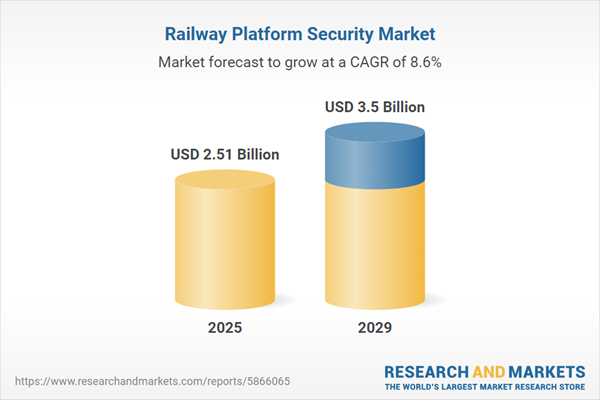

The railway platform security market size is expected to see strong growth in the next few years. It will grow to $3.5 billion in 2029 at a compound annual growth rate (CAGR) of 8.6%. The growth in the forecast period can be attributed to personalized experience, expanding middle-aged population, corporate wellness programs, government initiatives. Major trends in the forecast period include AI and machine learning applications, increasing consumer awareness, integration with advance technology, collaborations for research and development, regulatory support and standardization.

The increasing prevalence of security threats is expected to drive growth in the railway platform security market in the future. A security threat refers to an attack aimed at stealing data, corrupting systems, or disrupting an organization’s operations. Railway platform security systems are employed at many railway stations to detect unattended luggage in train carriages and monitor for suspected terrorist activity. These measures are essential for protecting passengers, staff, and infrastructure from potential threats. Consequently, a rise in security threats will boost the demand for railway platform security solutions. For instance, in November 2023, the Australian Signals Directorate (ASD), a government agency, reported that the number of C2 incidents increased from 2 in the financial year 2021-22 to 5 in 2022-23. This uptick includes significant data breaches where cybercriminals extracted information from critical infrastructure for financial gain. Therefore, the growing number of security threats is fueling the expansion of the railway platform security market.

The rise in infrastructure investment is expected to drive growth in the railway platform security market moving forward. Infrastructure investment involves allocating funds, resources, and efforts towards the development, enhancement, and maintenance of essential physical and organizational structures that support society, the economy, or industry. These investments provide the financial resources necessary to implement comprehensive security measures, utilizing technology and best practices to address the evolving nature of security threats on railway platforms. The growth of the railway platform security market is closely tied to a commitment to fostering a safe and secure environment through strategic infrastructure investments. For instance, in July 2024, the Office for National Statistics, a UK-based government department, reported that infrastructure investment reached £13.8 billion ($17.25 billion) in constant prices in 2023, marking a 3.9% increase compared to 2022. Therefore, the increase in infrastructure investment is driving the growth of the railway platform security market.

Major companies in the railway platform security market are focusing on developing innovative solutions, such as rail tech security platforms, to improve safety and efficiency. A rail tech security platform typically refers to an integrated security solution specifically tailored for the railway industry. For example, in May 2023, Cylus, an Israel-based software company, launched the Rail Tech Security Platform, an upgraded version of its CylusOne solution aimed at enhancing cybersecurity for rail operators. This platform offers comprehensive coverage across various rail technology systems, including signaling and command and control, while providing advanced risk management tools to identify and prioritize vulnerabilities. It also features continuous threat intelligence to keep operators informed about emerging cyber threats and integrates seamlessly with existing cybersecurity tools.

Major players in the railway platform security market are driving innovation through the introduction of comprehensive technological platforms such as the Rail Tech Security Platform. Cylus Ltd., an Israel-based cybersecurity solutions company, launched the Rail Tech Security Platform in May 2023. This platform offers rail operators a comprehensive solution for proactively monitoring and controlling risk and cybersecurity in running rail technology systems. Tailored specifically for rail applications, the platform is optimized to safeguard critical rail technology applications, including trackside infrastructure, rolling stock, train-to-ground communications, operations centers, and stations. The Rail Tech Security Platform provides automated, real-time visibility into rail technology, empowering security and operations teams to collaborate effectively, enhance rail security and resilience, and ensure safe and reliable rail operations. Additionally, it facilitates the acceleration and verification of compliance with industry and government regulations.

In March 2024, WSP Global Inc., a Canada-based environmental consulting company, acquired Proxion for an undisclosed amount. This acquisition is intended to enhance WSP's capabilities in the Finnish transport and infrastructure sector by incorporating Proxion Plan Oy and Proxion Pro Oy. The move will significantly bolster WSP's railway expertise, allowing the company to lead larger projects and effectively meet increasing market demands. Proxion, a consultancy firm based in Finland, specializes in railway infrastructure and design services and provides railway security solutions.

