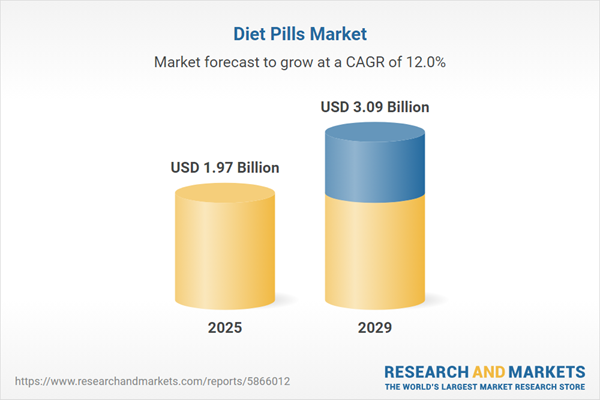

The diet pills market size is expected to see rapid growth in the next few years. It will grow to $3.09 billion in 2029 at a compound annual growth rate (CAGR) of 12%. The growth in the forecast period can be attributed to continued focus on health and wellness, global increase in overweight population, expansion of weight management services, innovations in formulations and ingredients, growing e-commerce and direct-to-consumer channels. Major trends in the forecast period include technological innovations in formulations, emphasis on mental well-being, incorporation of appetite suppressants, digital health integration, expansion of online and e-commerce distribution.

The forecast of 12% growth over the next five years reflects a modest reduction of 0.2% from the previous estimate for this market. This reduction is primarily due to the impact of tariffs between the US and other countries. Trade tensions could hinder U.S. weight management clinics by inflating prices of prescription lipase inhibitors manufactured in Ireland and Israel, resulting in reduced obesity treatment options and higher metabolic disorder care costs. The effect will also be felt more widely due to reciprocal tariffs and the negative effect on the global economy and trade due to increased trade tensions and restrictions.

The escalating issue of obesity is anticipated to drive the growth of the diet pill market in the future. Obesity, characterized by abnormal or excessive weight gain, typically with a body mass index (BMI) exceeding 30, poses significant health risks. It increases the likelihood of various cancers, including those affecting the esophagus, colon, rectum, liver, gallbladder, pancreas, and kidneys. Additionally, obesity is associated with the development of disorders such as type 2 diabetes (T2D) and cardiovascular diseases (CVD). Individuals struggling with obesity often turn to diet pills as a form of medication to aid in weight loss by reducing appetite and food cravings. For instance, as of May 2022, data from the National Institute of Diabetes and Digestive and Kidney Diseases (NIDDK) revealed that more than 2 in 5 adults (42.4%) have obesity, with approximately 1 in 11 adults (9.2%) experiencing severe obesity. Consequently, the increasing prevalence of obesity is a significant driver for the growth of the diet pill market.

The implementation of various initiatives is expected to contribute to the growth of the diet pills market. Initiatives involve specific actions, projects, or programs undertaken to achieve particular goals or address specific issues. One example is the initiative taken by Currax Pharmaceuticals LLC, a US-based specialty biopharmaceutical company and the manufacturer of the oral weight loss medication brand CONTRAVE (naltrexone HCl/bupropion HCl). In August 2022, the company launched a new campaign called One Size Does Not Fit All, aiming to highlight the unique challenges faced by individuals dealing with overweight or obesity. The campaign emphasizes the necessity of a personalized approach to weight loss for long-term success. Therefore, the increasing adoption of initiatives is a driving force behind the growth of the diet pills market.

The increasing prevalence of chronic diseases is expected to drive the growth of the diet pills market. Chronic diseases, characterized by conditions or illnesses that last for more than a year and require ongoing medical treatment, necessitate comprehensive management approaches. These approaches often involve lifestyle modifications, such as adopting a balanced diet, engaging in regular physical activity, and making behavioral changes. As of January 2023, data from the National Library of Medicine, a US-based agency, suggests that the number of people in the US aged 50 and older with at least one chronic condition is projected to increase to 142.66 million by 2050. The rising prevalence of chronic diseases will consequently contribute to the growth of the diet pills market.

