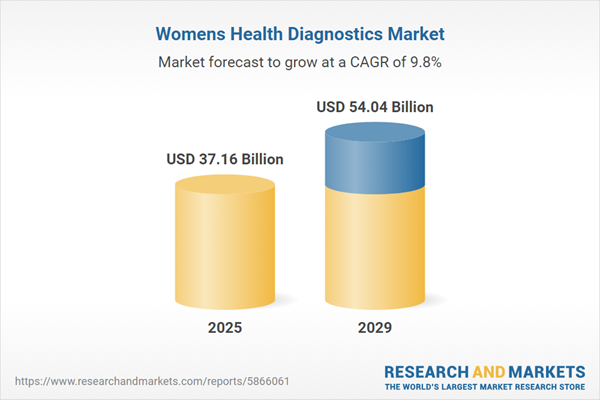

The womens health diagnostics market size is expected to see strong growth in the next few years. It will grow to $54.04 billion in 2029 at a compound annual growth rate (CAGR) of 9.8%. The growth in the forecast period can be attributed to rising incidence of reproductive health issues, growing aging population of women, advancements in personalized medicine, expanding role of genetic testing, increased focus on non-communicable diseases. Major trends in the forecast period include menopause management, preventive and early detection, inclusivity and diversity, pandemic-driven digitalization, environmental and lifestyle considerations.

The anticipated growth in the women's health diagnostics market is expected to be propelled by the increasing prevalence of chronic diseases. Chronic diseases are enduring conditions that typically progress gradually, necessitating ongoing management and care. The escalating prevalence of these conditions creates a heightened demand for women's health diagnostics, essential for identifying and monitoring diseases such as breast cancer, cervical cancer, and reproductive disorders. For example, data from the National Library of Medicine, a US-based agency, revealed that by 2050, the number of individuals in the US aged 50 and older with at least one chronic condition is projected to reach 142.66 million, underscoring how the rise in chronic diseases among women is a key driver for the growth of the women's health diagnostics market.

The increasing demand for personalized medicine is poised to drive the growth of the women's health diagnostics market. Personalized medicine involves utilizing knowledge about an individual's genes or proteins to prevent, detect, or treat diseases. This approach enables healthcare providers to develop treatment plans tailored to a woman's unique genetic, molecular, and clinical profile, often involving targeted therapies based on genetic markers or specific biomarkers. In 2022, the US Food and Drug Administration (FDA) approved 12 personalized medicines, constituting around 34% of all newly approved therapeutic molecular entities, as reported by the Personalized Medicine Coalition, a US-based professional membership organization. Hence, the increasing demand for personalized medicine is a significant driver for the growth of the women's health diagnostics market.

The prevailing trend gaining momentum in women's health diagnostics is technological advancements in personalized health solutions. Major players within the women's health diagnostics market are directing their efforts towards technological innovations and the development of new products to enhance diagnostic capabilities and maintain their market position. For example, in February 2022, FemTec Health, Inc., a US-based women's health company, introduced a direct-to-consumer (D2C) brand named Awesome Woman, offering personalized health and wellness products for women across various life stages. The brand employs AI, machine learning, and customer data encompassing genomics, genetics, and health history to create customized offerings. These personalized subscription boxes may include vitamins, probiotics, and at-home tests tailored to individual needs. Users can choose specific health focus areas such as vaginal and urinary health, reproductive health, hormone balance, and beauty. Additionally, the service provides telehealth support to enhance the overall customer experience and accessibility to healthcare professionals.

Prominent companies in the women's health diagnostics market are concentrating on product innovations, exemplified by the development of premium ultrasound systems, to reinforce their market standing. A premium ultrasound system is an advanced medical imaging device designed for detailed and high-quality imaging of internal structures in the human body, specifically tailored for obstetrics and gynecology within Samsung's HERA platform. In February 2023, Samsung’s digital radiography and ultrasound business unveiled the HERA W10 Elite, a cutting-edge women’s health ultrasound system. This system is equipped with a suite of artificial intelligence (AI) tools and clinical applications, signifying a significant advancement in the diagnostic experience for women's health. The HERA W10 Elite features advanced capabilities such as MV-Flow for displaying blood flow intensity, BiometryAssist for convenient fetal growth parameter measurement, and precise analytics to aid clinicians in diagnosis.

In October 2024, Hologic, a US-based medical technology company, acquired Gynesonics, Inc. for an undisclosed sum. This acquisition is intended to enhance Hologic's minimally invasive solutions for women's health, specifically targeting the treatment of symptomatic uterine fibroids and heavy menstrual bleeding. By integrating the Sonata system, Hologic aims to improve patient outcomes and provide GYN surgeons with a wider array of treatment options. This strategic decision underscores Hologic's commitment to innovation and growth in women's healthcare. Gynesonics is a US-based company that focuses on developing innovative medical technologies for women's health, emphasizing non-invasive treatments for uterine fibroids and providing diagnostic solutions.

