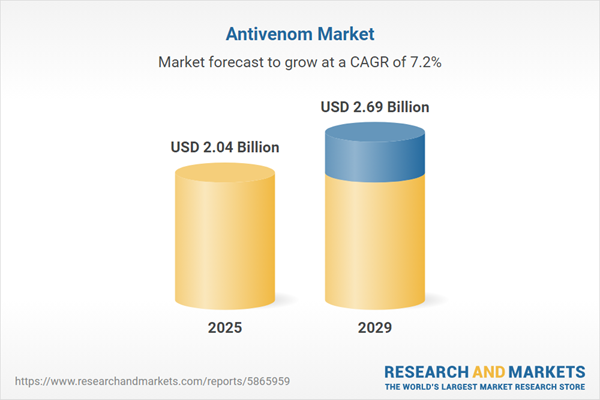

The antivenom market size is expected to see strong growth in the next few years. It will grow to $2.69 billion in 2029 at a compound annual growth rate (CAGR) of 7.2%. The growth in the forecast period can be attributed to climate change's impact on snake habitats, population growth in snake-prone regions, advancements in antivenom formulations, global health security initiatives, and collaborative efforts for antivenom development. Major trends in the forecast period include integration of data analytics, focus on education and training, strategic alliances for production scale-up, regulatory framework improvements, and research in novel therapeutic targets.

The forecast of 7.2% growth over the next five years reflects a modest reduction of 0.2% from the previous estimate for this market. This reduction is primarily due to the impact of tariffs between the US and other countries. Tariff escalations are likely to burden U.S. emergency response systems by driving up costs of polyvalent snake antivenoms imported from Mexico and Australia, exacerbating envenomation treatment expenses and increasing toxicology care burdens. The effect will also be felt more widely due to reciprocal tariffs and the negative effect on the global economy and trade due to increased trade tensions and restrictions.

The increasing occurrence of snake bites is anticipated to boost the antivenom market in the future. Snake bites are injuries that can result in a potentially deadly disease due to toxins in the bite of a venomous snake. Antivenom is a specific treatment that, when administered promptly and at the correct therapeutic dosage, can potentially prevent or alleviate most of the symptoms associated with snakebite envenoming. For example, in September 2023, the World Health Organization (WHO), a United Nations agency based in Switzerland focused on public health, reported that around 5.4 million people are bitten by snakes globally each year, leading to approximately 1.8 to 2.7 million cases of envenoming. Annually, an estimated 81,410 to 137,880 individuals lose their lives due to snake bites. This initiative aims to achieve a 50% reduction in mortality and disability caused by snakebite envenoming by 2030. Consequently, the rising incidence of snake bites is propelling the growth of the antivenom market.

The rising research and development activities are anticipated to drive the growth of the antivenom market in the future. Continuous efforts in research and development within the antivenom field lead to the discovery and creation of more advanced and effective formulations. Scientists and pharmaceutical companies are focused on improving the efficacy, safety, and specificity of antivenom products to achieve better treatment outcomes and minimize side effects. For example, in December 2023, Eurostat, the statistical office of the European Union based in Luxembourg, reported that in 2022, the business enterprise sector accounted for 66% of research and development expenditure in the EU, totaling €233 billion. This was followed by the higher education sector at 22% (€76 billion), the government sector at 11% (€37 billion), and the private non-profit sector at just 1% (€5 billion). Therefore, the increasing research and development activities are fueling the growth of the antivenom market.

Leading companies in the antivenom market are working on advanced technologies, including public-benefit target products, to enhance the efficacy, safety, and accessibility of antivenoms, with the ultimate goal of improving patient outcomes and alleviating the global burden of snakebite envenomation. Public-benefit target products refer to healthcare innovations or medical products developed primarily to meet specific public health needs, especially in underserved or vulnerable populations. For example, in June 2023, Bharat Serums and Vaccines Ltd., a biopharmaceutical company based in the US, partnered with the Indian Institute of Science, a public institution in India, to develop region-specific antivenoms for snakebites in India. This collaboration aims to enhance treatment effectiveness and lessen the public health impact of snakebites in the affected areas.

Major enterprises within the antivenom market are forging strategic partnerships to foster innovation and fortify their market presence. An illustrative instance is the collaboration between Bharat Serums and Vaccines Limited, an India-based pharmaceutical company, and the Indian Institute of Science (IISc) Bengaluru, a public university in India. Their partnership, established in August 2022, endeavors to advance the development of antivenoms tailored to specific regions. The joint effort seeks to pioneer the next generation of snakebite therapy in India by addressing the complexities stemming from variations in venoms across snake species and within regions. Present treatments predominantly rely on a single polyvalent antivenom designed for the country's 'big four' snakes, revealing limitations in efficacy as indicated by recent research. The collaboration focuses on creating region-specific antivenoms to elevate the effectiveness of snakebite therapy and ultimately save lives.

In June 2024, MicroPharm Limited, a pharmaceutical company based in the UK, announced its acquisition of Sanofi Pasteur for an undisclosed sum. This acquisition is intended to enhance MicroPharm's portfolio of vaccine products and bolster its research and development capabilities. Sanofi Pasteur is a global pharmaceutical company located in France, specializing in the research, development, manufacturing, and distribution of vaccines and biological products, including antivenoms.

Major companies operating in the antivenom market include Pfizer Inc., Commonwealth Serum Laboratories, Merck KGaA, Incepta Pharmaceuticals Limited, Bharat Serums and Vaccines Limited, Rare Disease Therapeutics Inc., Vins Bioproducts Limited, Boehringer Ingelheim International GmbH, Boston Scientific Corporation, Haffkine Bio-Pharmaceutical Corporation Limited, MicroPharm Limited, Latoxan SAS, Serum Institute of India Pvt. Ltd., BSV Group, Shanghai Serum Biotech Co Ltd., British Technology Group International, South African Vaccine Producers, Bioclon Institute, Inosan Biopharma, Instituto Bioclon S.A. de C.V., F. Hoffmann-La Roche AG, Protherics Inc., Sanofi Pasteur SA, Venom Supplies Pty Ltd, Instituto Clodomiro Picado, Laboratorios Silanes S.A. de C.V., Instituto Biológico Argentino S.A., Instituto Vital Brazil, Instituto Butantan, Instituto Nacional de Producción de Biológicos, Instituto de Biotecnología de la UNAM.

North America was the largest region in the global antivenom market size in 2024. Asia-Pacific is expected to be the fastest-growing region in the forecast period. The regions covered in the antivenom market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa. The countries covered in the antivenom market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Canada, Italy, Spain.

Note that the outlook for this market is being affected by rapid changes in trade relations and tariffs globally. The report will be updated prior to delivery to reflect the latest status, including revised forecasts and quantified impact analysis. The report’s Recommendations and Conclusions sections will be updated to give strategies for entities dealing with the fast-moving international environment.

The sudden escalation of U.S. tariffs and the resulting trade tensions in spring 2025 are having a significant impact on the pharmaceutical sector. Companies are grappling with higher costs on imported active pharmaceutical ingredients (APIs), glass vials, and laboratory equipment - many of which have limited alternative sources. Generic drug manufacturers, already operating with minimal profit margins, are particularly affected, with some scaling back production of low-margin medications. Biotech firms are also experiencing delays in clinical trials due to shortages of specialized reagents linked to tariffs. In response, the industry is shifting API production to regions like India and Europe, building up inventory reserves, and advocating for tariff exemptions on essential medicines.

The antivenom market research report is one of a series of new reports that provides antivenom market statistics, including antivenom industry global market size, regional shares, competitors with a antivenom market share, detailed antivenom market segments, market trends and opportunities, and any further data you may need to thrive in the antivenom industry. This antivenom market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenario of the industry.

Antivenom, also referred to as antivenin, is an antibody therapy designed to neutralize the toxins present in specific venoms when administered promptly after a bite. It is commonly employed in the treatment of poisonous animal bites or stings, such as those inflicted by rattlesnakes, moccasins, and copperheads.

The primary categories of antivenom include monovalent, polyvalent, and others. Monovalent antivenom is a specialized formulation crafted to counteract the effects of venom from a single species of snake or a specific toxin. These formulations are utilized to address venoms produced by a variety of animals, including snakes, scorpions, spiders, among others. They operate through diverse modes of action, such as cytotoxic, neurotoxic, hemotoxic, cardiotoxic, myotoxic, and others. These antivenom therapies are utilized by various end-users, including hospitals, clinics, ambulatory surgical centers, and other healthcare facilities.

