Proteins are altered using specific procedures to produce recombinant proteins. These recombinant proteins are then encoded by genes to produce massive amounts of protein, which are then utilized to manufacture therapeutic products. Increased government initiatives and investment in the field of life sciences are likely to drive Europe recombinant protein manufacturing services industry expansion.

In addition, the growing demand and complexity of manufacturing laws & regulations and the rising maintenance cost of GMP certification at sites are driving the adoption of outsourced manufacturing & packaging models. Outsourcing is also enabling companies to release capital and cut overhead costs. Furthermore, the biotech companies in the UK are outperforming their European peers in terms of securing early-stage funding. From 2018 to 2020, biotech start-ups in the country raised USD 3.6 billion, a 20% increase from the amount raised from 2015 to 2017. As a result, the R&D services landscape in the country is expected to witness significant growth in the coming decade.

In Europe, several leading companies offer recombinant protein production services, including Lonza; GenScript; Merck KGaA; Kaneka Eurogentec S. A.; ExcellGene SA., and others, creating growth prospects for outsourcing activities. Key players in the region are expanding their manufacturing capabilities to cater to the growing outsourcing demand in Europe.

For instance, in October 2022, Merck KGaA opened a new commercial facility for its Millipore CTDMO Services in Martillac, France. The new 2,700 sq. m. facility was built for producing drug substances, including monoclonal antibodies and other recombinant proteins. Similarly, in August 2019, Fujifilm acquired Biogen’s Denmark-based biologics manufacturing site for around USD 890 million. Such initiatives are expected to create lucrative growth opportunities in the recombinant protein manufacturing services industry over the coming decade.

Although the presence of strong regulations helps safeguard patient health and safety, it may lead to delayed approvals, high manufacturing costs, and challenges in compliance, which may hamper the development of recombinant protein-based products, limiting the growth of manufacturing services.

Europe Recombinant Protein Manufacturing Services Market Report Highlights

- By service type, the commercial production services segment accounted for the largest share of 58.82% in 2022. This attributed to the growing accessibility of high-yield expression systems

- By host cell, the mammalian segment accounted for the largest share of 54.70% in 2022. The market is expanding due to growing demand for mammalian cells from pharmaceutical and biotech companies

- By end-use, the pharmaceutical & biotechnology companies segment accounted for the largest share of 78.79% in 2022. Recombinant proteins have gained immense traction in the biotechnology & pharmaceutical industries, wherein they can be utilized to create vaccines and treatments for various illnesses and protein manufacturing services

- Germany held a large share of total revenues in 2022. This is mostly due to the presence of major market participants, increased research spending, and the availability of well-established healthcare infrastructure, which is driving market growth across the region

Table of Contents

Companies Mentioned

- Lonza

- Boehringer Ingelheim International GmbH

- FUJIFILM Diosynth Biotechnologies

- Merck KGaA

- Bruker (InVivo BioTech Services GmbH)

- Sino Biological, Inc.

- GenScript

- Kaneka corporation (Kaneka Eurogentec S.A)

- Polyplus Transfection (Xpress Biologics)

- Boster Biological Technology

- Trenzyme GmbH

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 98 |

| Published | August 2023 |

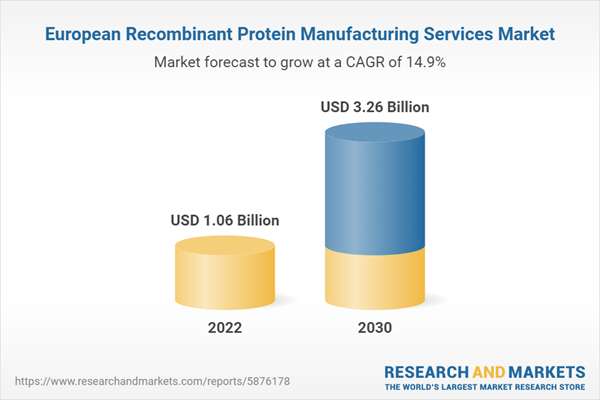

| Forecast Period | 2022 - 2030 |

| Estimated Market Value ( USD | $ 1.06 Billion |

| Forecasted Market Value ( USD | $ 3.26 Billion |

| Compound Annual Growth Rate | 14.8% |

| Regions Covered | Europe |

| No. of Companies Mentioned | 11 |