Rigid Endoscopes: Introduction

Rigid endoscopes are medical devices used for visualizing and accessing internal body cavities and organs. They are designed with a rigid tube-like structure that contains optical systems, such as lenses and fiber optic cables, to transmit light and images. Rigid endoscopes are commonly used in various medical specialties, including urology, gynecology, orthopedics, ENT (ear, nose, and throat), and general surgery. The introduction of rigid endoscopes revolutionized minimally invasive procedures by providing healthcare professionals with a direct visual examination of the internal structures, enabling precise diagnosis and treatment. These devices offer high-resolution imaging, superior illumination, and a wide field of view, allowing for detailed visualization of tissues, organs, and anatomical abnormalities.Key Trends in the Global Rigid Endoscopes Market

Some key trends in the rigid endoscopes market include:

- Technological Advancements: The market is witnessing continuous advancements in endoscopic technologies, such as high-definition imaging systems, 3D visualization, and enhanced image processing algorithms. These advancements improve image quality, enhance visualization, and provide more accurate diagnostic information

- Miniaturization and Portability: There is a growing demand for smaller, more compact rigid endoscopes that offer better maneuverability and ease of use. Miniaturization enables access to challenging anatomical areas and allows for less invasive procedures

- Integration of Additional Features: Rigid endoscopes are increasingly being integrated with additional features such as video recording and documentation capabilities. This allows for better documentation of procedures, sharing of images and videos for educational purposes, and improved communication among healthcare professionals

- Disposable or Single-Use Endoscopes: The market is witnessing a rise in the demand for disposable or single-use endoscopes. These endoscopes eliminate the need for reprocessing, reducing the risk of cross-contamination and improving efficiency in healthcare settings

- Increasing Adoption in Emerging Economies: The adoption of rigid endoscopes is growing in emerging economies, driven by the increasing prevalence of chronic diseases, improving healthcare infrastructure, and rising awareness about minimally invasive procedures

- Specialized Endoscopes: There is a growing demand for specialized endoscopes designed for specific medical procedures. For example, specialized endoscopes for laparoscopy, arthroscopy, and neuroendoscopy offer enhanced visualization and improved surgical outcomes

Global Rigid Endoscopes Market Segmentations

Market Breakup Product Type- Laparoscopes

- Arthroscopes

- Ureteroscopes

- Cystoscopes

- Gynecology Endoscopes

- Neuroendoscopes

- Bronchoscopes

- Hysteroscopes

- Laryngoscopes

- Sinuscopes

- Otoscopes

- Sigmoidoscopes

- Pharygnoscopes

- Duodenoscopes

- Nasopharygnoscopes

- Rhinoscopes

- Others

Market Breakup by Applications

- Nose

- Urinary Bladder

- Abdomen

- Others

Market Breakup by End User

- Hospitals

- Clinics

- Diagnostic Centres

- Others

Market Breakup by Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

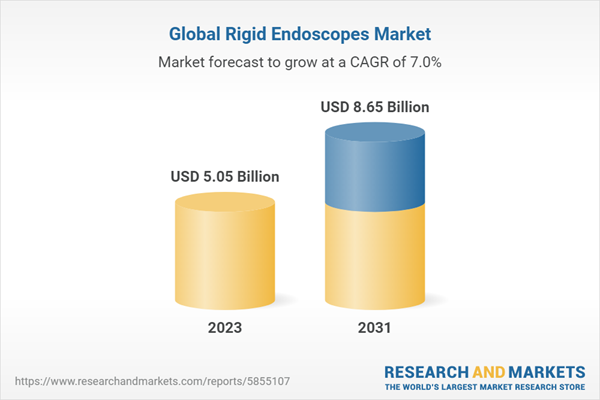

Global Rigid Endoscopes Market Scenario

The market for rigid endoscopes has experienced significant growth in recent years due to the increasing adoption of minimally invasive procedures and advancements in endoscopic technologies. Rigid endoscopes are widely used in various medical specialties, including urology, gastroenterology, gynecology, orthopedics, and otolaryngology, among others.Rigid endoscopes offer several advantages over traditional open surgeries, such as reduced invasiveness, shorter recovery times, lower risks of complications, and improved patient comfort. They enable healthcare professionals to visualize internal structures and perform diagnostic and therapeutic procedures with precision.

The market is characterized by intense competition among key players, leading to continuous innovations and technological advancements. Manufacturers are focusing on developing high-definition imaging systems, 3D visualization capabilities, and integration with additional features such as video recording and documentation. There is also a growing demand for disposable or single-use endoscopes, which eliminate the need for reprocessing and enhance infection control measures.

Geographically, the market for rigid endoscopes is expanding across various regions, with a particular emphasis on emerging economies. Factors such as improving healthcare infrastructure, rising healthcare expenditure, and growing awareness about minimally invasive procedures contribute to market growth in these regions.

In summary, the market for rigid endoscopes is witnessing significant growth due to the increasing preference for minimally invasive procedures, technological advancements, and the expanding application of endoscopy in various medical specialties. The market is highly competitive and characterized by continuous innovations to enhance image quality, functionality, and patient outcomes.

Global Rigid Endoscopes Market: Competitor Landscape

The key features of the market report include patent analysis, grants analysis, clinical trials analysis, funding and investment analysis, partnerships, and collaborations analysis by the leading key players. The major companies in the market are as follows:- B. Braun Melsungen AG

- CONMED Corp

- FUJIFILM Holdings Corp

- Integrated Endoscopy Inc

- KARL STORZ SE & Co. KG

- NeoScope Inc

- Olympus Corp

- Smith & Nephew Plc

- Stryker Corp

Table of Contents

Companies Mentioned

- B. Braun Melsungen AG

- CONMED Corp.

- FUJIFILM Holdings Corp.

- Integrated Endoscopy Inc.

- KARL STORZ SE & Co. KG

- NeoScope Inc.

- Olympus Corp.

- Smith & Nephew Plc.

- Stryker Corp.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 160 |

| Published | July 2023 |

| Forecast Period | 2023 - 2031 |

| Estimated Market Value ( USD | $ 5.05 Billion |

| Forecasted Market Value ( USD | $ 8.65 Billion |

| Compound Annual Growth Rate | 7.0% |

| Regions Covered | Global |

| No. of Companies Mentioned | 9 |