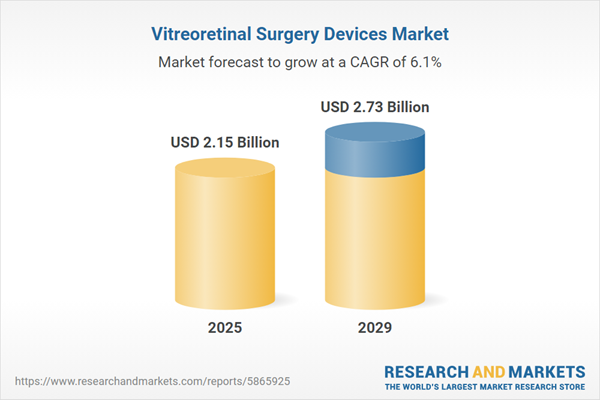

The vitreoretinal surgery devices market size is expected to see strong growth in the next few years. It will grow to $2.73 billion in 2029 at a compound annual growth rate (CAGR) of 6.1%. The growth in the forecast period can be attributed to continuous growth in aging demographics, increasing burden of retinal diseases, advancements in surgical instrumentation, growing diabetes epidemic, expansion of healthcare infrastructure. Major trends in the forecast period include focus on retinal imaging technologies, advancements in intraocular tamponades, innovations in laser systems, customization and patient-specific approaches, integration of artificial intelligence.

The anticipated growth in the vitreoretinal surgery device market is expected to be driven by the increasing incidences of eye disorders. Eye disorders encompass a range of non-neoplastic or neoplastic conditions affecting the eye. Vitreoretinal surgery devices are instrumental in treating various eye diseases such as macular degeneration, cataracts, diabetes-related retinopathy, glaucoma, and retinal detachment. As of December 2022, the Centers for Disease Control and Prevention reported that in the United States, approximately 12 million individuals aged 40 and older would experience vision impairment. Among them, 1 million are blind, 3 million have impairment after correcting their vision, and 8 million have it due to uncorrected refractive error. Hence, the increasing incidence of eye disorders is a significant driver for the vitreoretinal surgery device market.

The surge in minimally invasive surgeries is poised to contribute to the growth of the vitreoretinal surgery devices market. Minimally invasive surgeries (MIS) involve medical procedures aimed at achieving therapeutic effects while minimizing trauma to the body. In the context of vitreoretinal surgeries, these devices play a vital role by enabling precise interventions within the eye through small incisions. Such advanced devices enhance visualization, facilitate delicate procedures, and contribute to faster recovery times. For example, as of October 2023, the Organization for Economic Co-operation and Development reported an 8.4% increase in cataract surgical procedures in the Czech Republic, with a total of 142,670 procedures in 2022 compared to 131,612 in 2021. This trend underscores the growing number of minimally invasive surgeries, driving the demand for vitreoretinal surgery devices.

A notable trend gaining traction in the vitreoretinal surgery device market is product innovation, with companies within the sector actively working on introducing new products to maintain their competitive positions. In August 2022, Sight Sciences, a US-based ophthalmology company, introduced the SION Surgical Instrument, a groundbreaking bladeless device utilized in goniotomy procedures. This innovative device, known for its distinctive bladeless design, marks a significant advancement in goniotomy practices. The SION Surgical Instrument is a sterile, single-use, manually operated device designed for ophthalmic surgical procedures, specifically for excising trabecular meshwork.

Major players in the vitreoretinal surgery device market are engaging in strategic partnerships to foster collaboration for the development of novel technologies. In November 2022, Corza Ophthalmology, a Switzerland-based ophthalmic device company, collaborated with Vortex Surgical to enter the vitreoretinal surgical space. This collaborative effort aims to cater to the vitreoretinal surgical community by combining Corza Ophthalmology's portfolio of high-quality brands - such as Katana instruments, Sharpoint microsurgical knives, and Blink single-use instruments - with Vortex Surgical's innovative line of vitreoretinal instrumentation. Vortex Surgical, based in the US, specializes in designing and developing surgical instruments, particularly focusing on products for vitreoretinal surgery.

In October 2022, DORC Dutch Ophthalmic Research Center (International) BV, a Netherlands-based medical device manufacturer, acquired Peregrine Surgical LLC and WEFIS GmbH for an undisclosed amount. This acquisition served to enhance DORC's manufacturing capabilities, aligning with the strategic goal of securing the #2 position in the US retina market and advancing the development of laser and illumination technologies. Peregrine Surgical LLC, a US-based medical device manufacturer, specializes in devices used in vitreoretinal surgeries, while WEFIS GmbH, based in Germany, is a manufacturer of vitreoretinal surgical instruments.

Major companies operating in the vitreoretinal surgery devices market include Alcon Inc., Bausch & Lomb Inc., OCULUS Optikgerate GmbH, MedOne Surgical Inc., Carl Zeiss Meditec AG, Peregrine Surgical Group Pvt. Ltd., D.O.R.C. Dutch Ophthalmic Research Center B.V., Paragon Care Group Pvt. Ltd., Topcon Corporation, Geuder AG, IRIDEX Corporation, Ellex Medical Lasers, Erbe Elektromedizin, Design For Vision Inc., BVI Medical Inc., Allen Medical Systems, Abbott Laboratories, Medtronic plc, Mediland Enterprise Co., Sunnex MedicaLights, Stars Medical Devices, Smith & Nephew plc, Inami & Co. Ltd., Novartis AG, Katradis Marine Ropes Ind. S.A., Tufropes Pvt. Ltd., Hoya Corporation.

