In the United States, beauty products like cosmetics are growing owing to a huge demand for organic and natural products. Consumers are more aware of skincare, grooming, and physical appearance because of social and environmental concerns. Also, due to skin sensitivity issues and allergies, consumers' preference for organic and vegan skincare products has increased. The surge in new product innovations, increasing demand for chemical-free products, and advertising and promotion of products are driving the market. Market players are innovating organic skincare and personal care products according to consumer preferences. For instance, in September 2022, Amour's Secrets Skincare debuted in the United States beauty industry, emphasizing natural, clean, non-toxic, plant-based ingredients that refresh, rejuvenate, and enhance the skin. Amour's Secrets is launching five new anti-aging, plant-based skincare products, starting with a cleansing hydrating oil, followed by an eye cream, whipped face cream, mild foaming face wash, and a face scrub.

A larger proportion of the millennial population in the United States also serves as a market driver. The millennial generation accounts for the majority of the working population in the country. For daily usage, personal care products like deodorants, perfumes, and cosmetics have become necessary as physical appearance is essential. The market players target consumers of specific age groups and launch new products. Americans are engaged in physical activities like going to the gym and fitness centers. Due to this, demand for personal care products like deodorants has also increased. In February 2021, Procter & Gamble launched a deodorant under its Secret brand, Secret Derma+ Antiperspirant, a product designed by female dermatologists to provide skincare properties for minimizing irritation and underarm discoloration.

US Cosmetics Market Trends

Growing Inclination Toward Organic, Natural, and Cruelty-Free Products

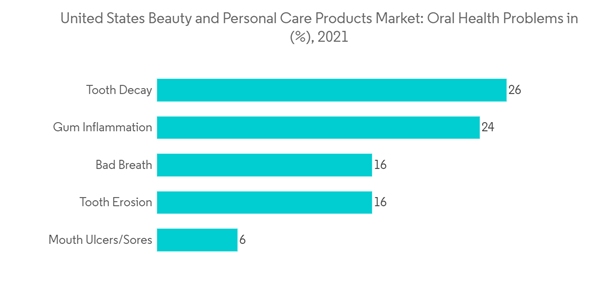

The beauty and personal care products market witnessed an increasing demand for natural and organic products due to the rise in consumer awareness about the harmful effects of certain compounds, such as paraben and aluminum compounds in skincare and hair care products and deodorants. A high percentage of consumers choose one brand over others based on its natural formulation. This has enhanced the demand for safe, natural, and organic products in recent times. An increase in oral health problems like tooth decay, premature demineralization, bad breath, and other problems is increasing in the United States. Owing to this, the demand for natural ingredients is evident in the market. Thus, most companies are launching products with nature-inspired ingredients, such as plant-inspired and premium botanical ingredients, coupled with multi-functional properties. Similarly, consumers in the market tend to prefer products with the label "cruelty-free," denoting that animals are not harmed in testing such products. Moreover, major players are working towards preparing vegan and plant-based products. For instance, in February 2021, Plus Ultra, a United States-based oral care company, launched Natural Toothpaste. The toothpaste is made with aloe vera, bamboo extract, glycerin, peppermint flavor, rosemary extract, and other natural ingredients. It also contains no BPA, SLS, parabens, neurotoxins, artificial flavors, or dyes.Surge in Spending Over Beauty and Personal Care Products

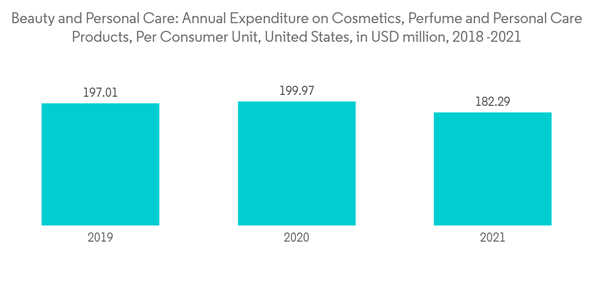

Consumer spending on cosmetics and other personal care products has witnessed a rise. Due to the increase in advertising and promotional activities, consumers in the United States are purchasing these cosmetics. Furthermore, advertising is frequently targeted at a specific age group, such as adolescents or aging women, to influence and target specific population groups. Due to frequent product innovation on the market, consumers are being introduced to new types of products and are trying them out. Consumers generally want to ensure that they buy products that suit their skin or hair type, and thus, product trials are important in the cosmetics market. Thus, companies such as Avon and Estee Lauder have been increasing their marketing expenditures toward such activities in recent years. Men are also taking care of their skin these days due to increased pollution and consciousness. Therefore, market players are manufacturing products for men as well. For instance, in April 2022, Beiersdorf AG's brand Nivea Men launched a skin-care product called "Climate Care Moisturizer" with an ingredient obtained from recycled carbon dioxide. The product contains 14% ethanol, which is obtained by carbon capture and utilization.US Cosmetics Industry Overview

Estée Lauder Companies, L'Oréal S.A., Unilever PLC, Colgate-Palmolive Company, and Procter & Gamble Company are among the major players in the US beauty and personal care products market. The market is highly competitive, with players actively competing in terms of new product launches, mergers and acquisitions, expansions, and partnerships. Additionally, leading players are investing heavily in research and development to come up with product innovations. In the market studied, major brands are launching or acquiring portfolios that claim to be natural, organic, and sustainable to have higher penetration across retail shelves and online channels. For instance, in 2020, L'Oréal SA signed an agreement to acquire Thayers Natural Remedies, a United States-based natural skincare brand from Henry Thayer Company. The brand is expected to be integrated into L'Oréal's consumer products division.Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- The Estée Lauder Companies Inc.

- L'Oréal S.A.

- Unilever PLC

- maxingvest AG (Beiersdorf AG)

- Alticor (Amway Corp.)

- Natura & Co

- Shiseido Company Limited

- Revlon Inc.

- Colgate-Palmolive Company

- Procter & Gamble Company

- Johnson & Johnson Services, Inc.