The antivenom market consists of sales of taipan antivenom and death adder antivenom. Values in this market are ‘factory gate’ values, that is the value of goods sold by the manufacturers or creators of the goods, whether to other entities (including downstream manufacturers, wholesalers, distributors and retailers) or directly to end customers. The value of goods in this market includes related services sold by the creators of the goods.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 1-3 business days.

Table of Contents

Executive Summary

Antivenom Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on antivenom market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as geopolitical conflicts, trade policies and tariffs, post-pandemic supply chain realignment, inflation and interest rate fluctuations, and evolving regulatory landscapes.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for antivenom? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward, including technological disruption, regulatory shifts, and changing consumer preferences? The antivenom market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include: the technological advancements such as AI and automation, Russia-Ukraine war, trade tariffs (government-imposed import/export duties), elevated inflation and interest rates.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) By Type: Monovalent; Polyvalent; Other Types2) By Animal: Snakes; Scorpions; Spiders; Other Animals

3) By Mode of Action: Cytotoxic; Neurotoxic; Hemotoxic; Cardiotoxic; Myotoxic; Other Modes of Action

4) By End User: Hospitals; Clinics; Ambulatory Surgical Centers; Other End-Users

Subsegments:

1) By Monovalent: Specific Antivenoms for Individual Snake Species; Specific Antivenoms for Individual Venom Types2) By Polyvalent: Broad-Spectrum Antivenoms; Regional Polyvalent Antivenoms

3) By Other Types: Antivenoms for Other Venoms; Recombinant Antivenoms; Antivenom for Rare Venoms

Companies Mentioned: Pfizer Inc.; Commonwealth Serum Laboratories; Merck KGaA; Incepta Pharmaceuticals Limited; Bharat Serums and Vaccines Limited; Rare Disease Therapeutics Inc.; Vins Bioproducts Limited; Boehringer Ingelheim International GmbH; Boston Scientific Corporation; Haffkine Bio-Pharmaceutical Corporation Limited; MicroPharm Limited; Latoxan SAS; Serum Institute of India Pvt. Ltd.; BSV Group; Shanghai Serum Biotech Co Ltd.; British Technology Group International; South African Vaccine Producers; Bioclon Institute; Inosan Biopharma; Instituto Bioclon S.A. de C.V.; F. Hoffmann-La Roche AG; Protherics Inc.; Sanofi Pasteur SA; Venom Supplies Pty Ltd; Instituto Clodomiro Picado; Laboratorios Silanes S.A. de C.V.; Instituto Biológico Argentino S.A.; Instituto Vital Brazil; Instituto Butantan; Instituto Nacional de Producción de Biológicos; Instituto de Biotecnología de la UNAM

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

The companies featured in this Antivenom market report include:- Pfizer Inc.

- Commonwealth Serum Laboratories

- Merck KGaA

- Incepta Pharmaceuticals Limited

- Bharat Serums and Vaccines Limited

- Rare Disease Therapeutics Inc.

- Vins Bioproducts Limited

- Boehringer Ingelheim International GmbH

- Boston Scientific Corporation

- Haffkine Bio-Pharmaceutical Corporation Limited

- MicroPharm Limited

- Latoxan SAS

- Serum Institute of India Pvt. Ltd.

- BSV Group

- Shanghai Serum Biotech Co Ltd.

- British Technology Group International

- South African Vaccine Producers

- Bioclon Institute

- Inosan Biopharma

- Instituto Bioclon S.A. de C.V.

- F. Hoffmann-La Roche AG

- Protherics Inc.

- Sanofi Pasteur SA

- Venom Supplies Pty Ltd

- Instituto Clodomiro Picado

- Laboratorios Silanes S.A. de C.V.

- Instituto Biológico Argentino S.A.

- Instituto Vital Brazil

- Instituto Butantan

- Instituto Nacional de Producción de Biológicos

- Instituto de Biotecnología de la UNAM

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 250 |

| Published | September 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 2.04 Billion |

| Forecasted Market Value ( USD | $ 2.69 Billion |

| Compound Annual Growth Rate | 7.2% |

| Regions Covered | Global |

| No. of Companies Mentioned | 32 |