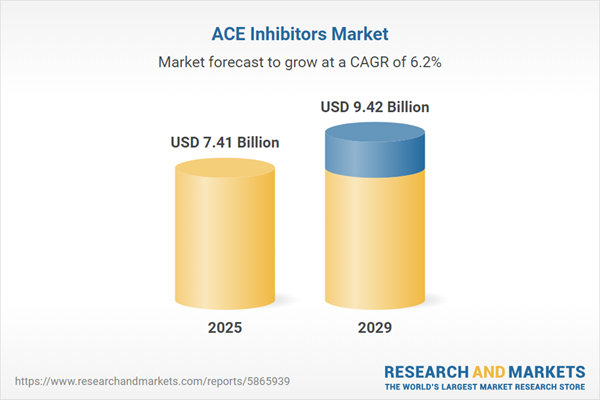

The ACE inhibitors market size is expected to see strong growth in the next few years. It will grow to $9.42 billion in 2029 at a compound annual growth rate (CAGR) of 6.2%. The growth in the forecast period can be attributed to growing global burden of cardiovascular diseases, expanding hypertension treatment guidelines, advancements in combination therapies, focus on heart failure management, rising awareness and healthcare access. Major trends in the forecast period include focus on kidney protection, preference for renin-angiotensin system inhibitors, generic competition and pricing pressures, patient-centric approaches in healthcare, regulatory updates and safety considerations.

The forecast of 6.2% growth over the next five years reflects a modest reduction of 0.2% from the previous estimate for this market. This reduction is primarily due to the impact of tariffs between the US and other countries. Trade tensions could hinder U.S. cardiology practices by inflating prices of ACE inhibitors manufactured in India and China, resulting in delayed hypertension management and higher cardiovascular medication expenses. The effect will also be felt more widely due to reciprocal tariffs and the negative effect on the global economy and trade due to increased trade tensions and restrictions.

The escalating prevalence of hypertension disorders is anticipated to play a pivotal role in driving the growth of the ACE inhibitors market. Hypertension, or high blood pressure, is characterized by elevated pressure within the blood vessels. ACE inhibitors, belonging to the category of angiotensin-converting enzyme inhibitors, represent a group of medications employed for the treatment and management of hypertension. These medications operate by relaxing blood vessels, leading to a reduction in blood pressure and an enhancement in blood flow. As of March 2023, the World Health Organization reported that an estimated 1.28 billion adults aged 30 to 79 worldwide were affected by hypertension, with two-thirds of these individuals residing in low- and middle-income nations. Over the past three decades, there has been a substantial increase of 650 million people aged 30 to 79 with hypertension. Alarmingly, around 46% of adults with hypertension are unaware of their condition due to a lack of diagnosis. This surge in hypertension cases stands as a significant factor propelling the growth of the ACE inhibitors market.

The rising incidence of cardiac disorders is expected to drive the growth of the ACE inhibitors market in the coming years. Cardiac disorders encompass a variety of medical conditions affecting the heart and blood vessels, including coronary artery disease, heart failure, and arrhythmias. ACE inhibitors are vital in managing these conditions by blocking the angiotensin-converting enzyme, which helps reduce vasoconstriction, sodium retention, and aldosterone secretion, ultimately improving heart function. For example, in September 2024, the British Heart Foundation, a UK-based cardiovascular research charity, reported that approximately 7.6 million people in the UK are living with heart and circulatory diseases, including around 4 million men and 3.6 million women. These conditions account for about 27% of all deaths in the UK, resulting in over 170,000 deaths annually, or roughly 480 deaths per day - equivalent to one death every three minutes. As a result, the growing prevalence of cardiac disorders is fueling the expansion of the ACE inhibitors market.

A notable trend with a strong emphasis on product innovations, as major companies strategically develop novel products to strengthen their market positions and gain a competitive advantage. For instance, in February 2023, Travere Therapeutics, a US-based biopharmaceutical company, achieved FDA approval for FILSPARI (sparsentan). This groundbreaking non-immunosuppressive therapy is intended for use in patients with IgA nephropathy (IgAN). FILSPARI represents a significant advancement as the only approved non-immunosuppressive therapy. It is an oral medication designed for once-daily use by adults with primary IgAN who are at risk of rapid disease progression, typically presenting with a UPCR of less than 1.5 g/g and proteinuria. This approval marks a noteworthy milestone in treatment options for IgAN, supplementing traditional approaches involving systemic glucocorticoids, angiotensin-converting enzyme (ACE) inhibitors, and antihypertensive medications, including angiotensin-receptor blockers (ARBs).

Leading companies in the ACE inhibitor market are increasingly focusing on launching generic drugs to strengthen their competitive position. Generic drugs contain the same active ingredients, dosage, safety, strength, and effectiveness as brand-name medications but are typically sold at a lower cost once the original drug’s patent expires. For example, in August 2023, Pharmascience Inc., a Canada-based pharmaceutical company, introduced pms-PERINDOPRIL-INDAPAMIDE, a generic medication designed for the initial treatment of mild to moderate essential hypertension (high blood pressure) in adults. This combination drug contains perindopril erbumine, an ACE inhibitor that helps relax blood vessels, and indapamide, a diuretic that aids in eliminating excess fluid and sodium from the body. These ingredients work together to effectively reduce blood pressure across a wide patient population. pms-PERINDOPRIL-INDAPAMIDE is available in several dosage combinations, including 2 mg, 4 mg, and 8 mg of perindopril erbumine with 0.625 mg, 1.25 mg, and 2.5 mg of indapamide, respectively.

In January 2023, AstraZeneca, a UK-based pharmaceutical company, made a significant acquisition by purchasing CinCor Pharma for $1.3 billion. This strategic move positions AstraZeneca to expand its product line of aldosterone synthase inhibitors (ASI), particularly for blood pressure lowering in the treatment of resistant hypertension. CinCor Pharma, a US-based clinical-stage biopharmaceutical company, specializes in developing novel treatments for resistant and uncontrolled hypertension, as well as chronic kidney disease. This acquisition aligns with AstraZeneca's overarching goal of diversifying its portfolio and addressing critical medical needs in the cardiovascular therapeutic area.

Major companies operating in the ACE inhibitors market include Pfizer Inc., Novartis AG, Johnson & Johnson Private Limited, Merck KGaA, Sanofi S.A., Bayer AG, Teva Pharmaceutical Industries Ltd., Bristol-Myers Squibb Co., Takeda Pharmaceuticals Company, Daiichi Sankyo Company Ltd., UCB Schwarz Pharma Inc., Endo International plc, Sun Pharmaceutical Industries Ltd., Boehringer Ingelheim, Bausch Health Companies Inc., Dr. Reddy's Laboratories, Abbott Laboratories, Eli Lilly and Company, Cipla Limited, GlaxoSmithKline plc, Cadila Healthcare Limited, AbbVie Inc., Sandoz Group AG, Accord Healthcare Ltd., AstraZeneca plc, Lupin Limited, Macleods Pharmaceuticals Limited, Zydus lifescience Ltd., Apotex Inc.

North America was the largest region in the ACE inhibitors market in 2024. Asia-Pacific is expected to be the fastest-growing region in the global ACE inhibitors market report during the forecast period. The regions covered in the ace inhibitors market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa. The countries covered in the ace inhibitors market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Canada, Italy, Spain.

Note that the outlook for this market is being affected by rapid changes in trade relations and tariffs globally. The report will be updated prior to delivery to reflect the latest status, including revised forecasts and quantified impact analysis. The report’s Recommendations and Conclusions sections will be updated to give strategies for entities dealing with the fast-moving international environment.

The sudden escalation of U.S. tariffs and the resulting trade tensions in spring 2025 are having a significant impact on the pharmaceutical sector. Companies are grappling with higher costs on imported active pharmaceutical ingredients (APIs), glass vials, and laboratory equipment - many of which have limited alternative sources. Generic drug manufacturers, already operating with minimal profit margins, are particularly affected, with some scaling back production of low-margin medications. Biotech firms are also experiencing delays in clinical trials due to shortages of specialized reagents linked to tariffs. In response, the industry is shifting API production to regions like India and Europe, building up inventory reserves, and advocating for tariff exemptions on essential medicines. The countries covered in the ACE inhibitors market consists of sales of various drugs including zofenopril, perindopril, enalapril, trandolapril. Values in this market are ‘factory gate’ values, that is, the value of goods sold by the manufacturers or creators of the goods, whether to other entities (including downstream manufacturers, wholesalers, distributors, and retailers) or directly to end customers. The value of goods in this market includes related services sold by the creators of the goods.

ACE inhibitors, or angiotensin-converting enzyme inhibitors, constitute a class of medications utilized for the treatment and management of hypertension. Their mechanism of action involves the inhibition of the body's production of angiotensin II, a chemical responsible for constricting blood vessels and raising blood pressure. The primary purpose of ACE inhibitors is to induce relaxation in veins and arteries, ultimately leading to a reduction in blood pressure.

The main categories of ACE inhibitors encompass sulfhydryl-containing agents, dicarboxylate-containing agents, and phosphonate-containing agents. Sulfhydryl-containing agents are compounds characterized by the presence of a sulfhydryl group (-SH) in their structure. Various drugs fall into this category, including ramipril, enalapril, benazepril, fosinopril, captopril, moexipril, and others. These medications are available in diverse dosage forms, such as oral tablets and oral solutions. They find application in the treatment of various conditions, including heart failure, chronic kidney disease, hypertension, diabetes, and heart attacks. These medications are utilized by a range of end-users, including hospitals and online drug stores.

The global ACE inhibitors market consists of sales of various drugs including zofenopril, perindopril, enalapril, trandolapril. Values in this market are ‘factory gate’ values, that is, the value of goods sold by the manufacturers or creators of the goods, whether to other entities (including downstream manufacturers, wholesalers, distributors, and retailers) or directly to end customers. The value of goods in this market includes related services sold by the creators of the goods.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 1-3 business days.

Table of Contents

Executive Summary

ACE Inhibitors Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on ace inhibitors market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as geopolitical conflicts, trade policies and tariffs, post-pandemic supply chain realignment, inflation and interest rate fluctuations, and evolving regulatory landscapes.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for ace inhibitors? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward, including technological disruption, regulatory shifts, and changing consumer preferences? The ace inhibitors market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include: the technological advancements such as AI and automation, Russia-Ukraine war, trade tariffs (government-imposed import/export duties), elevated inflation and interest rates.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) By Type: Sulfhydryl-containing Agents; Dicarboxylate-containing Agents; Phosphonate-containing Agents2) By Drug: Ramipril; Enalapril; Benazepril; Fosinopril; Captopril; Moexipril; Other Drugs

3) By Dosage Form: Oral Tablets; Oral Solutions

4) By Application: Heart Failure; Chronic Kidney Disease; Hypertension; Diabetes; Heart Attack; Other Applications

5) By End-Users: Hospitals; Online Drug Stores; Other End-Users

Subsegments:

1) By Sulfhydryl-Containing Agents: Captopril; Zofenopril2) By Dicarboxylate-Containing Agents: Enalapril; Lisinopril; Ramipril; Quinapril; Benazepril; Perindopril

3) By Phosphonate-Containing Agents: Fosinopril

Companies Mentioned: Pfizer Inc.; Novartis AG; Johnson & Johnson Private Limited; Merck KGaA; Sanofi S.A.; Bayer AG; Teva Pharmaceutical Industries Ltd.; Bristol-Myers Squibb Co.; Takeda Pharmaceuticals Company; Daiichi Sankyo Company Ltd.; UCB Schwarz Pharma Inc.; Endo International plc; Sun Pharmaceutical Industries Ltd.; Boehringer Ingelheim; Bausch Health Companies Inc.; Dr. Reddy's Laboratories; Abbott Laboratories; Eli Lilly and Company; Cipla Limited; GlaxoSmithKline plc; Cadila Healthcare Limited; AbbVie Inc.; Sandoz Group AG; Accord Healthcare Ltd.; AstraZeneca plc; Lupin Limited; Macleods Pharmaceuticals Limited; Zydus lifescience Ltd.; Apotex Inc.

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

The companies featured in this ACE Inhibitors market report include:- Pfizer Inc.

- Novartis AG

- Johnson & Johnson Private Limited

- Merck KGaA

- Sanofi S.A.

- Bayer AG

- Teva Pharmaceutical Industries Ltd.

- Bristol-Myers Squibb Co.

- Takeda Pharmaceuticals Company

- Daiichi Sankyo Company Ltd.

- UCB Schwarz Pharma Inc.

- Endo International plc

- Sun Pharmaceutical Industries Ltd.

- Boehringer Ingelheim

- Bausch Health Companies Inc.

- Dr. Reddy's Laboratories

- Abbott Laboratories

- Eli Lilly and Company

- Cipla Limited

- GlaxoSmithKline plc

- Cadila Healthcare Limited

- AbbVie Inc.

- Sandoz Group AG

- Accord Healthcare Ltd.

- AstraZeneca plc

- Lupin Limited

- Macleods Pharmaceuticals Limited

- Zydus lifescience Ltd.

- Apotex Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 250 |

| Published | September 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 7.41 Billion |

| Forecasted Market Value ( USD | $ 9.42 Billion |

| Compound Annual Growth Rate | 6.2% |

| Regions Covered | Global |

| No. of Companies Mentioned | 30 |