Rising penetration of genetic diseases such as cancer, diabetes, and tuberculosis, propels the market of genotyping market. According to the World Health Organization’s 2022, - it is projected that 10.6 million people fell ill with Tuberculosis (TB) in 2021, an increase of 4.5% from 2020, and 1.6 million people died from TB (including 187 000 among HIV-positive people). Additionally, according to IDF,” By 2045 approximately 783 million, will be living with diabetes, an increase of 46%. As per the World Health Organization (WHO), it's projected that around 10-11 million cancer cases are going to be diagnosed every year globally by 2030. These diseases are driven by socio-economic, demographic, environmental, and genetic factors. Thus, genotyping can be used to identify predetermined genetic aberration. As the demand for genotyping grows, manufacturers are investing in research and development to boost the market even further.

The global genotyping market is bifurcated by product, technology, application, and end-use. Further, the product segment is further bifurcated into instruments, reagents & kits, bioinformatics, and software and services. The reagents & kits segment is anticipated to have a significant impact on the market growth during the forecast period. The growth of the segment is attributed due to increasing demand for genetic testing, rising investments in R&D, and increasing genotyping testing volumes. Furthermore, the bioinformatics segment is also significant as bioinformatics has proven quite useful in medicine as the complete sequencing of the human genome has helped to unlock the genetic contribution for many diseases.

The global genotyping market is segmented into the Asia Pacific, North America, Europe, the Middle East & Africa, and South America. North America is predicted to be the fastest-growing region within the global market share. Due to the growing use of technologically advanced goods, the existence of significant pharmaceutical and biopharmaceutical businesses, pro-active government policies, and improvements in healthcare infrastructure. Another important element contributing to the high market share in this area is the existence of big players.

Report Findings

1) Drivers

- Rising research and development in the pharmaceutical sector drives the genotyping market.

- Rising penetration of genetic diseases such as cancer, diabetes, tuberculosis propels the market of genotyping market.

2) Restraints

- The genotyping market's overall growth is adversely affected by strict rules and regulations as well as unfavorable reimbursement practices.

3) Opportunities

- The deployment of genotyping technological advancement boosts the market of genotyping in future.

Research Methodology

A) Primary Research

The primary research involves extensive interviews and analysis of the opinions provided by the primary respondents. The primary research starts with identifying and approaching the primary respondents.The primary respondents are approached include

1. Key Opinion Leaders2. Internal and External subject matter experts

3. Professionals and participants from the industry

The primary research respondents typically include

1. Executives working with leading companies in the market under review2. Product/brand/marketing managers

3. CXO level executives

4. Regional/zonal/country managers

5. Vice President level executives.

B) Secondary Research

Secondary research involves extensive exploring through the secondary sources of information available in both the public domain and paid sources. Each research study is based on over 500 hours of secondary research accompanied by primary research. The information obtained through the secondary sources is validated through the crosscheck on various data sources.The secondary sources of the data typically include

1. Company reports and publications2. Government/institutional publications

3. Trade and associations journals

4. Databases such as WTO, OECD, World Bank, and among others.

5. Websites and publications by research agencies

Segment Covered

The global genotyping market is segmented on the basis of product, technology, application, and end-use.The Global Genotyping Market by Product

- Instruments

- Reagents & Kits

- Bioinformatics

- Software and Services

The Global Genotyping Market by Technology

- PCR

- Capillary Electrophoresis

- Microarrays

- MALDI-TOF

- Sequencing

- Mass Spectrometry

- Others

The Global Genotyping Market by Application

- Pharmacogenomics

- Diagnostics

- Personalized Medicine

- Agricultural Biotechnology

- Animal Genetic

- Others

The Global Genotyping Market by End-use

- Pharmaceutical and Biopharmaceutical Companies

- Diagnostics and Research Laboratories

- Academic Institutes

- Others

Company Profiles

The companies covered in the report include- Illumina, Inc.

- Thermo Fisher Scientific Inc.

- QIAGEN

- F. Hoffmann-La Roche Ltd

- Fluidigm (is now Standard BioTools)

- Danaher

- Agilent Technologies, Inc.

- Eurofins Scientific

- GE HealthCare

- BGI Group

What does this Report Deliver?

1. Comprehensive analysis of the global as well as regional markets of the genotyping market.2. Complete coverage of all the segments in the genotyping market to analyze the trends, developments in the global market and forecast of market size up to 2030.

3. Comprehensive analysis of the companies operating in the global genotyping market. The company profile includes analysis of product portfolio, revenue, SWOT analysis and latest developments of the company.

4. Growth Matrix presents an analysis of the product segments and geographies that market players should focus to invest, consolidate, expand and/or diversify.

Table of Contents

Companies Mentioned

- Illumina, Inc.

- Thermo Fisher Scientific Inc.

- QIAGEN

- F. Hoffmann-La Roche Ltd

- Fluidigm (is now Standard BioTools)

- Danaher

- Agilent Technologies, Inc.

- Eurofins Scientific

- GE HealthCare

- BGI Group

Table Information

| Report Attribute | Details |

|---|---|

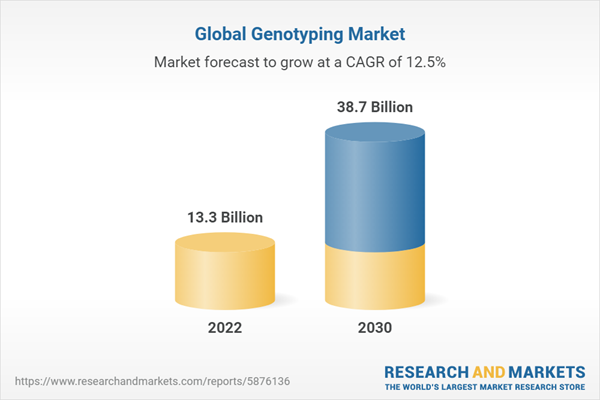

| No. of Pages | 300 |

| Published | August 2023 |

| Forecast Period | 2022 - 2030 |

| Estimated Market Value in 2022 | 13.3 Billion |

| Forecasted Market Value by 2030 | 38.7 Billion |

| Compound Annual Growth Rate | 12.5% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |