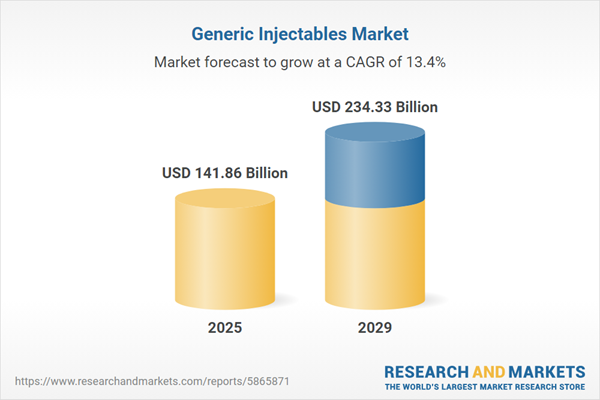

The generic injectables market size is expected to see rapid growth in the next few years. It will grow to $234.33 billion in 2029 at a compound annual growth rate (CAGR) of 13.4%. The growth in the forecast period can be attributed to the increasing aging population, strategic alliances, regulatory changes, rising healthcare awareness, and market innovation. Major trends in the forecast period include a focus on quality and regulatory compliance, adoption of the 505 (b) (2) regulatory pathway, development of novel drug delivery technologies, collaborations and partnerships in the industry, and increased focus on specialty injectable therapies.

The forecast of 13.4% growth over the next five years reflects a modest reduction of 0.2% from the previous estimate for this market. This reduction is primarily due to the impact of tariffs between the US and other countries. Trade tensions may burden U.S. hospital pharmacies by inflating costs of sterile vial filling components and intravenous solution bags imported from Brazil and Spain, raising medication shortage risks and acute care treatment expenses. The effect will also be felt more widely due to reciprocal tariffs and the negative effect on the global economy and trade due to increased trade tensions and restrictions.

The generic injectables market size is expected to see rapid growth in the next few years. It will grow to $209.47 billion in 2028 at a compound annual growth rate (CAGR) of 13.6%. Anticipated growth in the forecast period is expected due to various factors, notably the expanding aging population, strategic alliances between industry players, regulatory shifts, heightened awareness about healthcare, and a surge in market innovation.

The anticipated increase in cancer and cardiovascular diseases is set to drive the growth of the generic injectable market. Cancer, characterized by uncontrolled cell growth, and cardiovascular diseases affecting the heart and blood vessels are prevalent health concerns. Generic injectables play a vital role in treating these conditions by offering pharmaceutical equivalence to brand-name drugs. In 2022, approximately 74% of the 41 million global deaths attributed to noncommunicable diseases (NCDs) were due to cardiovascular diseases (17.9 million deaths) and cancer (9.3 million deaths). The availability of these injectables enhances treatment accessibility and affordability, contributing to the market's growth.

The expanding population of elderly individuals is expected to fuel the growth of the generic injectables market. As populations age due to increased life expectancy and declining fertility rates, the demand for generic injectables rises. These pharmaceuticals are commonly used in managing health conditions prevalent among older individuals, such as diabetes, cardiovascular diseases, and osteoporosis. For instance, projections indicate that by 2041, Australia's population aged 65 and above will grow by 54% to 6.66 million from an estimated 4.31 million in 2021. This demographic shift drives the demand for generic injectables catering to the healthcare needs of aging populations.

Product innovation emerges as a prominent trend shaping the generic injectables market. Key players in this market focus on advancing generic injectables to maintain competitiveness. In April 2022, Dr. Reddy’s Laboratories, an Indian pharmaceutical company, introduced Treprostinil Injection in the U.S. market. This injection, approved by the U.S. Food and Drug Administration (USFDA), serves as a therapeutic equivalent generic version of Remodulin (treprostinil) Injection. It facilitates a smooth transition for patients requiring a shift from epoprostenol, aiding in the reduction of clinical deterioration.

Major companies in the generic injectables market are forging strategic partnerships and collaborations to fortify their market position. These partnerships, aimed at achieving specific business objectives, play a pivotal role in sustaining market presence. For example, in December 2023, ITAAN Pharma, a Canadian pharmaceutical company specializing in injectable medications, collaborated with ACIC Pharmaceuticals, also based in Canada. This strategic alliance aims to jointly develop generic injectables targeting the North American market, leveraging the strengths of both entities for mutual growth and success.

