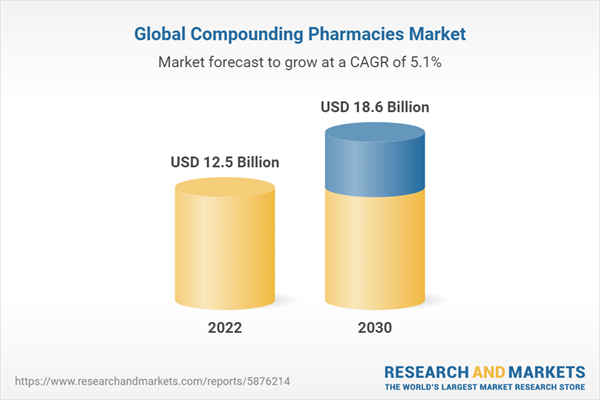

The global compounding pharmacies market size is expected to reach USD 18.6 billion by 2030. It is projected to register a CAGR of 5.11% during the forecast period. The market's growth can be attributed to the growing importance of medication adherence and increasing supportive government policies. For instance, in November 2022, the U. S. Food & Drug Administration conducted its 11th intergovernmental meeting to discuss compounding oversight, and efforts to support the Compounding Quality Act (CQA) implementation. Furthermore, the increasing demand for personalized medicine is driving the growth of the market. Compounding pharmacies specialize in creating customized medications based on the unique needs of individual patients.

Children and older adults often require medications in unique strengths or alternative dosage forms due to their specific age-related needs. Compounding pharmacies can tailor medications to meet the specific requirements of these populations, such as formulating liquid suspensions for easier administration or adjusting dosages based on body weight. The COVID-19 pandemic slightly impacted the market in the initial phase. The market recovered at the start of 2021 as patients suffering from chronic diseases could not acquire their medications due to government lockdowns in various nations and the closure of pharmacy stores in some nations. Several compounding pharmacies began offering a simple and secure method for consumers to deposit their compound prescriptions online and receive medicine at their door, which, in turn, increased the demand during the pandemic.

Children and older adults often require medications in unique strengths or alternative dosage forms due to their specific age-related needs. Compounding pharmacies can tailor medications to meet the specific requirements of these populations, such as formulating liquid suspensions for easier administration or adjusting dosages based on body weight. The COVID-19 pandemic slightly impacted the market in the initial phase. The market recovered at the start of 2021 as patients suffering from chronic diseases could not acquire their medications due to government lockdowns in various nations and the closure of pharmacy stores in some nations. Several compounding pharmacies began offering a simple and secure method for consumers to deposit their compound prescriptions online and receive medicine at their door, which, in turn, increased the demand during the pandemic.

Compounding Pharmacies Market Report Highlights

- Based on the therapeutic area, the pain management segment held the largest revenue share in 2022 owing to its tailored approaches to address the adverse effects of commercially available pain management medications

- Based on the age cohort, the adult segment dominated the market with the largest revenue share in 2022 due to factors, such as specific dosage strengths, allergies or sensitivities to certain ingredients, or preferences for alternative dosage forms

- Based on the compounding type, the pharmaceutical ingredient alteration (PIA) segment dominated the market. This can be attributed to the high demand for customized drugs from patients with special needs

- The sterile segment dominated the market with the largest revenue share in 2022 owing to the high demand for intravenous sterile preparations of different dosage forms from pediatric and geriatric patients

- The North America region held the largest revenue share in 2022 due to the presence of a large number of pharmacies offering compounding services and increasing support from authorities, such as the FDA

Table of Contents

Chapter 1. Methodology and Scope

1.1. Market Segmentation

1.2. Estimates and Forecast Timeline

1.3. Research Methodology

1.3.1. Information procurement

1.3.2. Purchased Database

1.3.3. Analyst's Internal Database

1.3.4. Secondary Sources

1.3.5. Primary Research

1.3.6. Details of Primary Research

1.4. Information or Data Analysis

1.4.1. Data Analysis Models

1.5. 1.5 Market Formulation & Validation

1.5.1. Volume Price Analysis

1.6. List of Secondary Sources

1.7. List of Abbreviations

1.8. Research Objectives

1.8.1. Objective - 1

1.8.2. Objective - 2

1.8.3. Objective - 3

1.2. Estimates and Forecast Timeline

1.3. Research Methodology

1.3.1. Information procurement

1.3.2. Purchased Database

1.3.3. Analyst's Internal Database

1.3.4. Secondary Sources

1.3.5. Primary Research

1.3.6. Details of Primary Research

1.4. Information or Data Analysis

1.4.1. Data Analysis Models

1.5. 1.5 Market Formulation & Validation

1.5.1. Volume Price Analysis

1.6. List of Secondary Sources

1.7. List of Abbreviations

1.8. Research Objectives

1.8.1. Objective - 1

1.8.2. Objective - 2

1.8.3. Objective - 3

Chapter 2. Executive Summary

2.1. Market Snapshot

2.2. Segment Snapshot

2.3. Competitive Landscape Snapshot

2.2. Segment Snapshot

2.3. Competitive Landscape Snapshot

Chapter 3. Market Variables, Trends, & Scope

3.1. Market Dynamics

3.1.1. Market Driver Analysis

3.1.1.1. Increasing supportive government policies

3.1.1.2. Increasing demand for personalized medications

3.1.1.3. Growing importance of pharmaceutical compounding in promoting medication adherence

3.1.2. Market Restraint Analysis

3.1.2.1. Risk of Chemical Contamination

3.1.2.2. Chances of human errors or medication errors

3.2. Industry Analysis Tools

3.2.1. Porter's Five Forces Analysis

3.2.2. PESTLE Analysis

3.3. COVID-19 Impact Analysis

3.1.1. Market Driver Analysis

3.1.1.1. Increasing supportive government policies

3.1.1.2. Increasing demand for personalized medications

3.1.1.3. Growing importance of pharmaceutical compounding in promoting medication adherence

3.1.2. Market Restraint Analysis

3.1.2.1. Risk of Chemical Contamination

3.1.2.2. Chances of human errors or medication errors

3.2. Industry Analysis Tools

3.2.1. Porter's Five Forces Analysis

3.2.2. PESTLE Analysis

3.3. COVID-19 Impact Analysis

Chapter 4. Compounding Pharmacies Market: Therapeutic Area Estimates & Trend Analysis

4.1. Segment Definitions

4.2. Compounding Pharmacies Market: Segment Dashboard

4.3. Compounding Pharmacies Market: Therapeutic Area Movement & Market Share Analysis

4.4. Hormone Replacement Therapy

4.4.1. Hormone Replacement Therapy Market, 2018 - 2030 (USD Million)

4.5. Pain Management

4.5.1. Pain Management Market, 2018 - 2030 (USD Million)

4.6. Dermatology

4.6.1. Dermatology Market, 2018 - 2030 (USD Million)

4.7. Specialty Drugs

4.7.1. Specialty Drugs Market, 2018 - 2030 (USD Million)

4.8. Nutritional Supplements

4.8.1. Nutritional Supplements Market, 2018 - 2030 (USD Million)

4.9. Others

4.9.1. Others Market, 2018 - 2030 (USD Million)

4.2. Compounding Pharmacies Market: Segment Dashboard

4.3. Compounding Pharmacies Market: Therapeutic Area Movement & Market Share Analysis

4.4. Hormone Replacement Therapy

4.4.1. Hormone Replacement Therapy Market, 2018 - 2030 (USD Million)

4.5. Pain Management

4.5.1. Pain Management Market, 2018 - 2030 (USD Million)

4.6. Dermatology

4.6.1. Dermatology Market, 2018 - 2030 (USD Million)

4.7. Specialty Drugs

4.7.1. Specialty Drugs Market, 2018 - 2030 (USD Million)

4.8. Nutritional Supplements

4.8.1. Nutritional Supplements Market, 2018 - 2030 (USD Million)

4.9. Others

4.9.1. Others Market, 2018 - 2030 (USD Million)

Chapter 5. Compounding Pharmacies Market: Age Cohort Estimates & Trend Analysis

5.1. Segment Definitions

5.2. Compounding Pharmacies Market: Segment Dashboard

5.3. Compounding Pharmacies Market: Age Cohort Movement & Market Share Analysis

5.4. Pediatric

5.4.1. Pediatric Market, 2018 - 2030 (USD Million)

5.5. Adult

5.5.1. Adult Market, 2018 - 2030 (USD Million)

5.6. Geriatric

5.6.1. Geriatric Market, 2018 - 2030 (USD Million)

5.2. Compounding Pharmacies Market: Segment Dashboard

5.3. Compounding Pharmacies Market: Age Cohort Movement & Market Share Analysis

5.4. Pediatric

5.4.1. Pediatric Market, 2018 - 2030 (USD Million)

5.5. Adult

5.5.1. Adult Market, 2018 - 2030 (USD Million)

5.6. Geriatric

5.6.1. Geriatric Market, 2018 - 2030 (USD Million)

Chapter 6. Compounding Pharmacies Market: Compounding Type Estimates & Trend Analysis

