Hearing loss, cataracts and refractive errors, chronic obstructive pulmonary disease, back and neck pain and osteoarthritis, diabetes, depression, and dementia are common ailments among elderly people. Therefore, the negative pressure wound therapy segment is expected to acquire around 70% share by 2030, as the number of elderly people and their share of the population are increasing in every nation on earth. For example, one in six individuals will be 60 or older by 2030. By this point, there will be 1.4 billion people over 60, up from 1 billion in 2020. The number of individuals in the world who are 60 or older will double (to 2.1 billion) by 2050. Between 2020 and 2050, the number of people 80 or older is projected to treble, reaching 426 million. Two-thirds of the world's population over 60 will reside in low- and middle-income nations by the year 2050. Some of the factors impacting the market are increasing diabetes prevalence, diabetic neuropathy is becoming more common and high Cost of Advanced Wound Care Technologies.

According to the latest information released by WHO and updated on April 2023, there were 422 million cases of diabetes worldwide in 2014, up from 108 million cases in 1980. Prevalence has been increasing more quickly compared to high-income countries in low- and middle-income nations. Diabetes significantly contributes to renal disease, heart attacks, strokes, blindness, and lower limb amputation. Age-specific diabetes mortality rates increased by 3% between 2000 and 2019. An estimated 2 million people died in 2019 from diabetes-related renal damage. Additionally, Diabetic neuropathy, a condition that may be brought on by chronically high blood sugar levels that are not controlled, is nerve damage connected to diabetes. Diabetic neuropathy usually affects the nerves in the legs and feet. Through several efforts, the general public has also been made aware of these diabetes implications. Due to increasing danger of developing a diabetic foot ulcer and the growing recognition of the relevance of diabetes, it is predicted that the market for treating diabetic foot ulcers will grow throughout the projection period.

However, although the frequency of this disorder is increasing internationally, some factors are now limiting expansion. One is the high price of cutting-edge wound care equipment and the few reimbursement programs available for these goods in underdeveloped countries. Even though several studies have shown that the total cost of wound dressing therapy is somewhat greater than that of a NWPT individual, these expenses are higher when compared to regular wound dressings. The market for treating diabetic foot ulcers may expand slower in light of the abovementioned issues.

Furthermore, the COVID-19 pandemic has hampered workflows in the medical community in different parts of the globe. Healthcare services, notably the treatment of diabetic foot ulcers, were affected by the pandemic. Treatments for diabetic foot ulcers were less accessible due to lockdowns, limitations on elective medical visits, and overburdened healthcare systems. The pandemic disrupted the manufacture and delivery of dressings, gadgets, and other items required to treat diabetic foot ulcers and the whole worldwide supply chain. As a result, COVID-19 had a detrimental influence on the market for treating diabetic foot ulcers.

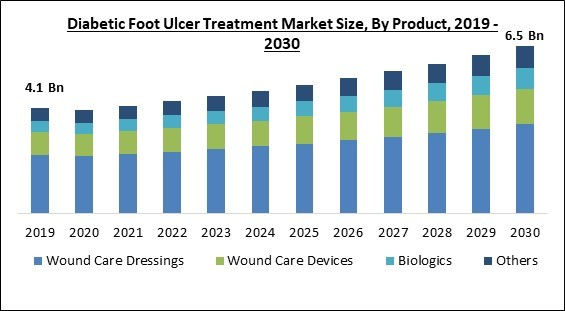

Product Outlook

On the basis of product, the market is divided into categories based on product, including biologics, wound care dressings, and wound care devices. In 2022, the wound dressing segment dominated the diabetes foot ulcer treatment market with the maximum revenue share. Alginate dressings, foam dressings, Hydrofiber dressings, film dressings, surgical dressings, hydrocolloid dressings, and hydrogel dressings are further categories for wound treatment. The key drivers influencing this market segment are the increased emphasis that market participants are placing on R&D, the growth in the number of technologically sophisticated product launches, the increased awareness of these goods in developing markets, and the sharp increase in per capita healthcare spending.Type Outlook