The popularity of plant-based supplements emerges as a key trend in the diet pill market, with companies developing plant-based diet pills to maintain their market positions. For instance, in April 2022, Wellbeing Nutrition, an India-based plant-based nutrition company, launched SLOW, a formulation consisting of 13 supplements catering to various health and wellness needs, including reproductive support, bone health, weight loss, and daily multivitamins. The SLOW technology employs continuous-release coated pellets in a capsule to ensure the timely digestion of vitamins and nutrients throughout the day. This new line is designed to meet consumer demands for increased energy, physical endurance, mental alertness, and functional health benefits for disease prevention.

In November 2022, Audax Private Equity, a US-based middle-market investment company, acquired Medi-Weightloss, Inc. for an undisclosed amount. Through this acquisition, Medi-Weightloss expanded access to care for an underserved and growing patient population. Medi-Weightloss is a US-based company that provides specialized weight-loss programs addressing obesity and associated ailments, including the provision of weight loss and diet pills.

Major companies operating in the diet pills market include GlaxoSmithKline plc, Iovate Health Sciences International Inc., Novo Nordisk A/S, Gelesis Inc., VIVUS Inc., Pfizer Inc., Creative Biosciences Pvt. Ltd., Applied Nutrition Ltd. (India), Herbalife Nutrition India Private Limited, Camillotek India Pvt. Ltd., NOW Foods, MuscleTech Research and Development LLC, Healthviva Group of Companies, Nalpropion Pharmaceuticals LLC, Chong's Health Care Pte. Ltd., Currax Pharmaceuticals LLC, TEVA PHARMACEUTICAL INDUSTRIES LTD, Eli Lilly and Company, Arena Pharmaceuticals GmbH & Co. KG, Orexigen Therapeutics Inc., Takeda Pharmaceutical Company Limited, Eisai Co. Ltd., Roche Holding AG, Sanofi SA, Boehringer Ingelheim International GmbH, Merck & Co. Inc., Johnson & Johnson, Abbott Laboratories.

North America was the largest region in the diet pills market in 2024. The regions covered in the diet pills market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa. The countries covered in the diet pills market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Canada, Italy, Spain.

Note that the outlook for this market is being affected by rapid changes in trade relations and tariffs globally. The report will be updated prior to delivery to reflect the latest status, including revised forecasts and quantified impact analysis. The report’s Recommendations and Conclusions sections will be updated to give strategies for entities dealing with the fast-moving international environment.

The sudden escalation of U.S. tariffs and the resulting trade tensions in spring 2025 are having a significant impact on the pharmaceutical sector. Companies are grappling with higher costs on imported active pharmaceutical ingredients (APIs), glass vials, and laboratory equipment - many of which have limited alternative sources. Generic drug manufacturers, already operating with minimal profit margins, are particularly affected, with some scaling back production of low-margin medications. Biotech firms are also experiencing delays in clinical trials due to shortages of specialized reagents linked to tariffs. In response, the industry is shifting API production to regions like India and Europe, building up inventory reserves, and advocating for tariff exemptions on essential medicines.

The diet pills market research report is one of a series of new reports that provides diet pills market statistics, including diet pills industry global market size, regional shares, competitors with a diet pills market share, detailed diet pills market segments, market trends and opportunities, and any further data you may need to thrive in the diet pills industry. This diet pills market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenario of the industry.

Diet pills, in the context of weight management, are tablets or capsules designed to aid users in reducing or controlling their weight. These pills are formulated to enhance metabolism, reduce appetite, and facilitate the breakdown of fat.

The primary categories of diet pill products include prescription, over-the-counter, and herbal supplements. A prescription is a written authorization from a doctor for access to a medication that cannot be obtained without such approval. Prescription diet pills are typically recommended by healthcare professionals due to the potential risks and dangers associated with misuse or abuse of these medications. These pills are utilized by teenagers and adults and are available through various channels such as hospital pharmacies, retail pharmacies, online pharmacies, and drug stores. They are applied for purposes such as appetite suppression, fat blocking, and other weight management objectives.