6.1. Segment Definitions

6.2. Compounding Pharmacies Market: Segment Dashboard

6.3. Compounding Pharmacies Market: Compounding type Movement & Market share Analysis

6.4. Pharmaceutical Ingredient Alteration (PIA)

6.4.1. Pharmaceutical Ingredient Alteration (PIA) Market, 2018 - 2030 (USD Million)

6.5. Currently Unavailable Pharmaceutical Manufacturing (CUPM)

6.5.1. Currently Unavailable Pharmaceutical Manufacturing (CUPM) Market, 2018 - 2030 (USD Million)

6.6. Pharmaceutical Dosage Alteration (PDA)

6.6.1. Pharmaceutical Dosage Alteration (PDA) Market, 2018 - 2030 (USD Million)

6.7. Others

6.7.1. Others Market, 2018 - 2030 (USD Million)

6.2. Compounding Pharmacies Market: Segment Dashboard

6.3. Compounding Pharmacies Market: Compounding type Movement & Market share Analysis

6.4. Pharmaceutical Ingredient Alteration (PIA)

6.4.1. Pharmaceutical Ingredient Alteration (PIA) Market, 2018 - 2030 (USD Million)

6.5. Currently Unavailable Pharmaceutical Manufacturing (CUPM)

6.5.1. Currently Unavailable Pharmaceutical Manufacturing (CUPM) Market, 2018 - 2030 (USD Million)

6.6. Pharmaceutical Dosage Alteration (PDA)

6.6.1. Pharmaceutical Dosage Alteration (PDA) Market, 2018 - 2030 (USD Million)

6.7. Others

6.7.1. Others Market, 2018 - 2030 (USD Million)

Chapter 7. Compounding Pharmacies Market: Sterility Estimates & Trend Analysis

7.1. Segment Definitions

7.2. Compounding Pharmacies Market: Segment Dashboard

7.3. Compounding Pharmacies Market: Sterility Movement & Market Share Analysis

7.4. Sterility

7.4.1. Sterility Market, 2018 - 2030 (USD Million)

7.5. Non-Sterility

7.5.1. Non-Sterility Market, 2018 - 2030 (USD Million)

7.2. Compounding Pharmacies Market: Segment Dashboard

7.3. Compounding Pharmacies Market: Sterility Movement & Market Share Analysis

7.4. Sterility

7.4.1. Sterility Market, 2018 - 2030 (USD Million)

7.5. Non-Sterility

7.5.1. Non-Sterility Market, 2018 - 2030 (USD Million)

Chapter 8. Compounding Pharmacies Market: Regional Estimates & Trend Analysis

8.1. Compounding Pharmacies Market: Regional Movement Analysis, 2022 & 2030

8.2. North America

8.2.1. North America Compounding Pharmacies Market Estimates and Forecasts, 2018 - 2030 (USD Million)

8.2.2. U.S.

8.2.2.1. Key Country Dynamics

8.2.2.2. Regulatory Scenario

8.2.2.3. Competitive Scenario

8.2.2.4. U.S. Compounding Pharmacies Market Estimates and Forecasts, 2018 - 2030 (USD Million)

8.2.3. Canada

8.2.3.1. Key Country Dynamics

8.2.3.2. Regulatory Scenario

8.2.3.3. Competitive Scenario

8.2.3.4. Canada Compounding Pharmacies Market Estimates and Forecasts, 2018 - 2030 (USD Million)

8.3. Europe

8.3.1. Europe Compounding Pharmacies Market Estimates and Forecasts, 2018 - 2030 (USD Million)

8.3.2. UK

8.3.2.1. Key Country Dynamics

8.3.2.2. Regulatory Scenario

8.3.2.3. Competitive Scenario

8.3.2.4. UK Compounding Pharmacies Market Estimates and Forecasts, 2018 - 2030 (USD Million)

8.3.3. Germany

8.3.3.1. Key Country Dynamics

8.3.3.2. Regulatory Scenario

8.3.3.3. Competitive Scenario

8.3.3.4. Germany Compounding Pharmacies Market Estimates and Forecasts, 2018 - 2030 (USD Million)

8.3.4. France

8.3.4.1. Key Country Dynamics

8.3.4.2. Regulatory Scenario

8.3.4.3. Competitive Scenario

8.3.4.4. France Compounding Pharmacies Market Estimates and Forecasts, 2018 - 2030 (USD Million)

8.3.5. Italy

8.3.5.1. Key Country Dynamics

8.3.5.2. Regulatory Scenario

8.3.5.3. Competitive Scenario

8.3.5.4. Italy Compounding Pharmacies Market Estimates and Forecasts, 2018 - 2030 (USD Million)

8.3.6. Spain

8.3.6.1. Key Country Dynamics

8.3.6.2. Regulatory Scenario

8.3.6.3. Competitive Scenario

8.3.6.4. Spain Compounding Pharmacies Market Estimates and Forecasts, 2018 - 2030 (USD Million)

8.3.7. Denmark

8.3.7.1. Key Country Dynamics

8.3.7.2. Regulatory Scenario

8.3.7.3. Competitive Scenario

8.3.7.4. Denmark Compounding Pharmacies Market Estimates and Forecasts, 2018 - 2030 (USD Million)

8.3.8. Sweden

8.3.8.1. Key Country Dynamics

8.3.8.2. Regulatory Scenario

8.3.8.3. Competitive Scenario

8.3.8.4. Sweden Compounding Pharmacies Market Estimates and Forecasts, 2018 - 2030 (USD Million)

8.3.9. Norway

8.3.9.1. Key Country Dynamics

8.3.9.2. Regulatory Scenario

8.3.9.3. Competitive Scenario

8.3.9.4. Norway Compounding Pharmacies Market Estimates and Forecasts, 2018 - 2030 (USD Million)

8.4. Asia Pacific

8.4.1. Asia Pacific Compounding Pharmacies Market Estimates and Forecasts, 2018 - 2030 (USD Million)

8.4.2. Japan

8.4.2.1. Key Country Dynamics

8.4.2.2. Regulatory Scenario

8.4.2.3. Competitive Scenario

8.4.2.4. Japan Compounding Pharmacies Market Estimates and Forecasts, 2018 - 2030 (USD Million)

8.4.3. China

8.4.3.1. Key Country Dynamics

8.4.3.2. Regulatory Scenario

8.4.3.3. Competitive Scenario

8.4.3.4. China Compounding Pharmacies Market Estimates and Forecasts, 2018 - 2030 (USD Million)

8.4.4. India

8.4.4.1. Key Country Dynamics

8.4.4.2. Regulatory Scenario

8.4.4.3. Competitive Scenario

8.4.4.4. India Compounding Pharmacies Market Estimates and Forecasts, 2018 - 2030 (USD Million)

8.4.5. Australia

8.4.5.1. Key Country Dynamics

8.4.5.2. Regulatory Scenario

8.4.5.3. Competitive Scenario

8.4.5.4. Australia Compounding Pharmacies Market Estimates and Forecasts, 2018 - 2030 (USD Million)

8.4.6. Thailand

8.4.6.1. Key Country Dynamics

8.4.6.2. Regulatory Scenario

8.4.6.3. Competitive Scenario

8.4.6.4. Thailand Compounding Pharmacies Market Estimates and Forecasts, 2018 - 2030 (USD Million)

8.4.7. South Korea

8.4.7.1. Key Country Dynamics

8.4.7.2. Regulatory Scenario

8.4.7.3. Competitive Scenario

8.4.7.4. South Korea Compounding Pharmacies Market Estimates and Forecasts, 2018 - 2030 (USD Million)

8.5. Latin America

8.5.1. Latin America Compounding Pharmacies Market Estimates and Forecasts, 2018 - 2030 (USD Million)

8.5.2. Brazil

8.5.2.1. Key Country Dynamics

8.5.2.2. Regulatory Scenario

8.5.2.3. Competitive Scenario

8.5.2.4. Brazil Compounding Pharmacies Market Estimates and Forecasts, 2018 - 2030 (USD Million)

8.5.3. Mexico

8.5.3.1. Key Country Dynamics

8.5.3.2. Regulatory Scenario

8.5.3.3. Competitive Scenario

8.5.3.4. Mexico Compounding Pharmacies Market Estimates and Forecasts, 2018 - 2030 (USD Million)

8.5.4. Argentina

8.5.4.1. Key Country Dynamics

8.5.4.2. Regulatory Scenario

8.5.4.3. Competitive Scenario

8.5.4.4. Argentina Compounding Pharmacies Market Estimates and Forecasts, 2018 - 2030 (USD Million)

8.6. Middle East & Africa

8.6.1. Middle East & Africa Compounding Pharmacies Market Estimates and Forecasts, 2018 - 2030 (USD Million)

8.6.2. South Africa

8.6.2.1. Key Country Dynamics

8.6.2.2. Regulatory Scenario

