The rate of urbanization and industrialization around the world has accelerated recently, which has increased the demand for power, therefore, the market is expanding due to rising power demand and grid construction. Hence, APAC is expected to capture more than 39% share of the market by 2030. According to the Electricity Market Report 2023 by IEA, by 2025, there will be an increase in demand of 2,500 terawatt hours (TWh), mostly in Asia. Demand would increase by 9%, reaching 29,281TWh total. From 5% in 1990 to 25% in 2015, China will make up a third of the world's electricity demand by 2025. The region will also account for overhalf of the global electricity demand owing to significant development in neighboring Asia Pacific countries.

The major strategies followed by the market participants are Product Launches as the key developmental strategy to keep pace with the changing demands of end users. For example, In June, 2022, Siemens expanded its generator circuit-breaker portfolio by releasing a new compact version HB1-Compact (HB1-C). The new product uses maintenance-free vacuum switching technology and addresses the most challenging of constraints. The HB1-Compact (HB1-C) is available in L-shape and I-shape designs and it can be mounted either vertically or horizontally. Additionally, In March, 2022, GE Renewable Energy’s Grid Solutions revealed a 420 kV, 63 kA g3 gas-insulated substation (GIS) circuit-breaker prototype. The development of GE’s 420 kV g3 circuit breaker would allow the power industries to accelerate the decarbonization of their electrical grids. Furthermore, it would enable the company to offer viable SF6-free alternatives for high-voltage products soon.

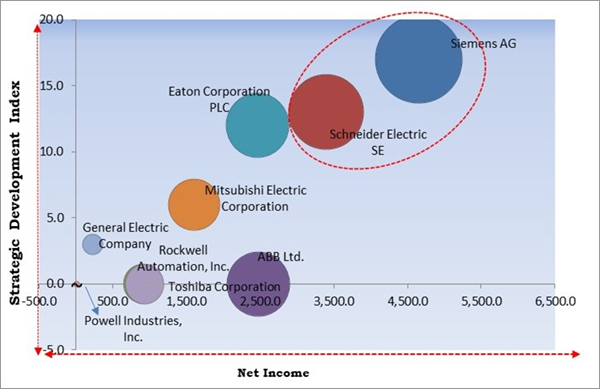

The Cardinal Matrix - Market Competition Analysis

Based on the Analysis presented in the The Cardinal Matrix; Siemens AG and Schneider Electric SE are the forerunners in the AC Circuit Breaker Market. In August, 2022, Siemens revealed new 3VA UL Large Frame moulded case circuit breakers (MCCBs). The new product offers variable application options for low and medium voltage. The new 3VA UL Large MCCB is available in 1,200A and 1,600A frame sizes* and meets the requirements of IEC and UL standards. Companies such as Eaton Corporation PLC, Mitsubishi Electric Corporation, ABB Ltd. are some of the key innovators in the AC Circuit Breaker Market.

Market Growth Factors

T&D networks' expanding capacity expansions and improvements

The demand for power is steadily rising in many developingnations like China and India. Due to their rapid industrialization and urbanization, these nations need more capacity to handle the resulting increase in loads. Once the energy is produced, it must be sent to final consumers, like renewable energy businesses and industries. In order to fulfill the increased demand for power in urban and rural regions, emerging nations’ governments are putting many measures into place to improve power distribution infrastructure and electrification rates.Evolving smart technologies and digital systems

Smart grids aredigital technologiesallowing two-way communication between the utility company and its customers. This helps to bring power distribution networks into the current era. Power companies worldwide are pouring more money into research and development of smart grid technology to better monitor, operate, and secure their electrical infrastructure. Smart grids can provide demand flexibility as well as customer engagement in energy system operations at the end-user level through distributed generation along with storage. Therefore, the development of smart technologies is propelling the growth of the market.Market Restraining Factors

Potential hazards of cyber threats

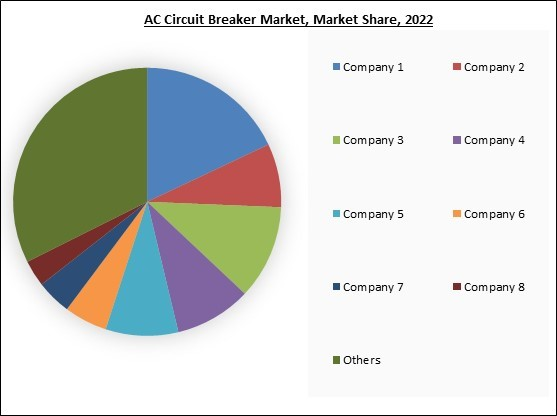

Cybersecurity threats to AC circuit breakers include data theft, grid instability,and security breaches that can be carried out by getting around security measures for remote access and result in blackouts and power outages. AnAC circuit breaker’s faulty setting, which controls the device’s reaction (or lack thereof), is responsible for these outages. The power system's operation may be negatively impacted by incorrect settings. This can be prevented by creating specialized, secure networks for managing and monitoring the equipment. Because of this, the extensive use of AC circuit breakers is impacted by financial disadvantages and cybersecurity threats associated with the energy sector, which seriously jeopardizes the market's growth.The leading players in the market are competing with diverse innovative offerings to remain competitive in the market. The above illustration shows the percentage of revenue shared by some of the leading companies in the market. The leading players of the market are adopting various strategies in order to cater demand coming from the different industries. The key developmental strategies in the market are Acquisitions, and Partnerships & Collaborations.

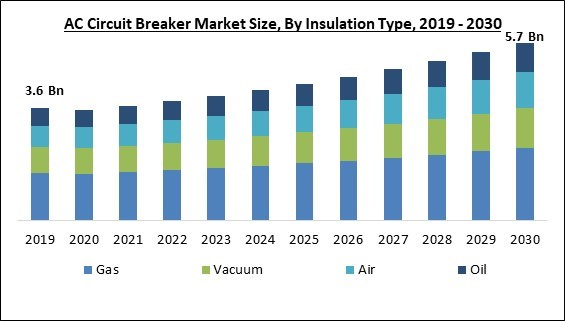

Insulation Type Outlook

Based on insulation type, the AC circuit breaker market is characterized into air, gas, vacuum, and oil. The gas segment garnered the highest revenue share in the AC circuit breaker market in 2022. SF6 gas is used as insulation in these types. SF6 has good dielectric properties when used at moderate pressure for insulation between phases and between phases and the earth. Gas-insulated solutions encase switches, circuit breakers, and fuses with SF6 gas inside grounded metal enclosures. Gas-insulated switchgear systems are widely used in subterranean high-voltage distribution networks because of their compact size, complete enclosure, and ability to conserve space. These systems are widely used, which is fostering the market's expansion.Voltage Outlook

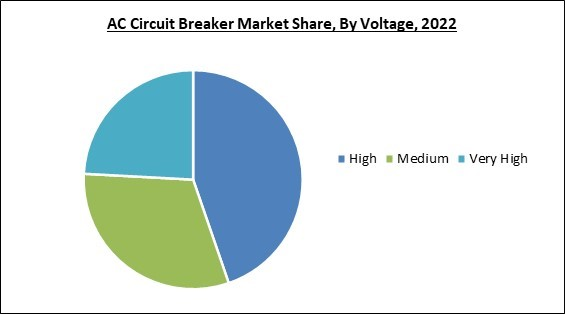

By voltage, the AC circuit breaker market is divided into medium, high, and very-high. The very-high segment garnered a remarkable growth rate in the AC circuit breaker market in 2022. Very high-voltage circuit breakers seldom trip or switch incorrectly; instead, they typically remain in the ON position and can be used for extended periods of time. Transmission of renewable energy use circuit breakersin this voltage range. Infrastructure for transmission and distribution must be quickly upgraded due to increased electrification and the incorporation of renewable energy sources in the national grid. As a result, the demand for these circuit breakers is anticipated to increase, propelling the growth of the segment.Installation Outlook

On the basis of installation, the AC circuit breaker market is classified into indoor and outdoor. The outdoor segment acquired the largest revenue share in the AC circuit breaker market in 2022. The increase in demand for outdoor placements of circuit breakers for the safety of electrical equipment and circuits in utility and industrial applications is responsible for the segment's growth. Additionally, the expansion of infrastructure projects, including the construction and renovation of power infrastructures for generation, transmission, and distribution, as well as the rapid expansion of the renewable energy industry, are anticipated to increase the demand for outdoor circuit breaker installations in these sectors.End-user Outlook

Based on end user, the AC circuit breaker market is segmented into transmission & distribution utilities, power generation, industrial, and others. The industrial segment acquired a substantial revenue share in the AC circuit breaker market in 2022. The industrial sector includes sectors that produce goods and perform processes, such as mining, oil and gas, chemical and pharmaceutical, food and beverage, steel, cement, and automotive. These industries require reliable backup power as well as a constant power source. Some industries use AC circuit breakersto guard against blackouts and provide a consistent flow of electricity. Industrial loads are linked to the distribution system at high voltage because they require huge amounts of power. Many businesses create individual substations to supply power to their facilities.Regional Outlook

Region wise, the AC circuit breaker market is analyzed across North America, Europe, Asia Pacific, and LAMEA. The Asia Pacific segment recorded the largest revenue share in the AC circuit breaker market in 2022. As evidenced by rising costs for smart grids, the market in this region is growing due to rising electricity demand from remote areas and the growing requirement to integrate renewable energy sources. The region's expansion is mostly attributable to nations like China, Japan, and Australia. In addition, the region's market is expected to increase favorably due to variables like quickening industrialization and growing demand for clean energy to meet rising energy needs.The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include ABB Ltd., Eaton Corporation PLC, Siemens AG, Schneider Electric SE, General Electric Company, Mitsubishi Electric Corporation, Rockwell Automation, Inc., Powell Industries, Inc., Toshiba Corporation, and Alstom SA.

Strategies Deployed in the Market

Partnerships, Collaborations, and Agreements:

- Feb-2022: Eaton came into a partnership with LG Electronics, a South Korean multinational conglomerate corporation. Through this partnership, Eaton would combine its intelligent power management technology along with its smart breakers and EV chargers, within LG ThinQ Energy mobile app and LG energy administration solutions to clarify load management in the home.

- Jan-2022: Eaton formed a partnership with Samsung, a multinational electronics corporation. Under this partnership, Samsung SmartThings Energy platform consumers can use Eaton smart circuit breakers to expand their capabilities to observe and gain intuition into energy use from connected technology beyond Samsung devices all over their homes.

- Jun-2021: Mitsubishi Electric signed a memorandum of understanding with Siemens, a German multinational conglomerate corporation. This MoU aimed to conduct an expediency study on the joint development of high-voltage switching solutions with zero global-warming potential that replaces greenhouse gases with clean air for covering. Additionally, the companies would research methods for climbing up the application of clean-air insulation technology to larger voltages. Moreover, the companies would begin with a 245kV dead-tank circuit destroyer that would boost the accessibility of climate-neutral HV switching solutions for consumers across the globe.

»Product Launches and Product Expansions:

- Aug-2022: Siemens revealed new 3VA UL Large Frame moulded case circuit breakers (MCCBs). The new product offers variable application options for low and medium voltage. The new 3VA UL Large MCCB is available in 1,200A and 1,600A frame sizes* and meets the requirements of IEC and UL standards.

- Jun-2022: Siemens expanded its generator circuit-breaker portfolio by releasing a new compact version HB1-Compact (HB1-C). The new product uses maintenance-free vacuum switching technology and addresses the most challenging of constraints. The HB1-Compact (HB1-C) is available in L-shape and I-shape designs and it can be mounted either vertically or horizontally.

- Mar-2022: GE Renewable Energy’s Grid Solutions, a subsidiary of General Electric Company, revealed a 420 kV, 63 kA g3 gas-insulated substation (GIS) circuit-breaker prototype. The development of GE’s 420 kV g3 circuit breaker would allow the power industries to accelerate the decarbonization of their electrical grids. Furthermore, it would enable the company to offer viable SF6-free alternatives for high-voltage products soon.

- Feb-2022: Schneider Electric SE released new updates to its EasyPact EXE vacuum circuit breaker series with a new generation thermal monitoring system. The new product offers additional IoT sensors and digital connectivity that provides an easy, more sustainable, and safer customer experience for facility managers, panel builders, and original equipment manufacturers (OEMs).

- Oct-2021: Schneider Electric unveiled Resi9, a range of electrical consumer units. The unit offers the highest level of domestic circuit conservation safety up to date. Additionally, the electrical unit provides matchless time-saving, modification to the adjustment.

Acquisition and Mergers:

- Feb-2022: Mitsubishi Electric Power Products, Inc. signed an agreement to acquire Computer Protection Technology, Inc., a backup power and distribution solution provider. The acquisition would enable the company to strengthen Mitsubishi Electric’s service capabilities in the critical power industry. Furthermore, the company would expand its footprints in the North American market by offering one-stop services-from installation to maintenance of UPS systems.

- Nov-2021: Schneider Electric took over DC Systems B.V. Through this acquisition, Schneider Electric would integrate its offering, to provide consumers with growing resiliency and simplicity for compatible applications including building microgrids in an untrustworthy public grid ecosystem, or long-distance applications such as governmental lighting.

- Mar-2021: Eaton took over Tripp Lite, a manufacturer of power protection and connecting electrical devices. Through this acquisition, Tripp Lite’s portfolio would improve the width of edge computing and scattered IT product offerings and expand the single-phase UPS enterprise.

Scope of the Study

By Insulation Type

- Gas

- Vacuum

- Air

- Oil

By Voltage

- High

- Medium

- Very High

By Installation

- Outdoor

- Indoor

By End-user

- Transmission & Distribution Utilities

- Power Generation

- Industrial

- Others

By Geography

- North America

- US

- Canada

- Mexico

- Rest of North America

- Europe

- Germany

- UK

- France

- Russia

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Singapore

- Malaysia

- Rest of Asia Pacific

- LAMEA

- Brazil

- Argentina

- UAE

- Saudi Arabia

- South Africa

- Nigeria

- Rest of LAMEA

Key Market Players

List of Companies Profiled in the Report:

- ABB Ltd.

- Eaton Corporation PLC

- Siemens AG

- Schneider Electric SE

- General Electric Company

- Mitsubishi Electric Corporation

- Rockwell Automation, Inc.

- Powell Industries, Inc.

- Toshiba Corporation

- Alstom SA

Unique Offerings

- Exhaustive coverage

- The highest number of Market tables and figures

- Subscription-based model available

- Guaranteed best price

- Assured post sales research support with 10% customization free

Table of Contents

Companies Mentioned

- ABB Ltd.

- Eaton Corporation PLC

- Siemens AG

- Schneider Electric SE

- General Electric Company

- Mitsubishi Electric Corporation

- Rockwell Automation, Inc.

- Powell Industries, Inc.

- Toshiba Corporation

- Alstom SA