Major companies operating in the womens health diagnostics market include Becton Dickinson And Company, F. Hoffmann-La Roche AG, General Electric Company, Koninklijke Philips N.V., Quest Diagnostics Incorporated, Siemens Healthineers, Abbott Laboratories, BioMérieux SA, Hologic Inc., PerkinElmer Inc., Cardinal Health Inc., Alere Inc., Carestream Health Inc., Mankind Pharma Limited, Procter & Gamble Co., Trinity Biotech plc, Medgyn Products Inc., URIT Medical Electronic Co. Ltd, Sonic Healthcare Limited, Fujifilm Holdings Corporation, Thermo Fisher Scientific Inc., Illumina Inc., Myriad Genetics Inc., Agilent Technologies Inc., Bio-Rad Laboratories Inc., Danaher Corporation, Genomic Health Inc., Invitae Corporation, Natera Inc., QIAGEN N.V., Opko Health Inc., Sysmex Corporation, Exact Sciences Corporation, Foundation Medicine Inc., Laboratory Corporation of America Holdings, NeoGenomics Laboratories Inc.

North America was the largest region in the women's health diagnostics market in 2024. Asia-Pacific is expected to be the fastest-growing region in the global women's health diagnostics market report during the forecast period. The regions covered in the womens health diagnostics market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa. The countries covered in the womens health diagnostics market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Canada, Italy, Spain.

Women's health diagnostics encompass medical examinations and procedures employed to assess and diagnose a range of health conditions and diseases specifically impacting women. These diagnostic measures play a crucial role in early identification of health issues, enabling timely and appropriate treatment and management to enhance outcomes and overall quality of life.

The primary categories of women's health diagnostics include accessories and consumables, diagnostic tests, and diagnostic devices. Accessories and consumables encompass a variety of supplementary items and materials utilized in diagnostic procedures tailored to women's health. These items contribute to improving the accuracy, convenience, and effectiveness of diagnostic tests and examinations for women. Applications of these accessories and consumables span diverse areas such as osteoporosis testing, ovarian cancer testing (OVC), cervical cancer testing, breast cancer testing, pregnancy and fertility testing, prenatal genetic screening, carrier testing, infectious disease testing, sexually transmitted disease (STD) testing, and ultrasound testing. These diagnostics find application across various end users, including hospitals and clinics, diagnostic and imaging centers, homecare settings, and other relevant end-user contexts.

The women's health diagnostics market research report is one of a series of new reports that provides women's health diagnostics market statistics, including women's health diagnostics industry global market size, regional shares, competitors with a women's health diagnostics market share, detailed women's health diagnostics market segments, market trends and opportunities, and any further data you may need to thrive in the women's health diagnostics industry. This women's health diagnostics market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenarios of the industry.

The women's health diagnostics market includes revenues earned by entities by providing women's health diagnostics, including pregnancy tests, breast imaging equipment, and hormone level tests. Values in this market are ‘factory gate’ values, that is the value of goods sold by the manufacturers or creators of the goods, whether to other entities (including downstream manufacturers, wholesalers, distributors, and retailers) or directly to end customers. The value of goods in this market includes related services sold by the creators of the goods.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

Womens Health Diagnostics Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on womens health diagnostics market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for womens health diagnostics? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The womens health diagnostics market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include:

- The forecasts are made after considering the major factors currently impacting the market. These include the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) By Type: Accessories and Consumables; Diagnostic Tests; Diagnostic Devices2) By Application: Osteoporosis Testing; Ovarian Cancer Testing (OVC); Cervical Cancer Testing; Breast Cancer Testing; Pregnancy and Fertility Testing; Prenatal Genetic Screening and Carrier Testing; Infectious Disease Testing; Sexually Transmitted Diseases (STD) Testing; Ultrasound Tests

3) By End User: Hospitals and Clinics; Diagnostic and Imaging Centers; Homecare; Other End Users

Subsegments:

1) By Accessories and Consumables: Test Kits; Sample Collection Devices; Reagents; Control Materials2) By Diagnostic Tests: Blood Tests; Imaging Tests; Genetic Tests; Hormonal Tests

3) By Diagnostic Devices: Imaging Devices; Invasive Diagnostic Devices; Non-Invasive Diagnostic Devices; Monitoring Devices

Key Companies Mentioned: Becton Dickinson and Company; F. Hoffmann-La Roche AG; General Electric Company; Koninklijke Philips N.V.; Quest Diagnostics Incorporated

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

- Becton Dickinson And Company

- F. Hoffmann-La Roche AG

- General Electric Company

- Koninklijke Philips N.V.

- Quest Diagnostics Incorporated

- Siemens Healthineers

- Abbott Laboratories

- BioMérieux SA

- Hologic Inc.

- PerkinElmer Inc.

- Cardinal Health Inc.

- Alere Inc.

- Carestream Health Inc.

- Mankind Pharma Limited

- Procter & Gamble Co.

- Trinity Biotech plc

- Medgyn Products Inc.

- URIT Medical Electronic Co. Ltd

- Sonic Healthcare Limited

- Fujifilm Holdings Corporation

- Thermo Fisher Scientific Inc.

- Illumina Inc.

- Myriad Genetics Inc.

- Agilent Technologies Inc.

- Bio-Rad Laboratories Inc.

- Danaher Corporation

- Genomic Health Inc.

- Invitae Corporation

- Natera Inc.

- QIAGEN N.V.

- Opko Health Inc.

- Sysmex Corporation

- Exact Sciences Corporation

- Foundation Medicine Inc.

- Laboratory Corporation of America Holdings

- NeoGenomics Laboratories Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 200 |

| Published | February 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 37.16 Billion |

| Forecasted Market Value ( USD | $ 54.04 Billion |

| Compound Annual Growth Rate | 9.8% |

| Regions Covered | Global |

| No. of Companies Mentioned | 36 |