8.6.2.3. Competitive Scenario

8.6.2.4. South Africa Compounding Pharmacies Market Estimates and Forecasts, 2018 - 2030 (USD Million)

8.6.3. Saudi Arabia

8.6.3.1. Key Country Dynamics

8.6.3.2. Regulatory Scenario

8.6.3.3. Competitive Scenario

8.6.3.4. Saudi Arabia Compounding Pharmacies Market Estimates and Forecasts, 2018 - 2030 (USD Million)

8.6.4. UAE

8.6.4.1. Key Country Dynamics

8.6.4.2. Regulatory Scenario

8.6.4.3. Competitive Scenario

8.6.4.4. UAE Compounding Pharmacies Market Estimates and Forecasts, 2018 - 2030 (USD Million)

8.6.5. Kuwait

8.6.5.1. Key Country Dynamics

8.6.5.2. Regulatory Scenario

8.6.5.3. Competitive Scenario

8.6.5.4. Kuwait Compounding Pharmacies Market Estimates and Forecasts, 2018 - 2030 (USD Million)

8.2. North America

8.2.1. North America Compounding Pharmacies Market Estimates and Forecasts, 2018 - 2030 (USD Million)

8.2.2. U.S.

8.2.2.1. Key Country Dynamics

8.2.2.2. Regulatory Scenario

8.2.2.3. Competitive Scenario

8.2.2.4. U.S. Compounding Pharmacies Market Estimates and Forecasts, 2018 - 2030 (USD Million)

8.2.3. Canada

8.2.3.1. Key Country Dynamics

8.2.3.2. Regulatory Scenario

8.2.3.3. Competitive Scenario

8.2.3.4. Canada Compounding Pharmacies Market Estimates and Forecasts, 2018 - 2030 (USD Million)

8.3. Europe

8.3.1. Europe Compounding Pharmacies Market Estimates and Forecasts, 2018 - 2030 (USD Million)

8.3.2. UK

8.3.2.1. Key Country Dynamics

8.3.2.2. Regulatory Scenario

8.3.2.3. Competitive Scenario

8.3.2.4. UK Compounding Pharmacies Market Estimates and Forecasts, 2018 - 2030 (USD Million)

8.3.3. Germany

8.3.3.1. Key Country Dynamics

8.3.3.2. Regulatory Scenario

8.3.3.3. Competitive Scenario

8.3.3.4. Germany Compounding Pharmacies Market Estimates and Forecasts, 2018 - 2030 (USD Million)

8.3.4. France

8.3.4.1. Key Country Dynamics

8.3.4.2. Regulatory Scenario

8.3.4.3. Competitive Scenario

8.3.4.4. France Compounding Pharmacies Market Estimates and Forecasts, 2018 - 2030 (USD Million)

8.3.5. Italy

8.3.5.1. Key Country Dynamics

8.3.5.2. Regulatory Scenario

8.3.5.3. Competitive Scenario

8.3.5.4. Italy Compounding Pharmacies Market Estimates and Forecasts, 2018 - 2030 (USD Million)

8.3.6. Spain

8.3.6.1. Key Country Dynamics

8.3.6.2. Regulatory Scenario

8.3.6.3. Competitive Scenario

8.3.6.4. Spain Compounding Pharmacies Market Estimates and Forecasts, 2018 - 2030 (USD Million)

8.3.7. Denmark

8.3.7.1. Key Country Dynamics

8.3.7.2. Regulatory Scenario

8.3.7.3. Competitive Scenario

8.3.7.4. Denmark Compounding Pharmacies Market Estimates and Forecasts, 2018 - 2030 (USD Million)

8.3.8. Sweden

8.3.8.1. Key Country Dynamics

8.3.8.2. Regulatory Scenario

8.3.8.3. Competitive Scenario

8.3.8.4. Sweden Compounding Pharmacies Market Estimates and Forecasts, 2018 - 2030 (USD Million)

8.3.9. Norway

8.3.9.1. Key Country Dynamics

8.3.9.2. Regulatory Scenario

8.3.9.3. Competitive Scenario

8.3.9.4. Norway Compounding Pharmacies Market Estimates and Forecasts, 2018 - 2030 (USD Million)

8.4. Asia Pacific

8.4.1. Asia Pacific Compounding Pharmacies Market Estimates and Forecasts, 2018 - 2030 (USD Million)

8.4.2. Japan

8.4.2.1. Key Country Dynamics

8.4.2.2. Regulatory Scenario

8.4.2.3. Competitive Scenario

8.4.2.4. Japan Compounding Pharmacies Market Estimates and Forecasts, 2018 - 2030 (USD Million)

8.4.3. China

8.4.3.1. Key Country Dynamics

8.4.3.2. Regulatory Scenario

8.4.3.3. Competitive Scenario

8.4.3.4. China Compounding Pharmacies Market Estimates and Forecasts, 2018 - 2030 (USD Million)

8.4.4. India

8.4.4.1. Key Country Dynamics

8.4.4.2. Regulatory Scenario

8.4.4.3. Competitive Scenario

8.4.4.4. India Compounding Pharmacies Market Estimates and Forecasts, 2018 - 2030 (USD Million)

8.4.5. Australia

8.4.5.1. Key Country Dynamics

8.4.5.2. Regulatory Scenario

8.4.5.3. Competitive Scenario

8.4.5.4. Australia Compounding Pharmacies Market Estimates and Forecasts, 2018 - 2030 (USD Million)

8.4.6. Thailand

8.4.6.1. Key Country Dynamics

8.4.6.2. Regulatory Scenario

8.4.6.3. Competitive Scenario

8.4.6.4. Thailand Compounding Pharmacies Market Estimates and Forecasts, 2018 - 2030 (USD Million)

8.4.7. South Korea

8.4.7.1. Key Country Dynamics

8.4.7.2. Regulatory Scenario

8.4.7.3. Competitive Scenario

8.4.7.4. South Korea Compounding Pharmacies Market Estimates and Forecasts, 2018 - 2030 (USD Million)

8.5. Latin America

8.5.1. Latin America Compounding Pharmacies Market Estimates and Forecasts, 2018 - 2030 (USD Million)

8.5.2. Brazil

8.5.2.1. Key Country Dynamics

8.5.2.2. Regulatory Scenario

8.5.2.3. Competitive Scenario

8.5.2.4. Brazil Compounding Pharmacies Market Estimates and Forecasts, 2018 - 2030 (USD Million)

8.5.3. Mexico

8.5.3.1. Key Country Dynamics

8.5.3.2. Regulatory Scenario

8.5.3.3. Competitive Scenario

8.5.3.4. Mexico Compounding Pharmacies Market Estimates and Forecasts, 2018 - 2030 (USD Million)

8.5.4. Argentina

8.5.4.1. Key Country Dynamics

8.5.4.2. Regulatory Scenario

8.5.4.3. Competitive Scenario

8.5.4.4. Argentina Compounding Pharmacies Market Estimates and Forecasts, 2018 - 2030 (USD Million)

8.6. Middle East & Africa

8.6.1. Middle East & Africa Compounding Pharmacies Market Estimates and Forecasts, 2018 - 2030 (USD Million)

8.6.2. South Africa

8.6.2.1. Key Country Dynamics

8.6.2.2. Regulatory Scenario

8.6.2.3. Competitive Scenario

8.6.2.4. South Africa Compounding Pharmacies Market Estimates and Forecasts, 2018 - 2030 (USD Million)

8.6.3. Saudi Arabia

8.6.3.1. Key Country Dynamics

8.6.3.2. Regulatory Scenario

8.6.3.3. Competitive Scenario

8.6.3.4. Saudi Arabia Compounding Pharmacies Market Estimates and Forecasts, 2018 - 2030 (USD Million)

8.6.4. UAE

8.6.4.1. Key Country Dynamics

8.6.4.2. Regulatory Scenario

8.6.4.3. Competitive Scenario

8.6.4.4. UAE Compounding Pharmacies Market Estimates and Forecasts, 2018 - 2030 (USD Million)

8.6.5. Kuwait

8.6.5.1. Key Country Dynamics

8.6.5.2. Regulatory Scenario

8.6.5.3. Competitive Scenario

8.6.5.4. Kuwait Compounding Pharmacies Market Estimates and Forecasts, 2018 - 2030 (USD Million)

Chapter 9. Competitive Landscape

9.1. Company Profiles

9.1.1. Walgreens Co.

9.1.1.1. Overview

9.1.1.2. Financial Performance

9.1.1.3. Service Benchmarking

9.1.1.4. Strategic Initiatives

9.1.2. JL Diekman and AQ Touchard (Fresh Therapeutics Compounding Pharmacy)

9.1.2.1. Overview

9.1.2.2. Financial Performance

9.1.2.3. Service Benchmarking

9.1.2.4. Strategic Initiatives

9.1.3. Fagron.

9.1.3.1. Overview

9.1.3.2. Financial Performance

9.1.3.3. Service Benchmarking

9.1.3.4. Strategic Initiatives

9.1.4. Albertsons Companies

9.1.4.1. Overview

9.1.4.2. Financial Performance

9.1.4.3. Service Benchmarking

9.1.4.4. Strategic Initiatives

9.1.5. The London Specialist Pharmacy Ltd (Specialist Pharmacy)

9.1.5.1. Overview

9.1.5.2. Financial Performance

9.1.5.3. Service Benchmarking

9.1.5.4. Strategic Initiatives

9.1.6. Galenic Laboratories Limited (Roseway Labs)

9.1.6.1. Overview

9.1.6.2. Financial Performance

9.1.6.3. Service Benchmarking

9.1.6.4. Strategic Initiatives

9.1.7. Aurora Compounding

9.1.7.1. Overview

9.1.7.2. Financial Performance

9.1.7.3. Service Benchmarking

9.1.7.4. Strategic Initiatives

9.1.8. MEDS Pharmacy

9.1.8.1. Overview

9.1.8.2. Financial Performance

9.1.8.3. Service Benchmarking

9.1.8.4. Strategic Initiatives

9.1.9. Apollo Clinical Pharmacy

9.1.9.1. Overview

9.1.9.2. Financial Performance

9.1.9.3. Service Benchmarking

9.1.9.4. Strategic Initiatives

9.1.10. Formul8

9.1.10.1. Overview

9.1.10.2. Financial Performance

9.1.10.3. Service Benchmarking

9.1.10.4. Strategic Initiatives

9.1.11. Fusion Apothecary

9.1.11.1. Overview

9.1.11.2. Financial Performance

9.1.11.3. Service Benchmarking

9.1.11.4. Strategic Initiatives

9.2. Company Categorization

9.3. Company Market Position Analysis

9.4. Strategy Mapping

9.1.1. Walgreens Co.

9.1.1.1. Overview

9.1.1.2. Financial Performance

9.1.1.3. Service Benchmarking

9.1.1.4. Strategic Initiatives

9.1.2. JL Diekman and AQ Touchard (Fresh Therapeutics Compounding Pharmacy)

9.1.2.1. Overview

9.1.2.2. Financial Performance

9.1.2.3. Service Benchmarking

9.1.2.4. Strategic Initiatives

9.1.3. Fagron.

9.1.3.1. Overview

9.1.3.2. Financial Performance

9.1.3.3. Service Benchmarking

9.1.3.4. Strategic Initiatives

9.1.4. Albertsons Companies

9.1.4.1. Overview

9.1.4.2. Financial Performance

9.1.4.3. Service Benchmarking

9.1.4.4. Strategic Initiatives

9.1.5. The London Specialist Pharmacy Ltd (Specialist Pharmacy)

9.1.5.1. Overview

9.1.5.2. Financial Performance

9.1.5.3. Service Benchmarking

9.1.5.4. Strategic Initiatives

9.1.6. Galenic Laboratories Limited (Roseway Labs)

9.1.6.1. Overview

9.1.6.2. Financial Performance

9.1.6.3. Service Benchmarking

9.1.6.4. Strategic Initiatives

9.1.7. Aurora Compounding

9.1.7.1. Overview

9.1.7.2. Financial Performance

9.1.7.3. Service Benchmarking

9.1.7.4. Strategic Initiatives

9.1.8. MEDS Pharmacy

9.1.8.1. Overview

9.1.8.2. Financial Performance

9.1.8.3. Service Benchmarking

9.1.8.4. Strategic Initiatives

9.1.9. Apollo Clinical Pharmacy

9.1.9.1. Overview

9.1.9.2. Financial Performance

9.1.9.3. Service Benchmarking

9.1.9.4. Strategic Initiatives

9.1.10. Formul8

9.1.10.1. Overview

9.1.10.2. Financial Performance

9.1.10.3. Service Benchmarking

9.1.10.4. Strategic Initiatives

9.1.11. Fusion Apothecary

9.1.11.1. Overview

9.1.11.2. Financial Performance

9.1.11.3. Service Benchmarking

9.1.11.4. Strategic Initiatives

9.2. Company Categorization

9.3. Company Market Position Analysis

9.4. Strategy Mapping

List of Tables

Table 1 List of secondary sources

Table 2 List of abbreviations

Table 3 Global compounding pharmacies market, by therapeutic area, 2018 - 2030 (USD Million)

Table 4 Global compounding pharmacies market, by age cohort, 2018 - 2030 (USD Million)

Table 5 Global compounding pharmacies market, by compounding type, 2018 - 2030 (USD Million)

Table 6 Global compounding pharmacies market, by sterility, 2018 - 2030 (USD Million)

Table 7 Global compounding pharmacies market, by region, 2018 - 2030 (USD Million)

Table 8 North America compounding pharmacies market, by country, 2018 - 2030 (USD Million)

Table 9 North America compounding pharmacies market, by therapeutic area, 2018 - 2030 (USD Million)

Table 10 North America compounding pharmacies market, by age cohort, 2018 - 2030 (USD Million)

Table 11 North America compounding pharmacies market, by compounding type, 2018 - 2030 (USD Million)

Table 12 North America compounding pharmacies market, by sterility, 2018 - 2030 (USD Million)

Table 13 U.S. compounding pharmacies market, by therapeutic area, 2018 - 2030 (USD Million)

Table 14 U.S. compounding pharmacies market, by age cohort, 2018 - 2030 (USD Million)

Table 15 U.S. compounding pharmacies market, by compounding type, 2018 - 2030 (USD Million)

Table 16 U.S. compounding pharmacies market, by sterility, 2018 - 2030 (USD Million)

Table 17 Canada compounding pharmacies market, by therapeutic area, 2018 - 2030 (USD Million)

Table 18 Canada compounding pharmacies market, by age cohort, 2018 - 2030 (USD Million)

Table 19 Canada compounding pharmacies market, by compounding type, 2018 - 2030 (USD Million)

Table 20 Canada compounding pharmacies market, by sterility, 2018 - 2030 (USD Million)

Table 21 Europe compounding pharmacies market, by country, 2018 - 2030 (USD Million)

Table 22 Europe compounding pharmacies market, by therapeutic area, 2018 - 2030 (USD Million)

Table 23 Europe compounding pharmacies market, by age cohort, 2018 - 2030 (USD Million)

Table 24 Europe compounding pharmacies market, by compounding type, 2018 - 2030 (USD Million)

Table 25 Europe compounding pharmacies market, by sterility, 2018 - 2030 (USD Million)

Table 26 UK compounding pharmacies market, by therapeutic area, 2018 - 2030 (USD Million)

Table 27 UK compounding pharmacies market, by age cohort, 2018 - 2030 (USD Million)

Table 28 UK compounding pharmacies market, by compounding type, 2018 - 2030 (USD Million)

Table 29 UK compounding pharmacies market, by sterility, 2018 - 2030 (USD Million)

Table 30 Germany compounding pharmacies market, by therapeutic area, 2018 - 2030 (USD Million)

Table 31 Germany compounding pharmacies market, by age cohort, 2018 - 2030 (USD Million)

Table 32 Germany compounding pharmacies market, by compounding type, 2018 - 2030 (USD Million)

Table 33 Germany compounding pharmacies market, by sterility, 2018 - 2030 (USD Million)

Table 34 France compounding pharmacies market, by therapeutic area, 2018 - 2030 (USD Million)

Table 35 France compounding pharmacies market, by age cohort, 2018 - 2030 (USD Million)

Table 36 France compounding pharmacies market, by compounding type, 2018 - 2030 (USD Million)

Table 37 France compounding pharmacies market, by sterility, 2018 - 2030 (USD Million)

Table 38 Italy compounding pharmacies market, by therapeutic area, 2018 - 2030 (USD Million)

Table 39 Italy compounding pharmacies market, by age cohort, 2018 - 2030 (USD Million)

Table 40 Italy compounding pharmacies market, by compounding type, 2018 - 2030 (USD Million)

Table 41 Italy compounding pharmacies market, by sterility, 2018 - 2030 (USD Million)

Table 42 Spain compounding pharmacies market, by therapeutic area, 2018 - 2030 (USD Million)

