Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Bioprocess containers serve as a cost-efficient and reliable alternative to traditional stainless-steel systems in drug manufacturing. Their single-use design offers flexibility, reduces contamination risk, and minimizes cleaning requirements. These containers are increasingly favored in biomanufacturing due to their scalability and operational efficiency. Recent developments have also seen the integration of smart sensors and IoT-based functionalities, further enhancing process monitoring and control within bioprocessing environments.

Key Market Drivers

Expansion of Biopharmaceutical R&D and Personalized Medicine

The growing investment in biopharmaceutical research and personalized medicine is a major driver fueling demand for bioprocess containers. These containers, particularly single-use systems, offer key advantages such as reduced contamination risk, scalability, and operational flexibility - features essential for the evolving needs of biopharmaceutical production.Significant funding initiatives are supporting this trend. In 2024, the U.S. National Institutes of Health (NIH) allocated over $47 billion to medical research, focusing on gene therapies and personalized treatments. Likewise, the European Union's Horizon Europe program earmarked €95.5 billion for innovation and health research between 2021 and 2027.

These investments are catalyzing the development of complex biologics, including monoclonal antibodies, cell therapies, and vaccines. Bioprocess containers play a vital role in this space, offering sterile, disposable solutions that help accelerate production timelines and reduce cross-contamination, thus supporting the efficient delivery of personalized medical solutions.

Key Market Challenges

Environmental Concerns and Waste Management

Despite operational advantages, the single-use nature of bioprocess containers presents a significant environmental challenge due to the generation of plastic-based biomedical waste. The disposal of these materials raises sustainability concerns across the biopharmaceutical industry.Global regulatory bodies are placing increased emphasis on sustainable manufacturing. For example, the European Union has enacted directives to reduce plastic waste and promote recyclable or biodegradable alternatives. In the United States, the Environmental Protection Agency (EPA) is driving initiatives to manage plastic waste and encourage eco-friendly practices.

However, recycling bioprocess containers remains complex due to contamination risks and material limitations. The lack of standardized disposal protocols and viable recycling infrastructure makes it difficult for manufacturers to meet environmental compliance goals. As a result, the market faces mounting pressure to develop innovative materials and waste mitigation strategies that align with growing sustainability expectations.

Key Market Trends

Integration of Smart Technologies and IoT

The incorporation of smart technologies and IoT into bioprocess containers is transforming modern biomanufacturing. Smart containers equipped with real-time sensors and digital connectivity are enabling manufacturers to monitor critical process parameters such as temperature, pH, and pressure with high precision.Governmental support for digital innovation in manufacturing is reinforcing this trend. The U.S. Department of Commerce’s NIST and the European Commission’s Industry 5.0 initiative both promote the adoption of intelligent systems to enhance industrial efficiency and adaptability.

This movement aligns with the broader evolution toward Industry 4.0, where automation, data analytics, and machine-to-machine communication are key drivers of operational excellence. Smart bioprocess containers enable predictive maintenance, improve traceability, reduce downtime, and support regulatory compliance - collectively enhancing product quality and manufacturing efficiency.

Key Market Players

- Thermo Fisher Scientific Inc.

- Danaher Corporation

- Saint-Gobain Group

- Lonza Group AG

- Avantor Funding Inc.

- Merck KGaA

- Sartorius AG

- CellBios Healthcare and Lifesciences Pvt Ltd.

- Cole-Parmer Instrument Co.

- Biomass Ventures Pte Ltd.

Report Scope:

In this report, the Global Bioprocess Containers Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Bioprocess Containers Market, By Type of Containers:

- 2D Bioprocess Containers

- 3D Bioprocess Containers

- Other Containers and Accessories

Bioprocess Containers Market, By Application:

- Upstream Process

- Downstream Process

- Process Development

Bioprocess Containers Market, By End Users:

- Biopharmaceutical Companies

- Life Science R&D Companies

- Others

Bioprocess Containers Market, By Region:

- North America

- United States

- Mexico

- Canada

- Europe

- France

- Germany

- United Kingdom

- Italy

- Spain

- Asia-Pacific

- China

- India

- South Korea

- Japan

- Australia

- South America

- Brazil

- Argentina

- Colombia

- Middle East and Africa

- South Africa

- Saudi Arabia

- UAE

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Bioprocess Containers Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Thermo Fisher Scientific Inc.

- Danaher Corporation

- Saint-Gobain Group

- Lonza Group AG

- Avantor Funding Inc.

- Merck KGaA

- Sartorius AG

- CellBios Healthcare and Lifesciences Pvt Ltd.

- Cole-Parmer Instrument Co.

- Biomass Ventures Pte Ltd.

Table Information

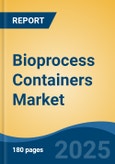

| Report Attribute | Details |

|---|---|

| No. of Pages | 180 |

| Published | July 2025 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 4.68 Billion |

| Forecasted Market Value ( USD | $ 15.87 Billion |

| Compound Annual Growth Rate | 22.5% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |