Military aircraft and ship systems operate in high temperatures, humidity, vibration, shock, electromagnetic interference, and other extreme conditions. Rugged computing systems are designed to withstand these harsh conditions and maintain reliable performance. They are equipped with robust components and undergo rigorous testing to ensure they can operate effectively in challenging environments. Military operations require reliable and resilient network infrastructure. Military ethernet switches incorporate redundant power supplies, fault-tolerant designs, and network redundancy protocols to ensure continuous operation, even in challenging environments or during equipment failures. Thus, the growing demand for rugged computing in aircraft and ship/vessel systems is driving the North America military ethernet switches market growth.

Regular commercial ethernet switches vary from ruggedized military ethernet switches in manufacturing, design, testing, and implementation. Ruggedized construction means these switches and their MIL-STD components are included inside ruggedized housing. Further, unlike the regular commercial Ethernet switches, the rugged switches for military applications are tested to meet the impact, EMF, and EMI requirements. Therefore, the advantages offered by the ruggedized configuration of ethernet switches for military applications are projected to propel the North America military ethernet switches market growth for the segment during the forecast period.

Restrictions on travel, social distancing measures, and workforce limitations affected manufacturing capacity, which led to delays and shortages production of various defense equipment. Despite the challenges, unmanned systems, cybersecurity, and medical equipment used in the defense industry witnessed increased demand in the defense industry of North America. The growth of the unmanned systems segment, owing to the rise in the number of procurement contracts, boosted the North America military ethernet switches market share in Q1 and Q2 of 2020. For instance, in March 2020, the US Air Force Research Laboratory awarded a contract to Planck Aerosystems Inc. With this contract, the company offered its expertise in the development of guidance, navigation, and control solutions for small, unmanned aircraft systems operating in challenging environments. Similarly, in March 2020, the US Air Force (USAF) awarded a contract of US$ 23 million to FLIR Systems to supply ~200 of its Centaur unmanned ground vehicles (UGV) and spares. Such contracts are expected to increase the North America military ethernet switches market share.

In Canada, vast maritime and aerospace domains require reliable and ruggedized ethernet switches for naval vessels, submarines, aircraft, and ground-based installations. These switches are designed to withstand harsh environmental conditions and ensure continuous communication and data exchange between the onboard systems and ground control stations. Military ethernet switches facilitate the integration of UAV/UAS systems into broader military networks. They provide connectivity and interoperability, allowing unmanned systems to communicate with other military platforms, ground stations, and command centers. This integration enables coordinated operations and data sharing among different assets on the battlefield. Thus, the adoption of military UAV/UAS platforms is supporting the growth of the North America military ethernet switches market in the country.

The North America military ethernet switches market is predominantly driven by end-user such as ground, naval, and air forces. The North America military ethernet switches market players also include companies such as Lockheed Martin Corporation, WB Group, IAI, UVision Air Ltd, Elbit Systems Ltd, STM Savunma Teknolojileri Mühendislik ve Ticaret AS, AVision Systems Pvt Ltd, Aeronautics Ltd, Rafael Advanced Defense Systems, and Thales Group, among others. Several other major North America military ethernet switches market players were studied and analyzed during this market research study.

Table of Contents

Companies Mentioned

- Milpower Source Inc

- Amphenol Socapex

- Curtiss-Wright Defense Solutions

- Abaco Systems Inc

- Ontime Networks LLC

- Diamond Systems Corp

- Red Lion

- Cisco Systems Inc

- Techaya

- Aeronix Incorporation

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 94 |

| Published | July 2023 |

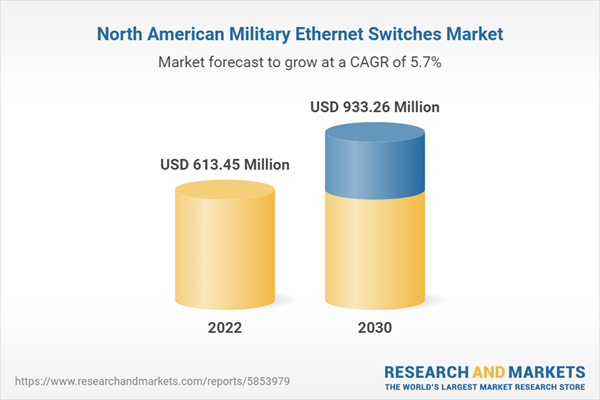

| Forecast Period | 2022 - 2030 |

| Estimated Market Value ( USD | $ 613.45 Million |

| Forecasted Market Value ( USD | $ 933.26 Million |

| Compound Annual Growth Rate | 5.7% |

| Regions Covered | North America |

| No. of Companies Mentioned | 10 |