Table 43 Spain compounding pharmacies market, by age cohort, 2018 - 2030 (USD Million)

Table 44 Spain compounding pharmacies market, by compounding type, 2018 - 2030 (USD Million)

Table 45 Spain compounding pharmacies market, by sterility, 2018 - 2030 (USD Million)

Table 46 Denmark compounding pharmacies market, by therapeutic area, 2018 - 2030 (USD Million)

Table 47 Denmark compounding pharmacies market, by age cohort, 2018 - 2030 (USD Million)

Table 48 Denmark compounding pharmacies market, by compounding type, 2018 - 2030 (USD Million)

Table 49 Denmark compounding pharmacies market, by sterility, 2018 - 2030 (USD Million)

Table 50 Sweden compounding pharmacies market, by therapeutic area, 2018 - 2030 (USD Million)

Table 51 Sweden compounding pharmacies market, by age cohort, 2018 - 2030 (USD Million)

Table 52 Sweden compounding pharmacies market, by compounding type, 2018 - 2030 (USD Million)

Table 53 Sweden compounding pharmacies market, by sterility, 2018 - 2030 (USD Million)

Table 54 Norway compounding pharmacies market, by therapeutic area, 2018 - 2030 (USD Million)

Table 55 Norway compounding pharmacies market, by age cohort, 2018 - 2030 (USD Million)

Table 56 Norway compounding pharmacies market, by compounding type, 2018 - 2030 (USD Million)

Table 57 Norway compounding pharmacies market, by sterility, 2018 - 2030 (USD Million)

Table 58 Asia Pacific compounding pharmacies market, by country, 2018 - 2030 (USD Million)

Table 59 Asia Pacific compounding pharmacies market, by therapeutic area, 2018 - 2030 (USD Million)

Table 60 Asia Pacific compounding pharmacies market, by age cohort, 2018 - 2030 (USD Million)

Table 61 Asia Pacific compounding pharmacies market, by compounding type, 2018 - 2030 (USD Million)

Table 62 Asia Pacific compounding pharmacies market, by sterility, 2018 - 2030 (USD Million)

Table 63 Japan compounding pharmacies market, by therapeutic area, 2018 - 2030 (USD Million)

Table 64 Japan compounding pharmacies market, by age cohort, 2018 - 2030 (USD Million)

Table 65 Japan compounding pharmacies market, by compounding type, 2018 - 2030 (USD Million)

Table 66 Japan compounding pharmacies market, by sterility, 2018 - 2030 (USD Million)

Table 67 India compounding pharmacies market, by therapeutic area, 2018 - 2030 (USD Million)

Table 68 India compounding pharmacies market, by age cohort, 2018 - 2030 (USD Million)

Table 69 India compounding pharmacies market, by compounding type, 2018 - 2030 (USD Million)

Table 70 India compounding pharmacies market, by sterility, 2018 - 2030 (USD Million)

Table 71 China compounding pharmacies market, by therapeutic area, 2018 - 2030 (USD Million)

Table 72 China compounding pharmacies market, by age cohort, 2018 - 2030 (USD Million)

Table 73 China compounding pharmacies market, by compounding type, 2018 - 2030 (USD Million)

Table 74 China compounding pharmacies market, by sterility, 2018 - 2030 (USD Million)

Table 75 Australia compounding pharmacies market, by therapeutic area, 2018 - 2030 (USD Million)

Table 76 Australia compounding pharmacies market, by age cohort, 2018 - 2030 (USD Million)

Table 77 Australia compounding pharmacies market, by compounding type, 2018 - 2030 (USD Million)

Table 78 Australia compounding pharmacies market, by sterility, 2018 - 2030 (USD Million)

Table 79 Thailand compounding pharmacies market, by therapeutic area, 2018 - 2030 (USD Million)

Table 80 Thailand compounding pharmacies market, by age cohort, 2018 - 2030 (USD Million)

Table 81 Thailand compounding pharmacies market, by compounding type, 2018 - 2030 (USD Million)

Table 82 Thailand compounding pharmacies market, by sterility, 2018 - 2030 (USD Million)

Table 83 South Korea compounding pharmacies market, by therapeutic area, 2018 - 2030 (USD Million)

Table 84 South Korea compounding pharmacies market, by age cohort, 2018 - 2030 (USD Million)

Table 85 South Korea compounding pharmacies market, by compounding type, 2018 - 2030 (USD Million)

Table 86 South Korea compounding pharmacies market, by sterility, 2018 - 2030 (USD Million)

Table 87 Latin America compounding pharmacies market, by country, 2018 - 2030 (USD Million)

Table 88 Latin America compounding pharmacies market, by therapeutic area, 2018 - 2030 (USD Million)

Table 89 Latin America compounding pharmacies market, by age cohort, 2018 - 2030 (USD Million)

Table 90 Latin America compounding pharmacies market, by compounding type, 2018 - 2030 (USD Million)

Table 91 Latin America compounding pharmacies market, by sterility, 2018 - 2030 (USD Million)

Table 92 Brazil compounding pharmacies market, by therapeutic area, 2018 - 2030 (USD Million)

Table 93 Brazil compounding pharmacies market, by age cohort, 2018 - 2030 (USD Million)

Table 94 Brazil compounding pharmacies market, by compounding type, 2018 - 2030 (USD Million)

Table 95 Brazil compounding pharmacies market, by sterility, 2018 - 2030 (USD Million)

Table 96 Mexico compounding pharmacies market, by therapeutic area, 2018 - 2030 (USD Million)

Table 97 Mexico compounding pharmacies market, by age cohort, 2018 - 2030 (USD Million)

Table 98 Mexico compounding pharmacies market, by compounding type, 2018 - 2030 (USD Million)

Table 99 Mexico compounding pharmacies market, by sterility, 2018 - 2030 (USD Million)

Table 100 Argentina compounding pharmacies market, by therapeutic area, 2018 - 2030 (USD Million)

Table 101 Argentina compounding pharmacies market, by age cohort, 2018 - 2030 (USD Million)

Table 102 Argentina compounding pharmacies market, by compounding type, 2018 - 2030 (USD Million)

Table 103 Argentina compounding pharmacies market, by sterility, 2018 - 2030 (USD Million)

Table 104 Middle East & Africa compounding pharmacies market, by country, 2018 - 2030 (USD Million)

Table 105 Middle East & Africa compounding pharmacies market, by therapeutic area, 2018 - 2030 (USD Million)

Table 106 Middle East & Africa compounding pharmacies market, by age cohort, 2018 - 2030 (USD Million)

Table 107 Middle East & Africa compounding pharmacies market, by compounding type, 2018 - 2030 (USD Million)

Table 108 Middle East & Africa compounding pharmacies market, by sterility, 2018 - 2030 (USD Million)

Table 109 South Africa compounding pharmacies market, by therapeutic area, 2018 - 2030 (USD Million)

Table 110 South Africa compounding pharmacies market, by age cohort, 2018 - 2030 (USD Million)

Table 111 South Africa compounding pharmacies market, by compounding type, 2018 - 2030 (USD Million)

Table 112 South Africa compounding pharmacies market, by sterility, 2018 - 2030 (USD Million)

Table 113 Saudi Arabia compounding pharmacies market, by therapeutic area, 2018 - 2030 (USD Million)

Table 114 Saudi Arabia compounding pharmacies market, by age cohort, 2018 - 2030 (USD Million)

Table 115 Saudi Arabia compounding pharmacies market, by compounding type, 2018 - 2030 (USD Million)

Table 116 Saudi Arabia compounding pharmacies market, by sterility, 2018 - 2030 (USD Million)

Table 117 UAE compounding pharmacies market, by therapeutic area, 2018 - 2030 (USD Million)

Table 118 UAE compounding pharmacies market, by age cohort, 2018 - 2030 (USD Million)

Table 119 UAE compounding pharmacies market, by compounding type, 2018 - 2030 (USD Million)

Table 120 UAE compounding pharmacies market, by sterility, 2018 - 2030 (USD Million)

Table 121 Kuwait compounding pharmacies market, by therapeutic area, 2018 - 2030 (USD Million)

Table 122 Kuwait compounding pharmacies market, by age cohort, 2018 - 2030 (USD Million)

Table 123 Kuwait compounding pharmacies market, by compounding type, 2018 - 2030 (USD Million)

Table 124 Kuwait compounding pharmacies market, by sterility, 2018 - 2030 (USD Million)

Table 125 Participant's overview

Table 126 Financial performance

Table 127 Key companies undergoing expansions

Table 128 Key Companies Undertaking Acquisitions

Table 129 Key companies undergoing partnership & collaborations

Table 130 Key companies launching new products

Table 131 Key companies undergoing other strategies

Table 2 List of abbreviations

Table 3 Global compounding pharmacies market, by therapeutic area, 2018 - 2030 (USD Million)

Table 4 Global compounding pharmacies market, by age cohort, 2018 - 2030 (USD Million)

Table 5 Global compounding pharmacies market, by compounding type, 2018 - 2030 (USD Million)

Table 6 Global compounding pharmacies market, by sterility, 2018 - 2030 (USD Million)

Table 7 Global compounding pharmacies market, by region, 2018 - 2030 (USD Million)

Table 8 North America compounding pharmacies market, by country, 2018 - 2030 (USD Million)

Table 9 North America compounding pharmacies market, by therapeutic area, 2018 - 2030 (USD Million)

Table 10 North America compounding pharmacies market, by age cohort, 2018 - 2030 (USD Million)

Table 11 North America compounding pharmacies market, by compounding type, 2018 - 2030 (USD Million)

Table 12 North America compounding pharmacies market, by sterility, 2018 - 2030 (USD Million)

Table 13 U.S. compounding pharmacies market, by therapeutic area, 2018 - 2030 (USD Million)

Table 14 U.S. compounding pharmacies market, by age cohort, 2018 - 2030 (USD Million)

Table 15 U.S. compounding pharmacies market, by compounding type, 2018 - 2030 (USD Million)

Table 16 U.S. compounding pharmacies market, by sterility, 2018 - 2030 (USD Million)

Table 17 Canada compounding pharmacies market, by therapeutic area, 2018 - 2030 (USD Million)

Table 18 Canada compounding pharmacies market, by age cohort, 2018 - 2030 (USD Million)

Table 19 Canada compounding pharmacies market, by compounding type, 2018 - 2030 (USD Million)

Table 20 Canada compounding pharmacies market, by sterility, 2018 - 2030 (USD Million)

Table 21 Europe compounding pharmacies market, by country, 2018 - 2030 (USD Million)

Table 22 Europe compounding pharmacies market, by therapeutic area, 2018 - 2030 (USD Million)

Table 23 Europe compounding pharmacies market, by age cohort, 2018 - 2030 (USD Million)

Table 24 Europe compounding pharmacies market, by compounding type, 2018 - 2030 (USD Million)

Table 25 Europe compounding pharmacies market, by sterility, 2018 - 2030 (USD Million)

Table 26 UK compounding pharmacies market, by therapeutic area, 2018 - 2030 (USD Million)

Table 27 UK compounding pharmacies market, by age cohort, 2018 - 2030 (USD Million)

Table 28 UK compounding pharmacies market, by compounding type, 2018 - 2030 (USD Million)

Table 29 UK compounding pharmacies market, by sterility, 2018 - 2030 (USD Million)

Table 30 Germany compounding pharmacies market, by therapeutic area, 2018 - 2030 (USD Million)

Table 31 Germany compounding pharmacies market, by age cohort, 2018 - 2030 (USD Million)

Table 32 Germany compounding pharmacies market, by compounding type, 2018 - 2030 (USD Million)

Table 33 Germany compounding pharmacies market, by sterility, 2018 - 2030 (USD Million)

Table 34 France compounding pharmacies market, by therapeutic area, 2018 - 2030 (USD Million)

Table 35 France compounding pharmacies market, by age cohort, 2018 - 2030 (USD Million)

Table 36 France compounding pharmacies market, by compounding type, 2018 - 2030 (USD Million)

Table 37 France compounding pharmacies market, by sterility, 2018 - 2030 (USD Million)

Table 38 Italy compounding pharmacies market, by therapeutic area, 2018 - 2030 (USD Million)

Table 39 Italy compounding pharmacies market, by age cohort, 2018 - 2030 (USD Million)

Table 40 Italy compounding pharmacies market, by compounding type, 2018 - 2030 (USD Million)

Table 41 Italy compounding pharmacies market, by sterility, 2018 - 2030 (USD Million)

Table 42 Spain compounding pharmacies market, by therapeutic area, 2018 - 2030 (USD Million)

Table 43 Spain compounding pharmacies market, by age cohort, 2018 - 2030 (USD Million)

Table 44 Spain compounding pharmacies market, by compounding type, 2018 - 2030 (USD Million)

Table 45 Spain compounding pharmacies market, by sterility, 2018 - 2030 (USD Million)

Table 46 Denmark compounding pharmacies market, by therapeutic area, 2018 - 2030 (USD Million)

Table 47 Denmark compounding pharmacies market, by age cohort, 2018 - 2030 (USD Million)

Table 48 Denmark compounding pharmacies market, by compounding type, 2018 - 2030 (USD Million)

Table 49 Denmark compounding pharmacies market, by sterility, 2018 - 2030 (USD Million)

Table 50 Sweden compounding pharmacies market, by therapeutic area, 2018 - 2030 (USD Million)

Table 51 Sweden compounding pharmacies market, by age cohort, 2018 - 2030 (USD Million)

Table 52 Sweden compounding pharmacies market, by compounding type, 2018 - 2030 (USD Million)

Table 53 Sweden compounding pharmacies market, by sterility, 2018 - 2030 (USD Million)

Table 54 Norway compounding pharmacies market, by therapeutic area, 2018 - 2030 (USD Million)

Table 55 Norway compounding pharmacies market, by age cohort, 2018 - 2030 (USD Million)

Table 56 Norway compounding pharmacies market, by compounding type, 2018 - 2030 (USD Million)

Table 57 Norway compounding pharmacies market, by sterility, 2018 - 2030 (USD Million)

Table 58 Asia Pacific compounding pharmacies market, by country, 2018 - 2030 (USD Million)

Table 59 Asia Pacific compounding pharmacies market, by therapeutic area, 2018 - 2030 (USD Million)

Table 60 Asia Pacific compounding pharmacies market, by age cohort, 2018 - 2030 (USD Million)

Table 61 Asia Pacific compounding pharmacies market, by compounding type, 2018 - 2030 (USD Million)

Table 62 Asia Pacific compounding pharmacies market, by sterility, 2018 - 2030 (USD Million)

Table 63 Japan compounding pharmacies market, by therapeutic area, 2018 - 2030 (USD Million)

Table 64 Japan compounding pharmacies market, by age cohort, 2018 - 2030 (USD Million)

Table 65 Japan compounding pharmacies market, by compounding type, 2018 - 2030 (USD Million)

Table 66 Japan compounding pharmacies market, by sterility, 2018 - 2030 (USD Million)

Table 67 India compounding pharmacies market, by therapeutic area, 2018 - 2030 (USD Million)

Table 68 India compounding pharmacies market, by age cohort, 2018 - 2030 (USD Million)

Table 69 India compounding pharmacies market, by compounding type, 2018 - 2030 (USD Million)

Table 70 India compounding pharmacies market, by sterility, 2018 - 2030 (USD Million)

Table 71 China compounding pharmacies market, by therapeutic area, 2018 - 2030 (USD Million)

Table 72 China compounding pharmacies market, by age cohort, 2018 - 2030 (USD Million)

Table 73 China compounding pharmacies market, by compounding type, 2018 - 2030 (USD Million)

Table 74 China compounding pharmacies market, by sterility, 2018 - 2030 (USD Million)

Table 75 Australia compounding pharmacies market, by therapeutic area, 2018 - 2030 (USD Million)

Table 76 Australia compounding pharmacies market, by age cohort, 2018 - 2030 (USD Million)

Table 77 Australia compounding pharmacies market, by compounding type, 2018 - 2030 (USD Million)

Table 78 Australia compounding pharmacies market, by sterility, 2018 - 2030 (USD Million)

Table 79 Thailand compounding pharmacies market, by therapeutic area, 2018 - 2030 (USD Million)

Table 80 Thailand compounding pharmacies market, by age cohort, 2018 - 2030 (USD Million)

Table 81 Thailand compounding pharmacies market, by compounding type, 2018 - 2030 (USD Million)

Table 82 Thailand compounding pharmacies market, by sterility, 2018 - 2030 (USD Million)

Table 83 South Korea compounding pharmacies market, by therapeutic area, 2018 - 2030 (USD Million)

Table 84 South Korea compounding pharmacies market, by age cohort, 2018 - 2030 (USD Million)

Table 85 South Korea compounding pharmacies market, by compounding type, 2018 - 2030 (USD Million)

Table 86 South Korea compounding pharmacies market, by sterility, 2018 - 2030 (USD Million)

Table 87 Latin America compounding pharmacies market, by country, 2018 - 2030 (USD Million)

Table 88 Latin America compounding pharmacies market, by therapeutic area, 2018 - 2030 (USD Million)

Table 89 Latin America compounding pharmacies market, by age cohort, 2018 - 2030 (USD Million)

Table 90 Latin America compounding pharmacies market, by compounding type, 2018 - 2030 (USD Million)

Table 91 Latin America compounding pharmacies market, by sterility, 2018 - 2030 (USD Million)

Table 92 Brazil compounding pharmacies market, by therapeutic area, 2018 - 2030 (USD Million)

Table 93 Brazil compounding pharmacies market, by age cohort, 2018 - 2030 (USD Million)

Table 94 Brazil compounding pharmacies market, by compounding type, 2018 - 2030 (USD Million)

Table 95 Brazil compounding pharmacies market, by sterility, 2018 - 2030 (USD Million)

Table 96 Mexico compounding pharmacies market, by therapeutic area, 2018 - 2030 (USD Million)

Table 97 Mexico compounding pharmacies market, by age cohort, 2018 - 2030 (USD Million)

Table 98 Mexico compounding pharmacies market, by compounding type, 2018 - 2030 (USD Million)

Table 99 Mexico compounding pharmacies market, by sterility, 2018 - 2030 (USD Million)

Table 100 Argentina compounding pharmacies market, by therapeutic area, 2018 - 2030 (USD Million)

Table 101 Argentina compounding pharmacies market, by age cohort, 2018 - 2030 (USD Million)

Table 102 Argentina compounding pharmacies market, by compounding type, 2018 - 2030 (USD Million)

Table 103 Argentina compounding pharmacies market, by sterility, 2018 - 2030 (USD Million)

Table 104 Middle East & Africa compounding pharmacies market, by country, 2018 - 2030 (USD Million)

Table 105 Middle East & Africa compounding pharmacies market, by therapeutic area, 2018 - 2030 (USD Million)

Table 106 Middle East & Africa compounding pharmacies market, by age cohort, 2018 - 2030 (USD Million)

Table 107 Middle East & Africa compounding pharmacies market, by compounding type, 2018 - 2030 (USD Million)

Table 108 Middle East & Africa compounding pharmacies market, by sterility, 2018 - 2030 (USD Million)

Table 109 South Africa compounding pharmacies market, by therapeutic area, 2018 - 2030 (USD Million)

Table 110 South Africa compounding pharmacies market, by age cohort, 2018 - 2030 (USD Million)

Table 111 South Africa compounding pharmacies market, by compounding type, 2018 - 2030 (USD Million)

Table 112 South Africa compounding pharmacies market, by sterility, 2018 - 2030 (USD Million)

Table 113 Saudi Arabia compounding pharmacies market, by therapeutic area, 2018 - 2030 (USD Million)

Table 114 Saudi Arabia compounding pharmacies market, by age cohort, 2018 - 2030 (USD Million)

Table 115 Saudi Arabia compounding pharmacies market, by compounding type, 2018 - 2030 (USD Million)

Table 116 Saudi Arabia compounding pharmacies market, by sterility, 2018 - 2030 (USD Million)

Table 117 UAE compounding pharmacies market, by therapeutic area, 2018 - 2030 (USD Million)

Table 118 UAE compounding pharmacies market, by age cohort, 2018 - 2030 (USD Million)

Table 119 UAE compounding pharmacies market, by compounding type, 2018 - 2030 (USD Million)

Table 120 UAE compounding pharmacies market, by sterility, 2018 - 2030 (USD Million)

Table 121 Kuwait compounding pharmacies market, by therapeutic area, 2018 - 2030 (USD Million)

Table 122 Kuwait compounding pharmacies market, by age cohort, 2018 - 2030 (USD Million)

Table 123 Kuwait compounding pharmacies market, by compounding type, 2018 - 2030 (USD Million)

Table 124 Kuwait compounding pharmacies market, by sterility, 2018 - 2030 (USD Million)

Table 125 Participant's overview

Table 126 Financial performance

Table 127 Key companies undergoing expansions

Table 128 Key Companies Undertaking Acquisitions

Table 129 Key companies undergoing partnership & collaborations

Table 130 Key companies launching new products

Table 131 Key companies undergoing other strategies

List of Figures

Fig. 1 Compounding pharmacies market segmentation

Fig. 2 Market research process

Fig. 3 Data triangulation techniques

Fig. 4 Primary research pattern

Fig. 5 Market research approaches

Fig. 6 Value-chain-based sizing & forecasting

Fig. 7 QFD modeling for market share assessment

Fig. 8 Market ownership & validation

Fig. 9 Market snapshot

Fig. 10 Segment snapshot

Fig. 11 Competitive landscape snapshot

Fig. 12 Compounding pharmacies market driver analysis

Fig. 13 Compounding pharmacies market restraint analysis

Fig. 14 Compounding pharmacies market: Porter's analysis

Fig. 15 Compounding pharmacies market: PESTLE analysis

Fig. 16 Compounding pharmacies market: Therapeutic area outlook and key takeaways

Fig. 17 Compounding pharmacies market: Therapeutic area market share and movement analysis, 2022 - 2030

Fig. 18 Global hormone replacement therapy market revenue estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 19 Global pain management market revenue estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 20 Global specialty drugs market revenue estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 21 Global dermatology market revenue estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 22 Global nutritional supplements market revenue estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 23 Global others market revenue estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 24 Compounding pharmacies market: Age cohort outlook and key takeaways

Fig. 25 Compounding pharmacies market: Age cohort market share and movement analysis, 2022 - 2030

Fig. 26 Global pediatric market revenue estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 27 Global adult market revenue estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 28 Global geriatric market revenue estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 29 Compounding pharmacies market: Compounding type outlook and key takeaways

Fig. 30 Compounding pharmacies market: Compounding type market share and movement analysis, 2022 - 2030

Fig. 31 Global pharmaceutical ingredient alteration (PIA) market revenue estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 32 Global currently unavailable pharmaceutical manufacturing (CUPM) market revenue estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 33 Global pharmaceutical dosage alteration (PDA) market revenue estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 34 Global others market revenue estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 35 Compounding pharmacies market: Sterility outlook and key takeaways

Fig. 36 Compounding pharmacies market: Sterility market share and movement analysis, 2022 - 2030

Fig. 37 Global sterile market revenue estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 38 Global non-sterile market revenue estimates and forecasts, 2018 - 2030 (USD Million

Fig. 39 Regional marketplace: Key takeaways

Fig. 40 North America compounding pharmacies market estimates and forecast, 2018 - 2030 (USD Million)

Fig. 41 U.S. compounding pharmacies market estimates and forecast, 2018 - 2030 (USD Million)

Fig. 42 U.S.: Country dynamics

Fig. 43 Canada compounding pharmacies market estimates and forecast, 2018 - 2030 (USD Million)

Fig. 44 Canada: Country dynamics

Fig. 45 Europe compounding pharmacies market estimates and forecast, 2018 - 2030 (USD Million)

Fig. 46 UK compounding pharmacies market estimates and forecast, 2018 - 2030 (USD Million)

Fig. 47 UK: Country dynamics

Fig. 48 Germany compounding pharmacies market estimates and forecast, 2018 - 2030 (USD Million)

Fig. 49 Germany: Country dynamics

Fig. 50 France compounding pharmacies market estimates and forecast, 2018 - 2030 (USD Million)

Fig. 51 France: Country dynamics

Fig. 52 Italy compounding pharmacies market estimates and forecast, 2018 - 2030 (USD Million)

Fig. 53 Italy: Country dynamics

Fig. 54 Spain compounding pharmacies market estimates and forecast, 2018 - 2030 (USD Million)

Fig. 55 Spain: Country dynamics

Fig. 56 Denmark compounding pharmacies market estimates and forecast, 2018 - 2030 (USD Million)

Fig. 57 Denmark: Country dynamics

Fig. 58 Sweden compounding pharmacies market estimates and forecast, 2018 - 2030 (USD Million)

Fig. 59 Sweden: Country dynamics

Fig. 60 Norway compounding pharmacies market estimates and forecast, 2018 - 2030 (USD Million)

Fig. 61 Norway: Country dynamics

Fig. 62 Asia-Pacific compounding pharmacies market estimates and forecast, 2018 - 2030 (USD Million)

Fig. 63 Japan compounding pharmacies market estimates and forecast, 2018 - 2030 (USD Million)

Fig. 64 Japan: Country dynamics

Fig. 65 China compounding pharmacies market estimates and forecast, 2018 - 2030 (USD Million)

Fig. 66 China: Country dynamics

Fig. 67 India compounding pharmacies market estimates and forecast, 2018 - 2030 (USD Million)

Fig. 68 India: Country dynamics

Fig. 69 Australia compounding pharmacies market estimates and forecast, 2018 - 2030 (USD Million)

Fig. 70 Australia: Country dynamics

Fig. 71 Thailand compounding pharmacies market estimates and forecast, 2018 - 2030 (USD Million)

Fig. 72 Thailand: Country dynamics

Fig. 73 South Korea compounding pharmacies market estimates and forecast, 2018 - 2030 (USD Million)

