Various strategic initiatives undertaken by key participants to strengthen E&L testing capabilities are anticipated to support market growth. For instance, in April 2023, Eurofins Medical Devices Testing, an industry leader with a robust network of scientists, expanded its E&L testing service capabilities in Germany. In addition, in February 2022, Merck and Waters Corporation collaborated to expand the E&L library to include ion mobility measurements. This collaboration provided confidence to testing laboratories in terms of results and outcomes. Furthermore, the growing number of conferences and exhibitions for E&L testing hold prominent promise for the market.

For instance, in November 2022, Smithers organized the Europe E&L conference in Germany. The company has been organizing such events past 15 years. Such initiatives are fueling the growth of the market in the U.S. and Europe over the forecast period. Market players focus on several other initiatives, such as collaboration, mergers, and acquisitions, to strengthen their industry presence. The main aim was to increase the production of pharmaceutical products that help detect and treat COVID-19 patients without compromising quality and following regulatory procedures. For instance, in April 2021, SGS acquired SYNLAB Analytics, a pharmaceutical, food, and environmental testing service provider.

This acquisition added more than 37 laboratories to SGS, and the key aim of this acquisition was to expand its analytical testing capabilities in pharmaceutical, environment, and food testing. Leachable and extractable testing services help determine the level of foreign substances in single-use systems and finished formulations, which, if not detected, can affect human health. However, these testing services are often complex and are subject to change owing to different factors, such as dynamic regulatory requirements, diverse product types, use of different analytical techniques, and variability in results. Thus, the service provider is required to comply with all these variables.

U.S. & Europe Extractable And Leachable Testing Services Market Report Highlights

- Based on products, the container closure systems segment accounted for the largest revenue share of 30.4% in 2024 owing to their ability to provide long-term stability.

- Based on applications, the orally inhaled & nasal drug products segment dominated the market with a revenue share of 41.2% in 2024 due to the increasing demand for innovative drug delivery methods.

- In 2024, the U.S. held the largest market share of 57.5% in 2024.

- The large share and rapid growth are attributed to the presence of major market players and robust healthcare infrastructure in the U.S.

Why should you buy this report?

- Comprehensive Market Analysis: Gain detailed insights into the global market across major regions and segments

- Competitive Landscape: Explore the market presence of key players worldwide

- Future Trends: Discover the pivotal trends and drivers shaping the future of the global market

- Actionable Recommendations: Utilize insights to uncover new revenue streams and guide strategic business decisions

This report addresses:

- Market intelligence to enable effective decision-making

- Market estimates and forecasts from 2018 to 2030

- Growth opportunities and trend analyses

- Segment and regional revenue forecasts for market assessment

- Competition strategy and market share analysis

- Product innovation listing for you to stay ahead of the curve

- COVID-19's impact and how to sustain in these fast-evolving markets

The leading players in the U.S. & Europe Extractable and Leachable Testing Services market include:

- Eurofins Scientific

- Intertek Group plc

- SGS Société Générale de Surveillance SA

- WuXi AppTec

- Merck KGaA

- West Pharmaceutical Services, Inc

- Wickham Micro Limited (Medical Engineering Technologies Ltd.)

- Pacific Biolabs

- Boston Analytical

- Sotera Health (Nelson Laboratories, LLC)

This product will be delivered within 2 business days.

Table of Contents

Companies Mentioned

- Eurofins Scientific

- Intertek Group plc

- SGS Société Générale de Surveillance SA

- WuXi AppTec

- Merck KGaA

- West Pharmaceutical Services, Inc

- Wickham Micro Limited (Medical Engineering Technologies Ltd.)

- Pacific Biolabs

- Boston Analytical

- Sotera Health (Nelson Laboratories, LLC)

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 120 |

| Published | October 2024 |

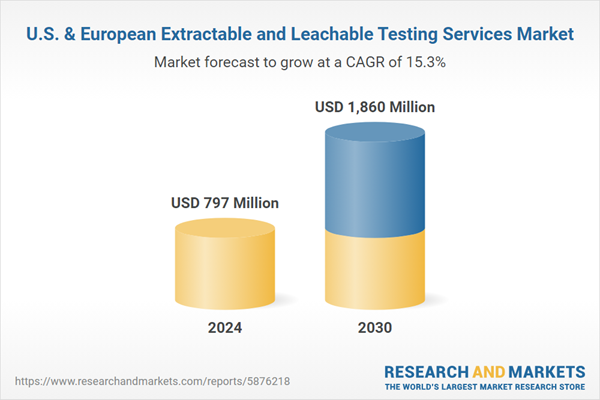

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 797 Million |

| Forecasted Market Value ( USD | $ 1860 Million |

| Compound Annual Growth Rate | 15.3% |

| Regions Covered | Europe, United States |

| No. of Companies Mentioned | 10 |