Aircraft tyres are available in two types: tube-type and tubeless. These tyres are designed to withstand high speeds, heavy loads, and extreme operating conditions of aviation, such as take-off, landing, and taxiing. Aircraft tyres are engineered with a significantly higher degree of deflection compared to automobile tyres. This intentional design feature enables them to effectively manage the high forces generated during landings without incurring damage. To improve the performance and durability of aircraft tyres, manufacturers use materials, such as carbon fiber, steel, and natural rubber. Carbon fiber is a strong, lightweight material that offers a number of benefits for aircraft tyres, including Enhanced resistance to wear and tear, Increased load capacity, and improved fuel efficiency. The global market for aircraft tyres is being driven by a consistent rise in the global commercial aircraft fleet. The airline companies are focusing on expansion of their aircraft fleets as the demand for air travel grows. As the aircraft fleet grow, the demand for tyres used in these aircraft is also expected thus boosting the growth of the market.

Commercial aviation tyre is expected to dominate the application segment of the Aircraft Tyre Market. The demand for commercial aviation tyres is growing due to the rising commercial aircraft fleet. Commercial air operations are on the rise due to increasing air passenger traffic around the globe. The main factor driving this growth is the growth of the economy and population. The growing middle-class population is driving air travel demand globally. The availability of low-cost airlines has made air travel more affordable for the middle class, leading to a significant increase in the number of air passengers in recent years. This has increased the frequency of flights, which in turn has increased the need for tyre replacements for commercial aircraft. As a result, the commercial aviation aircraft tyre market is expected to grow.

Among these areas, North America is anticipated to dominate the market for the duration of the forecast. With a revenue of more than USD 900 million in 2022 and an anticipated increase to more than USD 1,400 million by 2030, North America now owned more than 50% of the worldwide market share. With more than 70% of the region's market, the United States maintained the largest share within North America. The U.S. earned more than USD 600 million in income in 2022, and by the end of the forecast period, it is anticipated to exceed USD 1,000 million. The existence of large aircraft producers in the North American region, such as Boeing and Bombardier, leads to a sizable demand for aircraft tyres, which acts as a driving force in the market. As two of the world's biggest producers of aircraft, their operations create a sizable need for high-quality aeroplane tyres. This demand in North America is a driving force behind the expansion and development of the region's aircraft tyre market. The aviation tyre market is expanding the quickest in the Asia-Pacific region, with a compound annual growth rate (CAGR) of more than 5%. With more than 30% of the market share, China is predicted to dominate the Asia-Pacific area.

Report Findings

1) Drivers

- Continuous expansion of airline fleet, increasing fleet replacement and retirement is driving the aircraft tire market growth.

- Advancements in tire manufacturing technologies to improve performance and durability of aircraft tires drives the market.

2) Restraints

- Fluctuations in the availability of raw materials may restrain the growth of the market.

3) Opportunities

- Development of new lightweight materials used for manufacturing aircraft tires are expected to offer new growth opportunities.

Research Methodology

A) Primary Research

The primary research involves extensive interviews and analysis of the opinions provided by the primary respondents. The primary research starts with identifying and approaching the primary respondents, the primary respondents are approached include1. Key Opinion Leaders

2. Internal and External subject matter experts

3. Professionals and participants from the industry

The primary research respondents typically include

1. Executives working with leading companies in the market under review2. Product/brand/marketing managers

3. CXO level executives

4. Regional/zonal/country managers

5. Vice President level executives.

B) Secondary Research

Secondary research involves extensive exploring through the secondary sources of information available in both the public domain and paid sources. Each research study is based on over 500 hours of secondary research accompanied by primary research. The information obtained through the secondary sources is validated through the crosscheck on various data sources.The secondary sources of the data typically include

1. Company reports and publications2. Government/institutional publications

3. Trade and associations journals

4. Databases such as WTO, OECD, World Bank, and among others.

5. Websites and publications by research agencies

Segment Covered

The global aircraft tyre market is segmented on the basis of product type, platform, and end user.The Global Aircraft Tyre Market by Product Type

- Radial

- Bias

The Global Aircraft Tyre Market by Platform

- Fixed Wing

- Rotary

The Global Aircraft Tyre Market by End User

- Commercial Aviation

- Military and Defense Aviation

- General Aviation

Company Profiles

The companies covered in the report include- The Goodyear Tire & Rubber Company

- Bridgestone India Private Ltd.

- Dunlop Aircraft Tyres Limited

- MICHELIN

- Desser Holdings LLC

- Beringer Aero

- STOMIL-POZNAŃ SA

- Petlas

- Specialty Tires of America, Inc.

- Qingdao Sentury Tire Co.Ltd

What does this Report Deliver?

1. Comprehensive analysis of the global as well as regional markets of the aircraft tyre market.2. Complete coverage of all the segments in the aircraft tyre market to analyze the trends, developments in the global market and forecast of market size up to 2030.

3. Comprehensive analysis of the companies operating in the global aircraft tyre market. The company profile includes analysis of product portfolio, revenue, SWOT analysis and latest developments of the company.

4. Growth Matrix presents an analysis of the product segments and geographies that market players should focus to invest, consolidate, expand and/or diversify.

Table of Contents

Companies Mentioned

- The Goodyear Tire & Rubber Company

- Bridgestone India Private Ltd.

- Dunlop Aircraft Tyres Limited

- MICHELIN

- Desser Holdings LLC

- Beringer Aero

- STOMIL-POZNAŃ SA

- Petlas

- Specialty Tires of America, Inc.

- Qingdao Sentury Tire Co.Ltd

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 255 |

| Published | July 2023 |

| Forecast Period | 2022 - 2030 |

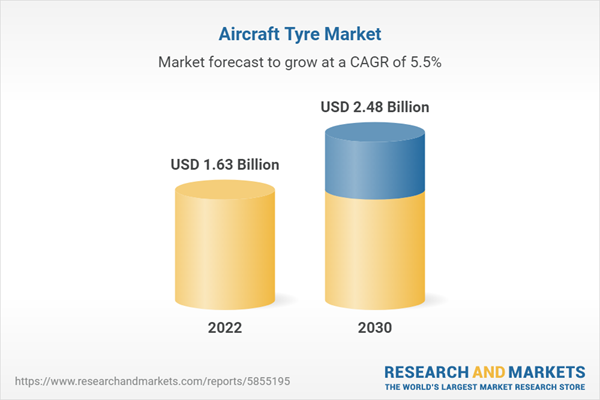

| Estimated Market Value ( USD | $ 1.63 Billion |

| Forecasted Market Value ( USD | $ 2.48 Billion |

| Compound Annual Growth Rate | 5.4% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |