Atherectomy Devices: Introduction

Atherectomy devices are specialized medical devices used for the removal of atherosclerotic plaque from arteries. These devices employ various mechanisms to physically cut, shave, or vaporize the plaque build-up, restoring blood flow and improving vessel patency. Atherectomy devices offer several uses and benefits in the field of cardiovascular medicine.The uses of atherectomy devices include:

- Treatment of Peripheral Artery Disease (PAD): Atherectomy devices are primarily used in the treatment of peripheral artery disease, a condition characterized by the narrowing or blockage of arteries in the legs, arms, or other peripheral regions. These devices are employed to remove plaque and restore blood flow, alleviating symptoms such as leg pain, improving walking distance, and promoting wound healing in patients with critical limb ischemia

- Coronary Artery Disease Intervention: Atherectomy devices are also used in coronary artery interventions for the treatment of coronary artery disease. They can be employed to remove plaque from the coronary arteries, improving blood flow to the heart muscle and relieving symptoms such as chest pain (angina)

The benefits of atherectomy devices include:

- Improved Vessel Patency: Atherectomy devices help improve vessel patency by effectively removing plaque build-up and restoring blood flow. This can lead to symptom relief, improved limb function, and enhanced quality of life for patients with peripheral artery disease

- Minimally Invasive Approach: Atherectomy procedures are generally less invasive compared to surgical interventions such as bypass surgery. They involve smaller incisions or access points, reducing the risk of complications, minimizing recovery time, and allowing for quicker return to normal activities

- Preservation of Vessel Integrity: Atherectomy devices are designed to specifically target and remove plaque, minimizing damage to the arterial wall and preserving the structural integrity of the blood vessel. This reduces the risk of vessel injury, dissection, or perforation that may be associated with other treatment methods

- Potential for Combined Therapies: Atherectomy devices can be used in combination with other treatment modalities such as balloon angioplasty or stenting. This combination approach allows for optimal vessel preparation and can enhance the effectiveness of the overall intervention

- Individualized Treatment: Atherectomy devices offer versatility in terms of device selection and the ability to tailor treatment based on the specific characteristics of the lesion and the patient's condition. This individualized approach can improve treatment outcomes and patient satisfaction

Atherectomy devices Market Segmentations

The market can be categorised into type, application, end user, and region.Market Breakup by Type

- Directional Atherectomy Systems

- Orbital Atherectomy Systems

- Photo-ablative (Laser) Atherectomy Systems

- Rotational Atherectomy Systems

Market Breakup by Application

- Peripheral Vascular Applications

- Cardiovascular Applications

- Neurovascular Applications

Market Breakup by End User

- Hospitals and Surgical centres

- Ambulatory Care Centres

- Other End Users

Market Breakup by Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Atherectomy Devices Market Overview

The atherectomy devices market has experienced significant growth and is expected to continue expanding in the coming years. Several factors contribute to the positive market scenario.One of the primary drivers of market growth is the increasing prevalence of peripheral artery disease (PAD) and coronary artery disease (CAD) globally. These conditions, characterized by the narrowing or blockage of arteries, require effective treatment to restore blood flow and alleviate symptoms. Atherectomy devices play a crucial role in these interventions, as they provide a minimally invasive approach for plaque removal, improving vessel patency and patient outcomes.

Moreover, advancements in atherectomy technologies and techniques have contributed to market expansion. Manufacturers are developing innovative devices with improved cutting or ablation mechanisms, enhanced visualization capabilities, and better lesion crossing profiles. These advancements aim to improve procedural success rates, reduce procedure times, and minimize the risk of complications, thereby driving the adoption of atherectomy devices.

Furthermore, the growing preference for minimally invasive procedures and the increasing focus on outpatient care have stimulated market demand for atherectomy devices. Atherectomy procedures offer several advantages over traditional surgical interventions, including smaller incisions, reduced hospital stays, faster recovery times, and lower healthcare costs. These benefits have led to an increasing shift towards outpatient settings, where atherectomy devices can be utilized effectively.

Additionally, the rising geriatric population and the increasing prevalence of lifestyle-related risk factors, such as obesity and diabetes, contribute to market growth. These factors have led to a higher incidence of peripheral artery disease and coronary artery disease, necessitating the use of atherectomy devices for effective treatment. The aging population is more susceptible to these conditions, creating a larger patient pool for atherectomy procedures.

However, challenges such as the high cost of atherectomy devices, limited reimbursement coverage, and the requirement for specialized training and expertise in using these devices exist within the market. Addressing these challenges, along with increasing awareness among healthcare professionals and patients, improving reimbursement policies, and providing comprehensive training programs, will be crucial for sustained market growth.

In conclusion, the atherectomy devices market is expected to witness significant growth due to the increasing prevalence of peripheral artery disease and coronary artery disease, advancements in device technologies, and the preference for minimally invasive procedures. As the demand for effective plaque removal and improved patient outcomes continues to rise, there will be a focus on developing innovative atherectomy devices, expanding access to outpatient settings, and optimizing reimbursement strategies. Continued investment in research and development, regulatory compliance, and collaboration between healthcare providers and device manufacturers will shape the future of the atherectomy devices market.

Key Players in the global atherectomy devices market

The key features of the market report include patent analysis, grants analysis, clinical trials analysis, funding and investment analysis, partnerships, and collaborations analysis by the leading key players. The major companies in the atherectomy devices market are as follows:- Abbott Laboratories

- Boston Scientific Corporation

- BD

- Cardinal Health Inc

- Koninklijke Philips NV

- Medtronic Plc

- Terumo Corporation

- Avinger

- Cardiovascular Systems

- Ra Medical Systems

Table of Contents

Companies Mentioned

- Abbott Laboratories

- Boston Scientific Corporation

- BD

- Cardinal Health Inc.

- Koninklijke Philips NV,

- Medtronic Plc,

- Terumo Corporation,

- Avinger,

- Cardiovascular Systems,

- Ra Medical Systems

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 160 |

| Published | June 2023 |

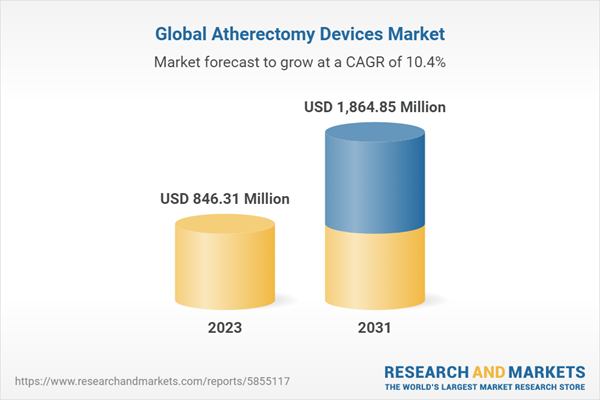

| Forecast Period | 2023 - 2031 |

| Estimated Market Value ( USD | $ 846.31 Million |

| Forecasted Market Value ( USD | $ 1864.85 Million |

| Compound Annual Growth Rate | 10.3% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |