Asia Pacific’s emerging nations have seen increases in their GDPs and levels of disposable income. These developments have led to higher healthcare expenditures, modernized healthcare infrastructure, and a growing uptake of clinical laboratory technologies in Asia Pacific nations. Consequently, the Asia Pacific region would acquire approximately 2/5thshare of the market by 2030. Low regulatory obstacles, improved healthcare infrastructure, an escalating patient population, an increase in infections, and rising healthcare costs are all possible causes. Additionally, compared to wealthy countries, several of these nations' regulatory systems are more flexible and business friendly. Some of the factors impacting the market are increasing funds and investments, high instances of sexually transmitted diseases (STDs) and sexually transmitted infections (STIs), and the high price of instruments.

The market has growth potential due to government programs, funding initiatives, and other initiatives supporting and promoting innovation and development. Companies might invest in infrastructure, improved diagnostic technology production, research and development, financial incentives, and support systems. By making it easier for manufacturers to get funding, they are motivated to advance CT/NG testing, resulting in ground-breaking developments in disease detection, monitoring, and specialty medicine. It is anticipated that more developing nations would have access to high-quality healthcare as a result of their rapid economic growth and rising healthcare costs. This is seen as an indication that the market is expanding. The frequency of sexually transmitted infections (STIs) is increasing globally, which will be a key factor in the market's growth rate. According to estimates from the World Health Organization (WHO), more than 1 million asymptomatic STIs are contracted each day worldwide. In 2020, an estimated 374 million new cases of one of the four STIs (gonorrhoea (82 million), chlamydia (129 million), syphilis (7.1 million), or trichomoniasis (156 million)) will be reported. Abdominal pain, urethral discharge or burning in males, genital ulcers, and vaginal discharge are all typical STI symptoms. As a result, the market is expected to expand due to the increased prevalence of STIs.

However, the variable costs of the necessary reagents, tools, and setup by the vendors raise the overall cost. Additional expenses include maintenance and insurance, laboratory supervision, and administrative costs (which include office space, rent, and administration). The vast array of diagnostic tools may only be affordable to large institutions and reference labs with substantial capital budgets. On the other hand, small laboratories, medical practices, and independent or private practitioners may have trouble affording large or bulky devices and analyzers due to capital constraints. These expensive constraints may hamper the market expansion. It is crucial to check current sources because market conditions and pricing are likely to change, which is also a key factor driving the market down.

Furthermore, the pandemic outbreak initially had a negative impact on the market. Due to the laboratories' denial of the CT/NG tests, more instances were not reported, and there was an increase in the spread of these diseases. Reduced screening, limited resources, and social alienation measures established by the government all contributed an essential role in this decline.

Product Outlook

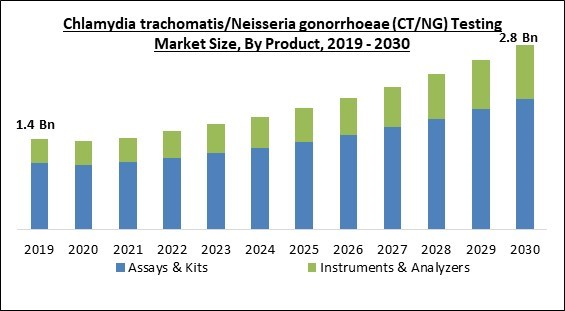

On the basis of product, the market is segmented into assays & kits, instruments/analyzers. The instruments/analyzers segment recorded a remarkable revenue share in the market in 2022. To diagnose such diseases, various instruments and analyzers were sold in the market. Since then, new technologies might have evolved due to the market's ongoing evolution. Nucleic Acid Amplification Tests (NAATs), Automated Analyzers, etc., are some instruments and analyzers often used for CT/NG testing. Using instruments and analyzers in Chlamydia trachomatis/Neisseria gonorrhoeae (CT/NG) testing provides many significant benefits that help in the accurate and speedy detection of these diseases.End-user Outlook

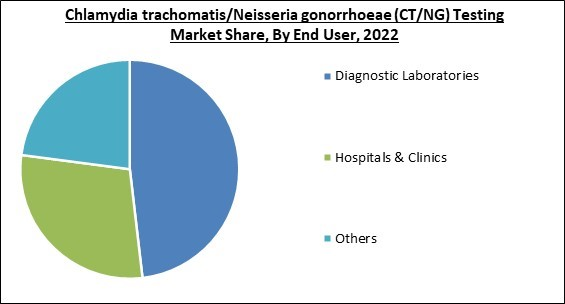

By end user, the market categorised into diagnostic laboratories, hospital & clinics, and other end users. In 2022, the diagnostic laboratories segment witnessed the largest revenue share in the market. These laboratories use chlamydia trachomatis/Neisseria gonorrhoeae (CT/NG) testing to identify or diagnose CT/NG and identify the best therapies. They take urine samples which are examined for CT/NG related diseases. The market is growing in this segment as a result of the presence of highly skilled professionals for diagnostics and availability of cutting-edge technologies in such laboratories.Technology Outlook

On the basis of technology, the market is fragmented into isothermal nucleic acid amplification technology, polymerase chain reaction, immunodiagnostics, and other technologies. In 2022, the isothermal nucleic acid amplification technology segment registered the highest revenue share in the market. The growing demand for quick, accurate diagnoses and the rising number of blood donations and transfusions have contributed to the growth of the INAAT sector. Other factors are the rising prevalence of CT/NG, the cost advantages of INAAT, the turnaround time of INAAT, and the necessity for these things. The INAAT segment's high sensitivity and specificity in CT/NG diagnosis can be blamed for segment’s growth.Testing Type Outlook

Based on testing type, the market is classified into lab tests, and PoC tests. The PoC tests segment garnered a significant revenue share in the market in 2022. Numerous terms, including "near-patient testing," "remote testing," "satellite testing," and "rapid diagnostics," may be used to describe it. Any test carried out at, close to, or at the location where care or treatment is provided falls within the broad category of point-of-care testing. This industry experienced growth due to patients' rising preferences and manufacturers' rising attention to creating point-of-care diagnostics.Regional Outlook

Region wise, the market is analysed across North America, Europe, Asia Pacific, and LAMEA. In 2022, the North America region generated the highest revenue share in the market. North America primarily led the development of technology in the region of diagnostics. A strong infrastructure for research and development is found in this region, which has accelerated the adoption of cutting-edge platforms and testing techniques. In the market, North America is also home to several significant businesses. The region's market dominance can be attributed to these businesses' extensive experience, resources, and established distribution networks.The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include Abbott Laboratories, Becton, Dickinson and Company, ZeptoMetrix LLC (Antylia Scientific), Danaher Corporation, F. Hoffmann-La Roche Ltd., Hologic, Inc., Thermo Fisher Scientific, Inc., Bayer AG, Qiagen N.V. and Siemens AG.

Scope of the Study

Market Segments Covered in the Report:

By Product

- Assays & Kits

- Instruments & Analyzers

By End-user

- Diagnostic Laboratories

- Hospitals & Clinics

- Others

By Testing Type

- Lab Tests

- PoC Tests

By Technology

- Isothermal Nucleic Acid Amplification Technology

- Polymerase Chain Reaction

- Immunodiagnostics

- Others

By Geography

- North America

- US

- Canada

- Mexico

- Rest of North America

- Europe

- Germany

- UK

- France

- Russia

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Singapore

- Malaysia

- Rest of Asia Pacific

- LAMEA

- Brazil

- Argentina

- UAE

- Saudi Arabia

- South Africa

- Nigeria

- Rest of LAMEA

Key Market Players

List of Companies Profiled in the Report:

- Abbott Laboratories

- Becton, Dickinson and Company

- ZeptoMetrix LLC (Antylia Scientific)

- Danaher Corporation

- F. Hoffmann-La Roche Ltd.

- Hologic, Inc.

- Thermo Fisher Scientific, Inc.

- Bayer AG

- Qiagen N.V.

- Siemens AG

Unique Offerings

- Exhaustive coverage

- The highest number of Market tables and figures

- Subscription-based model available

- Guaranteed best price

- Assured post sales research support with 10% customization free

Table of Contents

Companies Mentioned

- Abbott Laboratories

- Becton, Dickinson and Company

- ZeptoMetrix LLC (Antylia Scientific)

- Danaher Corporation

- F. Hoffmann-La Roche Ltd.

- Hologic, Inc.

- Thermo Fisher Scientific, Inc.

- Bayer AG

- Qiagen N.V.

- Siemens AG