COVID-19 and diabetes have a significant impact on public health in the Middle East and Africa, as well as elsewhere. Diabetes has been linked to an increased risk of fatal infections and severe infections in COVID-19 patients. Because diabetes is one of the most common health problems in the Middle East and Africa, the current study focused on understanding the epidemiology of COVID-19 in diabetics and the strategies put in place by governments to mitigate its impact. In light of the importance and necessity of the epidemic, countries in the Middle East and Africa have implemented a number of preventative and control measures.

Meglitinides are a type of non-sulfonylurea insulin secretagogues with a fast onset and short duration of action. They stimulate glucose-sensitive first-phase insulin release, lowering the risk of hypoglycemia. Meglitinides cause the body to release more insulin in people with type 2 diabetes, who have chronically high blood sugar levels. The World Health Assembly agreed on a Resolution to strengthen diabetes prevention and control in May 2021. It recommends actions such as increasing access to diabetes medicines and health products and assessing the feasibility and potential value of establishing a web-based tool to share information relevant to market transparency for diabetes medicines and health products.

This is driving the demand for Meglitinides in Middle-East and Africa, thereby driving the market in focus during the forecast period.

Middle East And Africa Meglitinide Market Trends

Rising Diabetes Prevalence in Middle East and Africa Region

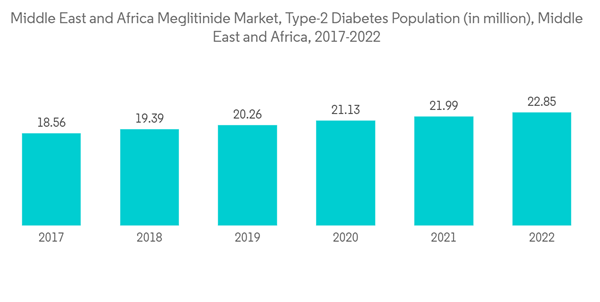

The diabetes population in the Middle East and Africa region is expected to rise by more than 3.5% over the forecast period.73 million adults lived with diabetes in the IDF MENA region in 2021. This figure is estimated to increase to 95 million by 2030. 48 million adults in the IDF MENA Region live with impaired glucose tolerance, which places them at increased risk of developing type-2 diabetes. Technological advancements have increased over the years in insulin delivery devices for safer and more accurate administration of insulin.

Governments in the ME have identified the threat of diabetes and started to respond with various policies, initiatives, and programs. Six out of 15 countries in this region still do not have a national operational action policy for diabetes. Many countries still do not have a national strategy to reduce overweight, obesity, and physical inactivity, which are important risk factors for diabetes. Most counties have fully implemented national diabetes treatment guidelines. However, constant measures are being taken to minimize diabetic complications; therefore, owing to the aforesaid factors, the growth of the studied market is anticipated in the Middle East and Africa region.

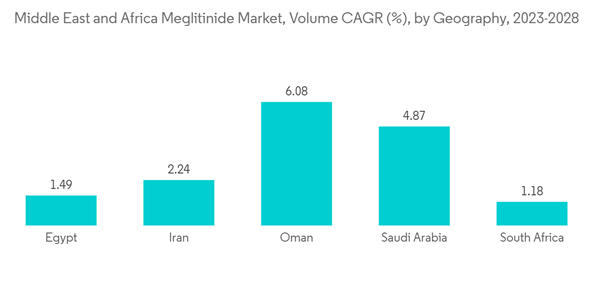

Saudi Arabia is Expected to Dominate the Middle-East and Africa Meglitinides Market.

Diabetes is one of the mounting health problems the country is facing. Saudi Arabia is ranked among the top three Middle Eastern and African countries with the highest prevalence of diabetes. The diabetes population in Saudi Arabia increased from 1.48 million in 2012 to 5.95 million in 2021 and is expected to reach more than 8 million by 2027. The type-1 diabetes population in the country is projected to reach more than 0.5 million by 2027, up from 0.39 million in 2021.Saudi Arabia is aiming to reduce the prevalence of the disease by 10% over the next decade. The government is taking on a number of initiatives to stop the epidemic from spreading, such as taxing sugary drinks, promoting physical fitness, and emphasizing preventative care. The government’s focus on combating diabetes and the higher purchasing power of the people in the country may help the market for diabetes drugs, like insulin drugs, during the forecast period.

Meglitinides, for example, bind to the sulfonylurea receptor in beta cells (pancreatic insulin-producing cells), but at a different site than sulfonylureas. Meglitinides' interaction with the receptor is not as "tight" as that of sulfonylureas, resulting in a much shorter duration of action and a higher blood glucose level required before the drugs produce pancreatic insulin secretion. There are currently two meglitinides available in the Middle East and Africa region: repaglinide (Prandin) and nateglinide (Starlix). Both are approved for use in type-2 diabetes patients, both alone and in combination with other oral diabetes medications. The main effect of meglitinides is to lower after-meal blood glucose levels, which results in a lower HbA1c (an indicator of blood glucose control over the previous 2-3 months).

Owing to the aforementioned factors, the market is expected to grow during the forecast period.

Middle East And Africa Meglitinide Industry Overview

The meglitinides market is fragmented, with manufacturers like Novo Nordisk, Glenmark, and Novartis having a global market presence, and the market is highly competitive due to generic drug manufacturers' presence.Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Novo Nordisk

- Novartis

- Glenmark

- Boehringer Ingelheim

- Biocon

- Kissei Pharmaceuticals