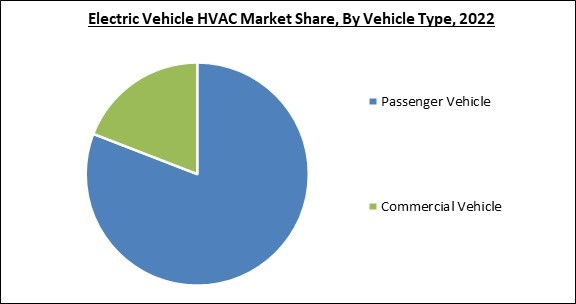

Technological advancements, particularly in battery technology, enable rapid electrification of trucks, buses, and other non-passenger vehicles. Consequently, the Commercial Vehicle segment would generate approximately 19% share of the market by 2030. The International Energy Agency (IEA) reported that more than 2.1 million electric cars were sold in 2019, representing nearly 2.6% of global car sales. In 2019, they also represented approximately 1% of the worldwide car stock, a 40% year-on-year increase compared to 2018. Original equipment manufacturers in developing regions, like China, India, and Japan, are adjusting to the shifting regional and segment trends in supply and demand concerning their production & supply base footprints, supply chains, and range of products. Moreover, urbanization and population growth enhance consumer demand for vehicles. Some of the factors impacting the market are environmental effects of HVAC system refrigerants, increasing demand for automobile thermal systems and automatic climate control, and high HVAC maintenance, repair, and installation expenses.

In the HVAC system of a car, the refrigerant is essential. Refrigerants such as hydrofluorocarbons, chlorofluorocarbons, and hydrofluoro-olefins (HFO) are used in the vehicle HVAC system. However, these refrigerants have a tendency to cause global warming (GWP), are detrimental to environmental sustainability, and may contribute to ozone depletion. For instance, the Minimum Energy Performance Standards (MEPS) levels in Australia are necessary specifications in the appropriate Australian Standards for certain items (such as air conditioners, refrigerators, and freezers) manufactured in or imported into Australia. One of the most crucial aspects to consider when buying a car is the thermal comfort inside. The HVAC system's installation ensures that both the driver and the passenger are in a comfortable temperature environment. The HVAC system enhances the temperature environment and increases air conditioning efficiency, lowering fuel usage. By switching from a positive temperature coefficient (PTC) heater to a heat pump-based system, for instance, an average energy savings of 17% to 52% can be made during cabin heating. As a result, the market is anticipated to rise favorably as HVAC systems based on heat pumpsbecome more widely used.

However, System failures brought on by poor maintenance can be expensive to fix or replace. The high cost of HVAC system maintenance is partly a result of the high price of replacement parts. HVAC system repairs can be pricey due to the high cost of replacement parts. Additionally, particularly with older HVAC systems, the accessibility of substitute parts can be problematic. The cost of the automobile will increase as a result of the large quantity that must be spent. The high price of HVAC systems could limit market expansion in the coming years.

Vehicle Type Outlook

Based on vehicle type, the market is segmented into passenger vehicle and commercial vehicle segments. In terms of revenue, the passenger vehicle segment dominated the market in 2022. The passenger car segment comprises vehicles for conveying people, such as compact cars, hatchbacks, sedans and luxury sedans, among others. Major global actors focus on passenger automobiles and luxury vehicles such as SUVs. Increased consumer disposable income and the production and sale of four-wheeled vehicles are responsible for incorporating HVAC systems in passenger automobiles. Principally automatic and manual technologies are utilized in passenger vehicles manufactured by industry leaders.Technology Outlook

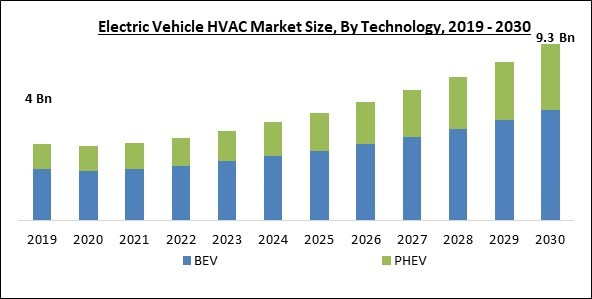

Based on technology, the market is segmented by technology into BEVs and PHEVs. In 2022, the BEV segment held the largest revenue share. To increase the driving range of BEVs, it is essential to install HVAC systems that minimize energy consumption while maximizing comfort. Optimized HVAC technologies can alleviate range anxiety, a significant concern among prospective BEV buyers. Furthermore, the demand for BEVs is driven by stringent emission standards and supportive policies encouraging the adoption of electric vehicles.Component Outlook

Based on component, the market is segmented into compressor, condenser, heater core, evaporator, and others. In 2022, the compressor segment captured a significant revenue share of the market. Independent of the vehicle's engine, an electric compressor is responsible for chilling the interior and battery pack and safeguarding the battery from overheating to prevent vehicle failure. Given that electric compressors are completely independent of the vehicle's engine, all of these benefits contribute to the improvement of the vehicle's overall efficiency, thereby fueling the demand for such compressors.Regional Outlook

Based on regions, the market is analyzed across North America, Europe, Asia Pacific, and LAMEA. Asia Pacific dominated the market in 2022 by generating the largest revenue share. China's demand for electric buses keeps rising, and many cities now operate electric fleets entirely. Under Phase 2 of the FAME (Faster Adoption and Manufacturing of Electric Vehicles) scheme, the procurement of electric vehicles, particularly for public transportation in India, has been accelerated. Consequently, such factors continue to fuel the demand for electric vehicles, which will, in turn, drive market expansion in this region.The market research report covers the analysis of key stakeholders of the market. Key companies profiled in the report include Valeo SA, Hanon Systems (Hahn & Co. Auto Holdings Co., Ltd.), Toyota Industries Corporation, Mahle GmbH (Mahle Stiftung GmbH), Panasonic Holdings Corporation, Johnson Electric Holdings Limited, Sanden Corporation (Hisense Home Appliances Group Co., Ltd), Marelli Holdings Co., Ltd., Denso Corporation, and Brose Fahrzeugteile SE & Co. KG.

Strategies Deployed in the Market

- Jul-2023: Marelli introduced its brand-new integrated Thermal Management Module (iTMM) for electric vehicles. This module enables the effective integration of the vehicle's various thermal circuits into a single component to create a more efficient thermal management system, ultimately enhancing driving range, safety, and flexibility. The iTMM effectively integrates the three systems, utilizing their synergies and sharing components, to provide improved energy management by using this integrated valve, which manages up to 6 channel combinations. This ensures excellent cooling of the electric drivetrain, great safety, ultra-rapid battery charging, and ideal thermal comfort within the cabin, all while reducing the complexity of the entire system.

- Jun-2023: Valeo introduced the Thermo HV, a new high-voltage water coolant heater for electric buses and other commercial electric vehicles. The 'Thermo HV' supports input voltages of 600 to 875 volts and produces variable heat outputs of up to 12 kW. It is extremely silent and emits no emissions. Its 4.9 kg weight and dimensions of 250 x 182 x 194 (l x w x h) make it both small and lightweight, making it simple to integrate into a car's HVAC system.

- Mar-2023: Panasonic's Heating & Ventilation A/C Company, took over Systemair AC SAS, Systemair S.r.l., and Tecnair S.p.A., which operate commercial air-conditioning businesses, all owned by Systemair. The combined resources of the companies will result in stronger development, production, sales, and maintenance structures, as well as the creation of new, highly valuable systems for the production of space heating and hot water supply in addition to air conditioning systems.

- Jan-2023: Marelli collaborated with Sibros following which Sibros will install its over-the-air software and data management solutions on Marelli's next-generation Cockpit Domain Controller (CDC) Unit. Marelli's MInD-Xp offers a single platform and domain control unit (DCU) to run various guest operating systems and in-cabin features such as infotainment, clusters, driver assistance systems, and head-up displays to improve the driving and passenger experiences in a coherent Human-Machine Interface (HMI).

- Oct-2022: Johnson Electric acquired an 80 percent stake in Pendix, a company focused on designing, manufacturing, and bringing complete electric cargo bikes and electric drives for bicycles. The acquisition would help Johnson Electric to enter the e-bike market, and by doing so, the company aspires to build a more sustainable future for individual transportation.

- Mar-2022: Hanon Systems established a new plant in Hubei, China for reinforcing Hanon's enhanced support to automakers in the electrified vehicle business. This plant serves as the company's dedication to providing locally produced solutions to foreign automakers doing business in China.

- Mar-2021: Sanden Holdings signed a share underwriting agreement with Hisense Home Appliances Group, an electronics manufacturer group. Following the agreement, the company aimed to offer an integrated thermal management system with more sophisticated AI-based air conditioning control and control technologies. Through collaborative procurement of raw materials/electronic components and usage of human resources, Sanden can produce synergistic results in the short term.

- Feb-2021: MAHLE took over the air conditioning business from the former Keihin Corporation (now Hitachi Astemo, Ltd.) in Japan, Thailand, and the USA. With this acquisition, MAHLE is enhancing its presence in the market for air conditioning systems.

Scope of the Study

Market Segments Covered in the Report:

By Technology

- BEV

- PHEV

By Component

- Condenser

- Compressor

- Heater Core

- Evaporator

- Others

By Vehicle Type

- Passenger Vehicle

- Commercial Vehicle

By Geography

- North America

- US

- Canada

- Mexico

- Rest of North America

- Europe

- Germany

- UK

- France

- Russia

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Singapore

- Malaysia

- Rest of Asia Pacific

- LAMEA

- Brazil

- Argentina

- UAE

- Saudi Arabia

- South Africa

- Nigeria

- Rest of LAMEA

Key Market Players

List of Companies Profiled in the Report:

- Valeo SA

- Hanon Systems (Hahn & Co. Auto Holdings Co., Ltd.)

- Toyota Industries Corporation

- Mahle GmbH (Mahle Stiftung GmbH)

- Panasonic Holdings Corporation

- Johnson Electric Holdings Limited

- Sanden Corporation (Hisense Home Appliances Group Co., Ltd)

- Marelli Holdings Co., Ltd.

- Denso Corporation

- Brose Fahrzeugteile SE & Co. KG

Unique Offerings

- Exhaustive coverage

- The highest number of Market tables and figures

- Subscription-based model available

- Guaranteed best price

- Assured post sales research support with 10% customization free

Table of Contents

Companies Mentioned

- Valeo SA

- Hanon Systems (Hahn & Co. Auto Holdings Co., Ltd.)

- Toyota Industries Corporation

- Mahle GmbH (Mahle Stiftung GmbH)

- Panasonic Holdings Corporation

- Johnson Electric Holdings Limited

- Sanden Corporation (Hisense Home Appliances Group Co., Ltd)

- Marelli Holdings Co., Ltd.

- Denso Corporation

- Brose Fahrzeugteile SE & Co. KG