The diet pills market consists of sales of xenical, qsymia, saxenda, diethylpropion, liraglutide, and phentermine. Values in this market are ‘factory gate’ values, that is, the value of goods sold by the manufacturers or creators of the goods, whether to other entities (including downstream manufacturers, wholesalers, distributors, and retailers) or directly to end customers. The value of goods in this market includes related services sold by the creators of the goods.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 1-3 business days.

Table of Contents

Executive Summary

Diet Pills Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on diet pills market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as geopolitical conflicts, trade policies and tariffs, post-pandemic supply chain realignment, inflation and interest rate fluctuations, and evolving regulatory landscapes.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for diet pills? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward, including technological disruption, regulatory shifts, and changing consumer preferences? The diet pills market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include: the technological advancements such as AI and automation, Russia-Ukraine war, trade tariffs (government-imposed import/export duties), elevated inflation and interest rates.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) By Product Type: Prescription; Over the Counter; Herbal Supplements2) By Age: Teenagers; Adults

3) By Distribution Channel: Hospital Pharmacies; Retail Pharmacies; Online Pharmacies; Drug Stores

4) By Application: Appetite Suppression; Fat Blocking; Other Applications

Subsegments:

1) By Prescription: Prescription Weight Loss Pills; Prescription Appetite Suppressants; Prescription Fat Blockers2) By Over the Counter: Non-Prescription Weight Loss Pills; Appetite Control Tablets; Fat Burners; Metabolism Boosters

3) By Herbal Supplements: Herbal Weight Loss Pills; Herbal Appetite Suppressants; Natural Fat Burners; Traditional Herbal Formulations

Companies Mentioned: GlaxoSmithKline plc; Iovate Health Sciences International Inc.; Novo Nordisk a/S; Gelesis Inc.; VIVUS Inc.; Pfizer Inc.; Creative Biosciences Pvt. Ltd.; Applied Nutrition Ltd. (India); Herbalife Nutrition India Private Limited; Camillotek India Pvt. Ltd.; NOW Foods; MuscleTech Research and Development LLC; Healthviva Group of Companies; Nalpropion Pharmaceuticals LLC; Chong's Health Care Pte. Ltd.; Currax Pharmaceuticals LLC; TEVA PHARMACEUTICAL INDUSTRIES LTD; Eli Lilly and Company; Arena Pharmaceuticals GmbH & Co. KG; Orexigen Therapeutics Inc.; Takeda Pharmaceutical Company Limited; Eisai Co. Ltd.; Roche Holding AG; Sanofi SA; Boehringer Ingelheim International GmbH; Merck & Co. Inc.; Johnson & Johnson; Abbott Laboratories

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

The companies featured in this Diet Pills market report include:- GlaxoSmithKline plc

- Iovate Health Sciences International Inc.

- Novo Nordisk A/S

- Gelesis Inc.

- VIVUS Inc.

- Pfizer Inc.

- Creative Biosciences Pvt. Ltd.

- Applied Nutrition Ltd. (India)

- Herbalife Nutrition India Private Limited

- Camillotek India Pvt. Ltd.

- NOW Foods

- MuscleTech Research and Development LLC

- Healthviva Group of Companies

- Nalpropion Pharmaceuticals LLC

- Chong's Health Care Pte. Ltd.

- Currax Pharmaceuticals LLC

- TEVA PHARMACEUTICAL INDUSTRIES LTD

- Eli Lilly and Company

- Arena Pharmaceuticals GmbH & Co. KG

- Orexigen Therapeutics Inc.

- Takeda Pharmaceutical Company Limited

- Eisai Co. Ltd.

- Roche Holding AG

- Sanofi SA

- Boehringer Ingelheim International GmbH

- Merck & Co. Inc.

- Johnson & Johnson

- Abbott Laboratories

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 250 |

| Published | September 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 1.97 Billion |

| Forecasted Market Value ( USD | $ 3.09 Billion |

| Compound Annual Growth Rate | 12.0% |

| Regions Covered | Global |

| No. of Companies Mentioned | 29 |