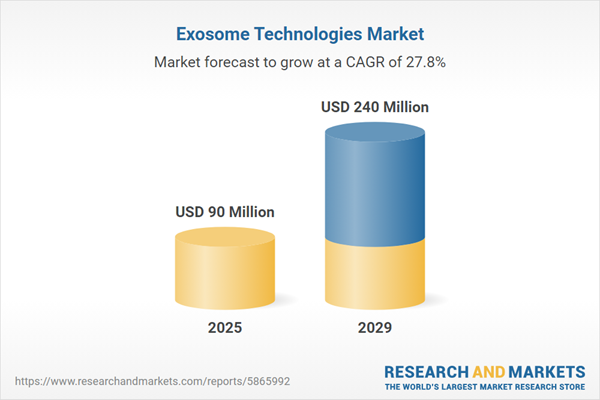

The exosome technologies market size is expected to see exponential growth in the next few years. It will grow to $0.24 billion in 2029 at a compound annual growth rate (CAGR) of 27.8%. The growth in the forecast period can be attributed to regulatory progress, biomedical engineering innovations, clinical trials proliferation, regenerative medicine development, and nanotechnology integration growth. Major trends in the forecast period include therapeutic advancements, diagnostic applications, nanotechnology integration, research funding surge, and the development of isolation techniques.

The anticipated growth in the exosome technologies market is driven by the increasing prevalence of chronic diseases. Chronic diseases, characterized by persistent or long-lasting effects lasting three months or more, are on the rise, creating a demand for exosome technologies. These technologies play a crucial role in identifying disease-specific biomarkers, monitoring disease progression through exosome cargo analysis, facilitating targeted drug delivery, and immune modulation in chronic conditions. For instance, statistics from January 2023 indicate that the number of individuals aged 50 years and older with one or more chronic illnesses in the United States is projected to increase by 99.5%, reaching 142.66 million by 2050, up from 71.522 million in 2020. In Australia, an estimated 47% of the population, or 11.6 million individuals, are affected by at least one of the ten selected chronic ailments, as reported by the Australian Institute of Health and Welfare (AIHW) in July 2022. Hence, the escalating prevalence of chronic diseases is expected to drive the growth of the exosome technologies market.

Increasing healthcare expenditure is expected to drive the growth of the exosome technologies market in the coming years. Healthcare expenditure represents the total funds allocated to healthcare services, goods, and activities within a specific healthcare system or economy over a defined period. This rising expenditure is a key factor in advancing exosome technologies, as it supports research and development, enables reimbursement for clinical applications, bolsters chronic disease management efforts, and enhances infrastructure. For example, in December 2022, the U.S.-based Centers for Medicare & Medicaid Services reported that U.S. healthcare spending grew by 4.1% to reach $4.5 trillion, a rise from the 3.2% increase in 2021. Consequently, growing healthcare spending is fueling the expansion of the exosome technologies market.

The exosome technology market is witnessing a prominent trend in the adoption of advanced exosome characterization technologies. Companies within this market are integrating new technologies to maintain their competitive standing. For example, in August 2022, Creative Biolabs Inc., a biotech company based in the United States, introduced the NanosightTM platform for exosome characterization, leveraging Nanosight technology. Nanosight is a nanoparticle tracking analysis (NTA) technique enabling the visualization and quantification of exosomes based on their size and concentration. By offering this platform, Creative Biolabs intends to equip researchers with sophisticated tools for the comprehensive characterization and analysis of exosomes, facilitating a deeper understanding of their properties and functions.

Major players in the exosome technology sector are embracing a strategic partnership approach, seeking to capitalize on synergies and expedite progress in this dynamically evolving field. Strategic partnerships involve companies leveraging each other's strengths and resources to achieve mutually beneficial outcomes. In June 2023, RoosterBio Inc., a biotechnology firm based in the United States, forged a partnership with Repligen, a life sciences company focused on bioprocessing. This collaboration aims to accelerate the development of scalable and cost-effective exosome bioprocessing solutions, ultimately enhancing accessibility to exosome-based therapies for patients.

In August 2024, BioIVT LLC, a U.S.-based provider of biospecimen solutions, acquired ZenBio Inc. for an undisclosed sum. This acquisition enables BioIVT to strengthen its expertise in cell and tissue models, expanding its portfolio of high-quality biological products for use in research and drug development. ZenBio Inc., also based in the U.S., is a biotechnology company specializing in human exosome research products.

Major companies operating in the exosome technologies market include AEGLE Therapeutics, Aruna Bio Inc., Carmine Therapeutics Inc., Exosome Diagnostics Inc., Creative Biolabs Inc., Danaher Corporation, OmniSpirant Limited, Thermo Fisher Scientific Inc., Fujifilm Holdings Corporation, Anjarium Biosciences, NOVADIP Biosciences S.A., Exopharm Ltd., Organicell Regenerative Medicine Inc., Evox Therapeutics, Direct Biologics, ExoCan Healthcare Technologies Pvt. Ltd., ExoCoBio, ExonanoRNA LLC, ILIAS Biologics Inc., Illumina Inc., Invitrix Therapeutics, XOStem Inc., VivaZome Therapeutics Pty Ltd., Aethlon Medical Inc., Capricor Therapeutics, Codiak BioSciences, Exogenus Therapeutics, Exovita Biosciences, HansaBioMed Life Sciences, Hitachi Chemical Advanced Therapeutics Solutions.

North America was the largest region in the exosome technologies market in 2024. Asia-Pacific is expected to be the fastest-growing region in the global exosome technologies market report during the forecast period. The regions covered in the exosome technologies market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa. The countries covered in the exosome technologies market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Canada, Italy, Spain.

Exosome technologies involve the utilization of exosomes, which are small extracellular vesicles originating from endosomes, across diverse fields such as regenerative medicine, biotechnology, and biomedical research. This technology holds promise for applications in diagnostics, especially in liquid biopsy-based diagnostics and projects focused on discovering biomarkers. Exosomes, due to their unique characteristics, can serve as diagnostic biomarkers for the early identification of diseases.

Two primary types of exosome technologies are loaded cargo and non-cargo. Loaded cargo pertains to exosomes that have been modified to carry specific cargos, including therapeutic agents, employing passive or active loading methods. These engineered exosomes are derived from various cell sources such as HEK293 cells, mesenchymal stem cells (MSCs), platelets, erythrocytes, natural killer cells, and others. They find applications in both therapeutics and diagnostics, with end-users encompassing healthcare providers, pharmaceutical and biotechnology companies, and other entities.

The exosome technologies market research report is one of a series of new reports that provides exosome technologies market statistics, including exosome technologies industry global market size, regional shares, competitors with an exosome technologies market share, detailed exosome technologies market segments, market trends and opportunities, and any further data you may need to thrive in the exosome technologies industry. This exosome technologies market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenarios of the industry.

The exosome technologies market consists of revenues earned by entities by providing exosome technologies services such as vaccine development, biomarker production, exosome-based diagnostic testing, and therapeutic development. The market value includes the value of related goods sold by the service provider or included within the service offering. The market value includes the value of related goods sold by the service provider or included within the service offering. The exosome technologies market consists of sales of exosome isolation kits, purification reagents, characterization tools, analysis kits, and exosome-based therapeutic products. Values in this market are 'factory gate' values, that is, the value of goods sold by the manufacturers or creators of the goods, whether to other entities (including downstream manufacturers, wholesalers, distributors, and retailers) or directly to end customers. The value of goods in this market includes related services sold by the creators of the goods.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

Exosome Technologies Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on exosome technologies market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for exosome technologies? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The exosome technologies market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include:

- The forecasts are made after considering the major factors currently impacting the market. These include the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) By Exosome Type: Loaded Cargos; Non-Cargo2) By Cell Source: HEK293 Cells; Mesenchymal Stem Cells (MSCs); Platelets; Erythrocytes; Natural Killer Cells; Other Cell Sources

3) By Application: Therapeutics; Diagnostics

4) By End-Users: Health Care Providers; Pharmaceutical and Biotechnology Companies; Other End-Users

Subsegments:

1) By Loaded Cargo: Proteins; Nucleic Acids (DNA, RNA); Lipids; Small Molecules2) By Non-Cargo: Exosome Membrane Components; Extracellular Matrix Components

Key Companies Mentioned: AEGLE Therapeutics; Aruna Bio Inc.; Carmine Therapeutics Inc.; Exosome Diagnostics Inc.; Creative Biolabs Inc.

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

- AEGLE Therapeutics

- Aruna Bio Inc.

- Carmine Therapeutics Inc.

- Exosome Diagnostics Inc.

- Creative Biolabs Inc.

- Danaher Corporation

- OmniSpirant Limited

- Thermo Fisher Scientific Inc.

- Fujifilm Holdings Corporation

- Anjarium Biosciences

- NOVADIP Biosciences S.A.

- Exopharm Ltd.

- Organicell Regenerative Medicine Inc.

- Evox Therapeutics

- Direct Biologics

- ExoCan Healthcare Technologies Pvt. Ltd.

- ExoCoBio

- ExonanoRNA LLC

- ILIAS Biologics Inc.

- Illumina Inc.

- Invitrix Therapeutics

- XOStem Inc.

- VivaZome Therapeutics Pty Ltd.

- Aethlon Medical Inc.

- Capricor Therapeutics

- Codiak BioSciences

- Exogenus Therapeutics

- Exovita Biosciences

- HansaBioMed Life Sciences

- Hitachi Chemical Advanced Therapeutics Solutions

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 200 |

| Published | February 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 90 Million |

| Forecasted Market Value ( USD | $ 240 Million |

| Compound Annual Growth Rate | 27.8% |

| Regions Covered | Global |

| No. of Companies Mentioned | 30 |