Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Key Market Drivers

Rising Incidence of Chronic and Acute Wounds

The growth of the Global Skin Substitutes Market is significantly driven by the increasing prevalence of both chronic and acute wounds. This trend presents considerable clinical and economic impacts, establishing skin substitutes as vital tools in advanced wound care. Chronic conditions like diabetic foot ulcers, pressure sores, and venous leg ulcers are on the rise, especially among elderly patients and those with diabetes, obesity, or vascular disorders. It is estimated that 15% to 34% of diabetic individuals may experience diabetic foot ulcers during their lifetime, indicating a substantial need for specialized wound care. These wounds often persist or recur, necessitating long-term treatment where skin substitutes can accelerate healing and reduce complications. With global prevalence rates of chronic wounds ranging from 1.51 to 2.21 per 1,000 people, the demand for advanced skin replacement therapies is consistent, fueling investment and innovation in this segment.Key Market Challenges

High Cost of Skin Substitute Products and Limited Reimbursement in Emerging Markets

The elevated costs of bioengineered or cellular-based skin substitutes, stemming from complex production processes and regulatory demands, pose a major barrier to widespread adoption. While cost-effectiveness may be justified in developed regions, price sensitivity in emerging markets restricts accessibility. In many low- and middle-income countries, healthcare budgets are limited and insurance coverage is inadequate, hindering the adoption of high-cost therapies. Even in wealthier nations, restricted reimbursement policies - especially for outpatient use - limit market penetration. Consequently, manufacturers must demonstrate strong clinical and economic benefits to secure coverage, which can slow the pace of adoption and market growth, particularly in Asia-Pacific, Latin America, and Eastern Europe.Key Market Trends

3D Bioprinting and Personalized Medicine

Technological advancements such as 3D bioprinting, stem cell engineering, and genomic profiling are transforming the skin substitute market. 3D bioprinting allows for the creation of patient-specific skin grafts that align with the wound’s shape and tissue structure, enhancing integration and recovery. Personalized medicine enables customization of skin substitutes based on a patient’s unique biology, improving therapeutic outcomes. Companies adopting AI-driven modeling and innovative biomaterials are setting new standards for product efficacy. This trend is drawing investor interest and academic partnerships, accelerating commercialization and enabling premium product positioning.Key Market Players

- Amarantus BioScience Holdings, Inc

- Organogenesis Inc.

- Smith+Nephew

- Integra LifeSciences Corporation

- BSN Medical GmbH

- Molnlycke Health Care ABss

- Medtronic Plc

- Tissue Regenix Ltd.

- Stratatech Corporation

Report Scope:

In this report, the Global Skin Substitutes Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Skin Substitutes Market, By Type:

- Biological

- Synthetic

Skin Substitutes Market, By Application:

- Acute Wounds

- Chronic Wounds

Skin Substitutes Market, By End User:

- Hospitals & Clinics

- Ambulatory Surgery Centers

- Others

Skin Substitutes Market, By Region:

- North America

- United States

- Canada

- Mexico

- Europe

- France

- United Kingdom

- Italy

- Germany

- Spain

- Asia-Pacific

- China

- India

- Japan

- Australia

- South Korea

- South America

- Brazil

- Argentina

- Colombia

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Skin Substitutes Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Amarantus BioScience Holdings, Inc

- Organogenesis Inc.

- Smith+Nephew

- Integra LifeSciences Corporation

- BSN Medical GmbH

- Molnlycke Health Care ABss

- Medtronic Plc

- Tissue Regenix Ltd.

- Stratatech Corporation

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 180 |

| Published | May 2025 |

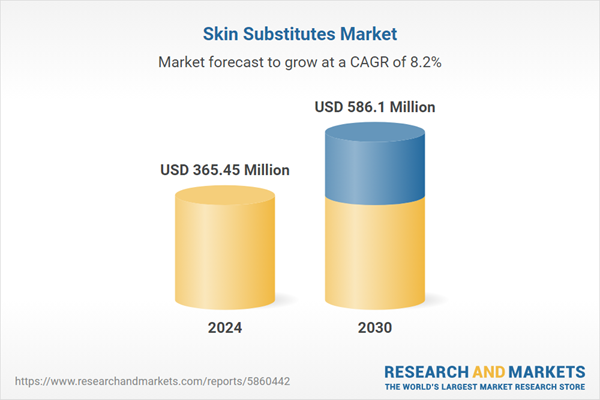

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 365.45 Million |

| Forecasted Market Value ( USD | $ 586.1 Million |

| Compound Annual Growth Rate | 8.1% |

| Regions Covered | Global |

| No. of Companies Mentioned | 9 |