Fig. 74 South Korea: Country dynamics

Fig. 75 Latin America compounding pharmacies market estimates and forecast, 2018 - 2030 (USD Million)

Fig. 76 Brazil compounding pharmacies market estimates and forecast, 2018 - 2030 (USD Million)

Fig. 77 Brazil: Country dynamics

Fig. 78 Mexico compounding pharmacies market estimates and forecast, 2018 - 2030 (USD Million)

Fig. 79 Mexico: Country dynamics

Fig. 80 Argentina compounding pharmacies market estimates and forecast, 2018 - 2030 (USD Million)

Fig. 81 Argentina: Country dynamics

Fig. 82 MEA compounding pharmacies market estimates and forecast, 2018 - 2030 (USD Million)

Fig. 83 South Africa compounding pharmacies market estimates and forecast, 2018 - 2030 (USD Million)

Fig. 84 South Africa: Country dynamics

Fig. 85 Saudi Arabia compounding pharmacies market estimates and forecast, 2018 - 2030 (USD Million)

Fig. 86 Saudi Arabia: Country dynamics

Fig. 87 UAE Compounding pharmacies market estimates and forecast, 2018 - 2030 (USD Million)

Fig. 88 UAE: Country dynamics

Fig. 89 Kuwait compounding pharmacies market estimates and forecast, 2018 - 2030 (USD Million)

Fig. 90 Kuwait: Country dynamics

Fig. 91 Key company categorization

Fig. 92 Company market position analysis

Fig. 93 Market Participant Categorization

Fig. 94 Strategy framework

Fig. 2 Market research process

Fig. 3 Data triangulation techniques

Fig. 4 Primary research pattern

Fig. 5 Market research approaches

Fig. 6 Value-chain-based sizing & forecasting

Fig. 7 QFD modeling for market share assessment

Fig. 8 Market ownership & validation

Fig. 9 Market snapshot

Fig. 10 Segment snapshot

Fig. 11 Competitive landscape snapshot

Fig. 12 Compounding pharmacies market driver analysis

Fig. 13 Compounding pharmacies market restraint analysis

Fig. 14 Compounding pharmacies market: Porter's analysis

Fig. 15 Compounding pharmacies market: PESTLE analysis

Fig. 16 Compounding pharmacies market: Therapeutic area outlook and key takeaways

Fig. 17 Compounding pharmacies market: Therapeutic area market share and movement analysis, 2022 - 2030

Fig. 18 Global hormone replacement therapy market revenue estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 19 Global pain management market revenue estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 20 Global specialty drugs market revenue estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 21 Global dermatology market revenue estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 22 Global nutritional supplements market revenue estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 23 Global others market revenue estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 24 Compounding pharmacies market: Age cohort outlook and key takeaways

Fig. 25 Compounding pharmacies market: Age cohort market share and movement analysis, 2022 - 2030

Fig. 26 Global pediatric market revenue estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 27 Global adult market revenue estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 28 Global geriatric market revenue estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 29 Compounding pharmacies market: Compounding type outlook and key takeaways

Fig. 30 Compounding pharmacies market: Compounding type market share and movement analysis, 2022 - 2030

Fig. 31 Global pharmaceutical ingredient alteration (PIA) market revenue estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 32 Global currently unavailable pharmaceutical manufacturing (CUPM) market revenue estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 33 Global pharmaceutical dosage alteration (PDA) market revenue estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 34 Global others market revenue estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 35 Compounding pharmacies market: Sterility outlook and key takeaways

Fig. 36 Compounding pharmacies market: Sterility market share and movement analysis, 2022 - 2030

Fig. 37 Global sterile market revenue estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 38 Global non-sterile market revenue estimates and forecasts, 2018 - 2030 (USD Million

Fig. 39 Regional marketplace: Key takeaways

Fig. 40 North America compounding pharmacies market estimates and forecast, 2018 - 2030 (USD Million)

Fig. 41 U.S. compounding pharmacies market estimates and forecast, 2018 - 2030 (USD Million)

Fig. 42 U.S.: Country dynamics

Fig. 43 Canada compounding pharmacies market estimates and forecast, 2018 - 2030 (USD Million)

Fig. 44 Canada: Country dynamics

Fig. 45 Europe compounding pharmacies market estimates and forecast, 2018 - 2030 (USD Million)

Fig. 46 UK compounding pharmacies market estimates and forecast, 2018 - 2030 (USD Million)

Fig. 47 UK: Country dynamics

Fig. 48 Germany compounding pharmacies market estimates and forecast, 2018 - 2030 (USD Million)

Fig. 49 Germany: Country dynamics

Fig. 50 France compounding pharmacies market estimates and forecast, 2018 - 2030 (USD Million)

Fig. 51 France: Country dynamics

Fig. 52 Italy compounding pharmacies market estimates and forecast, 2018 - 2030 (USD Million)

Fig. 53 Italy: Country dynamics

Fig. 54 Spain compounding pharmacies market estimates and forecast, 2018 - 2030 (USD Million)

Fig. 55 Spain: Country dynamics

Fig. 56 Denmark compounding pharmacies market estimates and forecast, 2018 - 2030 (USD Million)

Fig. 57 Denmark: Country dynamics

Fig. 58 Sweden compounding pharmacies market estimates and forecast, 2018 - 2030 (USD Million)

Fig. 59 Sweden: Country dynamics

Fig. 60 Norway compounding pharmacies market estimates and forecast, 2018 - 2030 (USD Million)

Fig. 61 Norway: Country dynamics

Fig. 62 Asia-Pacific compounding pharmacies market estimates and forecast, 2018 - 2030 (USD Million)

Fig. 63 Japan compounding pharmacies market estimates and forecast, 2018 - 2030 (USD Million)

Fig. 64 Japan: Country dynamics

Fig. 65 China compounding pharmacies market estimates and forecast, 2018 - 2030 (USD Million)

Fig. 66 China: Country dynamics

Fig. 67 India compounding pharmacies market estimates and forecast, 2018 - 2030 (USD Million)

Fig. 68 India: Country dynamics

Fig. 69 Australia compounding pharmacies market estimates and forecast, 2018 - 2030 (USD Million)

Fig. 70 Australia: Country dynamics

Fig. 71 Thailand compounding pharmacies market estimates and forecast, 2018 - 2030 (USD Million)

Fig. 72 Thailand: Country dynamics

Fig. 73 South Korea compounding pharmacies market estimates and forecast, 2018 - 2030 (USD Million)

Fig. 74 South Korea: Country dynamics

Fig. 75 Latin America compounding pharmacies market estimates and forecast, 2018 - 2030 (USD Million)

Fig. 76 Brazil compounding pharmacies market estimates and forecast, 2018 - 2030 (USD Million)

Fig. 77 Brazil: Country dynamics

Fig. 78 Mexico compounding pharmacies market estimates and forecast, 2018 - 2030 (USD Million)

Fig. 79 Mexico: Country dynamics

Fig. 80 Argentina compounding pharmacies market estimates and forecast, 2018 - 2030 (USD Million)

Fig. 81 Argentina: Country dynamics

Fig. 82 MEA compounding pharmacies market estimates and forecast, 2018 - 2030 (USD Million)

Fig. 83 South Africa compounding pharmacies market estimates and forecast, 2018 - 2030 (USD Million)

Fig. 84 South Africa: Country dynamics

Fig. 85 Saudi Arabia compounding pharmacies market estimates and forecast, 2018 - 2030 (USD Million)

Fig. 86 Saudi Arabia: Country dynamics

Fig. 87 UAE Compounding pharmacies market estimates and forecast, 2018 - 2030 (USD Million)

Fig. 88 UAE: Country dynamics

Fig. 89 Kuwait compounding pharmacies market estimates and forecast, 2018 - 2030 (USD Million)

Fig. 90 Kuwait: Country dynamics

Fig. 91 Key company categorization

Fig. 92 Company market position analysis

Fig. 93 Market Participant Categorization

Fig. 94 Strategy framework

Companies Mentioned

- Walgreens Co.

- JL Diekman and AQ Touchard (Fresh Therapeutics Compounding Pharmacy)

- Fagron.

- Albertsons Companies

- The London Specialist Pharmacy Ltd (Specialist Pharmacy)

- Galenic Laboratories Limited (Roseway Labs)

- Aurora Compounding

- MEDS Pharmacy

- Apollo Clinical Pharmacy

- Formul8

- Fusion Apothecary

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 168 |

| Published | August 2023 |

| Forecast Period | 2022 - 2030 |

| Estimated Market Value ( USD | $ 12.5 Billion |

| Forecasted Market Value ( USD | $ 18.6 Billion |

| Compound Annual Growth Rate | 5.1% |

| Regions Covered | Global |

| No. of Companies Mentioned | 11 |