North America was the largest region in the vitreoretinal surgery devices market in 2024. Asia-Pacific is expected to be the fastest-growing region in the global vitreoretinal surgery devices market report during the forecast period. The regions covered in the vitreoretinal surgery devices market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa. The countries covered in the vitreoretinal surgery devices market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Canada, Italy, Spain.

Vitreoretinal surgery devices are specialized medical instruments that typically incorporate a peristaltic pump, a venturi pump, or a combination of both to manage fluids. They play a crucial role in core vitrectomy removal, membrane cutting, and addressing hyaloid and vitreous bases during surgical procedures. These vitreoretinal surgical instruments are designed with enhanced flow control features, aiming to minimize retinal traction.

The primary product types within the vitreoretinal surgery devices category include photocoagulation lasers, illumination devices, vitrectomy machines, vitrectomy probes, vitreoretinal packs, and others. Photocoagulation lasers are medical devices utilized to either shrink or eliminate abnormal structures in the retina. Surgical approaches encompass both anterior vitreoretinal surgery and posterior vitreoretinal surgery, addressing applications such as diabetic vitreous hemorrhage, retinal detachment, macular hole, among others. These devices find application across various end-users, including hospitals, specialty clinics, ambulatory surgery centers, and others.

The vitreoretinal surgery devices market research report is one of a series of new reports that provides vitreoretinal surgery devices market statistics, including vitreoretinal surgery devices industry global market size, regional shares, competitors with a vitreoretinal surgery devices market share, detailed vitreoretinal surgery devices market segments, market trends, and opportunities, and any further data you may need to thrive in the vitreoretinal surgery devices industry. This vitreoretinal surgery devices market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenario of the industry.

The vitreoretinal surgery devices market consists of sales squeezers, luer locks, forceps, and surgical instruments. Values in this market are ‘factory gate’ values, that is the value of goods sold by the manufacturers or creators of the goods, whether to other entities (including downstream manufacturers, wholesalers, distributors, and retailers) or directly to end customers. The value of goods in this market includes related services sold by the creators of the goods.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

Vitreoretinal Surgery Devices Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on vitreoretinal surgery devices market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for vitreoretinal surgery devices? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The vitreoretinal surgery devices market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include:

- The forecasts are made after considering the major factors currently impacting the market. These include the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) By Product: Photocoagulation Lasers; Illumination Devices; Vitrectomy Machines; Vitrectomy Probes; Vitreoretinal Packs; Other Products2) By Surgery: Anterior Vitreoretinal Surgery; Posterior Vitreoretinal Surgery

3) By Application: Diabetic Vitreous Hemorrhage; Retinal Detachment; Macular Hole; Other Applications

4) By End-Users: Hospitals; Specialty Clinics; Ambulatory Surgery Centers; Other End-Users

Subsegments:

1) By Photocoagulation Lasers: Argon Lasers; Diode Lasers; Solid-State Lasers2) By Illumination Devices: Fiber Optic Illumination Devices; LED Illumination Devices; Halogen Illumination Devices

3) By Vitrectomy Machines: 20-Gauge Vitrectomy Systems; 23-Gauge Vitrectomy Systems; 25-Gauge Vitrectomy Systems

4) By Vitrectomy Probes: Single-Use Vitrectomy Probes; Multi-Use Vitrectomy Probes

5) By Vitreoretinal Packs: Single-Use Vitreoretinal Packs; Multi-Use Vitreoretinal Packs

6) By Other Products: Surgical Instruments; Fluid Management Systems; Scleral Buckles

Key Companies Mentioned: Alcon Inc.; Bausch & Lomb Inc.; OCULUS Optikgerate GmbH; MedOne Surgical Inc.; Carl Zeiss Meditec AG

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

- Alcon Inc.

- Bausch & Lomb Inc.

- OCULUS Optikgerate GmbH

- MedOne Surgical Inc.

- Carl Zeiss Meditec AG

- Peregrine Surgical Group Pvt. Ltd.

- D.O.R.C. Dutch Ophthalmic Research Center B.V.

- Paragon Care Group Pvt. Ltd.

- Topcon Corporation

- Geuder AG

- IRIDEX Corporation

- Ellex Medical Lasers

- Erbe Elektromedizin

- Design For Vision Inc.

- BVI Medical Inc.

- Allen Medical Systems

- Abbott Laboratories

- Medtronic plc

- Mediland Enterprise Co.

- Sunnex MedicaLights

- Stars Medical Devices

- Smith & Nephew plc

- Inami & Co. Ltd.

- Novartis AG

- Katradis Marine Ropes Ind. S.A.

- Tufropes Pvt. Ltd.

- Hoya Corporation

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 200 |

| Published | February 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 2.15 Billion |

| Forecasted Market Value ( USD | $ 2.73 Billion |

| Compound Annual Growth Rate | 6.1% |

| Regions Covered | Global |

| No. of Companies Mentioned | 27 |