT sector and the growing hotel industry due to increased tourism. This growth in residential and non-residential construction is likely to drive the demand in the market for pipe fabrication in India over the forecast period.

Pipe fabrication heavily relies on machines, hand-held tools, computers, and software for the fabrication process, still, the process tends to be people-oriented. From programming the machines to carry out cutting and piercing to carrying out the operations, creating assembly to quality check workforce is required. By using digital technology the more efficient coordination of various steps such as procurement, engineering, manufacturing, and assembly can be carried out. Various pipe fabricators in the market are investing and proactively focusing on the digitization and automation of the fabrication process over the forecast period.

India Pipe Fabrication Market Report Highlights

- The energy and power segment held 14.0% of the market share in 2022. Steel pipe fabrication finds considerable usage in power plants. Steel pipes, especially seamless pipes, which come in carbon, stainless, and alloy forms are used. These pipes are fabricated for heat recovery steam generators and coal-fired boilers

- Pipes are increasingly used in chemical plants for process refining on account of their characteristics such as oxidation resistance and strong corrosion. The increasing construction of chemical plants in India is anticipated to boost the consumption of pipe fabrication over the coming years

- The pipe fabrication industry is at a pivotal point where IoT has massive opportunities for automation controls and computer systems, providing a new generation of equipment for pipe fabrication

- The complex and delicate nature of the process of pipe fabrication is one of the challenges for the Indian pipe fabrication market. Pipe fabrication demands high-precision jobs among different components, with challenging assembly and installation at the working site

- For instance, in June 2020, McDermott completed the divestment of the Shaw Group pipe fabrication assets to Ithaca Acquisitions Holdings. The acquisition re-established Shaw as a pipe fabricator with significant fabrication capacity

Table of Contents

Companies Mentioned

- Darshil Technology

- FABRI-TEK ENGINEERS

- McDermott

- DEE Piping Systems

- Artson

- Shree Sainath Enterprises

- TECHSKILL (INDIA) PVT. LTD.

- Deepak Steel India

- Stevanato Group

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 100 |

| Published | July 2023 |

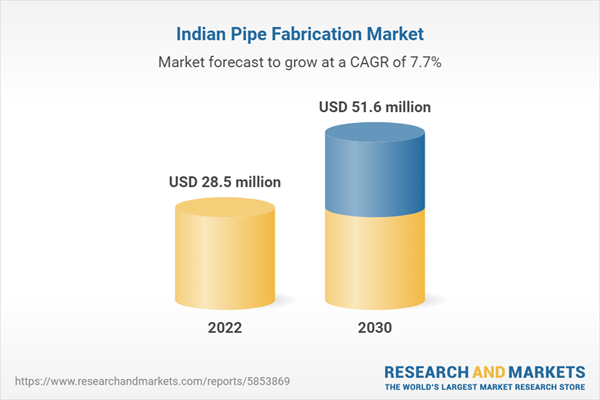

| Forecast Period | 2022 - 2030 |

| Estimated Market Value ( USD | $ 28.5 million |

| Forecasted Market Value ( USD | $ 51.6 million |

| Compound Annual Growth Rate | 7.7% |

| Regions Covered | India |

| No. of Companies Mentioned | 9 |