Major companies operating in the railway platform security market include Honeywell International Inc., Indra Sistemas S.A, Huawei Technologies Co. Ltd., Robert Bosch GmbH, Atos SE, Mitsubishi Electric Corporation, Genetec Technology company, L&T Technology Services Limited, Teledyne FLIR LLC, Wabtec Corporation, Knorr-Bremse AG, Cervello Ltd., Adani Systems Inc., Navtech Radar company, Thales Group Inc., Siemens AG, Alstom, Nokia Networks, Axis Communications AB, Zhejiang Dahua Technology Co.Ltd., Verint Systems Inc., Hikvision Digital Technology Co.Ltd., Talentum lnc., Anixter International Inc., Senstar Corporation, Bosch Security Systems lnc., FLIR Systems Inc., G4S plc, Johnson Controls International plc, NICE Systems Ltd., Panasonic Corporation, Qognify Inc., Safran Identity & Security, Tyco International Ltd., United Technologies Corporation.

Asia-Pacific was the largest region in the railway platform security market in 2024. The regions covered in the railway platform security market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa. The countries covered in the railway platform security market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Canada, Italy, Spain.

Railway platform security is a critical element in ensuring the safety and welfare of passengers at train stations. It encompasses a range of strategies and practices designed to prevent accidents, crimes, and other incidents on railway platforms.

The key elements of railway platform security involve software and services. In this context, software components are defined as compositional units with precisely outlined context dependencies and contractually established interfaces. These software components play a crucial role in managing and controlling the network of surveillance cameras deployed on railway platforms. The comprehensive railway platform security solutions encompass sensors, video surveillance systems, platform edge doors, and alert systems equipped with specialized sensors such as radar, microwave, and infrared. The provision of professional services and managed services is extended to subways and trains as part of the railway platform security framework.

The railway platform security market research report is one of a series of new reports that provides railway platform security market statistics, including railway platform security industry global market size, regional shares, competitors with a railway platform security market share, detailed railway platform security market segments, market trends and opportunities, and any further data you may need to thrive in the railway platform security industry. This railway platform security market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenario of the industry.

The railway platform security market consists of revenues earned by entities by providing solutions to risk assessment and security planning, access control, and crowd management. The market value includes the value of related goods sold by the service provider or included within the service offering. The railway platform security market also includes sales of emergency alert systems, communication devices, and access control systems used to regulate the entry and exit of passengers on railway platforms. Values in this market are ‘factory gate’ values, that is the value of goods sold by the manufacturers or creators of the goods, whether to other entities (including downstream manufacturers, wholesalers, distributors, and retailers) or directly to end customers. The value of goods in this market includes related services sold by the creators of the goods.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

Railway Platform Security Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on railway platform security market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for railway platform security? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The railway platform security market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include:

- The forecasts are made after considering the major factors currently impacting the market. These include the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) By Component: Software; Services2) By Solution: Sensors; Video Surveillance Systems; Platform Edge Doors; Alert System

3) By Sensor: Radar; Microwave; Infrared

4) By Application: Subways; Trains

Subsegments:

1) By Software: Surveillance Software; Access Control Software; Alarm Management Software; Incident Management Software; Analytics Software2) By Services: Installation and Integration Services; Maintenance and Support Services; Consulting Services; Managed Services

Key Companies Mentioned: Honeywell International Inc.; Indra Sistemas S.A; Huawei Technologies Co. Ltd.; Robert Bosch GmbH; Atos SE

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

- Honeywell International Inc.

- Indra Sistemas S.A

- Huawei Technologies Co. Ltd.

- Robert Bosch GmbH

- Atos SE

- Mitsubishi Electric Corporation

- Genetec Technology company

- L&T Technology Services Limited

- Teledyne FLIR LLC

- Wabtec Corporation

- Knorr-Bremse AG

- Cervello Ltd.

- Adani Systems Inc.

- Navtech Radar company

- Thales Group Inc.

- Siemens AG

- Alstom

- Nokia Networks

- Axis Communications AB

- Zhejiang Dahua Technology Co.Ltd.

- Verint Systems Inc.

- Hikvision Digital Technology Co.Ltd.

- Talentum lnc.

- Anixter International Inc.

- Senstar Corporation

- Bosch Security Systems lnc.

- FLIR Systems Inc.

- G4S plc

- Johnson Controls International plc

- NICE Systems Ltd.

- Panasonic Corporation

- Qognify Inc.

- Safran Identity & Security

- Tyco International Ltd.

- United Technologies Corporation

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 200 |

| Published | February 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 2.51 Billion |

| Forecasted Market Value ( USD | $ 3.5 Billion |

| Compound Annual Growth Rate | 8.6% |

| Regions Covered | Global |

| No. of Companies Mentioned | 35 |