In April 2022, Hikma Pharmaceuticals PLC, a US-based biopharmaceutical firm, completed the acquisition of Custopharm Inc for $425 million. This strategic move by Hikma is geared towards broadening its portfolio of injectable medications while bolstering its research and development capabilities. Custopharm, also based in the US, specializes in generic pharmaceutical products, notably in the realm of generic injectables, aligning well with Hikma's objectives for portfolio expansion and R&D advancement.

Note that the outlook for this market is being affected by rapid changes in trade relations and tariffs globally. The report will be updated prior to delivery to reflect the latest status, including revised forecasts and quantified impact analysis. The report’s Recommendations and Conclusions sections will be updated to give strategies for entities dealing with the fast-moving international environment.

The sudden escalation of U.S. tariffs and the resulting trade tensions in spring 2025 are having a significant impact on the pharmaceutical sector. Companies are grappling with higher costs on imported active pharmaceutical ingredients (APIs), glass vials, and laboratory equipment - many of which have limited alternative sources. Generic drug manufacturers, already operating with minimal profit margins, are particularly affected, with some scaling back production of low-margin medications. Biotech firms are also experiencing delays in clinical trials due to shortages of specialized reagents linked to tariffs. In response, the industry is shifting API production to regions like India and Europe, building up inventory reserves, and advocating for tariff exemptions on essential medicines.

These injectables are packaged in various containers such as vials, ampoules, premix solutions, and prefilled syringes. Their administration involves different routes such as intravenous, intramuscular, subcutaneous, and others. These medications are distributed through channels including hospital pharmacies, retail pharmacies, drug stores, and online prescription outlets. They serve diverse medical conditions spanning oncology, diabetes, infectious diseases, blood disorders, musculoskeletal disorders, hormonal disorders, pain management, central nervous system (CNS) ailments, and cardiovascular diseases.

Generic injectables, also known as sterile injectables, are medications identical in dosage, strength, performance, intended use, potential side effects, and method of administration to branded injectables. These drugs demonstrate bioequivalence, ensuring they function in the same way as their brand-name counterparts, delivering equivalent therapeutic benefits.

Within the realm of generic injectables, diverse categories exist, including monoclonal antibodies, cytokines, insulin, vaccines, and more. Monoclonal antibodies, for instance, are artificial proteins mirroring natural antibodies in the human body. They find application in treating various conditions such as breast cancer, leukemia, asthma, macular degeneration, arthritis, Crohn's disease, and transplant-related issues.

Major companies operating in the generic injectables market include Baxter International Inc., Sanofi SA, AstraZeneca plc., Fresenius Medical Care AG & Co. KGaA, Johnson & Johnson, Merck & Co. Inc., Biocon Limited, Lupin Limited, Dr. Reddy's Laboratories Ltd., Teva Pharmaceutical Industries Ltd., Cipla Limited, Aurobindo Pharma Limited, Samsung Biologics Co. Ltd., Piramal Pharma Limited, Bristol-Myers Squibb Company, Pfizer Inc., Hikma Pharmaceuticals PLC, Par Pharmaceutical, Pharmascience Inc., SAGENT Pharmaceuticals, AmerisourceBergen Corporation, Hospira Inc., Sandoz International GmbH, Singota Solutions Inc., MVASI Bevacizumab-awwb Syringes, Mylan N.V., Sun Pharmaceutical Industries Ltd., Endo International plc, Akorn Pharmaceuticals Inc., Wockhardt Limited.

North America was the largest region in the generic injectable market in 2024. Asia-Pacific is expected to be the fastest-growing region in the forecast period. The regions covered in the generic injectables market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa. The countries covered in the generic injectables market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Canada, Italy, Spain.

The generic injectables market consists of sales of drug solutions, dry solid injectables, drug solids suspended in a liquid medium, drug suspension for injection, drug emulsions, and biological injectables. Values in this market are ‘factory gate’ values, that is the value of goods sold by the manufacturers or creators of the goods, whether to other entities (including downstream manufacturers, wholesalers, distributors, and retailers) or directly to end customers. The value of goods in this market includes related services sold by the creators of the goods.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 1-3 business days.