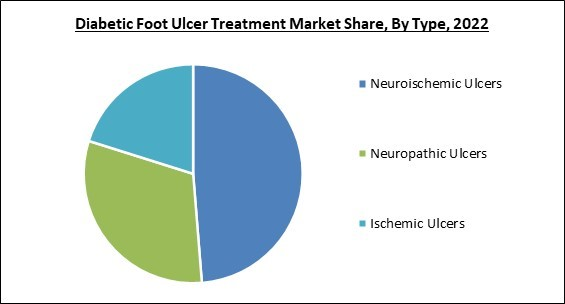

Based on type, the market is divided into neuropathic, ischemic, and neuro ischemic ulcers. The neuropathic ulcers segment garnered a significant revenue share in the market in 2022. The most typical sort of ulcers that individuals have are neuropathic ulcers. As a result, this group dominated the market for this kind of product. The usage of medications also rises which raises the revenue return for the market. This kind is the most difficult to manage since it causes the person great agony and anguish.Wound Care Devices Outlook

Under wound care devices type, the market is further bifurcated into negative pressure wound therapy and others. In 2022, the negative pressure wound therapy segment witnessed the largest revenue share in the market. The market is also expected to increase as a result of factors, including the increasing elderly population worldwide, which is extremely sensitive to numerous medical disorders that can result in the production of various types of wounds.End-user Outlook

By end user, the market is classified into hospitals, homecare settings, and others. In 2022, the homecare settings segment generated the maximum revenue share in the market. Since many patients prefer receiving treatment in a familiar setting, home care has become a promising market. This industry grew rapidly when hospitals stopped treating patients during the pandemic to reduce the danger of cross-infection. People handled and organized their care in their comfort zones, which helped the market.Regional Outlook

Region wise, the market is analyzed across North America, Europe, Asia Pacific, and LAMEA. In 2022, the North America region led the diabetes foot ulcer treatment market by generating the highest revenue share. Increased incidence of diabetic foot ulcers, the availability of a well-developed healthcare infrastructure, including specialist wound care facilities and diabetic clinics, and an increasing focus on the early identification and thorough treatment of diabetic foot ulcers are all factors that have contributed to this expansion.The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include Coloplast Group, B. Braun Melsungen AG, Integra LifeSciences Holdings Corporation, Smith & Nephew PLC, Cardinal Health, Inc., Medtronic PLC, 3M Company, Molnlycke Health Care AB, Essity AB and ConvaTec Group PLC.

Scope of the Study

By Product

- Wound Care Dressings

- Wound Care Devices

- Negative Pressure Wound Therapy

- Others

- Biologics

- Others

By Type

- Negative Pressure Wound Therapy

- Others

By End-user

- Homecare Settings

- Hospitals

- Others

By Geography

- North America

- US

- Canada

- Mexico

- Rest of North America

- Europe

- Germany

- UK

- France

- Russia

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Singapore

- Malaysia

- Rest of Asia Pacific

- LAMEA

- Brazil

- Argentina

- UAE

- Saudi Arabia

- South Africa

- Nigeria

- Rest of LAMEA

Key Market Players

List of Companies Profiled in the Report:

- Coloplast Group

- B.Braun Melsungen AG

- Integra LifeSciences Holdings Corporation

- Smith & Nephew PLC

- Cardinal Health, Inc.

- Medtronic PLC

- 3M Company

- Molnlycke Health Care AB

- Essity AB

- ConvaTec Group PLC

Unique Offerings

- Exhaustive coverage

- The highest number of Market tables and figures

- Subscription-based model available

- Guaranteed best price

- Assured post sales research support with 10% customization free

Table of Contents

Companies Mentioned

- Coloplast Group

- B. Braun Melsungen AG

- Integra LifeSciences Holdings Corporation

- Smith & Nephew PLC

- Cardinal Health, Inc.

- Medtronic PLC

- 3M Company

- Molnlycke Health Care AB

- Essity AB

- ConvaTec Group PLC