Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

The surge in adoption of latest technologies, such as artificial intelligence, machine learning, the internet of things, blockchain technology, and data analytics, among others, is advancing the existing systems and generating a massive volume of data to make informed decisions by providing the required insights, which is fostering the Vietnam server market growth. Increasing government and enterprise spending on internet ecosystem security is fuelling the market growth. Despite the difficulties posed by the COVID-19 pandemic, the Vietnam server landscape improved significantly because of a coordinated campaign by the government and private partners.

A server is a computer and a system that consists of resources, services, data, or numerous programs for transferring to other computers, known as clients, over a network. Whenever the computers share resources with client machines, they are considered servers. With a local network, the server links to a router or switch that all other computers use. Once linked to the network, different computers can access that server and its components. Usually, users link to a server using its domain name, registered with a domain name registrar. When users connect to the domain name, the name is automatically translated to the server's IP address by a DNS resolver.

While the information technology equipment typically has limited collateral value and can quickly become obsolete, financing opportunities allow numerous organizations of all sizes and industries to benefit from cloud-based computing, data analytics, and the range of functionalities that help them compete in tech-driven markets. The revenue in the Vietnam Server Market mainly comes from professional services, telecommunications, discrete manufacturing, and banking verticals. The professional services vertical spending was led by investments from fintech, cloud service providers (CSPs), telecom players, and IT/ITeS companies. Additionally, increasing focus on digitalization and modernization has led to higher banking and discrete manufacturing investments.

Increasing Reliance on Digital Technology is Fueling the Market Growth

With the rise of digital technology across Vietnam, the increasing reliance of individuals on the same is evident. From connecting socially to carrying on tasks such as banking, there has been a rapid increase in user registration on online portals, with websites saving personal data. Additionally, businesses across the country have transformed the way operations are performed, with many entirely relying on cloud-based systems. Further traction for the enterprises to enhance technological integration was provided by remote working post-pandemic. All these factors are leading to a rise in digital data generation, requiring larger storage space. As a result, demand for servers is increasing, boosting growth in Vietnam Server Market.Growing Hyperscale Data Centers is Driving the Market Growth

A network made up of separate server segments has inherent costs and inefficiencies. Reduced operating costs and capital costs directly impact the category and integrated operating costs, structural density, overall power consumption, and carbon footprint due to competition and increased customer demand for a variety of services. This makes hyperscale data centers very appealing. Thus, with the increase in the demand for hyperscale data centers, the adoption of the servers is expected to drastically grow across the country in the forecast period.Commercialization of 5G is Driving the Market Growth

The commercialization of 5G is expected to revolutionize many sectors, including servers, in the future. Vietnam is one of the initial countries across the world to successfully test 5G technology. According to the Cisco Systems, the number of 5G subscriptions across the Vietnam is projected to reach 6.3 million by 2025. 5G is expected to enable mobile devices to transfer large volumes of data and enterprises requiring server services to manage the increase in data storage. It is projected that 5G would hasten the digital transformation of numerous businesses in the country, which is expected to expand the market for servers in Vietnam.Market Segmentation

Based on Type, the market is divided into x86 and Non-x86. Based on Hardware, the market is segmented into Rack Server, Blade Server and Tower Server. Based on Operating System, the market is divided into Linux, Windows, IOS and Others. Based on Enterprise Size, the market is segmented into Small, Medium and Large. Based on End User, the market is fragmented into Telecommunication, IT & ITES, Government, BFSI and Others. Based on Distribution Channel, the market is divided into Reseller, Direct, Systems Integrator and Other. Based on the region the market is segmented into Northern Vietnam, Southern Vietnam and Central Vietnam. The market is also segmented into the top 10 provinces that includes Ho Chi Minh City, Hanoi, Bac Ninh, Thai Nguyen, Da Nang, Quang Ninh, among others.Company Profiles

VNPT VinaPhone, Viettel-CHT Ltd. Co., CMC Corporation, IBM Vietnam Company Ltd., Nhan Hoa Software Company, FPT Corporation, Mat Bao Corporation, NTC Server Company Limited, Fujitsu Vietnam Ltd, HPT Vietnam Corporation, etc. are among the major market players in the Vietnam Server Market.Report Scope

In this report, the Vietnam Server market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Vietnam Server Market, by Type:

- x86

- Non-x86

Vietnam Server Market, by Hardware:

- Rack Server

- Blade Server

- Tower Server

Vietnam Server Market, by Operating System:

- Linux

- Windows

- IOS

- Others

Vietnam Server Market, by Enterprise Size:

- Small

- Medium

- Large

Vietnam Server Market, by End User:

- Telecommunication

- IT & ITES

- Government

- BFSI

- Others

Vietnam Server Market, by Distribution Channel:

- Reseller

- Direct

- Systems Integrator

- Other

Vietnam Server Market, by Region:

- Northern Vietnam

- Southern Vietnam

- Central Vietnam

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Vietnam Server market.Available Customizations

The following customization options are available for the report:- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- VNPT VinaPhone

- Viettel-CHT Ltd. Co.

- CMC Corporation

- IBM Vietnam Company Ltd.

- Nhan Hoa Software Company

- FPT Corporation

- Mat Bao Corporation

- NTC Server Company Limited

- Fujitsu Vietnam Ltd.

- HPT Vietnam Corporation

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 86 |

| Published | September 2023 |

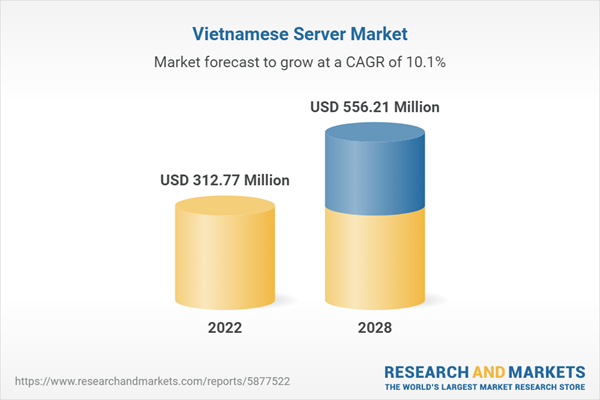

| Forecast Period | 2022 - 2028 |

| Estimated Market Value ( USD | $ 312.77 Million |

| Forecasted Market Value ( USD | $ 556.21 Million |

| Compound Annual Growth Rate | 10.0% |

| Regions Covered | Vietnam |

| No. of Companies Mentioned | 10 |