Table of Contents

Executive Summary

Generic Injectables Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on generic injectables market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as geopolitical conflicts, trade policies and tariffs, post-pandemic supply chain realignment, inflation and interest rate fluctuations, and evolving regulatory landscapes.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for generic injectables? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward, including technological disruption, regulatory shifts, and changing consumer preferences? The generic injectables market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include: the technological advancements such as AI and automation, Russia-Ukraine war, trade tariffs (government-imposed import/export duties), elevated inflation and interest rates.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) By Product Type: Monoclonal Antibodies; Cytokines; Insulin; Vaccines; Other Products2) By Container Type: Vials; Ampoules; Premix; Prefilled Syringes; Other Containers

3) By Route of Administration: Intravenous; Intramuscular; Subcutaneous; Other Routes of Administration

4) By Distribution Channel: Hospital Pharmacy; Retail Pharmacy; Drug Stores; Online Prescription Stores

5) By Application: Oncology; Diabetes ; Infectious Diseases ; Blood Disorders ; Musculoskeletal Disorders ; Hormonal Disorders ; Pain Management ; CNS Diseases ; Cardiovascular Diseases

Subsegments:

1) By Monoclonal Antibodies: IgG Monoclonal Antibodies; IgM Monoclonal Antibodies; Other Types of Monoclonal Antibodies2) By Cytokines: Interferons; Interleukins; Tumor Necrosis Factor (TNF) Inhibitors

3) By Insulin: Rapid-Acting Insulin; Long-Acting Insulin; Combination Insulin

4) By Vaccines: Inactivated Vaccines; Live Attenuated Vaccines; Recombinant Vaccines

5) By Other Products: Hormones; Peptides; Enzymes

Companies Mentioned: Baxter International Inc.; Sanofi SA; AstraZeneca plc.; Fresenius Medical Care AG & Co. KGaA; Johnson & Johnson; Merck & Co. Inc.; Biocon Limited; Lupin Limited; Dr. Reddy's Laboratories Ltd.; Teva Pharmaceutical Industries Ltd.; Cipla Limited; Aurobindo Pharma Limited; Samsung Biologics Co. Ltd.; Piramal Pharma Limited; Bristol-Myers Squibb Company; Pfizer Inc.; Hikma Pharmaceuticals PLC; Par Pharmaceutical; Pharmascience Inc.; SAGENT Pharmaceuticals; AmerisourceBergen Corporation; Hospira Inc.; Sandoz International GmbH; Singota Solutions Inc.; MVASI Bevacizumab-awwb Syringes; Mylan N.V.; Sun Pharmaceutical Industries Ltd.; Endo International plc; Akorn Pharmaceuticals Inc.; Wockhardt Limited

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

The companies featured in this Generic Injectables market report include:- Baxter International Inc.

- Sanofi SA

- AstraZeneca plc.

- Fresenius Medical Care AG & Co. KGaA

- Johnson & Johnson

- Merck & Co. Inc.

- Biocon Limited

- Lupin Limited

- Dr. Reddy's Laboratories Ltd.

- Teva Pharmaceutical Industries Ltd.

- Cipla Limited

- Aurobindo Pharma Limited

- Samsung Biologics Co. Ltd.

- Piramal Pharma Limited

- Bristol-Myers Squibb Company

- Pfizer Inc.

- Hikma Pharmaceuticals PLC

- Par Pharmaceutical

- Pharmascience Inc.

- SAGENT Pharmaceuticals

- AmerisourceBergen Corporation

- Hospira Inc.

- Sandoz International GmbH

- Singota Solutions Inc.

- MVASI Bevacizumab-awwb Syringes

- Mylan N.V.

- Sun Pharmaceutical Industries Ltd.

- Endo International plc

- Akorn Pharmaceuticals Inc.

- Wockhardt Limited

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 250 |

| Published | September 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 141.86 Billion |

| Forecasted Market Value ( USD | $ 234.33 Billion |

| Compound Annual Growth Rate | 13.4% |

| Regions Covered | Global |

| No. of Companies Mentioned | 31 |