Increasing prevalence of lymphoma & myeloma, growing demand for personalized therapy, availability of advanced molecular techniques for hemato-oncology diagnostics, and increasing drug-diagnostics co-development are some of the major factors anticipated to boost the growth of the market during the forecast period. The rapid evolution of molecular diagnostics has transformed the landscape of hemato-oncology, offering precise and personalized approaches for the detection, diagnosis, prognosis, and treatment of various blood cancers. These cutting-edge techniques have significantly improved the understanding of disease biology and therapeutic response, leading to better patient outcomes and more efficient clinical workflows.

Molecular diagnostics in hematologic malignancies often rely on methods like real-time PCR, fluorescence in situ hybridization (FISH), and next-generation sequencing (NGS) to detect specific genetic alterations. For instance, chronic myeloid leukemia (CML) is routinely diagnosed using PCR-based tests targeting the BCR::ABL1 fusion gene or FISH assays. Standardization of BCR/ABL measurement internationally has facilitated easier and more accurate diagnosis of CML across laboratories. Similarly, acute myeloid leukemia (AML) and acute lymphoblastic leukemia (ALL) benefit from molecular diagnostics, with NGS panels enabling the identification of multiple gene mutations simultaneously, including FLT3-ITD, NPM1, and TP53, which are critical for risk stratification and treatment selection. In lymphomas, techniques like T-cell clonality assays, targeted FISH, and IgVH analysis are widely employed, while the JAK2 V617F mutation serves as a critical marker for diagnosing polycythemia vera in high-risk patients.

Recent advancements have introduced more sophisticated tools such as single-cell sequencing, optical genome mapping (OGM), and long-read sequencing. Single-cell sequencing provides unprecedented resolution at the cellular level, offering insights into clonal diversity and tumor evolution. OGM, as demonstrated in a recent study published in The Journal of Molecular Diagnostics, enables comprehensive cytogenomic profiling of tumors, including multiple myeloma, by efficiently identifying structural variants and copy number changes even in low-yield cell populations. This pan-genomic approach reduces the need for separate, marker-specific tests, streamlining workflows and improving diagnostic accuracy. The study at Lille University Hospital confirmed that OGM can reduce the number of cells required for complete genomic profiling, showing 93% concordance with traditional FISH on five tested markers and identifying over 22 additional genomic variants of interest.

In 2024, Oxford Gene Technology (OGT) introduced the SureSeq Myeloid Fusion Panel, a groundbreaking RNA-based NGS tool designed for the comprehensive identification of fusion genes in AML. This panel, developed in collaboration with leading myeloid cancer experts, covers over 30 key disease-associated fusions, including KMT2A and MECOM, and employs a partner-gene agnostic approach to detect rare and novel fusions in a single assay. The integration of this panel into end-to-end NGS workflows has significantly enhanced the ability to classify samples, reducing the need for extensive bioinformatics resources and improving turnaround times in clinical laboratories.

Moreover, long-read sequencing technologies, such as those developed by Pacific Biosciences and Oxford Nanopore, are revolutionizing the field by providing complete, error-free readouts of complex genomic regions. These platforms are overcoming the limitations of short-read NGS, enabling the detection of structural variants, complex rearrangements, and copy number changes with unparalleled precision.

Collectively, these advanced molecular technologies are reshaping the diagnostic landscape in hemato-oncology, providing clinicians with powerful tools for personalized medicine. The continuous innovation in this space promises to further enhance the accuracy, speed, and cost-effectiveness of cancer diagnostics, ultimately leading to better patient outcomes and more personalized treatment strategies.

In addition, lymphoma and myeloma are among the most common and clinically significant hematologic malignancies in the United States, contributing significantly to the overall cancer burden.

Global Hemato Oncology Testing Market Report Segmentation

This report forecasts revenue growth and provides an analysis on the market trends in each of the sub-markets from 2018 to 2030. For this study, the analyst has segmented the global hemato oncology testing market report based on cancer, product, technology, end use, and region:Cancer Outlook (Revenue, USD Million, 2018 - 2030)

- Leukemia

- Acute Myeloid Leukemia (AML)

- Acute Lymphocytic Leukemia (ALL)

- Chronic Lymphocytic Leukemia

- Chronic Myeloid Leukemia

- Lymphoma

- Non-Hodgkin Lymphoma

- Hodgkin Lymphoma

- Myeloproliferative Neoplasms

- Polycythemia vera (PV)

- Essential thrombocythemia (ET)

- Myelofibrosis (MF)

- Other Cancers

Product Outlook (Revenue, USD Million, 2018 - 2030)

- Assay Kits and Reagents

- Services

Technology Outlook (Revenue, USD Million, 2018 - 2030)

- PCR

- Real-time qPCR

- Digital PCR

- IHC

- NGS

- Cytogenetics

- Others

End Use Outlook (Revenue, USD Million, 2018 - 2030)

- Hospitals

- Academic and Research Institutes

- Others

Regional Outlook (Revenue, USD Million, 2018 - 2030)

- North America

- U.S

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Russia

- Denmark

- Sweden

- Norway

- Asia Pacific

- India

- China

- Japan

- Australia

- Singapore

- South Korea

- Thailand

- Latin America

- Argentina

- Brazil

- Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Kuwait

Why should you buy this report?

- Comprehensive Market Analysis: Gain detailed insights into the global market across major regions and segments.

- Competitive Landscape: Explore the market presence of key players worldwide.

- Future Trends: Discover the pivotal trends and drivers shaping the future of the global market.

- Actionable Recommendations: Utilize insights to uncover new revenue streams and guide strategic business decisions.

This report addresses:

- Market intelligence to enable effective decision-making

- Market estimates and forecasts from 2018 to 2030

- Growth opportunities and trend analyses

- Segment and regional revenue forecasts for market assessment

- Competition strategy and market share analysis

- Product innovation listing for you to stay ahead of the curve

- COVID-19's impact and how to sustain in these fast-evolving markets

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- F. Hoffmann-La Roche Ltd

- Abbott

- EntroGen, Inc.

- Qiagen N.V.

- Cepheid (Danaher Corporation)

- Thermo Fisher Scientific, Inc.

- Bio-Rad Laboratories, Inc.

- Illumina, Inc.

- Amoy Diagnostics Co., Ltd.

- ASURAGEN, INC

- ArcherDX, Inc. (IDT)

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 120 |

| Published | July 2025 |

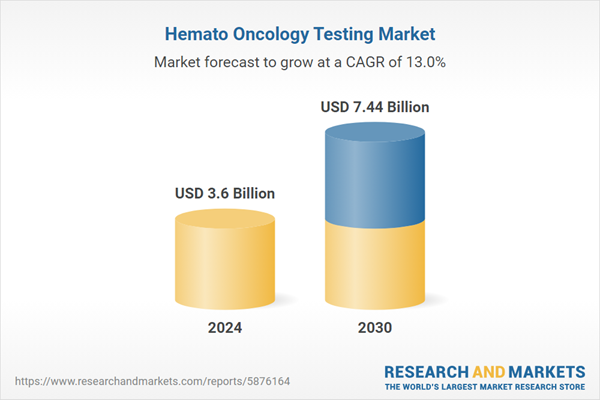

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 3.6 Billion |

| Forecasted Market Value ( USD | $ 7.44 Billion |

| Compound Annual Growth Rate | 12.9% |

| Regions Covered | Global |

| No. of Companies Mentioned | 11 |